(The views expressed here are for information purposes only and should not be construed as a

recommendation or investment advice. While the author is a CFA Charterholder

with nearly 25 years of experience in financial markets, this content

is intended to share general insights and does not constitute financial

guidance. Please consult your financial

adviser before taking any investment decision. Safe to assume the author

has a vested

interest in stocks / investments discussed if any.)

Stock indices are constantly evolving, and in the process, they undergo shifts that reshape their overall composition. In this article, we take a deep dive into the Nifty 50 Index, exploring how its stock and sector leadership has transformed over the past decade.

By analysing data from 2015, 2020 and 2025, we’ll examine the changes in the top 15 stocks and the top 10 sectors, shedding light on the forces that have driven this evolution and what the future may hold.

A similar blog was written earlier with data from 2011 to 2021.

(write-up continues below)

------------------------

Related blogs on Nifty 50 Index Movements:

------------------------

2. Top 15 Stocks over a decade

The data presented in table 1 below pertain to top 15 stocks in India's premier index Nifty 50. Ten years data are presented with data points as on 31Dec2015, 31Dec2020 and 30Jun2025 -- with intervals of nearly five years.

An analysis of the data reveals the following insights:

a) Changes in 10 years between Dec2015 and Jun2025:

When comparing the Nifty 50 in 2025 to its composition in 2015, we see that 11 of the top 15 stocks are the same. The 11 stocks are:

HDFC Bank

ICICI Bank

Reliance Industries

Infosys

Larsen & Toubro

ITC Ltd

Tata Consultancy Services

Axis Bank

Kotak Mahindra Bank

State Bank of India

Hindustan Unilever

While the weights and rankings of these stocks have fluctuated over the past 10 years, the same 11 stocks continue to dominate the top 15 in the 50-stock index.

This is somewhat surprising, highlighting the resilience of these bluechip Nifty 50 stocks, which have remained steadfast even as technological advancements and structural market changes reshaped the market landscape.

However, a few have have moved in and out of the top 15 in the index. Notably, Sun Pharma, Tata Motors and Maruti Suzuki have dropped out, while Bharti Airtel, Mahindra & Mahindra (M&M), Bajaj Finance and HCL Technologies have climbed into the top 15 as at the end of Jun2025.

b) Changes in 5 years between Dec2020 and Jun2025:

Of the top 15 stocks in 2020, 14 still remain in top 15 of the index, though their weights and rankings have changed in the past five years. Only Asian Paints moved out of the top 15, while Mahindra & Mahindra climbed to the top 15.

c) Top 10 Stocks weight:

The concentration of the top 10 stocks shows an increasing dominance:

2025: 56.5%

2020: 61.4%

2015: 54.2%

This

indicates that while the top 10 stocks still make up a large portion of

the Nifty 50, their share increased between 2015 and 2020, before

declining in 2025.

It's insane the total weight of top 10 stocks in Nifty 50 is 56.5 per cent as of 30Jun2025; in contrast, the total weight of top 10 stocks in US S&P 500 is just 38.2 per cent for the same period.

Concentration risk in Indian stock indices is much higher versus those in the US.

d) Top 5 Stocks weight:

The concentration of the top five stocks too shows an increasing dominance:

2025: 40.6%

2020: 42.4%

2015: 34.8%

The insight here is the top five stocks still make up more than a third of

the Nifty 50 -- their share increased between 2015 and 2020, before

declining to 40.6 per cent now.

e) Dominance of key stocks:

Reliance Industries has consistently been a key player in the Nifty 50 index, ranking first in 2020 and third 2025.

HDFC Bank has seen a rise from second place in 2015 to 1st place in 2025, after its amalgamation with its parent HDFC Ltd.

It's worth noting that the

combined weight of HDFC Bank Ltd and HDFC Ltd pre-amalgamation was

substantially greater than their current representation of the merged

entity HDFC Bank.

The total weight of HDFC Bank and HDFC Ltd was 18 per cent in 2020 (before merger with HDFC Ltd): but as of 30Jun2025, HDFC Bank's share (after merger) is just 13.2 per cent -- as private sector banks have lost sheen in the past five years.

Infosys Ltd has always remained in the top 5, strengthening its position as a major technology player in the index.

ICICI Bank also features prominently, moving from sixth place in 2015 to second place in 2025.

ITC Ltd has gradually declined in terms of weight, moving from fourth place in 2015 (6.5 per cent weight) to seventh place in 2025 (3.4 per cent).

