Compare GDP, Exports and Population

P.S.:

Trendlyne all ETF Volumes, expense ratios and AUM at one place / portfolio overlap

Trendlyne ETF Dashboard - weblinks for ETF volume data

Trendlyne individual ETFs: (data on overview, peer comparison, share price history, etc.)

-----------------------

Apr2025: Screener.in weblinks for several Nifty indices and Rupee Vest weblinks for passive funds based on these indicesIndia Passive Equity Funds and Their Asset Size >

NSE Market Watch for ETFs (volumes check)

India Flagship Equity ETFs

comparison weblinks: compare funds / compare mutual funds

-----------------------

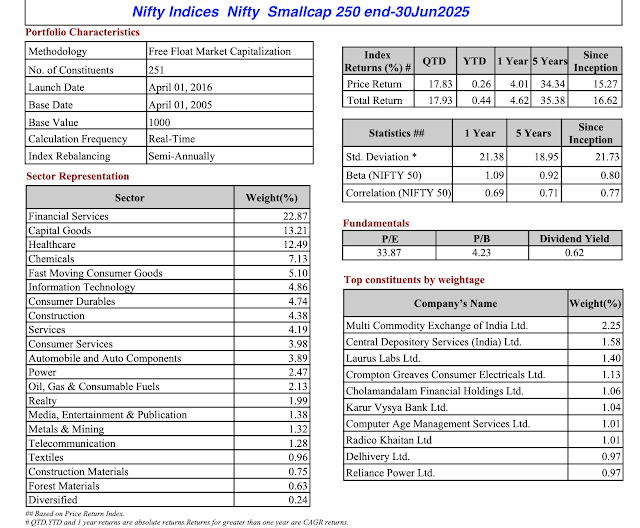

broad Nifty indices

Smart Beta indices: Factor investing

comparison weblinks: compare funds / compare mutual funds

compare funds - parent versus child indices

select list of smart beta indices and their asset size

select list of smart beta passive funds and their details

Sectoral / Thematic / Strategy Nifty Indices:

-----------------------

Apr2025: Tweets on stock investing

Jun2025: Tweets on stock investing

-----------------------

Sep2025: Screener.in Industries Overview / Sectors and their stocks weblinks

Nifty Total Market Index (top 750 stocks in India) as on 31Aug2025

Sectors and number of stocks as per Screener.in

-----------------------

Oct2025: Google Finance peer comparison weblinks

-----------------------

Oct2025: Rupee Vest stocks held by mutual funds > for example >

-----------------------

Dec2025: Rupee Vest Mutual funds and their monthly portfolios - factsheets

-----------------------

Super investors

-----------------------

Hollywood Quotes

Trendlyne ETF Dashboard - weblinks for ETF volume data >

(choose drop down menu for ETFs based on various inidces) - data on volumes, AUM, expense ratio, returns, perfornace over benchmark, etc., are available

Nifty 200 Quality 30 ETFs - ETF volume data (3-month average)

Nifty Midcap 150 Quality 50 ETF - ETF volume data (3-month average)

Nifty Midcap 150 Momentum 50 ETFs - ETF volume data (3-month average)

Nifty Midcap 150 ETFs - ETF volume data (3-month average)

Nifty 100 Low Volatility 30 ETFs - ETF volume data (3-month average)

- ETF volume data (3-month average)

- ETF volume data (3-month average)

Trendlyne individual ETFs: (data on overview, peer comparison, share price history, etc.)

ICICI Prudential Nifty 200 Quality 30 ETF

Aditya Birla SL Nifty 200 Quality 30 ETF

DSP Nifty Midcap 150 Quality 50 ETF

ICICI Prudential Nifty 100 Low Volatility 30 ETF

Kotak Nifty 100 Low Volatility 30 ETF

Volumes for ETFs are extremely important to consider before investing.

NSE Market Watch - Exchange Traded Funds / ETFs (to check volumes)

- Nifty Indices all -

- list of ETFs based on the respective Nifty index

- PE ratio and PB ratio

- real time returns (trailing returns upto 5 years)

- index graph upto 30 years

- heatmap with all stocks and their daily returns

- shareholding pattern of all stocks

- financial results of all stocks

NSE India - ICICI Pru Nifty 50 ETF

NSE India - Mirae Asset Nifty 50 ETF

NSE India - HDFC Nifty 50 ETF

NSE India - Aditya Birla SL Nifty 50 ETF

DSP Nifty 50 Equal Weight

ICICI Pru Nifty Next 50

Motilal Oswal Nifty 500

UTI Nifty 200 Quality 30

Nippon India Nifty 50

ICICI Pru Nifty Next 50

Motilal Oswal Nifty 500

Nippon India Nifty 50 Value 20

Nippon India Nifty 50

ICICI Pru Nifty Next 50

Motilal Oswal Nifty 500

Sundaram Nifty 100 Equal Weight

| UTI Nifty 200 Momentum 30 |

| DSP Nifty 50 Equal Weight |

| ICICI Pru Nifty Next 50 |

| Motilal Oswal Nifty 500 |

| Nippon India Nifty 50 Value 20 |

Broad Nifty Indices:

NSE Indices tracker (new as of Dec2025) - index tracker (dropdown menu) - Nifty Inidces all - heatmap with all stocks and their daily returns

The so-called smart beta indices (where funds based on these indices have reasonable AUM and to assess their volumes also):

Nifty 100 Low Volatility 30 index - Screener.in - full stocks / valuation available

VRK100 Blog - Analysis of Nifty 100 Low Volatility 30 index

Nifty Alpha Low Volatility 30 - Screener.in - full stocks / valuation available

Nifty 200 Alpha 30 - Screener.in (stock list not available)

Nifty 500 Value 50 - Rupee Vest

Nifty Midcap 150 Quality 50 - Rupee Vest

Nifty Midcap 150 Momentum 50 - Rupee Vest

Comparison weblinks: Compare funds / Compare mutual funds: Smart beta indices:

