Mutual Fund Categories with Similar Returns

(This is for information and educational purposes only. This should not be

construed as a recommendation or investment advice even though the author is a CFA

Charterholder. Please consult your financial adviser before taking any

investment decision. Safe to assume the author has a vested interest in stocks

/ investments discussed if any.)

A close examination of annual returns and trailing returns of mutual funds in India reveals that some categories of mutual funds have similar returns over a long period of time.

An earlier blog examined mutual fund categories with similar returns. See Annexure A given at the end of the blog for details of those categories.

Now, this blog takes a look at two categories (other than those in the earlier blog) with returns that resemble each other; though they are two different types of schemes with different scheme characteristics.

The two categories are: 'conservative hybrid,' and 'equity savings.' Both of them belong to hybrid funds. Hybrid schemes invest in a blend of asset classes, like, equity, debt, commodities like gold and silver, REITs or real estate investment trusts.

(article continues below)

------------------------

Related blogs on Debt Mutual Funds:

Crux of Kotak Debt Hybrid Fund (Template for Analysing Debt Mutual Funds)

SEBI Categorization and Rationalization of Mutual Funds 24Feb2024

Negative Impact of Debt Mutual Fund Tax Changes (quixotic changes by PM Modi government) MF tax rates

------------------------

1. SEBI definition

Conservative hybrid funds: India's capital market regulator SEBI or Securities and Exchange Board of India defines a conservative hybrid fund as:

Type of scheme: an open-end hybrid scheme investing predominantly in debt instruments

Scheme Characteristics: investment in equity and equity-related instruments - between 10 per cent and 25 per cent of total assets; and investment in debt instruments - between 75 per cent and 90 per cent of total assets.

Scheme Characteristics: investment in equity and equity-related instruments - between 10 per cent and 25 per cent of total assets; and investment in debt instruments - between 75 per cent and 90 per cent of total assets.

Equity Savings funds:

Type of scheme: An open-end hybrid scheme investing in equity, arbitrage and debt

Scheme Characteristics: A minimum of 65 per cent of total assets should be invested in equity and equity-related instruments and a minimum of 10 per cent of total assets should be invested in debt instruments. Minimum hedged and unhedged should be stated in the scheme information document (SID) of the scheme.

A conservative hybrid scheme invests mainly in debt instruments and a smaller portion in equities; while an equity savings fund invests mainly in equities and a smaller portion in debt papers.

2. Similar returns

The trailing and annual returns of Conservative Hybrid and Equity Savings fund categories tend to be similar over a long period of three or more years. The returns of these two categories have close resemblance to each other even for short term.

Let us look at the screenshots attached below:

Screenshot: Hybrid MF category returns (regular plans): Trailing returns as on 15Jul2024 >

The return chart above indicates that the

Conservative Hybrid and Equity Savings fund

categories offer similar returns. The tax treatment of these two fund

categories differ widely, but their pre-tax returns are similar.

For example, the 5-year compounded annual returns of Conservative Hybrid and Equity Savings fund categories are 8.77 and 9.86 per cent respectively (the category returns are for regular plans); the difference between the two categories is small.

But if you take 5-year absolute returns, they come to 52.2 and 60 per cent respectively; the difference is not negligible.

As

equity savings funds enjoy favourable tax treatment compared to

conservative hybrid funds, the post-tax returns

would be bigger and considerable for individual investors who are in

tax slabs of 30 per cent or more.

For individual investors in lower tax slab rates, the post-tax returns of these two fund categories could be negligible.

As

you know, funds with higher share of equities (for example, equity

savings funds) tend to carry higher risk compared to funds with higher

share of debt instruments (for example, conservative hybrid funds).

In portfolio theory, one should not hold correlated

assets. Correlation means the relation between two asset types and how much

they tend to vary with one another. To reduce risk, it’s better to hold

uncorrelated assets in a portfolio.

Debt and equity asset classes have lower correlation historically and a blended portfolio of debt and equity could provide better returns per unit of risk.

Depending on one's risk appetite, investment goals, tax considerations and the need for better returns, investors need to opt for either equity savings funds or conservative hybrid funds.

Exercise: You can compare the 3-year compounded returns of these two fund categories and calculate the absolute pre-tax returns. You can further calculate your post-tax returns based on your marginal tax rate.

The following two screenshots provide trailing returns of the two fund categories for direct plans: Don't forget to check how the 10-year annaulised returns of the two categories compare >

Screenshot: Hybrid MF category returns (regular plans): Annual returns - from 2015 to 2023:

Annual returns of the two fund categories, namely, conservative hybrid and equity savings, show that in calendar years from 2018 to 2023, the difference in returns is less than two percentage points, with equity savings outperforming conservative hybrid funds. And in year 2015 too, the difference between the two is smaller than two percentage points.

