--------------------------------------------------------------

Update 01Mar2026: Charts 114 and 115:

India GST Collections: Goods and Services Tax: Gross GST revenue collections, refund data and net GST revenue collections (Blog: Is GST growth now tracking nominal GDP? and Tweet thread 01Jul2017 on GST):

Monthly collections:

Gross GST revenue collections in Feb2026 are Rs 1.84 lakh crores. Net GST revenue collections (net of

refunds) in the same month are 1.61 lakh crore, an improvement of 7.9 per cent over Feb2025 (Note: Feb2025 figures given in Feb2026 GST Collections report do not match with those given in Feb2025 GST Collections report -- no explanation for the difference is given by GST Council).

As can

be seen from the below chart, these YoY growth rates are volatile and

not much can be gleaned from the data.

One may have to see more granular data to analyse the monthly GST data.

For

the financial year 2025-26 (11 months till Feb2026), the net GST

collections are Rs 17.57 lakh crore, showing a YoY growth of 6.9 per cent

compared to Apr2024-Feb2025 period (see two charts below for data).

Average monthly Net GST Collections:

During FY 2025-26 (11 months data), the average monthly

net GST collections are Rs 1.60 lakh crore, compared to average monthly

figure of Rs 1.49 lakh crore for the correponding period of FY 2024-25 (see chart below).

Due

to inflationary pressures and other factors, average monthly net GST

collections improved from Rs 0.98 lakh crore for full FY 2018-19 to Rs

1.60 lakh crore now.

Net GST revenue equals gross GST revenue minus GST refunds. GST refund data prior to 2020-21 aren't available with GST Portal.

data sources:

Two charts:

1. Monthly Gross / Net GST Collections, with refunds, from Sep2024 to Feb2026:

2. Yearly Gross / Net GST collections, with refunds, from 2017-18 till 2025-26:

Charts 114 and 115 click on them to view better >

--------------------------------------------------------------

Update 28Feb2026: Charts 112 and 113:

India GDP New Series (base year 2022-23) >

Complement this data with:

Blog 1: From Farms to Factories to Services: India’s GDP Explained via Production Approach 22Feb2026

Blog 2: Understanding India’s GDP – A Simple Guide to the Expenditure Approach 18Feb2026

Tweet thread 28Feb2026 - India GDP New Series (base year 2022-23) - methodology changes - ACNAS - background - key points of GDP revisions - Pronab Sen interview

Tweet thread 28Feb2026 - India GDP New Series (base year 2022-23) - GDP / GVA for recent years and GDP growth rates

India's MoSPI (Ministry of Statitistics and Programme Implementation) released a press note (62-page PDF) on 27Feb2026 detailing GDP estimates under new series with base year as FY 2022-23.

Here are the top seven key points from the press note:

1. New Base Year (2022–23): The base year for National Accounts has been shifted from 2011–12 to 2022–23. This "post-pandemic" benchmark was chosen to better reflect the current structure of the economy, including the digital shift and the gig economy.

2. Real GDP growth for FY 2025–26 is estimated at 7.6 per cent, an upward revision from the 7.4 per cent projected in January under the old series. Nominal GDP for the year is now pegged at Rs 345.47 lakh crore.

3. Adoption of "Double Deflation": MoSPI has moved away from "Single Deflation." It now deflates output and input prices separately to calculate real GVA or gross value added. This is likely to improve accuracy in sectors like manufacturing where raw material price volatility (like oil / steel) often distorted growth figures.

4. Integration of New Data Sources: The methodology now formally integrates high-frequency data from GST (Goods and Services Tax), e-Vahan (vehicle registrations) and the MCA-21 corporate database. It also incorporates the latest findings from the ASUSE (unincorporated enterprises) and PLFS (labor force) surveys.

5. The new series uses the Supply and Use Table (SUT) framework to reconcile production and expenditure data. This "product-balancing" principle aims to minimise the "statistical discrepancy" that often plagued previous GDP releases.

6. Investment Momentum: Gross Fixed Capital Formation (GFCF), a proxy for investment, remained robust at 32 per cent of GDP.

data sources: MoSPI press note 27Feb2026 and author

Methodological improvements in compilation of GDP under Expenditure approach - India GDP New Series (base year 2022-23) - document released 27Feb2026

Methodological improvements in compilation of GDP under Production / Income approach - India GDP New Series (base year 2022-23) - document released 27Feb2026

Two charts below showing:

India Nominal GDP: FY 2025-26: Expenditure Approach and Its Components: GDP New Series (base year 2022-23) >

India Nominal GDP Measurement: FY 2025-26: Production Approach: GDP New Series (base year 2022-23) >

Charts 112 to 113 Click on the chart to view better >

What the two charts above reveal:

Expenditure Side Structure:

India’s Nominal GDP ( GDP new series, with base year 2022–23, for FY 2025–26) using the expenditure approach: Nominal GDP is Rs 345.47 lakh crore. The largest component is Private Final Consumption Expenditure (PFCE) at Rs 195.78 lakh crore, accounting for 56.7 per cent of GDP. This indicates that household consumption remains the primary driver of demand in the Indian economy.

Investment Dynamics:

Gross Fixed Capital Formation (GFCF) stands at Rs 109.44 lakh crore, contributing 31.7% of GDP, which reflects a strong investment share. When combined with changes in stocks (1.2%) and valuables (1.7%), total investment-related components exceed one-third of GDP. This suggests relatively solid capital formation, though still secondary to consumption-led growth.

Government Spending Role:

Government Final Consumption Expenditure (GFCE) is Rs 37.21 lakh crore, forming 10.8 per cent of GDP. This indicates a moderate fiscal consumption footprint compared to private consumption and investment. The government’s role is significant but not dominant in driving aggregate demand.

External Sector Position:

Exports are Rs 76.91 lakh crore (22.3% of GDP), while imports are higher at Rs 82.93 lakh crore (24.0% of GDP). This results in a negative net export contribution, implying a trade deficit that slightly drags on GDP. The economy is demand-driven domestically rather than export-led.

Statistical Discrepancy:

A small negative discrepancy of Rs - 1.04 lakh crore (-0.3% of GDP) exists. This is an adjustment between the production and expenditure methods of GDP estimation. The magnitude is minor relative to total GDP, indicating reasonable statistical consistency.

Production Side Structure:

On the production (GVA) side, total GVA at basic prices is 313.61 lakh crore. Adding net taxes on products (31.86 lakh crore) yields the same total nominal GDP of 345.47 lakh crore, ensuring internal consistency.

Sectoral Composition:

The tertiary (services) sector dominates with 54.4 per cent share in GVA or gross value added ( Rs 170.45 lakh crore). Within services, financial, real estate and professional services form the largest subcomponent at 27.0 per cent of GVA. Trade, hotels, transport and communication also contribute significantly (14.2%).

The secondary sector contributes 25.9 per cent of GVA (Rs 81.20 lakh crore), with manufacturing at 14.8 per cent and construction at 8.4 per cent. This indicates moderate industrial depth but continued reliance on services.

The primary sector contributes 19.8 per cenet of GVA (Rs 61.96 lakh crore), with agriculture forming the bulk (17.9%). This shows that agriculture still holds a notable share compared to more advanced economies, though it is no longer dominant.

Overall assessment:

India’s GDP structure reflects a services-led, consumption-driven economy. Domestic demand (especially private consumption) is the core engine. Investment levels are substantial but not yet dominant enough to signal a manufacturing-led transformation.

The services sector’s majority share suggests a structural shift typical of developing economies transitioning toward higher value-added activities, though manufacturing’s share indicates room for industrial expansion.

--------------------------------------------------------------

Update 10Feb2026: Charts 109 to 111:

Mutual Fund Assets: Growth of India Passive Equity Funds AUM:

Share of Total Equity AUM in Total Mutual Fund Industry AUM:

Mutual Fund net inflows: India Passive funds net inflows:

Complement this data with:

Update 12Jan2026 with Chart 100

Update 11Jan2026 with Charts 98 and 99

Update 11Jan2026 with Chart 97

Update 19Nov2025 with Chart 88

Update 19Nov2025 with Chart 87

Update 18Jul2025 with Chart 62

Update 17Jun2025 with Chart 50

Chart 1: Passive Equity AUM growth: Between

Mar2025 and Dec2025, total assets under management (AUM) of passive

equity funds (both ETFs as well as index funds) grew by Rs 1.76 lakh crore or 21 per cent -- the growth is

primarily driven by Indian stocks recovering from their Mar2025 lows.

In

the same period, the ETF asset growth is 19.2 per cent while that of

index funds is 28.3 per cent from a lower base. The share of ETFs in the total passive pie

is 78.4 per cent (see chart 1 below).

As of 31 Dec2025, the total number of equity ETF schemes are 231 and the number of index funds are 246, totaling 477.