UTI Nifty 200 Momentum 30

UTI Nifty 200 Quality 30

ICICI Pru Nifty Next 50

HDFC Nifty 50

UTI Nifty 200 Momentum 30

UTI Nifty 200 Quality 30

HDFC Nifty 50

Edelweiss Nifty 100 Quality 30

DSP Nifty Midcap 150 Quality 50

Nippon India Nifty Alpha Low Volatility 30

HDFC Nifty 50

Motilal Oswal Nifty Midcap 150

Bandhan Nifty100 Low Volatility 30

Nippon India Nifty Alpha Low Volatility 30

ICICI Pru Nifty 50

Tata NIFTY Midcap 150 Momentum 50

DSP Nifty Midcap 150 Quality 50

ICICI Pru Nifty Next 50

UTI Nifty 200 Quality 30

Tata Nifty 200 Alpha 30

Kotak NIFTY Midcap 150 Momentum 50

Nippon India Nifty 500 Momentum 50

Bandhan Nifty 100 Low Volatility 30

Motilal Oswal Nifty 500

Bandhan Nifty 100 Low Volatility 30

Nippon India Nifty Alpha Low Volatility 30

UTI Nifty 200 Quality 30

Motilal Oswal Nifty Midcap 150

DSP Nifty Midcap 150 Quality 50

Tata Nifty 200 Alpha 30

UTI Nifty 500 Value 50

Motilal Oswal Nifty 500

Bandhan Nifty 100 Low Volatility 30

DSP Nifty Midcap 150 Quality 50

Nippon India Nifty Alpha Low Volatility 30

ICICI Pru Nifty 50

Edelweiss Nifty 100 Quality 30

DSP Nifty Midcap 150 Quality 50

Nippon India Nifty 50 Value 20

ICICI Pru Nifty Next 50

Motilal Oswal Nifty 500

Sectoral / Thematic / Strategy Nifty Indices:

Nifty Passive insights - quarterly (incl archives)

Tweet thread 26Mar2024 India rupee natural depreciation - factor influencing it

Tweet thread 21Feb2024 University of Brutal Markets, indiscipline, lavish spending, human emtion, income-generating assets, Las Vegas and excitement

Tweet 31Jan2024 on EMS sector

Tweet thread 30Nov2023 India market cap - BSE market cap of all companies - continues in Jun2025

Tweet thread 22Sep2023 market breadth of BSE 500 index - advance decline ratio or ADR

Economic freedom or monetary control? gold silver

Boycott America seems to be working

the effective average US tariff rose from 2.5% in 2024 to 15.6%

Socialism under Trump

Gautam Adani bribery charges

India EU trade deal mother of all deals / EU withdrawal of GSP

Europe owns Greenland, it also owns US Treasuries Deutsche Bank's George Saravelos

Trump the more windmills a country has, the less GDP growth it will have

To avoid paying taxes, Eduardo Saverin, Facebook co founder migrated to Singapore

Europe may go for a "nuclear option" the EU's Anti Coercion Instrument (ACI)

US Economic Coercion under Trump

EU pulls tariff preferences GSP on 87% of Indian exports ahead of FTA

Denmark pension fund sell its US Treasury holdings of USD 100 million

Capital wars Wall Street impacted by Trump’s Greenland annexation threat

Polish Central Bank Approves Plan to Buy 150 Tonnes of Physical Gold

Peter Thiel invested USD 500,000 in Facebook in 2004

Growth of USD ETF AUM in USD trillion

Amazon’s European sovereign cloud launch AWS

Gold USD 35 Berkshire Hathaway USD 19

India Supreme Court capital gains Tiger Global stake sale in Flipkart to Walmart

Tax sovereignty

State Street to invest Rs 580 cr for 23% stake in Groww AMC

Global investing International diversification

Mirae Asset Nifty Midcap 150 ETF

History of an impulsive trader in one line

Time for rebalancing? gold Nifty 50

India City gas distribution (CGD) sector national gas grid

Hollywood quote

Japan Government Bond (JGB) yields

Taleb Turkey Problem Recency bias in Indian gold investors

New labour codes impact India IT sector

RBI forex intervention

Checks and balances in the US clean energy grants

WhatsApp leak of UPSI is not new Hatsun Agro Operational risk ICICI Lombard

US price controls under Trump >

Powerful Words (internal poster of The Plaza Hotel, New York)

Indicative NAV (iNAV) or real time NAV of gold / silver ETFs

Steve Wozniak is the engineer who quietly built Apple Here are 26 ideas

proposed California wealth tax

The 'magical' blue flower butterfly pea flower (Aparijitha)

US Fed "independence" Fed chair Powell says The threat of criminal charges

another narrative tailwind pushing the dollar gold / silver prices higher

listed space in Textiles sector (export oriented) contrarian opportunity?

Checks and balances US Senate rebukes Trump - Venezuela

NYT interviews Trump international law doesn't matter

RBI selling US dollar Because US Treasury securities most liquid assets

When you want to sell your assets, which assets will you sell the most?

Unforgotten Brands: Nutrine

Despite his maxim of 'everything flows' Nifty 50 index

Nostalgia Grape varieties in Hyderabad

Iran protests

Trump Signs Order Pressing Defense Firms to Cut Buybacks

NSE (Nifty Indices) is implementing weight capping of top three stocks in Nifty Bank

Gold / Silver mania continues... new all time highs gold ATH silver ATH

Maruti Suzuki Dzire Becomes Best-Selling Car In India

Anecdote: Nisha Patil, a Bombay housewife bequeathed her entire estate to Sanjay Dutt

Boots-in-the-air US policy under Trump

US captures president Nicolas Maduro

Demerger process (can be lengthy at times) depends on NCLT efficiency

Derivatives trader uses Rs 40 crore margin credited mistakenly by Kotak Securities

India equity funds with high share of foreign stocks (international stocks)

India equity funds with high share of foreign stocks (international stocks) >

Not Alpha Managers!

India real estate REIT sector thread 🧵 >

digital arrest cyber scam impersonation

Low-sugar fruits

9 healthiest fruits for a longer life - Low-sugar, high vitamin fruits

The Aravalli Hills range

South Korean e-commerce firm Coupang announces a compensation deal data leak

Thailand was at the epicentre of the 1997–1998 Asian Contagion

How the UK-based NRI invests his money?

Export value of toys to the US last year

Asset price distortion

Some reasons why asset prices are distorted

Govt of India's ‘One State-One RRB’ policy

India banking sector thread 🧵 >

Why would happen if you're put in a cryogenic chamber (deep freeze)...

CME Group raised margin requirements for silver, copper

RBI introduced External Benchmark Based Lending (EBLR) in Sep2019

What was considered luxury once is now a need

India hosts 20% of the world’s data but only 3% of its storage data centres

neem tree Dieback disease

Self Help the land of you-are-on-your-own

positive feedback loop

Classic self-reinforcing cycle > Rupee depreciates > Foreign investors sell

There is some confusion with terms used in BoP data.

More banking liquidity injection by RBI

The lower the profit, the higher the market cap!