Significantly, Bharti Airtel moved from 14th rank in 2020 with just 2 per cent weight in 2020 to fifth place with 4.7 per cent weight now -- telecom services have become an integral part of Indian consumers in recent years, not to speak of the duopoly nature of mobile telecommunications market in India.

But

Hindustan Unilever's stock suffered, between 2020 and 2025, with its

weighting halving and moving from rank 8 in 2020 to rank 14 now.

Overall, the top 15 stocks in the Nifty 50 haven’t seen dramatic changes in the past 10 years, with a few exceptions.

Please click on the image to view better >

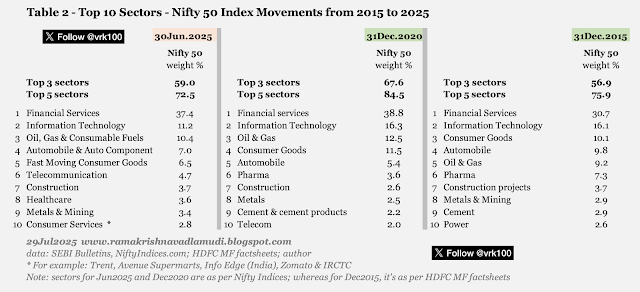

3. Top 10 Sectors over a decade

The

data presented in table 2 below pertain to top 10 sectors in Nifty 50 index. Ten years data are presented with data points as

on 31Dec2015, 31Dec2020 and 30Jun2025 -- with intervals of nearly five

years.

a) Top 5 Sectors:

The concentration of the top five sectors is as follows:

2025: 72.5%

2020: 84.5%

2015: 75.9%

In 2015, the top five sectors held 75.9 per cent of the Nifty 50 weight, which increased to 84.5 per cent by 2020. This demonstrates the increasing concentration of the index in just a few sectors.

In 2025, the share of the top five sectors has decreased to 72.5 per cent, indicating a trend toward slightly more diversification, but the index still suffers from high concentration risk.

Let us see the concentration of top five sectors in S&P 500.

Information Technology 33.03%

Financials 14.00%

Consumer Discretionary 10.35%

Communication 9.77%

Health Care 9.30%

The total weight of top five sectors in S&P 500 is 76.5 per cent, higher than that of Nifty 50 index. Information technology is one-third in S&P 500. (Note: For Nifty 500 index, the figure is much lower at 60.8 per cent).

The concentration of the top three sectors is as follows:

2025: 59.0%

2020: 67.6%

2015: 56.9%

In

2015, the top three sectors (Financial services, IT and FMCG) held 56.9 per cent of the Nifty 50 weight,

which increased to 67.6 per cent by 2020. This demonstrates the

increasing concentration of the index in just a few sectors.

In

2025, the share of the top three sectors (financial services, IT and Oil & Gas) has come down to 59 per

cent, indicating a trend toward slightly more diversification, but the

index undoubtedly suffers from high concentration risk.

c) Key sectors:

Financial Services has always been the largest sector (see yesterday's blog for more on this), with its weight rising from 30.7 per cent in 2015 to 37.4 per cent in 2025, reinforcing the importance of financial companies like banks, non-banking financial companies (NBFCs), asset management companies (AMCs) and insurance firms.

Information Technology has also been consistently among the top two, but its weight fell from 16.1 per cent in 2015 to 11.2 per cent in 2025.

Oil, Gas & Consumable Fuels has maintained a steady position within the top three, with a slight increase in weight over the years from 9.2 per cent in 2015 to 10.4 per cent in 2025 -- Reliance Industries is the dominant component here.

The auto sector lost its weight over the past 10 years, though its rank remains fourth.

FMCG (fast moving consumer goods) has lost its lustre over the years, especially in the past five years, with its share falling from 11.5 per cent in 2020 to 6.5 per cent now.

Indian consumers, especially after the COVID-19 Pandemic, have diversified and broadened their basket of goods and services. Young and digitally-savvy consumers have moved towards quick commerce, online food delivery, digital payment services and e-commerce trade -- dominated by companies like, Eternal Ltd, Swiggy, Paytm, Nykaa, Honasa Consumer and others.

In the process, consumer staples sector has suffered due to lack of growth and massive shift in consumer preferences. Consumers have moved from goods to more services, as such, sectors, like, consumer services (a new sector added recently by index provider Nifty Indices), telecom, auto and construction have gained weight in the past five years at the cost of traditional FMCG companies.

When analysing long-term trends (over five to 10 years), remember that sector classifications and individual stock characteristics are not static; both evolve significantly over time.