The number of indices tracked by equity ETFs are 97, while that of index funds are 86.

data: NSE India passive funds - monthly data available

Chart 3: Share of Total Equity AUM in Total Industry: The share of total equity (including active and passive) AUM in total mutual fund industry has grown rapidly from about one-third in Mar2017 to about 57 per cent by Dec2025.

31Mar2017 (Rs lakh crore):

5.44 active equity

0.46 passive equity

5.89 total equity

33.6% share of equity in total MF industry

31Dec2025 (Rs lakh crore):

35.73 active equity

10.13 passive equity

45.86 total equity

57.2% share of equity in total MF industry

Five crisp reasons for the rise in equity’s share of total mutual fund industry AUM:

1. Strong Equity Market Performance: Sustained bull markets between 2017–2025 boosted equity valuations, increasing equity AUM faster than debt.

2. Shift in Retail Investor Preference: Growing financial literacy, the "search for yield" (investors shifting to higher-return -- often higher-risk -- assets like equities when returns on safer instruments such as deposits or bonds are low) and higher risk appetite led investors to prefer equity for long-term wealth creation over traditional fixed-income products.

3. Massive SIP Inflows: Record systematic investment plan (SIP) contributions provided steady, compounding inflows into equity funds.

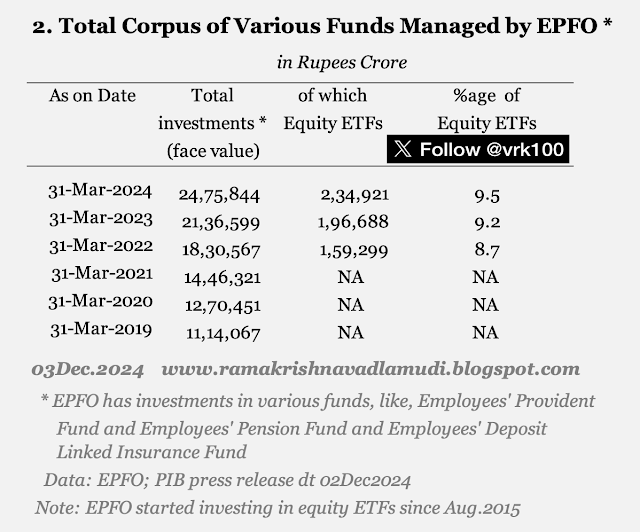

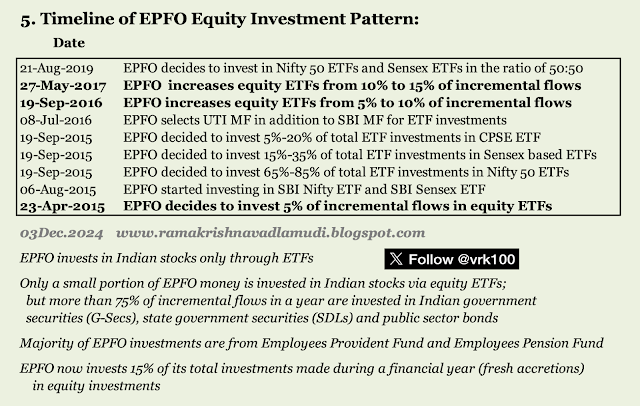

4. EPFO Allocation to Equity ETFs: EPFO’s increasing allocation to equity ETFs significantly boosted passive equity AUM, raising equity’s overall share.

5. Tax & Regulatory Changes Impacting Debt: Changes in debt fund taxation, removal of indexation benefits and lower post-tax returns reduced the relative attractiveness of debt funds, indirectly increasing equity’s share.

Chart 2: Mutual Fund net inflows: India Passive funds net inflows: data include ETFs and Index funds for both equity and debt segments:

Net

inflows during the nine months of FY 2025-26 are Rs 0.73 lakh crore for ETFs

and Rs 0.15 lakh crore for index funds -- the data include equity and

debt segments (Nifty Indices does not provide break up of equity and

debt data).

Net inflows in nine months of 2025-26 seem to have slowed down due to higher redemptions in index funds.

In the past three years (FY 2022-23 to FY 2024-25), net inflows to ETFs and index funds were identical at Rs 1.71 lakh crore.

In the past five years (FY 2020-21 to FY 2024-25), net inflows to ETFs and index funds were at Rs 2.91 lakh crore and Rs 2.20 lakh crore respectively.

Read more:

Decoding the Nifty Midcap 150 Quality 50 Index: A Midcap Strategy Built on Fundamentals

Chart: India Passive Equity Funds AUM Growth (both ETFs and Index funds tracking BSE as well as NSE / Nifty equity indices)

Charts 109 to 111 Click on the chart to view better >

--------------------------------------------------------------

Update 09Feb2026: Charts 107 and 108:

India GST Collections: Goods and Services Tax: Gross GST revenue collections, refund data and net GST revenue collections (Blog: Is GST growth now tracking nominal GDP? and Tweet thread 01Jul2017 on GST):

Monthly collections:

Gross GST revenue collections in Jan2026 are Rs 1.93 lakh crores. Net GST revenue collections (net of

refunds) in the same month are 1.71 lakh crore, an improvement of 7.6 per cent over Jan2025 (Note: Jan2025 figures given in Jan2026 GST Collections report do not match with those given in Jan2025 GST Collections report -- no explanation for the difference is given by GST Council).

During Jan2026, the year or year (YoY) net GST collections growth rate improved to at 7.6 per cent

(versus Jan2025 data), compared to very low growth rate months between Sep2025 and Dec2025.

As can

be seen from the below chart, these YoY growth rates are volatile and

not much can be gleaned from the data.

One may have to see more granular data to analyse the monthly GST data.

For

the financial year 2025-26 (10 months till Jan2026), the net GST

collections are Rs 15.96 lakh crore, showing a YoY growth of 6.8 per cent

compared to Apr-Jan2025 period (see two charts below for data).

Average monthly Net GST Collections:

During FY 2025-26 (10 months data till Jan2026), the average monthly

net GST collections are Rs 1.60 lakh crore, compared to average monthly

figure of Rs 1.49 lakh crore for the correponding period of FY 2024-25 (see chart below).

Due

to inflationary pressures and other factors, average monthly net GST

collections improved from Rs 0.98 lakh crore for full FY 2018-19 to Rs

1.60 lakh crore now.

Net GST revenue equals gross GST revenue minus GST refunds. GST refund data prior to 2020-21 aren't available with GST Portal.

data sources:

India: Monthly Gross / Net GST Collections from Sep2024 to Oct2025:

Charts 107 and 108 click on them to view better >

--------------------------------------------------------------

Update 19Jan2026: Chart 106:

India PMS Industry AUM: India PMS Industry assets: PMS or portfolio management services (Check previous blog dated 09May2024 - Rapid Rise of India's PMS Industry - for a comprehensive analysis)

The industry's assets under management (AUM) as on 30Nov2025 are Rs 41 lakh crore including those from EPFO / other PFs (check update 19Jun2025 with charts 51 to 55 below for EPFO data).

India’s PMS industry has expanded steadily over the last decade, with total assets under management rising from about Rs 7 lakh crore in Mar2015 to Rs 41 lakh crore by Nov2025.

This represents nearly a six-fold increase in AUM over ten years.

A major portion of the increase in PMS assets is driven by EPFO investments routed through equity ETFs since Aug2015.

It may be noted EPFO investments in Equity ETFs are shown under EPFO / PFs column of the SEBI data; not under Listed Equity column in the chart below.

So, Listed Equity category assets do not include EPFO investments in Equity ETFs or exchange traded funds. As such, the listed equity numbers understate the true equity exposure under the PMS.

The number of PMS clients has grown from 46,700 in Mar2015 to 2.11 lakh by Nov2025, more than a four-fold increase.

A portfolio manager basically manages money in two routes, namely, discretionary and non-discretionary basis. The data presented here include money under both the routes.

In a discretionary portfolio, a portfolio manager enjoys full discretion to manage clients' funds. However, in case of a non-discretionary portfolio, a portfolio manager does not have any discretion to invest a client’s money.

Chart showing AUM of PMS industry, number of portfolio managers and number of clients >

Chart 105 click on the image to view better >

--------------------------------------------------------------

Update 16Jan2026: Chart 105:

AMFI List: Classification of Indian stocks by market capitalisation: To be followed by Equity Mutual Funds or EMFs (previous blog dated 17Feb2024 / Tweet thread 05Jan2023)

SEBI's Oct2017 definition of stocks on the basis of their

market capitalisation is as follows:

1) large-cap stocks: 1st to 100th company in terms of full market capitalisation

2) mid-cap stocks: 101st to 250th company in terms of full market capitalisation

3) small-cap stocks: 251st company onwards in terms of full market capitalisation

According to SEBI definition, Association of Mutual Funds in India (AMFI) prepares a

list of all listed stocks (more than 5,000 in number) based on their

average market capitalisation and publishes the list of large-, mid- and

small-cap stocks.