The case for global investing for Indians

The Four Primary Routes for Global Investing

Timeline of Trump tariffs in 2025

Why did Infosys ADR surge 56% NYSE

Kahlil Gibran

Adani Cement Empire The three-way merger approved

Latha Venkatesh talks to Ananth Narayan

"Dual Speed" Export Market

Trump tariffs and India exports

cyber crime cyber fraud WhatsApp

Standard Chartered Bank widens fraud probe after Rs 80 crore HNI funds diversion

Foreign ownership in Indian financial sector / NBFCs

RBI forex intervention data RBI currency intervention

India New CPI series 🧵 >

Kotak Nifty 100 Low Volatility 30 ETF

GDP back series >

Background to new GDP series

Examples of Indian companies that suffered high financial leverage / equity multiplier

NSE Indices tracker - index tracker (dropdown menu) - Nifty Indices all

Dupont analysis

Follow-up on asset turnover ratio >

Compare midcap funds > funds comparison

Ambri apples variety origin Kashmir apple varieties

A beautiful story Queen Didda (Catherine of Kashmir) Sangram Raja

The worst Sensex declines were

The biggest rupee drops occurred during

Private sector in space / nuclear power

South Korea economist Ha-Joon Chang India needs trade protectionism

India Targets Space Economy by Private Firms RDI scheme

Trump Eyes Tariffs Over Canadian Fertiliser, Indian Rice

Checks and balances in the US Trump ban on wind power overturned

Indian retail investors seem to be finding more opportunities in

A new baby always attracts greater attention IPO market

China’s trade surplus topped a record USD 1 trillion

9 ‘healthiest’ fruits for a longer life

Kenneth Andrade businesses with dollar exposure (with image)

20 biggest data breaches cyber security data leak

Louis-Vincent Gave of Gavekal Research gold silver hedge (with image)

M&A deals They often fail because of

Netflix Inc to buy Warner Bros

Bloomberg reported this story ‘India’s Digital Dream, Hacked’

Martina Navratilova told Maria Sharapova's father that her daughter had talent (with image)

Maria Sharapova There's no match point in business

exemplary sportsman ship Serena Williams Maria Sharapova

Maria Sharapova I don’t want to be a sad version of my old self

EV Charging infra

QIP funds raised by India Inc

Pronab Sen India Inc is not sharing data

India market cap GDP ratio

Ken Burns

Thomas Jefferson liberty freedom slaveowner

mandatory Sanchar Saathi government app mobile phone

LME copper prices

Classic Legends - Yezdi trademark patents IPR

regressive SIM binding ditective chaos

India is an electoral autocracy

IMF C grade for India GDP data

new phrase enclave growth

Human greed

trading of futures options halted CME

India’s de jure exchange rate arrangement - IMF crawl like

US govt stakes in private sector bogey of national security

Lovely Green Flags in a Man's Apartment

Marico Ltd's digital brands acquired ones

A Swath of Bank Customer Data hack / cyber security

New Labour Codes notified by govt

Pradip Shah of IndAsia Fund Advisors (with image)

India climbdown on Quality Control Orders

Risk allocation should precede asset allocation Markowitz

PPFAS To Enable Easy Access To US Stocks Via Two New GIFT City

SEBI caution Online Bond Platform

India is a hard-soft state YV Reddy

Diabetes capital Dengue capital

No Relief for Bata, Liberty - Crocs

World's Road Accident Capital

Czech National Bank has purchased digital assets

The US stopped minting one-cent coin

Trump reciprocal tariffs climbdown >

Cocoa futures prices

legislators treat Indian citizens like jokers

Global maritime power

Australia ban on social media for children under 16 / Denmark too

Peter Thiel Capitalism is not working for a lot of people in NYC

Tesla pay package for Elon Musk

new phrase Keyboard crusader

Share of Global IP5 Patents > Patent > Innovation

The biggest culprits in job cuts / layoffs in recent years

"Humanity learns slowly" James Robinson Why Nations Fail

Left slice of India

World's toxic capital? forever chemicals

#Clientalism under Erdoğan is similar to what Thiru PM Modi... Turkey

How the US Economy Has Defied DD Predictions on Tariffs

Oyo Scraps 6,000:1 Bonus Share Plan

Oracle Corp's market cap now is more sober

Problems with eSIM / eSIMs > mobile phones >

Prof Jeffrey Sachs video on how China is trying to dismantle US hegemony

India jewellery sector - social media Boycott / outrage

Ajit Ranade: India's Households Are Borrowing More & Saving Less

Irony is during both QT and QE, stock markets rise, contrary to

apple banana coconut puzzle / math problem

secret to equity investing - consistency, patience and long term orientation - power of compounding

The "killer" for Apple Inc is growth in services business

Point to point returns (CAGR) from 31Oct2000 to 31Oct2025 - 25 years

Top 15 Equity MFs >

stock holdings of Indian politicians will be made available on Perplexity Finance

Henley passport index

cashew apple

DeepFake example

US firms structure investor decks around facts, trends and forward-looking analysis

Childhood / Children / kids games

India Passive Equity Mutual Funds suitable for youngsters - high risk appetite

Alphabet Inc (Google) - first-ever USD 100 billion revenue quarter

Stress-induced flowering > Stress from dry season- samanea saman / rain tree -

World's top 10 companies by market cap >

Under GST 2.0, roughly 62.4% of the CPI basket (by weight) is taxed at 0%

India’s CPI - selective GST design insulate inflation from tax changes

Marks and Spencer ends contract with TCS ltd to run its IT service desk

China seems to be ahead of Canada in quoting Ronald Reagan on tariffs >

Global migration - exodus from Europe to GCC / Dubai / Abu Dhabi >

Energy transition > Fossil fuels to RE > European Union >

Amazon Web Services outage

a striking contradiction in investment behaviour - gold vs stock

India's Supreme Court rejects Swiss Roche AG's plea seeking Natco Pharma

JSW Steel chair Sajjan Jindal - Lack of Innovation / R&D spend in India

Indian household financial assets > total wealth

Total market cap in USD trillion > Equities / bonds / gold / crypto

Debanking: What you need to know

Coforge Public Library, Kondapur

Gold asset class 🧵> Gold "market cap" or gold asset size >

Equity stakes in more companies by US gov't?

Three Factions: Shapoorji Pallonji - Noel Tata - Mehli Mistry

To access individual weights of all stocks, in real time, like Nifty Services Sector index

checks and balances in the US - limits to Trump's executive powers

three mutual fund houses halted fresh investments silver ETF FOF

Google Vizag investment USD 15 billion data centre

Most Investments are Actually Bad. Here’s Why. By Lyn Alden

Dutch govt takes control of Nexperia - China

Qantas Airways says customer data breach - cyber security - privacy

Google to ChatGPT - Cartoon by Harley Schwadron > fun

India household assets / total wealth > Gold holdings 34,600 tonnes (USD 3.8 trillion)

silver ETFs in India are quoting at a premium to their NAVs

entrepreneurs are considering moving to a new country. Singapore is their top option - global migration

Qatar Air Force facility to be built at US Air Force

India pharma CDMO sector - US Biosecure Act

In financial markets, there is no substitute for original, data-driven research conducted independently

China imposes new curbs on rare earth minerals

Indian household gold holdings

Gita Gopinath US Trade balance not improved - US manufacturing footprint remains same

Tweet thread 01Apr2025 Dupont Analysis / asset turnover ratio - follow-up Tweet thread 17Dec2025 on Dupont with examples and screenshots

Tweet 07Jan2025 Shankar Sharma (image)

Tweet 25Feb2025 promoter buying / market purchase (image)

