MSCI Emerging Markets Index

(A new blog dated 07Jan2023 is available)

(latest graph updates till Dec2022 are available below)

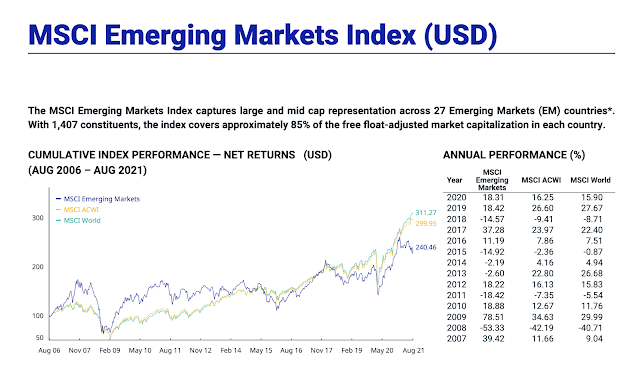

The MSCI Emerging Markets Index captures large and mid cap representation across 27 Emerging Markets (EM) countries*. With 1,412 constituents, the index covers approximately 85% of the free float-adjusted market capitalization in each country.

----------------------

Read more: Fed Tapering is Postponed

---------------------- * EM countries include: Argentina, Brazil, Chile, China, Colombia, Czech Republic, Egypt, Greece, Hungary, India, Indonesia, Korea, Kuwait, Malaysia, Mexico, Pakistan, Peru,Philippines, Poland, Qatar, Russia, Saudi Arabia, South Africa, Taiwan, Thailand, Turkey and United Arab Emirates. The MSCI Emerging Markets Index was launched on Jan 01, 2001. Data prior to the launch date is back-tested data.

Data as of 30th of June, 2021 (click on the image for better view):

1) Index performance: (data as of 30Jun2021)

2) Risk and returns: (data as of 30Jun2021)

3) Top 10 index constituents: (data as of 30Jun2021)

4) Country weights: (data as of 30Jun2021)

- - -

The following images / information are added for information purpose after the above blog was published on 03Aug2021:

Update with data as of 31Dec2022 >

24 EM countries with 1,377 securities in the index representing 85% of

free float-adjusted market cap; India remains in 2nd place with 14.4%

weight and four stocks in top 10 of the index >

Update with data as of 31Oct2022 > 24 EM countries with 1,386 securities in the index representing 85% of free float-adjusted market cap; India remains in 2nd place with 16.2% weight and four stocks in top 10 of the index;

Update with data as of 30Sep2022 > India climbed to second place for the first time in the MSCI EM Index, replacing Taiwan -- now, there are three Indian companies in the index, namely, Reliance Inds, Infosys and ICICI Bank with weights of 1.55%, 1.02% and 0.95% respectively >

Update with data as of 31Jul2022 > As on 31Dec2021, India's Reliance Industries and Infosys were in sixth (weight 1.2%) and seventh (1.1%) position respctively in MSCI EM Index. As of 31Jul2022, Reliance Industries and Infosys are in fifth (1.5%) and seventh (1.0%) position respectively.

Update with comments 30Nov2021

China's pain appears to be India's gain--at least in the case of emerging markets index, if not economically or militarily.

A scrutiny of the MSCI EM index between COVID-19 Pandemic outbreak (31Mar2020) and now (30Nov2021) indicates the following:

i) China's share in the index is down from 40.7% end-Mar2020 to 34.0% end-Nov2021; while India's share goes up from 7.8% end-Mar2020 to 12.1% end-Nov2021.

ii) China retains number one spot in the index, and India maintains its position at No 4 spot during this period. But India is closing its gap with South Korea, whose share is slightly up from 11.9% (Mar2020) to 12.2% (Nov2021).

iii) Taiwan retains its No 2 spot, but its share increases from 12.3% (Mar2020) to 15.6% (Nov2021). South Korea's share marginally up from 11.9% to 12.2% in the same period, at No 3 spot.

iv) In Mar2020, there used to be only one Indian company--Reliance Industries with 0.9% stake--in the top ten of the index; now (30Nov2021) there are three Indian firms, namely, Reliance Inds (1.2%), Infosys (1.0%) and HDFC Ltd (0.8%) in the top ten. But Chinese firms have lost their top-notch status in the index, with three firms (ICBC, China Mobile and Ping An Ins) moving out of the top ten--but two firms, Meituan and JD.com, entered the top ten during the period.

v) Chinese government / authorities crackdown on Chinese technology firms has negatively impacted with many top-notch Chinese firms, Alibaba, Pinduoduo, JD.Com, Baidu, Nio, Tencent, etc., losing their market cap between 30 and 40 per cent in the past one year or so.

vi) Year-to-date (Jan-Nov2021), Indian stock markets have outperformed several major stock markets--this too has contributed to the India's gain in the emerging markets index.

Update with data as of 30Nov2021

Update with data as of 31Oct2021

Update with data as of 30Sep2021

Update with data as of 31Aug2021

MSCI Review of 24Jun2021 - MSCI

removed Argentina from MSCI EM index. MSCI removed Pakistan from MSCI

EM index, but included it in MSCI Frontier Markets index - As a result, there are now only 25 countries in MSCI EM index -

Disclosure: I've vested interested

in Indian stocks and other investments. It's safe to assume I've interest in the financial products discussed, if

any.

Disclaimer: The analysis and

opinion provided here are only for information purposes and should not be construed

as investment advice. Investors should consult their own financial advisers

before making any investments. The author is a CFA Charterholder with a vested

interest in financial markets. He blogs at:

https://ramakrishnavadlamudi.blogspot.com/

https://www.scribd.com/vrk100

Twitter @vrk100

No comments:

Post a Comment