AMFI

prepares the list two times in a year, that is, at the end of June and

December of every year.

The below chart provides data as published by AMFI for the half-yearly period (based on average market capitalization of stocks during Jul-Dec2025) ended 31Dec2025.

As on 31Dec2025:

Large-cap stocks: Stocks with market cap of more than Rs 105,000 crore

Mid-cap stocks: Stocks with market cap of more than Rs 34,700 crore, but less than Rs 105,000 crore

Small-cap stocks: All stocks with market cap of less than Rs 34,700 crore

Percentage change in market cap is modest in the past one year.

Changes in market cap in the past one year:

5.0% large-cap

5.2% mid-cap

But market cap expansions are more than 100 per cent in the past three years.

Changes in market cap in the past three years:

115% large-cap

107% mid-cap

This means, a stock with more than Rs 16,800 crore, but less than Rs 48,800 crore market cap was considered a mid-cap stock three years ago; but now the market cap range for a mid-cap stock has more than doubled to Rs 34,700-105,000 crore -- as Indian stocks provided stellar returns in the past three years.

Chart: Snapshot of AMFI classification of stocks by market cap: Data from Dec2022 to Dec2025:

Chart 105 click on the image to view better >

--------------------------------------------------------------

Update 16Jan2026: Chart 104:

India Real interest rates: (old blog

dated 05Aug2021) >

Real

interest rate in India for the month of Dec2025 declined to 3.9 per cent

from 4.8 per cent in Nov2025, as

India's CPI

inflation for Dec2025 ticked up slightly to 1.3 per cent -- though price rise guage overall is on a downward trajectory.

In fact, Oct2025 print of 5.3 per cent for real interest rate is the highest for several years.

The past 15-month data in the chart given below suggest the real rate cycle is inflation-led, not policy-rate-led.

Real interest rate equals LAF repo rate minus CPI inflation.

If

you believe the official CPI figures dished out by Govt of India,

Indian savers have been enjoying highh real interest rates since May2025,

while RBI has been reducing interest rates aggressively as India's CPI

inflation touched almost zero levels in Oct2025.

Term deposit rates average 6.22 per cent, even as inflation is below one per cent.

Inflation collapse is doing the heavy lifting for high real rates.

As argued earlier, high real interest rates usually slow economic growth by raising the true cost of borrowing and discouraging investment.

Dichotomy between sticky G-Sec yields while rates are falling:

Over the last 15 months, the RBI cut the repo rate by 125 basis points and CRR (cash reserve ratio) by 100 basis points (check Update 13Jan2026, with Charts 101 and 102 below), but the 10-year government bond yield barely moved, staying in a narrow range.

India

10-year benchmark G-Sec yield hovers around 6.3 to 6.7 per cent in the

past six months, though RBI has injected massive amounts of liquidity in

to the banking system (OMO purchases and USD INR swaps) in addition cutting repo rates aggressively and undertaking CRR rate cuts too.

This shows that long-term bond markets are not guided by short-term policy cuts or monthly inflation prints.

Instead, they reflect expectations about medium-term inflation returning closer to RBI target, along with India’s long-run growth and fiscal borrowing needs.

Investors appear unconvinced that today’s low inflation and high real rates will last. As a result, long-term yields remain “sticky” even while short-term rates fall sharply.

Bond markets may also be worried about large government borrowing, which keeps bond supply high and pushes yields up. Fiscal concerns raise term premia and inflation risks over time, making long-term yields sticky despite repo rate cuts.

MCLR rate and monetary policy transmission:

One

more column is added with data pertaining to MCLR (1 year) or marginal cost of

funds based lending rate.

By placing MCLR 1-year rate alongside repo, inflation and G-Sec yields, the chart allows a reader to see how much of the RBI policy stance actually reaches borrowers (monetary policy transmission).

The slow and partial decline in MCLR versus repo cuts highlights transmission delay. Slower MCLR decline shows that banks are not easing lending rates in proportion to repo rate cuts.

CPI

inflation, average 1-year bank term deposit rates and India 10-year

G-Sec yield data too have been included in the below chart for

comparison purposes.

Check Update 13Jan2026 with charts 101 and 102 below to know more about MCLR overnight rate versus MCLR 1-year rate.

Check Update 13Jan2026 with chart 103 below to know more about EBLR and MCLR mix overall rupee floating rate loans outstanding.

See Tweet thread 27Dec2025 for internal benchmark lending rates and external benchmark lending rates (EBLRs).

Chart 104 click on the image to view better >

--------------------------------------------------------------

Update 13Jan2026: Chart 103:

Lending Rates of Banks in India : (Reference: Tweet thread dated 27Dec2025)

India's banking regulator RBI introduced External Benchmark Based Lending in Sep2019, making it mandatory for all new floating rate personal or retail loans and floating rate loans to Micro and Small Enterprises (MSMEs).

Since then, Banks in India have been offering personal or retail loans (like housing, auto and others) and MSME loans based on external benchmark lending rates (EBLR).

External benchmarks of banks in India (approved by RBI):

1. RBI LAF policy repo rate

2. 91-day Treasury bill yield published by FBIL

3. 182-day Treasury bill yield published by FBIL

4. Any other benchmark market interest rate published by FBIL

FBIL is Financial Benchmarks India Pvt Ltd, a financial benchmark setter supervised by RBI.

Internal benchmark interest rates, like, base rate and BPLR have largely become irrelevant now -- with banks lending only a tiny portion of their total outstanding loans through base rate and BPLR.

As per RBI data, the share of total outstanding floating rate rupee loans (of 74 SCBs in India) as of 30Sep2025 is:

64.8% EBLR or external benchmark-based lending rate

32.2% MCLR or marginal cost of funds based lending rate

3.0% Others (include BPLR or benchmark prime lending rate and Base rate)

As shown here, the lion's share of bank lending in India is linked to EBLRs (which is good for monetary policy transmission or MPT).

One-third of total loans outstanding is linked to MCLR. Most of the corporate loans and a small portion of retail loans are linked to MCLR.

In the context of monetary policy transmission (MPT), the relevance of external benchmark lending rates (EBLRs) is:

1. EBLRs ensure RBI policy changes reach borrowers immediately by linking loan rates directly to market benchmarks instead of internal bank costs.

2. With mandatory three-month resets, EBLRs remove the delays seen under MCLR.

3. Repo Rate changes now quickly and directly affect borrowing costs across most of the lending market.

Pass-through of RBI policy rates is quicker now with almost two-thirds of bank lending is linked to external benchmark rates.

Using benchmarks like the Repo rate or Treasury bill yields enables quarterly resets and direct monetary policy transmission (MPT).

Kudos to RBI! 👍

Monetary policy transmission is slower under MCLR because most loans reset only annually, delaying the pass-through of RBI rate changes.

Indian banks depend largely on deposits rather than RBI borrowing. And deposit rates are sticky downward, so funding costs fall slowly.

Banks also have discretion with MCLR and tend to pass on rate hikes faster than cuts to protect margins.

So, lending rates adjust with a lag, which is why RBI in 2019 nudged banks to shift to external benchmarks for faster transmission.

Chart showing data on share of EBLR and MCLR in outstanding bank loans >

Data: RBI press release 31Dec25 on Lending and Deposit Rates of SCBs

What the data in the above chart show at a glance:

The data show a steady and structural shift in India’s banking system from MCLR-linked lending to external benchmark–linked rate (EBLR) lending. The data are for 74 SCBs in India.

Over six years, EBLR’s share has risen from just 5.2 per cent in Dec2019 to 64.8 per cent by Sep2025, while MCLR’s share has fallen correspondingly from over 80 per cent to just above 32 per cent.

Pace and timing of the transition:

The transition accelerates sharply after 2021, reflecting regulatory push by the RBI to improve transparency and monetary policy transmission.

The most rapid gains for EBLR occur between Dec2020 and Dec2023, when its share more than doubles, indicating banks actively migrated new loans—and some existing ones—toward externally benchmarked pricing.

Implications for monetary transmission:

A higher EBLR share means policy rate changes transmit faster and more directly to borrowers. Unlike MCLR, which depends on banks’ internal cost of funds, EBLR adjusts almost automatically with repo rate changes.

This explains why recent repo rate cuts have shown quicker impact on new floating-rate loans, even though overall WALR transmission (see Update 13Jan2026 with Charts 101 and 102 below) remains partial.

Why MCLR still matters:

Despite the decline, MCLR-linked loans still account for nearly one-third of outstanding floating-rate loans. This legacy stock is a key reason aggregate lending rates remain sticky despite policy easing.

Structural takeaway

The data confirm a durable shift toward a more policy-sensitive lending framework in India. However, until MCLR-linked loans shrink further and deposit-side rigidities ease, monetary transmission will remain faster than in the past—but still weak.