Tweet 05Dec2024 Aswath Damodaran on Mag 7

Tweet 05Dec2024 PE ratio sucks

Tweet thread 02Nov2023 SEBI license for Andrade's Old Bridge MF

Top 5 sectors account for 59% of total weight

Top 6 sectors two-thirds

Top 10 sectors 82%

Top 15 sectors 96%

1. Financial Services 29.99

2. Information Technology 7.95

3. Oil, Gas & Consumable Fuels 7.27

4. Automobile and Auto Components 7.24

5. Fast Moving Consumer Goods 6.63

6. Healthcare 6.57

7. Capital Goods 6.21

8. Consumer Services 3.98

9. Metals & Mining 3.31

10. Telecommunication 3.27

11. Power 3.15

12. Consumer Durables 3.08

13. Construction 2.92

14. Chemicals 2.31

15. Construction Materials 2.21

IT software 153

metals steel 14

metals seamliess pipes

EMS 13 after login

finance credit rating 3 (after login)

textiles branded apparel 264

real estate 161

Amara Raja Energy & Mobility Ltd

Asahi India Glass Ltd.

Asian Paints Ltd.

avalon tech

Biocon Ltd.

Cera Sanitaryware Ltd.

CMS info systems

dr lal pathlabs

genus power infra

HCL Technologies Ltd.

ICRA Ltd.

IEX

Indiamart Intermesh

Ipca Laboratories Ltd.

ITC Hotels Ltd.

ITC Ltd.

jagran prakashan

kaveri seed

Larsen & Toubro Ltd.

LTIMindtree Ltd.

Lupin Ltd.

Maharashtra Seamless Ltd.

Maruti Suzuki India Ltd.

Nuvoco Vistas Corporation Ltd.

Persistent Systems Ltd.

Pidilite Industries Ltd.

Raymond Lifestyle Ltd.

Raymond Ltd.

Raymond Realty Ltd

SH Kelkar & co

sharda cropchem

Sundram Fasteners Ltd.

tata steel

The Great Eastern Shipping Company Ltd.

Thermax Ltd.

Venky's (India) Ltd.

Zydus life sceinces

at around 17:30 into the movie "Elizabeth: The Golden Age" >

Sir Francis Walsingham: "William, you look dreadful, they are not feeding you in Paris.

"You can't learn the secrets of the universe on an empty stomach."

"When you work for me, you're mine.' ~ real estate broker Rick Carver (Michael Shannon) - 99 Homes (2014)

---------------------------------

The Regime Shift No One is Prepared For: Grant Williams on the 100 Year Pivot: YouTube video

12Jan2026: Grant Williams talking to Excess Returns

YouTube video > https://www.youtube.com/watch?v=jBIrOkyTZcM

Highlights from the above video >

The kind of change we're talking about is the kind of change that happens once every 80 to 100 years. And if that environment has changed and not just changed but reversed, you know, what went down went up, it stands to reason that if for 40 years the default has been to make money and all you had to do was be there and stay out the way. If everything's reversed, it stands to reason that the next 40 years can be really hard to make money. If you are set up for how the world has been and these changes that we're talking about are real and they're happening. They continue to happen. There is no chance in hell that what worked in that previous environment works the same way going forward.

You're watching Excess Returns. I'm Matt Ziggler.

It's Grant Williams. Welcome back, Grant.

What is the 100-year pivot?

Well, it's a it's a great question and and the good news and the answer is you don't have to be a finance person for this to for this to mean something.

People lose trust in institutions and we're seeing that whether it's the institution of politics not just in America but here in the UK and across Europe and everywhere you know trust in politics has gone.

Trust in each other is kind of falling apart thanks to social media and trust in institutions you look at something like you know NATO perfect example. NATO is an institution that's been there our entire lives. And now NATO is heading to a break up of sorts.

The United Nations, the World Bank, the IMF, all these institutions are not in good condition.

Between the global financial crisis (2007/2008 GFC), COVID-19, the seizing of Russian assets and now Venezuela (US capturing Nicolas Maduro) and those all kind of feel linked to me as like a continuation of this institutional breakdown and institutional decay.

Can you sort of connect through and I really do want to laser in on the financial crisis to the seizing of the Russian assets. I think how you frame that's so useful to understand what this decay looks like as it actually happens.

After the 2007/2008 GFC, we lost trust in banks and bankers. So trust in the bankers went first.

President Barack Obama failed to put notorious bankers in jail and the bankers were not punished at all. It was terrible missed opportunity by Obama administration.

(On 15Aug1971, president Richard Nixon effectively ended the direct convertibility of the US dollar into gold. This event is famously known as the "Nixon Shock.")

Since 1971, we’ve been living in a purely fiat currency world. Earlier, currencies were backed by gold. But, they are now backed by nothing.

We trusted money before 1971 because it was backed by gold. Now, that trust is money (fiat currency) is gone due to lack of gold backing.

And so as the trust broke down in a purely fiat world where everything is built on trust, you have to trust the money because there's nothing behind it whatsoever. It's the full faith and credit of the United States government.

And of course, you know, faith is faith is trust.

And then we get to 2022, where when Russia crossed the border in Ukraine and started the war there, one of the first responses from the US Treasury, it's important to say to point out, was to freeze Russian assets (forex reserves) within the Swift system.

And the second they did that, I wrote a piece at the time called the end of the financial world as we know it.

By sanctioning those assets, by freezing them, what America did was basically say you can no longer trust in us as a partner for state level national sovereign reserves. And what that meant was that every single central bank in the world had a decision to make because they've all got holdings of dollars because dollars are the currency that oil and energy is transacted in.

Now, every central bank in the world say, "Okay, we can no longer absolutely trust in America to look after our money."

Central banks have been buying a lot of gold since then.

And this is a problem for America at a time where obviously it has massive budget deficits. It needs to fund. It needs buyers for treasuries. And so that that move I called it the end of the financial world as we know it. And and I don't think that was hyperbole.

I think that has changed everything because if you can't if you can't trust the issuer of the reserve currency, you've got some very tricky decisions to make. And it doesn't mean the dollar's going away tomorrow.

It doesn't mean the dollar's finished. But what it does mean is now every central bank in the world is incentivized to find alternatives to being completely captive within the dollar system.

By capturing Nicolas Maduro from his bedroom in Venezuela, Trump has basically said, "I don't need international laws."

You've lost faith in the fact that if something is done against you, then international law is going to apply and there will be recourse for you through some sort of court action. And the solution to all these problems on a financial level at a state level is gold.

You own gold in a vault underneath your own central bank and you don't have to worry about any of these things unless you get invaded and someone takes it.

Suez crisis in 1956 is an important history lesson for people to understand.

And if we've got time, I I'll just give you a quick recap of it.

Give us the recap because this was hugely insightful to me.

