Indian Savers and Negative Real Interest Rates

(Please see Indian economy data bank for latest updates, since Jun2024, on India's real interest rates)

(note: Updates with latest information charts as at the end of 31Mar2024, 29Feb2024, 31Dec2023, 30Nov2023, 30Sep2023, 30Aug2023, 30Jun2023, 31Mar2023, 31Jan2023, 31Dec2022 and 30Nov2022 are available at the end of this blog - regular monthly updates are available since Sep2021 on this blog post)

Indian savers have been getting a raw deal with interest income falling faster even as inflation has been going up persistently. One needs to focus on real interest rates rather than nominal interest rates.

----------------------

Read more: Fed Tapering is Postponed

Real interest rate is the nominal interest rate minus inflation rate. For example, inflation (as

measured by consumer price inflation or CPI) rate for June 2021 is 6.26 per

cent and Reserve Bank of India's (RBI is India's central bank) benchmark interest rate called repo rate is 4.00 per cent, thus giving a real interest rate of minus 2.26 (=4.00 - 6.26) per

cent for savers.

Effectively, over a one year period, with negative real interest rate of 2.26 per cent, Rs 10,000 would be worth only Rs 9,774.

Alternatively, if you compare one-year term deposit rate (bank fixed deposit rate for one year averages 5.20 per cent) with inflation rate of 6.26 per cent, it gives a real interest rate of minus 1.06 (=5.20 - 6.26) per cent.

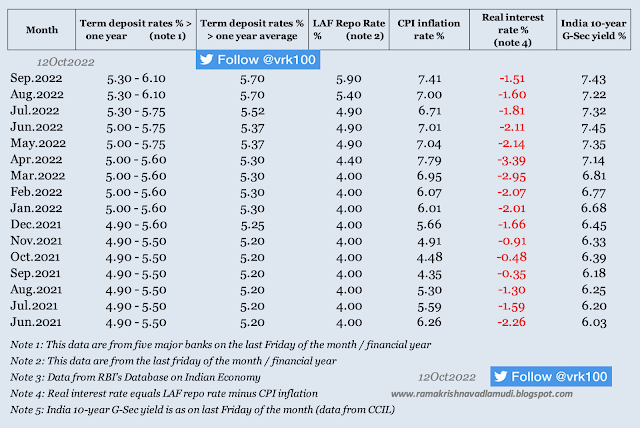

Details of term deposit rates, CPI inflation rate and repo rate for the period from September 2019 to June 2021 are given in Table 1 below.

Live example

A senior citizen (60 years and above), two years ago, made a term / fixed deposit of Rs 400,000 for two years in a major bank with the then interest rate of 7.30 per cent per year, fetching him a total interest income of Rs 62,270.

The fixed deposit matured yesterday. After taking interest income, he renewed the principal of Rs 400,000 for another two-year term at yesterday's interest rate of 5.50 per cent per year--which would fetch him an interest income of just Rs 46,170 in the next two years.

Effectively, he would be losing Rs 16,000 (Rs 62,270 - Rs 46,170) or 25 per cent of previous period income. With such a huge loss of income, the suffering of depositors, especially, pensioners is immeasurable.

Inflationary pressures

India's monetary authority, RBI, is supposed to keep inflation rate (CPI inflation) in the range of 2.00-6.00 per cent. But as can be seen from the given table, inflation has been persistently above RBI's upper bound of 6.00 per cent between December 2019 and June 2021, except for a few months in between.

After the COVID-19 pandemic hit India severely, incomes of households have come down drastically due to untimely, draconian and capricious lockdowns by Indian governments. With inflation persistently above 6.00 per cent in the past 20 months, high consumer prices have hit households badly.

Prices of daily essentials like, edible oil, vegetables, fruits and fuel LPG cylinder have gone up by 30 to 80 per cent in recent months affecting the lower strata of income pyramid the most.

Despite persistently elevated inflationary pressures in the economy, RBI has kept interest rates very low for 16 months continuously. RBI seems to be interested more in boosting economic growth.

The objective of high economic growth is laudable, but the heavy burden of growth engine should be taken more on the fiscal side (mainly with tax incentives and income support for the vulnerable sections) by the Indian government.

But the Indian government headed by prime minister Modi and state governments would have none of it. Of all the major global economies, India spent the lowest, at less than two per cent of GDP, to alleviate the suffering of people in times of Corona Virus pandemic.

India Inc has got a powerful lobby demanding lower interest rates at all points of interest rate cycles. But Indian savers don't have any such lobbying advantage.

It's time the fiscal and monetary authorities recognised the problem being faced by Indian savers and hiked interest rates, keeping interests of both savers and debtors in balance.

Table 1 (click on the image for a better view):

Table 2 (from Jan2019 to Dec2020) (click on the image for a better view):

References:

My tweet thread dated 14Jun2021

My blog dated 20Sep2020

Updated chart as on 25Sep2021 showing negative real interest rates in India (please click on the image for a better view) >

Updated chart as on 14Aug2021 showing negative real interest rates in India (please click on the image for a better view) >

Disclosure: I've vested interested in Indian stocks and other investments. It's safe to assume I've interest in the financial products discussed, if any.

Disclaimer: The analysis and opinion provided here are only for information purposes and should not be construed as investment advice. Investors should consult their own financial advisers before making any investments. The author is a CFA Charterholder with a vested interest in financial markets.

CFA Charter credentials - CFA Member Profile

CFA Badge

No comments:

Post a Comment