--------------------------------------------------------------

Update 13Jan2026: Charts 101 and 102:

How Rates and Ratios are Moving : (previous blog dated 26May2022)

The

following charts provides data on key interest rates and ratios of

interest rate market in India. The rates and ratios range from CPI

inflation, Policy repo rate, lending and deposit rates, short-term rates

such as call money and Treasury bill yields, long term bond yields and

government-administered small savings rates of PPF, NSC and post office

deposit rates.

By looking at data over medium and long periods, one can glean some insights.

Two charts:

Quarterly data (Dec2023 to Dec2025) of rates and ratios

Yearly data (Dec2018 to Dec2025).

Please click on the charts to view better >

What the above two charts reveal >

Quarterly chart:

The quarterly data highlights short-term momentum and turning points rather than long-cycle trends. Between Dec2024 and Dec2025, the most striking development is the rapid collapse in inflation, with CPI falling from above 5 per cent to near 1.3 per cent and WPI slipping into negative territory.

This disinflation is much faster than changes in policy rates, showing that prices are cooling much faster than the central bank is reducing nominal interest rates. This is contributing to higher real interest rates, which makes borrowing more expensive in inflation-adjusted terms leading to tighter financial conditions.

Monetary policy stance and liquidity conditions:

Liquidity conditions are clearly easing. CRR cuts from 4.0 per cent to 3.0 per cent release durable liquidity into the system, and this is reflected first in money-market instruments. Policy repo rate has been cut by 125 basis points (one percentage point equals 100 basis points) in the past one year.

Money market and short-term yields:

Call money rates and Treasury bill yields fall across in the past one year, confirming surplus liquidity and lower short-term rate expectations. The short end of the curve reacts quickly, indicating confidence that the easing cycle is not a one-off move.

There

have been no changes in interest rates of Post Office savings schemes (NSC, PPF, post

office term deposit rates, etc.) in the past two years. It is not clear

why Govt of India has not been changing these interest rates as per the

market rates.

Bank lending and borrowing conditions:

Transmission to bank lending is slower. Weighted average lending rate (WALR) of scheduled commercial banks (SCBs) and Marginal cost-of-funds lending rate (MCLR) decline only gradually and remain sticky despite repo cuts.

In 2025: while the RBI's policy repo rate fell sharply by 125 basis points, the WALR declined only 65 basis points -- clearly exhibiting weak policy transmission in India. In effect, banks passed through barely half of that cut to borrowers.

This quarterly stickiness suggests banks are prioritising balance-sheet strength and risk pricing. In the near term, borrowers benefit more from capital market yields than from bank lending rates.

Real interest rates rise sharply on a quarterly basis because inflation falls faster than nominal rates. This makes each quarter of 2025 progressively more restrictive in real terms, even though headline policy signals suggest easing.

The quarterly picture therefore shows a paradox: easing liquidity and falling yields alongside tightening real financial conditions.

Deposit growth has lagged credit growth in the past one year, forcing banks to compete aggressively for term deposits. Because small savings schemes and debt funds offer attractive alternatives, banks cannot cut deposit rates sharply without risking outflows.

As a result, banks’ cost of funds remains high, keeping MCLR and WALR sticky. Even when the repo rate is cut, banks are reluctant to pass it on fully to borrowers.

Improved system liquidity from CRR cuts, OMO purchases and forex swaps do not solve this structural deposit scarcity.

Hence, difficulty in attracting deposits is a key reason lending rates have not fallen meaningfully in the past one year.

Observations from movement in 8-year data between Dec2018 to Dec2025:

The yearly data tells a structural story of regime change rather than short-term adjustments. From 2019 to 2022, India experienced elevated inflation volatility and periods of deeply negative real interest rates, especially during and after the COVID-19 pandemic.

This era was characterised by accommodative policy, low repo rates and inflation spikes that eroded Indian savers’ returns.

From 2023 onward, the trend reverses decisively. Inflation moderates, policy rates peak and by 2025 the system shifts into a high real interest rate regime. Real rates move from negative in 2020–2022 to strongly positive in 2024–2025, marking a clear break from the post-pandemic monetary framework.

This indicates restored inflation control and better central bank credibility.

Yearly bond yields show a gradual but persistent decline rather than sharp swings. The 10-year G-Sec yield falls from above 7.2 per cent in 2023 to around 6.65 per cent in 2025, signaling long-term confidence in lower inflation, even as fiscal supply remains a constraint.

Unlike quarterly volatility, the yearly view confirms that yields are normalising, not collapsing.

Govt of India's small savings instruments have been structurally rigid in the yearly data. NSC and PPF rates barely change across years, which means their attractiveness rises sharply when inflation falls.

Over the long run, this creates a sustained incentive for household financial savings, potentially diverting funds away from risk assets.

Overall, the yearly chart shows India transitioning from a growth-support, inflation-tolerant regime to a stability-focused regime with positive real returns.

It's worth repeating that liquid fund returns are market-determined; but not savings bank

(SB) interest rates and government's small savings rates.

Bonus tip:

Overnight MCLR rate versus One-year MCLR rate:

Overnight MCLR applies mainly to very short-term loans, while 1-year MCLR benchmarks common retail products like home loans.

MCLR, or Marginal Cost of Funds based Lending Rate, is a benchmark set by banks under RBI guidelines for setting loan interest rates. Banks publish rates for tenors including overnight, 1-month, 3-month, 6-month, 1-year, 2-year and 3-year.

Overnight MCLR applies to very short-term loans lasting one day, such as emergency credit or interbank dealings. It reflects immediate funding costs but has limited relevance for typical retail borrowers.

MCLR overnight is used mostly by bank treasury departments. It's primarily used for interbank transactions, institutional lending or specific corporate credit lines that need to be settled in 24 hours.

The 1-year MCLR serves as the most popular benchmark for home loans and other long-term retail lending products. Most floating-rate retail loans taken between Apr2016 and Sep2019 (like home loans) are linked to the 1-year MCLR.

Even if a bank changes its MCLR every month, your specific loan interest rate usually only changes once a year on your reset date, based on the 1-year MCLR prevailing at that time.

Data:

Tweet thread 27Dec2025 - bank lending rates in India (EBLR vs MCLR) EBLR - external benchmark-based lending rate

(Note: Base rate system of loan pricing becomes irrelevant now, with less than 2% bank loans priced via base rate)

RBI press release 31Dec2025 - deposit and lending rates of SCBs --------------------------------------------------------------

Update 12Jan2026: Chart 100:

Mutual Fund Assets: Fund-wise MF AUM data: Top 20 AMC-Wise MF AUM data: Average AUM or AAUM data:

Complement this data with:

Update 11Jan2026 with Charts 98 and 99

Update 11Jan2026 with Chart 97

Update 19Nov2025 with Chart 88

Update 19Nov2025 with Chart 87

Update 18Jul2025 with Chart 62

Update 17Jun2025 with Chart 50

Chart showing Top 20 Fund-wise Average AUM data for the quarter ending 31Dec2025 >

What the above chart reveals >

The total AAUM (average assets under management) of India's mutual fund industryis Rs 81 lakh crore for the Oct-Dec2025 quarter ending 31Dec2025.

The chart shows top 20 fund houses, their average AUM and their share in the total average AUM.

The data cover 51 AMCs (asset management companies) in total, though the table displays the top 20 fund houses.

The industry remains meaningfully concentrated among the largest fund houses. SBI Mutual Fund leads with Rs 12.49 lakh crore AAUM and a 15.4 per cent market share.

ICICI Prudential and HDFC follow with 13.3 per cent and 11.4 per cent respectively. The top three together account for roughly 40 per cent of total industry AAUM, indicating strong scale advantages and Bank-led AMC dominance at the very top.

The insane concentration is as follows:

55.8% top 5 fund houses

76.2% top 10

86.9% top 15

94.5% top 20

This leaves just 5.5 per cent of AAUM spread across the remaining 31 AMCs.

The cumulative AUM shares underline a highly concentrated industry structure.

The numbers strongly show the Pareto principle at work. A small fraction of AMCs controls a disproportionately large share of industry assets, which is the classic 80/20 dynamic.

Bank-led Fund Houses Dominate:

Bank-sponsored AMCs clearly dominate the landscape. SBI, ICICI Prudential, HDFC, Kotak, Axis, Canara Robeco and Bandhan together account for a large portion of the cumulative share.

Bank-sponsored AMCs benefit from captive distribution via branch networks, long-standing customer relationships and preferential access to retail and institutional flows.

Salary accounts, corporate banking relationships and branch-driven sales create a steady pipeline of assets that smaller, non-bank AMCs cannot easily replicate.

Non-bank and independent fund houses are largely competing within a narrow slice of the remaining market.

Even successful players like Nippon India, Aditya Birla Sun Life and Mirae Asset operate in an environment where incremental growth requires either differentiated performance, niche product leadership or aggressive digital and intermediary-led distribution.