Yeah. So after World War II when the Brettonwoods conference happened and the Brettonwoods system was put in place with the dollar fixed to gold at USD 35 an ounce and then every other currency revolving orbiting around the dollar.

When that happened at the time 1943 the pound sterling had basically 75% of sovereign reserves. the dollar was 22% and there were you know the French franc and the Deutsch mark.

In 1956 the president of Egypt Gamal Abdul Nasser nationalized the Suez canal which had been built by the French and the British in during the colonial days.

He nationalized the Suez canal creating all kinds of chaos and this was done after the US and the UK decided to pull funding to build the Aswan dam. So that was a US-led decision to pull funding. And that was what led to this moment in time.

And that's important to understand because what happened was the British, the French and the British basically started a a war with Egypt. the pound was coming under pressure and the prime minister at the time Anthony Eden went to his friends in Washington and said hey guys look I need some help here can you either lend us some dollars or at least put your enthusiastic support around the pound.

The US which had been part of the fermentation of this crisis by pulling that funding saw an opportunity and they said No, we're not going to do that. We are not going to support you unless you pull out of Egypt.

And had Britain not pulled out of Egypt, there would have been a full-blown sterling crisis. The country's finances were in a mess after the war after the end of World War II, obviously.

So, Britain was forced to back down and it became clear to the world that the US the UK was not a powerful country anymore. In fact, the United States held the upper hand. And from that point on, dollar supremacy began taking off.

And by 1973, the dollar was I think 87% of foreign exchange reserves.

And the reason I recapped the story was a to make people understand that that no sovereign reserve currency in history has survived. They've all gone away.

You know, at one time it was the Portuguese escudo, the Dutch Guilder, the French Frank, the Spanish Peseta, all gone. The British pound largely irrelevant now. And the dollar will go that way too. It could be years in the making, but it's headed in that direction.

The point about the Suez Canal crisis that's so important is that Britain was struggling. It had a lot of debt after the war. It was in bad financial shape. And America saw an opportunity to advance its own cause at the expense of a once powerful nation that was hegemonic and it took it. Special relationship or no special relationship.

America plunged the knife in and it was the right thing to do from a political standpoint. I called it a Machiavellian master stroke.

It really was. And that paved the way for the dollar-based system. We see today the swift system, the payment system, you know, 60% of sovereign reserves are in dollars. 88% of transactions, FX transactions have a dollar cross in them. It's extraordinary.

But through that period from 1956 when the US pulled that Machiavellian masterstroke to now, they haven't really had any challenges.

And so you throw into the mix Donald Trump in the White House who is an agent of change/chaos depending on your political leanings and you have every ingredient you need for an enormous amount of uncertainty and a and the potential for a complete reordering of the financial system.

To save itself, the United States will have to print a ton of money. If this goes the way it went for the Brits and while they can do that, it will trash the dollar. It will send interest rates through the ceiling. It will send inflation, all the things that we know would be bad if the dollar was no longer a reserve currency.

So, it's a big sweeping change.

This this financialization of everything has been a massive tailwind for a long time. But I but I think in 2020 after COVID came through all that changed.

You know, if you look back from 1980 to 2020, we had rising stock prices, rising bond prices, rising house prices, falling rates, falling inflation, globalisation. We had the biggest tailwinds the world has ever seen.

That's changed. You know, we don't have rising bond prices.

The volatility is coming back, and there's a very strong chance that some of these things are going to start to fall. We've certainly seen higher inflation. We've certainly seen rates go up and they tend to lead. So that environment has changed and and if that environment has changed and not just changed but reversed.

You know, what went down went up, it stands to reason that if for 40 years the default has been to make money and all you had to do was be there and stay out the way. If everything's reversed, it stands to reason that the next 40 years can be really hard to make money and you can't just have your money in the markets. you need to make decisions and be out at the right time and understand that markets can go sideways for 20 year periods in nominal terms.

So, the investment style that served you very well for 40 years, the one that has been ingrained in you over and over again, buy the dip, buy the dip, buy the dip has worked, but I don't think that's going to work in the next 10 years and possibly not in the next 20.

You know, every country in the world has done the same thing and outsourced everything. Every country in the world, every sorry, that's not correct. Every Western country who outsourced their supply chains to cheaper labor is in the same boat.

Canada has the natural resources, United States has the resources. Britain doesn't have the resources. France doesn't have the resources.

China has very solid relationships with Brazil in terms and Australia in terms of buying all their commodity offtake that has enabled a country like Brazil or Australia to grow massively over these last 20 30 years.

The New "Monroe Doctrine":

The quid pro quo that sustained the Petrodollar—US security guarantees in exchange for oil priced in dollars—is evaporating.

Energy Independence: The US has transitioned from the Gulf’s biggest customer to its biggest competitor as a leading oil exporter.

Strategic Withdrawal: An overt US shift toward prioritizing the Western Hemisphere. This leaves Middle Eastern nations in a difficult position: if forced to choose between a withdrawing security partner (USA) and their primary customer (China), the decision is no longer a "no-brainer." (Grant Williams thinks the Middle East nations will shift toward China against the US if push comes to shove).

So, in the midst of all this, we find ourselves with this little invention called AI.

With AI, there is a hunt for resources. We got to power all these data centers and these things if we're going to use it. Then also the promise of all this growth.

You really need to sit down and re-examine everything. It's not this is not just yeah maybe we rotate out of cyclicals into momentum. It's not that it may be in a part of your portfolio, but the kind of change we're talking about is the kind of change that happens once every 80 to 100 years.

And if you get it right, if you if you if you completely reorient yourself for this next cycle, you have the advantage of the kind of period that we've just been through where it it's you've got these great tailwinds, but you have to be set up correctly.

And for me, you know, that is commodities that all the basically all the things that have been out of favor that have been unloved through this period. Again, on some level, this is actually pretty easy because what's happening on most level is a reversal. It's interest rates are going up.

Interest rate are not going down anymore. Trust is going down.

You probably need to own commodities now. If you didn't own any gold, gold's done really well. You probably need to own some gold. If you were massively overweight US stocks, that's done extraordinarily well. Are you right to be overweight US stocks in this environment? I suspect probably not.

You can't borrow from someone else's lived experiences.