For instance, Nifty Indices has made changes to some sectors in recent years, adding sectors, like, consumer services and services. Consumer services, include, retail and other companies, like, Trent Ltd, Dmart, Info Edge, Zomato and IRCTC. The services sector includes stocks, like, Indigo Airlines.

Please click on the image to view better >

4. Concluding remarks

The Nifty 50 index has become increasingly concentrated in a few stocks and sectors over the last decade. Financial services and information technology remain dominant, while sectors like automobile and oil & gas are also maintaining their significant presence.

The top stocks like HDFC Bank, Reliance Industries and Infosys continue to lead, while some other companies have shown a decline in their relative weight.

The trend towards increasing concentration of power among the largest players and sectors in the index suggests that the Nifty 50 has become more reliant on a small number of dominant companies and industries. However, there is also slight diversification observed in the last few years, with some sectors and stocks losing weight.

What of the future?

Going by the past trends, one could expect Financial Services sector would continue to play a dominant role in Nifty 50 index. Information technology sector too will continue its anchor role.

Services sector is likely to play a bigger role in the next 10 years, given our favourable demographics. The share of consumer services and affluent consumption is likely to increase.

In the next 10 years, even some stocks may get dethroned from their pedestal with new economy companies moving in.

The evolving dynamics of the Nifty 50 composition, especially the decline in the FMCG sector's share, coupled with the rise of technology, fintech and consumer tech stocks carries several important investment implications for retail investors.

Emphasizing the principles of diversification and the pitfalls of concentration risk, here are some key takeaways:

Retail investors must consider diversifying their investments across sectors and asset classes depending on their personal situation.

While retaining Nifty 50 index funds as their core portfolio, they could diversify into other broader index funds focused on Midcap stocks for a growth edge, if they have lower risk aversion.

They better avoid over-concentration in a single sector.

As we’ve seen, stocks and sectors can experience significant shifts in leadership. For example, FMCG stocks, once dominant, have seen their weight decline, while consumer tech and fintech stocks have gained prominence.

Retail investors who ignore such shifts may be left holding stocks that are losing relative importance.

Those who diversify their portfolios across different sectors, avoid concentration in any one stock or sector and regularly review their investments regularly will have built portfolios that could weather any serious bear market in future.

- - -

-------------------

References and additional data:

Five screenshots with old data for Nifty 50 index >

Please click on the images to view better >

-------------------

Related Blogs on Mutual Funds (for a comprehensive list of all articles on Mutual Funds, look for section "4 Mutual Funds" in my blog Blog of Blogs Theme-wise):

Passive Titans of India: The Top 10 Equity Indices by Fund Size 17Jul2025

Low Expense Ratios, High Returns: Why Passive Equity Funds Matter 06Jun2025

Mutual Fund Asset Class Returns 02Jun2025 (Fund categories with similar returns)

Mutual Fund Asset Class Returns 30Sep2024 (Fund categories with similar returns)

Crux of Kotak Debt Hybrid Fund 15Jul2024

The Little Secret Behind Nifty Next 50 Index's Recent Success 13May2024

NSE Indices Calendar Year Returns: 2006 to 2024 05May2024

How to Buy Nifty Midcap Index 03May2024

India Passive Funds and Their Asset Size 29Apr2024 (Big Picture View of Passive Equity Funds)

Guide to Tracking Error of Mutual Funds 27Apr2024

NSE Indices (Nifty 50, Nifty Next 50, Nifty 100 and Nifty 500) Comparison 31Dec2022

Who is Eating My Gold ETF Return?

Mutual Fund Asset Class Returns 31Mar2024 (MF categories with similar returns)

-------------------

Read more:

Passive Titans of India: The Top 10 Equity Indices by Fund Size 17Jul2025

The Pitfalls of Market Timing and Why FOMO is Your Worst Financial Adviser 12Jul2025

The Elusive Current Account Surplus: What 25 Years Data Reveal About India's Trade Balance 30Jun2025

Low Expense Ratios, High Returns: Why Passive Equity Funds Matter 06Jun2025

Disclosure: I've got a vested interest

in Indian stocks and other investments. It's safe to assume I've interest in the financial instruments / products discussed, if

any.

Disclaimer: The analysis and

opinion provided here are only for information purposes and should not be construed

as investment advice. Investors should consult their own financial advisers

before making any investments. The author is a CFA Charterholder with a vested

interest in financial markets.

------------------------

CFA Charter credentials - CFA Member Profile

CFA New Badge

CFA Badge