The data reinforces that the Indian mutual fund industry is not just concentrated, but structurally tilted in favour of bank-led AMCs.

Scale, distribution, and legacy banking relationships matter more than marginal performance differences, especially when viewed through average AUM rather than point-in-time assets.

One may say return performance alone is very unlikely to be the primary reason for bank-led AMC dominance.

The 11 bank-led AMCs together command 58.5 per cent of total industry AAUM, even though they represent only about 22 per cent of all AMCs (11 out of 51).

This dominance suggests that the Indian mutual fund industry is not just concentrated by size, but also by sponsor type. Bank ownership acts as a powerful moat, reinforcing the Pareto distribution and making market share gains by independent AMCs inherently more difficult.

Explanation: Why is the average AUM figure of Rs 81 lakh crore differs from Rs 80.23 lakh crore AUM figure (see update 11Jan2026 with charts 98 and 99 below)?

The higher figure (Rs 81.01 lakh crore) is a three-month average that reflects how much money was in the system during the overall quarter, including when the markets were peaking.

The lower figure (Rs 80.23 lakh crore) is a single snapshot of the very last day of the calendar year 2025, which is always skewed by a temporary outflows in the last month of a quarter.

Essentially, the average shows the general health of the quarter, while the closing figure shows the temporary effect of tax outgo by cororates. AMFI does not provide ready-data for AUM by AMC-wise as at the end of a month / quarter.

Data: Average AUM data (fund-wise) of AMFI

--------------------------------------------------------------

Update 11Jan2026: Charts 98 and 99:

Mutual Fund Assets: Growth of India Mutual Fund Industry: Mutual Fund AUM data (For a detailed analysis, please refer to the blog dated 18Jul2024)

In

the 2025-26 financial year (9-month data), India's mutual fund industry experienced an

impressive 22 per cent growth in assets under management (AUM), as per AMFI data. The growth rate for full FY 2025-26 is likely to surpass that of FY 2024-25 growth.

The

industry's total assets surged from Rs 65.74 lakh crore on 31Mar2025 to

Rs 80.23 lakh crore by 31Dec2025, reflecting robust investor

participation and growing confidence in mutual funds as an investment

vehicle.

In comparison, the aggregate deposits of India's scheduled commercial banks (SCBs) as on 31Dec2025 are Rs 248.6 lakh crore.

Two charts:

Growth from 2000 to 2012 >

Growth from 2013 to 2025 >

--------------------------------------------------------------

Update 11Jan2026: Chart 97:

Mutual Fund Assets: India Passive Funds AUM Data: Passive Funds asset size (ETFs and Index funds of equity, debt and commodities): MF AUM data:

Complement this data with:

Update 19Nov2025 with Chart 88

Update 19Nov2025 with Chart 87

Update 18Jul2025 with Chart 62

Update 17Jun2025 with Chart 50

As of 31Dec2025,

total passive funds' AUM (assets under management) in India is Rs 14.21 lakh crore -- covering all ETFs (exchange trade funds) and index funds

across Equity, Debt and Commodities. Commodities include gold and

silver.

Break up of the total passive funds' AUM is as follows:

Asset-wise split:

Equity Passive Funds (ETFs + Index funds):

Equity

is the largest component of passive investing in India. Total equity

passive AUM is Rs 10.12 lakh crore, accounting for roughly three-fourths

of all passive assets.

This shows that equity ETFs are the primary driver of passive fund growth in India.

Within equity:

ETFs hold Rs 7.95 lakh crore.

Index funds hold Rs 2.17 lakh crore.

Debt Passive Funds (ETFs + Index funds):

Total debt passive AUM is Rs 2.04 lakh crore.

Within debt:

ETFs account for Rs 0.99 lakh crore.

Index funds account for Rs 1.05 lakh crore.

Debt index funds slightly exceed debt ETFs, indicating growing investor comfort with index-based debt products.

Commodities Passive Funds (Only ETFs):

Total commodity passive AUM is Rs 2.01 lakh crore, showing a sharp increase in recent months, as gold and silver prices have soared sharply.

The entire commodity exposure comes through ETFs.

Commodity ETFs include gold and silver ETFs. Gold ETFs form the bulk of this category. There are not commodity index funds.

ETF vs Index Fund Comparison:

As on 31Dec2025, total ETF AUM is Rs 10.95 lakh crore, bulk of which is from equity.

ETFs make up about three-fourths of the total passive fund market.

Total index fund AUM is Rs 3.26 lakh crore, majority is from equity segment.

Index funds account for about one-fourth of total passive assets.

Key Observations:

> Passive investing in India is strongly equity-led

> ETFs dominate the passive fund landscape, especially in equity and commodities

> Debt index funds are growing and have slightly overtaken debt ETFs

> Commodity passive investing remains ETF-centric, suggesting scope for new product development.

data: NSE India passive funds - monthly data available Chart 97 click on the image to view better >

--------------------------------------------------------------

Update 28Dec2025: Chart 96:

India CPI Inflation : India Cumulative Inflation: India consumer price inflation data:

The

following chart shows: cumulative CPI inflation numbers for the

past 10, five and three years,

The

cumulative data will give you a new perspective on how much consumers

have suffered over the years, instead of just looking at one-year

numbers.

The

data shown in the chart are for the past 15 months -- cumulative data

for 10, 5 and 3 years are given. Year-on-year CPI inflation is also

included in the chart.

CPI

inflation has been falling continuously for the past one year --

falling from a high of 6.2 per cent in Oct2024 to 0.7 per cent in Nov2025 (In fact, the Oct2025 print of 0.3 percent is the lowest for several years).

But

if you compare the cumulative inflation, it clearly shows Indian

consumers still face long term price pressures -- as indicated by 3-year

cumulative price rise of 12.1 per cent and 5-year cumulative price rise

of 24.5 per cent and 10-year cumulative inflation of 56.3 per cent as at the end of Nov2025.

Why “Low Inflation” Doesn’t Feel Low?

You may see headlines saying inflation is just 0.7 per cent this year. Yet most people feel that daily expenses are still high. That confusion is natural, and it comes from how inflation is usually explained.

Inflation Speed vs Inflation Distance

One-year inflation only tells us how much prices have risen compared to last year. It shows the current pace of price increases, not the total rise over time. Think of it like speed versus distance. Slowing down does not take you back to where you started.

The Missing Picture: Cumulative Price Rise

When we look at cumulative inflation, prices today are about 12 per cent higher than three years ago, roughly 25 per cent higher than five years ago, and over 56 per cent higher than ten years ago. This is what households actually experience in food, rent, education and healthcare.

Why Prices Still Feel High

Even if inflation falls to zero (provided you believe in the official inflation data put out by the governments), prices do not come down. They simply stop rising. People are still living with years of accumulated price increases, while incomes often lag behind.

The Bottom Line

Low inflation is helpful because it prevents further damage. But it does not erase past price rises. To understand the real cost of living, we must look beyond one-year inflation and acknowledge the cumulative loss of purchasing power.

Tweet thread on joke about cryogenic chamber and cumulative inflation

Data sources:

Chart 96 click on the image to view better >

--------------------------------------------------------------

Update 28Dec2025: Chart 95:

Mutual Fund Assets: India Passive Funds AUM Data: Passive Funds asset size (ETFs and Index funds of equity, debt and commodities):

Complement this data with:

Update 19Nov2025 with Chart 88

Update 19Nov2025 with Chart 87

Update 18Jul2025 with Chart 62

Update 17Jun2025 with Chart 50

As of 30Nov2025, total passive funds' AUM (assets under management) in India is Rs 13.72 lakh crore -- covering all ETFs (exchange trade funds) and index funds across Equity, Debt and Commodities. Commodities including gold and silver.

Break up of the total passive funds' AUM is as follows:

Asset-wise split:

Equity Passive Funds (ETFs + Index funds):

Equity is the largest component of passive investing in India. Total equity passive AUM is Rs 10.03 lakh crore, accounting for roughly three-fourths of all passive assets.

This shows that equity ETFs are the primary driver of passive fund growth in India.

Within equity:

ETFs hold Rs 7.88 lakh crore.

Index funds hold Rs 2.15 lakh crore.

Debt Passive Funds (ETFs + Index funds):

Total debt passive AUM is Rs 2.05 lakh crore.

Within debt:

ETFs account for Rs 0.99 lakh crore.

Index funds account for Rs 1.06 lakh crore.

Debt index funds slightly exceed debt ETFs, indicating growing investor comfort with index-based debt products.

Commodities Passive Funds (Only ETFs):

Total commodity passive AUM is Rs 1.60 lakh crore.

The entire commodity exposure comes through ETFs.

Commodity ETFs include gold and silver ETFs. Gold ETFs form the bulk of this category. There are not commodity index funds.

ETF vs Index Fund Comparison:

As on 30Nov2025, total ETF AUM is Rs 10.47 lakh crore, bulk of which is from equity.