---------------------------------

11Jan2026rant Williams: "There is no Safe Haven, it's an Illusion"

Talking to Reinvent Money on YouTube on 11Jan2026:

Trump is an agent, he's also an agent of chaos

Trump is prone to changing his views rapdily; and goes in completely opposite direction

You don't know what's going to happen; so don't invest with any certainty

Be wary of certainty

Having certainty is the biggest danger to investors

I don't change my investment thesis now with the turn of global events

my investment thesis is playing defence; it's different from many young investors

I don't my portfolio to lose value; I want to protect my purchasing power

I've enough money and I focus on keeping its purchasing power intact

How should I protect my purchasing power in the light of Governments becoming more confiscatory and Government Debt levels are more unmanageable now

I don't want to punt on things at the stage of my lifecycle

There are no safe havens, it's an illusion and there has nevera been a safe haven -- I mean there are relatively safe havens -- US dollar and US Treasuries have been relatively safe for a long time -- gold is a safe haven even though the price can move up or down -- everybody should start with the premise that there is no safe haven.

the biggest worry for investor is the loss of purchasing power of money in the backdrop of loose monetary policies

I kept buying gold since 2003, I have never sold any -- even though the price is at record highs, I'm not selling any of my gold -- gold has become a substantial part of my portfolio

Nicolas Maduro thought he had a safe haven, a panic room until two people from a Black Hawk descended on his palace and cut open the door with a 3000-degree cutters in the middle of the night -- so there is no safe haven

The turning for central bank gold buying was -- the West (the US and Europe) freezing the dollar assets of Russia in 2022; and the same asset freeze is responsible for central banks doubting the safe haven aspect of US Treasuries

And the West freezing Russia forex reserves has become a "national security" imperative for other countries

So, now sovereign nations have lost trust in the US treasuries and switching their money to gold -- we have lost trust in countries, societies and governments

I would agree with Marc Faber's assertion that crude oil is cheap

In my opinion, copper is cheap

Perfecting ownership of tangible things, copper, gold, oil, silver, etc., is the in-thing

the less tips we take, the better we are

we need to think through things, generate more ideas ourselves

crypto is not suitable for me

---------------------------------

Tweet 26Feb2020: 21Aug2006: Beyond Markowitz: A Comprehensive Wealth Allocation Framework for Individual Investors

Beyond Markowitz: A Comprehensive Wealth Allocation Framework for Individual Investors

SSRN Paper: The Journal of Wealth Managment, 21 Aug 2006

By Ashvin B. Chhabra, Institute for Advanced Study

In sharp contrast to the recommendations of Harry Markowitz's Modern Portfolio Theory (MPT), a vast majority of investors are not well diversified. This paper attempts to provide a solution to this "diversification paradox," by expanding the Markowitz Framework of diversifying market risk to also include the concepts of Personal Risk and Aspirational Goals.

The Wealth Allocation Framework enables individual investors to construct appropriate portfolios using all their assets, such as their home, mortgage, market investments and human capital. The investor may choose to accept a slightly lower "average rate of return" in exchange for downside protection and upside potential.

The resulting portfolios are designed to meet individual investors' needs and preferences, as well as to protect individuals from Personal, Market and Aspirational risk factors.

The Wealth Allocation Framework attempts to bring together MPT with aspects of Behavioral Finance through a single pragmatic Framework.

For the individual investor, Risk Allocation should precede Asset Allocation.

Portfolio diversification:

In order to achieve a truly diversified portfolio, one must also diversify within each asset class.

For example, equity portfolios should be composed of a large number of minimally correlated stocks; bonds should be diversified across both maturities and credit ratings. According to MPT, diversification minimizes non-systematic risk, and diversification, combined with the use of a utility function, provides the investor with the right balance between risk and reward.

Lack of diversification leads to the danger of one's investments becoming worthless, as happened during the 1990s Internet / Dotcom bubble when investors heavily exposed to technology stocks sustained massive losses and never recovered.

However, a small but influential group—overrepresented among the wealthy—became rich by defying diversification. Ironically, many would not have achieved such wealth had they followed conventional diversified strategies.

Examples include highly leveraged property investors, corporate executives who concentrated in their own company’s stock and options and entrepreneurs who reinvested heavily in a single business.

In each case, success produced outsized gains, while failure led to severe or total loss—highlighting that undiversified strategies create extreme outcomes, not reliable ones.

The need for securing our own financial future:

Longer life expectancy, pension changes (from defined benefit to defined contribution) and globalised markets (with increased correlation among asset classes) have shifted financial responsibility to individuals, making sound investing the key determinant of retirement security and long-term financial success.

Individuals need to deal with two issues:

1) we need to maintain our lifestyle needs regardless of market conditions

2) we have the risk of living too long and outliving one's assets (longevity risk)

As we experienced in the past, there is a good probability of us not being able to meet the above two things.

While Markowitz's MPT deals market risk only, the Wealth Allocation Framkework deals with personal risk and aspirational risk in addition to market risk.

Three risk profiles (three buckets approach):

1) Personal Risk (Safety): The risk of a life-changing drop in lifestyle. This should be a fail-safe bucket that protects standard of living with downside protection and some investment types are: human capital, cash, TIPS, CDs, T-bills, primary residence, traditional annuities (to hedge longevity risk), health insurance and asset insurance.

2) Market Risk (long term growth): Systematic risk that can't be diversified away. This aims to maintain wealth and grow with the economy. Examples of investments are diversified equity funds, bond funds (diversified across credit quality and duration), cash (reserved for opportunistic investing) and commodities (the "Markowitz" part).

3) Aspirational Risk (moonshots): This aims to achieve great wealth or legacy goals, with high-concentration risk for high-upside potential. Examples include private business, concentrated stock, private equity, hedge funds, rental property and others.

More on "Risk allocation should precede asset allocation":

In traditional finance, people often jump straight to asset allocation—deciding what percentage of their money goes into stocks versus bonds or other asset classes. Chhabra’s framework argues this is putting the cart before the horse.

Risk allocation is the process of defining your goals and determining which "type" of risk you are willing to take to achieve them before you ever look at a ticker symbol.

Chhabra suggests that risk should be allocated in a specific hierarchy. You don't move to the next level until the previous one is "fully funded" or stabilized.

Personal Risk (The Floor): This is the first allocation. You allocate enough low-risk assets to protect against "ruin." This is not about beating the market; it's about avoiding poverty. This bucket should aim for a guaranteed cash flow.

Market Risk (The Engine): Once your floor is secure, you allocate risk to the broad markets. This is your "diversified" wealth meant to keep pace with inflation and economic growth.

Aspirational Risk (The Upside): Only after the first two are satisfied do you allocate risk to concentrated bets (like a single stock, a private business, or crypto). This bucket comes with the risk of loss of substantial capital.

Components of Personal Risk:

Cash flow: The investor’s current and foreseeable cash flow is at least as important as his/her asset allocation.

Lifecycle stage: Someone at the peak of his/her earning capacity may be able to take on more risk than someone approaching retirement. On the other hand, a wealthy person in retirement seeking to achieve an ambitious legacy goal may want to take on more risk with a portion of the portfolio.

Ability to weather shortfalls (longevity risk): How does one protect against outliving one’s assets, e.g., living 10-15 years longer than life expectancy?

Event risk: The investor needs to understand and protect, if possible, against a variety of singular events such as loss of job, major health problems, disability, the need to support an additional family member or lawsuits.

The Wealth Allocation Framework allows clients to segment their assets and create appropriate financialstrategies toward particular goals, while assuming a consistent overall approach to resource allocation.