But in years 2016 and 2017, the difference is more than three percentage points, with equity savings categories outperforming.

3. Risk measures

Equity savings funds: As per Value Research, there are 22 schemes in this category. The data are for direct plans as on 30Jun2024.

> the three-year standard deviation for Conservative Hybrid and Equity Savings fund categories are 3.97 and 4.44 respectively -- equity savings funds have higher volatility

> the three-year Sharpe ratio of the two categories are 1.04 and 1.09 respectively -- the difference is negligible

> other risk measures are similar in nature for the two fund categories

A further examination of Value Research data shows the following:

For the 31 funds in the conservative hybrid category, the range of standard deviation is 2.11 to 11.74; and the Sharpe ratio range is 0.38 to 1.75.

For the 22 funds in the equity savings category, the range of standard deviation is 2.05 to 5.91; and the Sharpe ratio range is 0.47 to 1.87.

The standard deviation range for equity savings is much tighter compared to conservative hybrid funds. And the Sharpe ratio range for these two funds bears close resemblance.

4. Best and worst period returns

Five randomly-picked funds are compared here. The comparison shows (one-year returns for all direct plans):

a) ABSL Regular Savings: The best and worst period returns are 32.9 per cent and minus 8.8 per cent respectively.

b) Baroda BNP Baripas Conservative Hybrid: The best and worst period returns are 19.5 and 1 per cent respectively.

c) Canara Robeco Conservative Hybrid: The best and worst period returns are 25.9 and 0.2 per cent respectively.

d) HDFC Hybrid Debt: The best and worst period returns are 27.5 and minus 6.2 per cent respectively.

e) SBI Conservative Hybrid: The best and worst period returns are 29.2 and minus 4.8 per cent respectively.

Equity savings funds:

Five randomly-picked funds are compared here. The comparison shows (one-year returns for all direct plans):

a) Edelweiss Equity Savings: The best and worst period returns are 27.4 and minus 2 per cent respectively.

b) HSBC Equity Savings: The best and worst period returns are 39.2 and minus 14.7 per cent respectively.

c) LIC MF Equity Savings: The best and worst period returns are 35.2 and minus 9.4 per cent respectively.

e) Sundaram Equity Savings: The best and worst period returns are 39.2 and minus 9.1 per cent respectively.

Comparison between the two categories:

The best one-year return range for five randomly-picked conservative hybrid funds compared above is 32.9 to 19.5 per cent; which is narrower than that of 39.2 to 27.4 per cent for five randomly-picked equity savings funds.

The worst one-year return

range for five randomly-picked conservative hybrid funds compared above

is minus 8.8 to plus 1 per cent; which is narrower than that of minus 14.7 to minus 2 per

cent for five randomly-picked equity savings funds.

From the sample study above, we can deduce that equity savings schemes are likely to provide superior returns compared to conservative hybrid funds (based on the best one-year returns); but equity savings schemes tend to lose more during stock market downturns (based on the worst one-year returns).

Overall, as equity savings funds have greater exposure to equities, they lose more during market meltdown and entail greater risk for investors, as compared to conservative hybrid funds. Conservative hybrid funds score better on downside protection.

One caveat here is: The author does not have the wherewithal to compare the best and worst period returns of all the funds in these two categories. If you happen to compare them for all the funds, the results could be different from the sample presented above by the author.

5. Others

a) Assets under management: The AUM of Conservative Hybrid and Equity Savings fund categories are Rs 27,780 crore and Rs 34,150 crore respectively, as on 30Jun2024.

The asset size indicates equity savings funds are more popular than conservative hybrid funds.

b) Their tax treatment of these two categories differs widely:

Conservative hybrid funds: Please refer Section 6 (Tax treatment) of an earlier blog.

Equity Savings funds: As equity savings funds invest 65 per cent or more in equities, the short-term capital gains (for holdings of less than one year) is taxed at 15 per cent, while long-term capital gains (for holdings of one year or more) is taxed at 10 per cent.

Additionally, for individual investors, an amount of up to Rs 1 lakh is exempt from long-term capital gains tax on equities and equity mutual funds in a financial year.

For individual taxpayers in higher tax brackets, the tax treatment of equity savings funds is more beneficial as compared to the tax treatment of conservative hybrid funds, as of now.

As favourable tax treatment is accorded to equity savings funds, they may provide better post-tax returns relative to conservative hybrid funds. (please note the author has no tax expertise; this is just for informational purposes -- consult your tax adviser before making any decisions)

c) Possible reasons for close resemblance of returns:

Equities entail higher volatility of returns while debt / fixed income asset class offers lower volatility. And in portfolio theory, equities and debt tend to have lower correlation.

When equities lag, debt tends to provide downside protection to the overall portfolio -- as such, the two categories though holding debt and equities in different proportions tend to offer similar returns.