ETFs make up about three-fourths of the total passive fund market.

Total index fund AUM is Rs 3.25 lakh crore, majority is from equity segment.

Index funds account for about one-fourth of total passive assets.

Key Observations:

> Passive investing in India is strongly equity-led

> ETFs dominate the passive fund landscape, especially in equity and commodities

> Debt index funds are growing and have slightly overtaken debt ETFs

> Commodity passive investing remains ETF-centric, suggesting scope for new product development.

data: NSE India passive funds - monthly data available Chart 95 click on the image to view better >

--------------------------------------------------------------

Update 28Dec2025:

Look for Update dated 28Dec2025: Gold and silver prices hitting all time highs (ATH) in Dec2025 in my blog 'Who is Eating My Gold ETF Return? 25Jan2022

--------------------------------------------------------------

Update 27Dec2025: Chart 94:

India Real interest rates: (old blog

dated 05Aug2021) >

Real

interest rate in India for the month of Nov2025 declined to 4.8 per cent

from 5.3 per cent in Oct2025, as

India's CPI

inflation is on a downward trajectory (Oct2025 print for real interest rate is the highest for several years).

Real interest rate equals LAF repo rate minus CPI inflation.

If you believe the official CPI figures dished out by Govt of India, Indian savers have been enjoying high real interest rates since May2025, while RBI has been reducing interest rates aggressively as India's CPI inflation toughed almost zero levels in Oct2025.

Term deposit rates average 6.22 per cent, even as inflation is below one percent.

India 10-year benchmark G-Sec yield hovers around 6.3 to 6.6 per cent in the past six months, though RBI has injected massive amounts of liquidity in to the banking system (OMO purchases and USD INR swaps) in addition cutting repo rates aggressively and undertaking CRR (cash reserve ratio) rate cut too.

Inflation collapse is doing the heavy lifting for high real rates.

What Global Experience Tells Us About High Real Interest Rates

1. High real interest rates usually slow economic growth by raising the true cost of borrowing and discouraging investment.

2. Consumers tend to spend less and save more, especially on big-ticket items like homes and vehicles.

3. Asset prices such as equities and real estate typically weaken as valuations compress and demand falls.

4. Financial stress rises over time, particularly for highly leveraged firms and emerging economies.

5. If high real rates persist, inflation often undershoots and central banks eventually cut rates to revive growth.

CPI

inflation, average 1-year bank term deposit rates and India 10-year

G-Sec yield data too have been included in the below chart for

comparison purposes.

One more column is added with data pertaining to MCLR or marginal cost of funds based lending rate, so that readers can discern whether banks are reducing their lending rates when RBI reduces its policy Repo rate.

See Tweet thread 27Dec2025 for internal benchmark lending rates and external benchmark lending rates (EBLRs).

Data sources are Reserve Bank of India, MOSPI, CCIL India and author.

Chart 94 click on the image to view better >

--------------------------------------------------------------

Update 07Dec2025: Chart 93:

India CPI Inflation : India Cumulative Inflation: India consumer price inflation data:

The

following chart shows: cumulative CPI inflation numbers for the

past 10, five and three years,

The

cumulative data will give you a new perspective on how much consumers

have suffered over the years, instead of just looking at one-year

numbers.

The

data shown in the chart are for the past 15 months -- cumulative data

for 10, 5 and 3 years are given. Year-on-year CPI inflation is also

included in the chart.

CPI inflation has been falling continuously for the past one year -- falling from a high of 6.2 per cent in Oct2024 to just 0.3 per cent in Oct2025. In fact, the Oct2025 print is the lowest for several years.

But

if you compare the cumulative inflation, it clearly shows Indian

consumers still face long term price pressures -- as indicated by 3-year

cumulative price rise of 11.7 per cent and 5-year cumulative price rise

of 24.6 per cent and 10-year cumulative inflation of 56.5 per cent as at the end of Oct2025.

Data sources:

--------------------------------------------------------------

Update 02Dec2025: Chart 92:

QIP funds raised by India Inc: (Tweet thread 16Dec2024):

Data from FY 2006-07 to FY 2025-26 >

During

the financial year 2025-26 (data for 8 months till 30Nov2025), India

Inc raised funds worth Rs 47,500 crore via QIPs or qualified

institutional placements (equity capital).

The Indian media kept highlighting that QIP fundraising had been the “highest in 19 years” up to March 2025. Yet in the first eight months of FY 2025-26, India Inc has raised only about Rs 47,500 crore through QIPs—a clear slowdown. Strangely, this shift has gone largely unreported.

The chart below adjusts QIP mobilisation for the average BSE market capitalisation of all listed companies in India. Once you look at the numbers in relative terms, the picture changes sharply.

In FY 2025-26 (till 30 Nov 2025), funds raised via QIPs amount to just 0.11 per cent of the average BSE market cap.

For comparison, the figure for the full FY 2024-25 was 0.33 per cent. Even number of issues are only 21 this year versus 85 in 2024-25.

In the past 20 years, the biggest QIP raised is in FY 2009-10,

when QIP raised was 0.91 per cent of the average market cap for the

financial year. Media will give only the absolute numbers, without

adjusting with other metrics, like, market cap -- in the process, the

data lose relevance and may lead to misinterpretation.

As

data from FY 2006-07 to 2024-25 show: In 2009-10, 2007-08, 2020-21

& others, QIP as a percentage of BSE market cap is much higher

compared to FY 2023-24 and 2024-25.

For

example, in FY 2009-10, India Inc raised QIP of Rs 41,968 crore (0.91

per cent of market cap) when the average BSE market cap was just Rs

46.26 lakh crore. Whereas, QIP raised was Rs 62,520 crore (just 0.47 per

cent of market cap) in 2017-18 when average BSE market cap was Rs

131.90 lakh crore -- though absolute QIP number is higher.

Take

another example: in both FY 2014-15 & 2021-22, the QIP raised is

nearly the same at Rs 28,500 crore.

But in 2014-15, the Sensex and BSE market cap are much lower -- hence,

the amount raised is nearly three times in 2014-15, when compared to

2021-22.

Don't believe the nonsense of absolute numbers.

Yet this context is almost always missing in media coverage. Reports highlight absolute fundraising totals but rarely adjust for market size or provide year-wise comparisons that show whether the activity is actually strong, weak or average.

The takeaway: absolute numbers can mislead.

Just because data points are available—and repeated in headlines—doesn’t mean they tell the full story. Always question the context, look at ratios and do your own research.

Data sources:

See BSE Ltd weblink for QIP issuers.

Chart 92 Click on the chart to view better >

--------------------------------------------------------------

Update 02Dec2025: Chart 91:

India GDP quarterly growth rates: Real GDP and Nominal GDP Growth Rates %: Data from Apr-Jun2023 to Jul-Sep2025 Quarter:

For

the Jul-Sep2025 quarter, India real GDP clocked a year-on-year (yoy)

growth rate of 8.2 per cent, the highest in the past six quarters.

However, the nominal GDP growth rate (yoy) slumped to 8.3 per cent, the

lowest in four quarters.

In fact, nominal GDP has been decelerating for the past two quarters: it decreased from Rs 88.18 lakh crore in Jan-Mar2025 quarter to Rs 86.05 lakh crore in Apr-Jun2025 quarter and further to Rs 85.25 lakh crore in Jul-Sep2025 quarter.

The second quarter real GDP growth is driven by: manufacturing (9.1%) and construction (7.2%) in the Secondary Sector; and financial, real estate and professional services (10.2%) in the Tertiary Sector.

However, Agriculture sector grew by just 3.5 per cent.

For

the past four quarters (Oct2024-Sep2025), India's real GDP is Rs 195.14

lakh crore, while the nominal GDP is Rs 344.5 lakh crore in the same

period.

India market cap-GDP ratio:

As of today, that is 02Dec2025, the market cap of all BSE companies is

Rs 472.51 lakh crore (or USD 5.26 trillion). The market cap to GDP ratio, based on the Oct2024-Sep2025 nominal GDP of Rs 344.5 lakh crore (USD 3.83 trillion), works out to 137 per cent, which is high by

historical standards.

India follows an April to March financial year.