Investors are strongly exposed to country default and currency devaluation risks. These risks are often neglected, but they do occur frequently, e.g., in recent years in Argentina, Russia, and Korea.

An investor’s optimal risk allocation depends not only on market risk–return trade-offs but also on how much wealth she has relative to her needs and how far she is from financial danger. This is dynamic.

Investors near the danger zone should prioritize downside protection and favor investments that minimize losses, even at the cost of upside, making personal risk dominant.

If she has sufficient cushion, risk preferences resemble the broader market and volatility becomes the relevant risk measure, leading to a market-risk-focused allocation in liquid assets like stocks and bonds.

As wealth increases further, she can pursue higher-upside opportunities and accept the possibility of principal loss.

For an investor with high longevity risk:

The amount of allocation to annuities depends on one’s net worth, lifestyle needs, bequest motive and risk tolerance.

The Wealth Allocation Framework includes annuities in the asset allocation decision by including them in the personal risk bucket. The bulk of the assets is invested in the personal risk bucket (~75%), which includes significant exposure to annuities and inflation-protected securities. The market risk bucket (~20%) provides the necessary cushion to maintain lifestyle in the event of significant inflation and other market risks.

Delaying annuitization while withdrawing funds in a phased manner:

The idea is that delaying annuitization while withdrawing funds gradually can lower the risk of running out of money (longevity risk), and here’s why.

If a retiree annuitizes too early, they lock in annuity payments based on interest rates and annuity prices at that point in time. By delaying annuitization, the retiree keeps flexibility: assets remain liquid and can benefit from market growth, and annuity purchase can be timed for more favorable conditions.

In addition, annuity payouts generally rise with age because life expectancy shortens, so the same premium can buy more guaranteed income later.

At the same time, using a phased or gradual withdrawal strategy (rather than spending too aggressively early on) helps preserve capital during the early retirement years, which are especially vulnerable to poor market returns. This reduces sequence-of-returns risk—the danger that bad market performance early in retirement permanently damages the portfolio.

When these two strategies are combined, the retiree covers current spending through controlled withdrawals while postponing the purchase of lifetime income. Later, when annuitization occurs, it provides a higher guaranteed income stream and reduces longevity risk. Together, this approach lowers the probability of an income shortfall, meaning the chance that the retiree cannot sustain their desired level of consumption over their lifetime.

Timeline example for investors with longevity risk:

From ages 60 to 70, the retiree relies on phased withdrawals from their investment portfolio to fund spending, keeping assets liquid and flexible while still participating in market growth (if a retiree receives a guaranteed pensions from his former employer, she or he may not need extra monthly income to fund retirment between 60 and 70 years -- so that she can continue with her market risk investments till age 70).

At age 70 or later, the retiree uses part of the remaining wealth to purchase an annuity, locking in lifetime income at a time when annuity payouts are typically higher due to shorter life expectancy.

From that point onward, regular expenses are covered by a combination of annuity income and smaller, more sustainable withdrawals from the remaining investments (nest egg).

This sequence illustrates exactly how delayed annuitization plus gradual withdrawals can reduce income shortfall risk and mitigate longevity risk.

Human capital plays a key role in wealth strategy by linking lifestyle and life cycle considerations. Early-career professionals with strong earning potential (high human capital) can treat future income as part of their portfolio, reducing personal risk and allowing greater market and aspirational risk, including earlier home ownership.

As retirement approaches and human capital declines, aspirational investing should be limited to those who are already affluent.

Key Takeaways for Investors:

Risk Allocation Precedes Asset Allocation: Before you pick stocks or bonds, you must decide how much money you cannot afford to lose (Personal Risk) and how much you are willing to "swing for the fences" with (Aspirational Risk).

Human Capital is an Asset: Your ability to earn an income is often your largest asset. If you work in technology, your "Market Risk" bucket shouldn't be over-weighted in tech stocks, as your Personal and Market risks would become too correlated.

The Goal is "Peace of Mind": By slicing assets into these three buckets, investors can better withstand market volatility. If the stock market (Market Bucket) drops 20%, the investor stays calm because their lifestyle (Personal Bucket) is funded by safe assets.

Efficiency vs. Sufficiency: MPT seeks the most efficient portfolio (highest return for lowest risk). The Wealth Allocation Framework seeks a sufficient portfolio (one that ensures you don't go broke while giving you a shot at your dreams).

---------------------------------

RAMA KRISHNA VADLAMUDI

Equity Analyst, STB,

STATE BANK OF MYSORE

MUMBAI

Date: January 12, 2007

Thailand’s attempt to control capital flows:

Between the start of 2006 and mid-December 2006, the Thai baht rose by 16% against the dollar-more than most other currencies. When capital inflows accelerated in December, the Bank of Thailand panicked and slapped a tax on inward portfolio investment (similar to that used in Chile). After the share prices fell by 15% in a day, the controls were hastily removed from equities. They remain on debt investments. This clumsy flip-flop has severely undermined the credibility of Thailand’s economic policymakers. Yet the drastic measures highlight the seriousness of a dilemma faced elsewhere in Asia: how to curb domestic liquidity when foreign capital is flooding in.

Capital controls are a way around what economists call the “impossible trinity”: an economy cannot simultaneously control domestic liquidity, manage its exchange rate and have an open capital account. Only two of the three are possible. Controls on short-term capital inflows, if (a big if) they are implemented in a well-thought-out and transparent way, can offer a viable compromise, curbing capital inflows and excessive money growth, while taking pressure off the currency.

Other Asian countries are also looking for ways to discourage foreign capital inflows. In December 2006, South Korea raised reserve requirements on foreign-currency debt to make it harder for banks to borrow from abroad. China has kept its restrictions on portfolio capital inflows, helping it to hold down its exchange rate. This, however, is squeezing the competitiveness of other Asian economies. Many economists reckon that a rise in the Yuan would do little to reduce America’s trade deficit, but it would certainly help to take pressure off other Asian exporters-and assist in curbing the gush of global liquidity.

The deluge of spare cash has two main sources. First, average real interest rates in the developed world are still below their long-term average. Second, America’s huge current-account deficit and the consequent build-up of foreign exchange reserves by countries with external surpluses has also pumped vast quantities of dollars into the financial systems.

A large chunk of Asia’s reserves and oil exporters’ petrodollars have been used to buy American Treasury securities, thereby reducing bond yields. In turn, low bond-market returns have encouraged bigger inflows into higher yielding emerging-market bonds, equities and property, especially in Asia. Liquidity has been further boosted by the use of derivatives, and by carry trades (borrowing in currencies with low interest rates, such as yen, to buy higher-yielding currencies).

*eq.res./vrk/120107

Transcript from the above video of What Warren Buffett said:

When I was young, there was a saying that stuck with me: When people get scared, they run to gold. When they panic, they run to cash. When they lose faith, they run to nothing at all. I believe we are very close to the third stage. Most people don’t realize this—they think the big threat is inflation or currency collapse, but there’s something even more dangerous brewing, something that will hit gold before it spreads elsewhere.