Over a period of time, the two fund categories are offering balanced returns to the overall portfolio.

Another reason could be fund managers may be managing the equity funds more conservatively, or may be they just want to earn adequate average returns without jeopardising their own personal survival.

6. Wrap up

In the financial world, simple products many a time provide peace of mind and can be a better alternative compared to complex products.

Mutual funds globally tend to provide a zoo of products, which ordinary and unsophisticated investors find hard to understand.

Investors need to select mutual funds based on their asset allocation, investment goals, risk appetite and their personal situation. If investors want higher return entailing higher risk, they may look for equity savings funds.

However, on a risk-reward basis (Sharpe ratio), these two fund categories are similar, as discussed in Section 3 above.

As stated in Section 4 above, conservative hybrid funds tend to offer superior downside protection.

Individual investors in higher tax slabs cannot ignore tax treatment, which currently is in favour of equity savings funds (see Section 5-b above).

Ceteris paribus, equity savings funds tend to provide superior post-tax returns for individual investors in higher tax brackets; as compared to conservative hybrid funds. But equity savings funds are riskier versus conservative hybrid category.

Different people have different preferences.

Note: SEBI introduced norms

SEBI categorization and rationalization of mutual funds in October

2017. So, AMCs (asset management companies) made several changes to the

mutual fund plans shifting them

from one MF category to another MF category and data aggregators

changed the data retrospectively. As such, before interpreting trailing

returns of more than five years (annual returns before 2018), please be

aware of SEBI categorization rules.

(This is just

for educational purposes only and should not be considered as investment

advice. Financial products discussed here are just for illustration purposes. Readers should consult their own investment adviser before

considering any investment.)

- - -

------------------------

Annexure A:

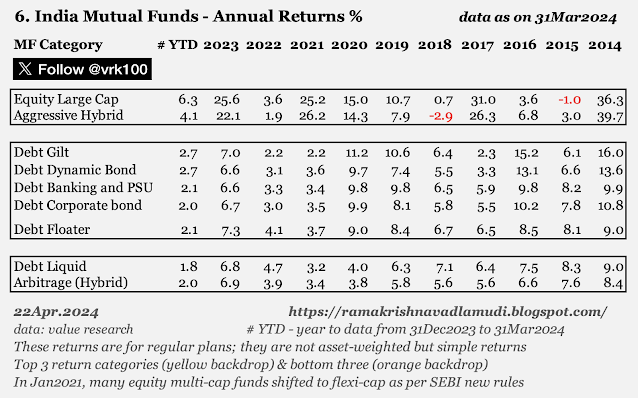

Tables in the above blog are presented below for easy access (data as of 31Mar2024)>

------------------------

The Reference Shelf:

Top image: AI image of Central Park, NYC from Google Gemini

several weblinks throughout the blog

VR risk measures equity savings funds (one can explore other details, like, trailing / annual returns, overview, portfolio, expense ratio, fund manager, etc.)

VR Fund monitor - trailing returns

VR Fund monitor - annual returns

VR fund compare - five conservative hybrid funds

VR fund compare - five equity savings funds

P2P return Point to point return - all debt funds 19Sep2019 to 19Dec2019

MS risk measures - MF category-wise

weblinks throughout the blog

------------------------

Read more:

Blog of Blogs Theme-wise

Weblinks and Investing

India Fixed Income Data Bank

Indian Economy Data Bank

India Forex Data Bank

Side Pocketing Episode of Aditya Birla SL Dynamic Bond Fund

Crux of Kotak Debt Hybrid Fund

Global Market Data 30Jun2024

Brief History of India's 1991 Forex Crisis and Gold Pledge

You Can Boast About It!

Big Surge in Number of Shareholders in PSUs

Why RBI Won't Favour A Strong Rupee

Currency Pairs: How to Calculate Depreciation or Appreciation

Sensex versus Gold Price

RBI's Record Surplus Transfer to Govt of India

The Little Secret Behind Nifty Next 50 Index's Recent Success

NSE Indices Calendar Year Returns: 2006 to 2024

Understanding Real Sensex and Currency Debasement

Select Gilt Funds Performance

-------------------

Disclosure: I've got a vested interest in Indian stocks and other investments. It's safe to assume I've interest in the financial instruments / products discussed, if any.

Disclaimer: The analysis and opinion provided here are only for information purposes and should not be construed as investment advice. Investors should consult their own financial advisers before making any investments. The author is a CFA Charterholder with a vested interest in financial markets.

CFA Charter credentials - CFA Member Profile

CFA Badge

Viewing Options for this blog in different formats:

He blogs at:

https://ramakrishnavadlamudi.blogspot.com/

X (Twitter) @vrk100

No comments:

Post a Comment