Data Accurancy problems in India and IMF has given India GDP data a 'C' grade (second lowest) >

Pronab Sen, former India's chief statistician talking to Karan Thapar of The Wire on 29Nov2025:

> IMF is casting doubts on data accuracy of Indian government's GDP data

> IMF has recently India 'C' grade (the second lowest) for GDP data

> IMF is concerned there is wide gap between production and expenditures methods of GDP calculation

> India does not have PPI or Producer Price Index

> PPI data will be different from CPI data

> Data on prices (using CPI data) while calculating GDP estimates are problematic

> The problem lies with lack of PPI Index in India

> India Inc is not sharing actual data with Indian govt, which does not want to force India Inc to share data

> India Inc considers the PPI data confidential, hence they are reluctant to share it with Govt

> India was supposed to revise its CPI data and GDP base year every five years; but Govt has not been doing it -- hence, the IMF finds problems with India GDP data accuracy

> CPI basket of goods are services is outdated (2011-12 base year); what we actually consume now is not represented in the outdated CPI basket of itmes we use currently > Outdated CPI basket means you're are not capturing the goods / services that are in demand today

> As such, India official GDP data are less than reliable

> GDP deflator (nominal GDP minus real GDP growth) is just 0.5 per cent, which is too low to believe

> Hard Quarterly GDP is not available; hence NSO / MOSPSI uses proxy data

> actual GDP data is available only annually (after annual hard survey data are available)

> proxy data used here is based on formal sector data, from which informal sector data is inferred

> GDP estimates (lot of assumptions here) for the informal sector are based on past trends; but after the 2016 Demonetisation and 2017 GST implementation and 2020 COVID-19 Outbreak -- the formal and informal sectors are not moving in sync -- meaning for several years after 2016/2017, formal sector has been growing while unorganised sector is degrowing

> Due mainly to negative effects of Demonetisation, GST and COVID-19, informal sector has been shrinking in India; while the the formal corporate sector / India Inc has been growing

> The corporate sector has expanded rapidly while the unorganised sector has suffered badly

> The burden of Demonetisation, GST and COVID-19 has deeply destroyed informal sector in India

> However, the informal sector has recovered in the past two years or so; with the result that the informal sector has again showing positive correlation with changes in the formal sector

>

Data sources:

Chart 91 Click on the chart to view better >

--------------------------------------------------------------

Update 02Dec2025: Chart 90:

India Gold Price Annual Return / India Gold Price Calendar Year Return: Yearly return of domestic gold price vs USD gold price vs USD appreciation / Rupee depreciation: related blog 'Who is Eating my Gold ETF Return? 25Jan2022' > See Update 30Mar2025 with charts 63 and 64 of blog: Forex Data Bank (25-year data on USD gain vs INR) > Blog Sensex versus gold price >

As per IBJA data,

domestic price of gold in India closed yesterday at Rs 128,800 per 10

grams. The USD gold price closed at USD 4,248 per troy ounce, whereas

the rupee closed at 89.53 versus the dollar.

Meanwhile, Nifty 50 has provided tepid returns; it closed last yesterday at 25,176 with a return of 10.7 per cent year to date.

Gold in rupee terms has provided a spectacular return

of 69.1 per cent in 2025 (year to date till 01Dec2025), versus a subdued return of just 10.7 per cent for the Nifty 50 in the same

period. India gold price is driven mainly by world gold price in US dollars, which

has increased by 60.8 per cent YTD, aided in part by Indian rupee's

depreciation against the US dollar.

Other insights from the following chart:

>

India gold price is expressed in Indian rupees, while the USD gold

price is international gold price expressed in US dollars

> USD INR exchange rate is US dollar to Indian rupee

> Though gold does not provide any periodic cash flows, like, bonds or stocks, Indians' love for gold is legendary

> Of the 16 years, in four years only INR gold returns are negative; and in five years USD gold returns are negative

>

INR gold returns in years like 2022, 2018 and 2011 were indeed driven

primarily by the rupee's weakness against the USD rather than the

performance of gold in USD terms.

> In

contrast, 2013 was an outlier where both INR and USD gold prices

dropped, with the USD gold price falling by 27.8 per cent while USD gaining

13 per cent versus the INR. During the year 2013, INR suffered heavily

due to a combination of high current account deficit in India and US

Fed's Taper Tantrum.

>

The INR depreciation acts as a multiplier on the gold price in India,

so even when global gold prices are relatively stable or showing modest

growth, a weakening domestic currency can still lead to significant

positive returns in INR gold

> INR gold returns are higher than USD gold returns due to structural depreciation of the rupee against the dollar over long periods of time

> Periods of high INR gold returns often align with macroeconomic instability or rupee weakness as seen in 2011

>

During 2008-2013, India suffered from high inflation leading to large

depreciation of INR vs USD -- creating outsized INR gold return for

investors in that period

While

gold holds a deep cultural significance in India, is viewed as a safe

haven investment and store of value and has provided superior

inflation-beating returns for decades, its outsized share in household wealth has economic consequences:

> It impedes the growth of capital markets and more productive investments

> It contributes to import dependencies and pressure on forex reserves

> It increases households' vulnerability to gold price volatility without offering any yield.

Of course, it is investors' choice and they are not expected to take a macro view from a country perspective.

As

shown elesewhere (see Update 02Dec2025 with chart 89 below), it's

amazing to note that in the last 25 years, INR gold return has been

negative only in five years -- they are, 2021, 2015, 2014, 2013 and

2001.

In

such a scenario, it's hard to make a case for caution on gold

investments for Indian investors. Anyway, let me make such a case:

The INR depreciation has been a significant factor driving gold prices in India.

In

this light, gold has historically worked as an excellent hedge against

the rupee loss against the dollar and inflation, as gold rises in value

when the rupee weakens. This makes gold especially appealing for Indian

investors, who may see it as a protective asset against currency

depreciation and inflation.

Despite the impressive track record

of INR gold returns, there are a few reasons for caution, on the part of

Indian investors, when considering gold investments:

1. Past four to five years returns may be inflated due to INR Depreciation,

2. If rupee were to gain versus the dollar (low probability event), gold returns may suffer,

3.

If global uncertainities exacerbated by Russia-Ukraine war and others

were to ease, gold's appeal for central banks may diminish,

4. While some portion of gold exposure may be ideal from asset allocation perspective (most

Indian families as it is hold a high proporation of their assets in

gold and / or gold and other precious metals ornaments), over-exposure

may be detrimental to portfolio returns in the long run,

5. Investors should refrain from extrapolating past four to five years good returns into future, and

6. Many a time, asset prices tend to fall on their own weight.

Gold's

volatility, its reliance on INR depreciation and its lack of income

generation mean that overexposure to gold can make investors vulnerable

to risks.

Note:

India gold price return in this update (Update 02Dec2025 with chart 90 using Nippon MF data) are slightly different from IGP returns in the

Update 02Dec2025 with chart 89 below (using Forbes India data), due to

different sources of data.

Data sources:

Nippon India ETF Gold BeES fact sheets - domestic gold return CNBC and others for USD gold price Impact of customs duty cut on gold / silver in Union Budget

Chart

with 16-Year data showing calendar wise returns for India gold price,

USD gold price; and USD appreciation versus Indian rupee >

Chart 90 Click on the chart to view better >

--------------------------------------------------------------

Update 02Dec2025: Chart 89:

Sensex versus Gold Price: Annual return of Sensex compared to annual return India Gold Price (related blog: Sensex versus Gold Price 29May2024):

As

of 31Dec2024, Sensex level and rupee gold price were almost same level

of around 78,200. This looks quite uncanny, but it is true.

During

the Global Financial Crisis (GFC) of 2008 and self-induced crisis of

the UPA government in 2011, gold had offered good protection to Indian

investors with generating decent returns in 2008 and 2011 while Sensex

had disappointed.

In COVID-19 pandemic outbreak year of 2020, gold outperformed Indian stocks by a considerable margin.

Even

in 2025 and 2024, gold has comfortably outperformed Sensex by a

significant margin. The outperformance of gold versus Sensex amounted to

15.6 percentage point in 2024 and so far in 2025, the gold's

outperformance is a massive 55 percentage points.

In the past 25 years (see chart below), Sensex outperformed gold in 13 years and gold outperformed Sensex in 12 years.

But in the past 10 years (2016-2025), gold outperformed Sensex massively in 7 years.

A decade prior to that (2006-2015), Sensex outperformed gold in 7 years.

Past 25 years (2001-2025) absolute return:

(Sensex moved from 3,972 at the end of 2000 to 85,642 by now and gold from 4,400 at end-2000 to 128,800 now):

Sensex: 2,056%

Gold: 2,827%

Past 25 years CAGR %:

Sensex: 13.07%

Gold: 14.46%

Past 10 years (2016-2025) absolute return:

(Sensex moved from 26,118 at the end of 2015 to 85,642 by now and gold from 24,931 at end-2015 to 128,800 now):

Sensex: 228%

Gold: 417%

Past 10 years CAGR %:

Sensex: 12.61%

Gold: 17.85%

Prior decade (2006-2015) absolute return:

(Sensex moved from 9,398 at the end of 2005 to 26,118 at the end of 2015 and gold from 7,638 at end-2005 to 24,931 at end-2015):

Sensex: 178%

Gold: 226%

Prior decade CAGR %:

Sensex: 10.76%

Gold: 12.56%

Note:

India gold price return in this update (Update 02Dec2025 with chart 89 using Forbes India data) are slightly different from IGP returns in the

Update 02Dec2025 with chart 90 above (using Nippon MF data), due to

different sources of data.

Chart showing 25-year data of Sensex and domestic gold price returns >

Chart 89 Click on the chart to view better >

--------------------------------------------------------------

Update 19Nov2025: Chart 88:

Mutual Fund net inflows: India Passive funds net inflows: data include ETFs and Index funds for both equity and debt segments:

Net inflows during first half of FY 2025-26 are Rs 0.44 lakh crore for ETFs and Rs 0.09 lakh crore for index funds -- the data include equity and debt segments (Nifty Indices does not provide break up of equity and debt data).

Net inflows in H1 of 2025-26 seem to have slowed down due to higher redemptions in index funds.

In the past three years (FY 2022-23 to FY 2024-25), net inflows to ETFs and index funds were identical at Rs 1.71 lakh crore.

In the past five years (FY 2020-21 to FY 2024-25), net inflows to ETFs and index funds were at Rs 2.91 lakh crore and Rs 2.20 lakh crore respectively.

Chart 88 Click on the chart to view better >

--------------------------------------------------------------

Update 19Nov2025: Chart 87:

Mutual Fund Assets: Growth of India Passive Equity Funds AUM: Passive Funds AUM data (complement

this

data with 31Mar2025 data as per Update 18Jul2025 with chart 62 and

entire MF industry growth data as per Update 17Jun2025 with chart 50

below):

Between

Mar2025 and Sep2025, total assets under management (AUM) of passive

equity funds grew by Rs 96,000 crore or 11 per cent -- the growth is

primarily driven by Indian stocks recovering from their Mar2025 lows.

In

the same period, the ETF asset growth is 10 per cent while that of

index funds is 18 per cent. The share of ETFs in the total passive pie

is 79 per cent.

As of 30Sep2025, the total number of equity ETF schemes are 207 and the number of index funds are 235, totaling 442.

The number of indices tracked by equity ETFs are 90, while that of index funds are 83.

data: NSE India passive funds - monthly data available

Read more:

Decoding the Nifty Midcap 150 Quality 50 Index: A Midcap Strategy Built on Fundamentals

Chart: India Passive Equity Funds AUM Growth (both ETFs and Index funds tracking BSE as well as NSE / Nifty equity indices)

Chart 87 Click on the chart to view better >

--------------------------------------------------------------

Update 01Nov2025: Charts 85 and 86:

India GST Collections: Goods and Services Tax: Gross GST revenue collections, refund data and net GST revenue collections (Tweet thread 01Jul2017 on GST):

Monthly collections:

Gross GST revenue collections in Oct2025 are Rs 1.96 crores. Net GST revenue collections (net of

refunds) in the same month are 1.69 lakh crore, an improvement over Rs 1.6 lakh crore in Sep2025.

During Oct2025, the year or year (YoY) net GST collections growth rate is tepid at 0.6 per cent

(versus Oct2024 data). The corresponding YoY growth rates for Sep2025, Aug2025, Jul2025, and Jun2025 and May2025 are 5, 10.7, 1.7 and 3.3 per cent respectively. As can

be seen from the below chart, these YoY growth rates are volatile and

not much can be gleaned from the data.

One may have to see more granular data to analyse the monthly GST data.

For

the financial year 2025-26 (seven months till Oct2025), the net GST

collections are Rs 12.07 lakh crore, showing a YoY growth of 7.1 per cent

compared to Apr-Oct2024 period (see two charts below for data).

Average monthly Net GST Collections:

During FY 2025-26 (seven months data till Oct2025), the average monthly

net GST collections are Rs 1.73 lakh crore, compared to average monthly

figure of Rs 1.63 lakh crore for full 2024-25 (see chart below).

Due

to inflationary pressures and other factors, average monthly net GST

collections improved from Rs 0.98 lakh crore for full FY 2018-19 to Rs

1.73 lakh crore now.

Net GST revenue equals gross GST revenue minus GST refunds. GST refund data prior to 2020-21 aren't available with GST Portal.

data sources:

India: Monthly Gross / Net GST Collections from Sep2024 to Oct2025:

Charts 85 and 86 click on them to view better >

--------------------------------------------------------------

Update 30Oct2025: Charts 82 to 84:

India GNI per capita as per World Bank : India's

per capita national income (or simply India per capita income), in current US dollars, grew by an anaemic 2.7 percent

in 2024 to 2,650, as per latest data from World Bank (related blog dated 15Nov2023 and India falling behind Bangladesh).

India's

rank as per capita GNI in current US dollars (Atlas method) is 167 in

the world, among the 227 countries for which data are available.

India's per capita GNI rank slipped from 148 (among 198 countries for which data were available) in 2023 to 167 in 2024.

Gross national

income (GNI) is the total income earned by a nation’s residents and businesses irrespective of where it is

earned. It can be calculated by adding income from foreign countries to country’s

gross domestic product (GDP).

Per

capita GNI is often considered as an indicator of a nation's economic

health and standard of living. In the past 25 years, India's

per capital national income in US dollars grew by an annualised rate of

7.45 per cent.

The Atlas method is a technique used by the World Bank to calculate a country's per capita Gross National Income (GNI) in US dollars. It smooths exchange rate fluctuations by using a three-year average of exchange rates, adjusted for inflation using the GDP deflators of the country and developed economies.

This method provides a more stable and comparable measure of income levels across countries over time.

Data from 1998 to 2024:

As can be observed from the chart, the period from 2003 to 2011 has

seen the biggest jumps in India's per capita GNI in current US dollars.

Comparison with comparable countries: Comparable

countries, like, BRICS, G20 and others are included in the chart below

to see how

India performs relatively. As per World Bank’s 2024 data about per

capita GNI as of Jul2025, India is a lower middle income country.

India's rank at 167 is below that of comparables like, Bangladesh, Egypt and Vietnam. India’s

rank in per capita income is the lowest not only among the

G20 nations, but also among BRICS countries (it may be noted on a per

capita income by purchasing power parity or PPP method, India's rank in 2024 is

slightly higher at 147, with per capita income by PPP at 11,000 current international dollars).

In 2023, Russia moved from an 'upper middle income' country to a 'high income' country, even though the country is at war with Ukraine.

By next year, it is quite likely Vietnam will move from lower middle income to upper middle income country.

World Bank Country Classification: World Bank

divides countries into four groups by their income level. The groups

are: low income, lower middle income, upper middle income and high

income.

The thresholds for

country classification, as on 01Jul2025 for FY 2026, are given in the

below chart. The levels are as per Atlas GNI per capita in current US

dollars (2024 data).

With per capita GNI is USD 2,650, India falls under lower middle income

country. To reach the current threshold (which is likely to go up in

future) of USD 4,495 for upper middle income category, it may take more

than a decade for the world's most populous nation to reach the next

higher income level threshold.

As per 2024 World Bank data, India's population is 145.09 crore or 1.45 billion.

Big Slowdown in India Per Capita GNI annualised growth rates >

7.45% past 25-year CAGR (1999 to 2024)

7.62% 20-y CAGR

5.97% 15-y CAGR

5.58% 10-y CAGR

5.06% 5-y CAGR

There has been a marked slowdown in per capita income (in US dollars) during Thiru PM Modi's government.

Data Sources:

World Bank per capita GNI, Atlas Method (current US dollars) World Bank per capita by PPP (current international dollar)

Note: South Korea data are not updated for 2024 by World Bank, hence, data for 2023 is taken.

--------------------------------------------------------------

Update 30Oct2025: Chart 81:

Growth in Gold loans (loans against gold jewellery):

Gold loans outstanding grew by almost 50 per cent (to be exact 46.5 per cent) from Rs 2.09 lakh crore in Mar2025 to Rs 3.06 lakh crore by Aug2025, as per RBI data.

Interestingly, the growth of all personal loans during Apr-Aug2025 period is just 4.4 per cent versus 46.5 per cent for gold loans.

Betwee Mar2024 and Aug2025, gold loans outstanding trebled from Rs 1+ lakh crore to Rs 3+ lakh crore.

Gold loans were 1.1 per cent of total personal loans in Mar2019 and 2.5 per cent in Mar2021 (COVID-19 effect -- during COVID-19 Pandemic, households borrowed heavily to meet essential hospitalisation charges and medical bills).

As of Aug2025, gold loan outstanding is 4.9 per cent of total personal loans.

The rise in gold loans is partly driven by surging gold prices (and consequent rise in value of the gold jewellery collateral), which may have embolended individuals to borrow more against theier gold ornaments.

Stress on personal incomes and slowdown in real income growth may have forced households to opt for eaily accessible gold loans to meet their consumption needs.

Several large banks and NBFCs have launched digital gold loan products. These include features like:

Instant Top-ups: Allowing existing customers to quickly get additional loan amounts on the same collateral.

Mobile App Renewals/Repayments: Enabling customers to manage their accounts from their phones, reducing the need to visit a branch.