Before we go further, I encourage you to pause and think about your own savings, your nest egg, your sense of security. Consider where you put your trust. What I’m about to discuss isn’t about price movements or trading signals; it’s about confidence. And once confidence disappears, it takes generations to rebuild. I’ve seen that cycle repeat itself throughout my life.

In the 1970s, Americans lost faith in their government’s ability to manage inflation. In 2008, they lost faith in the financial system. Now, in 2025, people are starting to lose faith in the idea that any currency or store of value can hold meaning when governments and institutions behave as if the basic rules of arithmetic don’t apply.

I’ve often said gold has no real utility. You can polish and admire it or wear it, but it doesn’t produce cash flow. Still, for thousands of years it’s been the emotional anchor for people sensing instability. Gold is not an investment; it’s a mirror reflecting human fear. The more fear in the world, the shinier gold appears.

However, the current fear isn’t just emotional; it’s structural. The entire monetary system is being stretched in ways gold can’t meaningfully hedge against anymore. You could own all the gold bars you want, but it won’t save you if confidence in the system vanishes. I can say with certainty something is seriously out of balance. Central banks, including our Federal Reserve, have built a world where debt is frequently mistaken for wealth and liquidity for stability. It’s what I call the great illusion of modern finance.

When governments print money faster than the economy can grow—and investors pretend it doesn’t matter—you can almost hear the ticking of a time bomb. Gold, throughout history, is now sitting right atop that bomb. People have said, “Isn’t gold supposed to go up when things fall apart?” That’s the common belief, but beliefs don’t last forever.

Gold is priced in dollars, and if the dollar loses meaning, gold becomes just another shiny rock whose price can’t be agreed upon. In a real crisis, the debate won’t be about whether gold is up or down, but about what ‘up’ or ‘down’ even mean when every reference point breaks. I’ve watched this happen before—not in America, but in places where faith in money disappeared overnight. In those moments, people don’t flock to gold, but to food, land, and safety. You can’t eat gold. You can’t grow crops with it. You can’t convince someone starving to trade their last loaf of bread for a metal coin.

If I’m bringing this up now, it’s because I see familiar signs: complacency, blind trust in central banks, experts insisting “this time is different.” In my experience, that’s never true. The next big crisis for gold won’t come from investors selling it—it will come from governments deciding they can’t tolerate gold as an alternative to their control. Already we’re seeing experiments with digital currencies—money that can be tracked, frozen, taxed instantly. The world’s moving from tangible value to virtual trust, and when that happens, gold will stop being a refuge for the fearful and become just a relic of the past.

I’m not saying gold will vanish or has no use in a portfolio. I own some, indirectly, through companies. But the time is coming when the foundation of what gold represents—independent security, resistance to manipulation—will be undermined by something new: the union of government power and digital technology. When that happens, the question won’t be “How much is gold worth?” but “Is gold allowed to be worth anything at all?” Very few are prepared for that stage. We are heading toward a world where value is determined by permission, not by scarcity. Even gold will need permission to matter.

Some may say I’ve changed my view on gold or turned pessimistic, but I’m not predicting doom—just noticing a historical pattern. History doesn’t repeat, but it rhymes. Every strong economy eventually convinces itself it can change the rules of money without consequences. It always ends the same: denial, inflation, then control. Control is the last stage before collapse—and it always starts with things people trust most, like gold.

Markets, like people, have memory. After 2008, people felt fear. After the pandemic, desperation. Now? Fatigue—which makes people careless, willing to accept easy answers and stop asking tough questions. That’s why I’m sounding this warning: something bad will happen to gold—not because it’s losing value, but because the very system that gave it meaning is losing credibility. To explain this, let’s revisit a lesson from 1971: President Nixon suspended the dollar’s convertibility into gold. It seemed temporary but was permanent. From that moment, the financial world changed. For centuries, gold kept governments honest. You couldn’t print more gold. Its scarcity enforced discipline. But removing that anchor opened the door to unlimited promises.

I watched as people struggled to understand, and what followed was a gradual separation of value from reality. At first, everything seemed fine: business was booming, innovation thrived, and markets prospered. But behind the scenes, incentives shifted. Governments started spending more than they had, companies borrowed more than they earned, and investors speculated on things that didn’t exist. It worked—until it didn’t.

The 1970s taught Americans a hard lesson about inflation. When gold was unlinked from the dollar, prices crept up—then surged. Ordinary people watched their savings disappear. Gold soared from $35 to over $800 an ounce. Many believed gold was a perfect escape—safe from government mistakes. But in the end, timing was everything; when inflation cooled and faith in the system returned, gold’s price collapsed. Those who treated it as a religion, not a hedge, lost most of their wealth. The real lesson: trust is the foundation of value, not metal.

The same cycle is repeating now, but at a global scale, and more dangerously. Now, we have dollars not backed by gold, but debts not backed by reason, and assets whose value depends on someone else wanting to buy them at a higher price later. In such a world, gold feels comforting—physical, ancient, tangible. That honesty makes it a target, though. Governments can print and trace digital money, but they can’t control gold. It’s the last bit of financial privacy—a problem in a world obsessed with oversight.

Central banks and governments prefer digital currencies, not for convenience, but for control. If something can’t be printed, it can be banned. That’s where we’re headed. The real threat to gold isn't volatility or competition — it’s policy. A world where gold ownership could be restricted, in the name of stopping crime or protecting the nation. This isn’t far-fetched; history supports it. In 1933, the government confiscated gold from Americans, then revalued it, reducing their wealth overnight. Modern governments can use regulation and code rather than physical raids.

Ask yourself how many of your assets exist as digital numbers on a screen. You trust that system because it works. But if the system itself excludes certain assets like gold, what then? The issue isn't fear—it’s arithmetic and incentives. Every government, sooner or later, picks inflation over discipline. When the bill comes due, they tighten control, create new rules, redefine value. The next big shift won’t come from a market crash, but from a new definition of money itself—and in that world, gold won’t behave as people expect. It’ll be seen as a symbol of rebellion, and symbols often attract powerful enemies.

What’s the alternative? If gold suffers, if paper money inflates, where is safety? Real wealth is not a static thing—it’s a flow of trust, productivity, and energy. It must keep moving and growing. Throughout my life, I’ve invested in companies that create real value, solving real problems. Those win over time, adapting to change. Gold, for all its appeal, cannot adapt. It just waits. The world ahead won’t reward waiting, but participation, creativity, and resilience.

Many people will still hold to the belief that gold is safe when all else fails. But a new kind of crisis is coming—not a crisis of currency but of permission. Soon, we must talk about money’s future: a system already being built that will redefine ownership, value, and freedom.

Money is just a tool—a way society pursues its goals. Change the tool, and you change society. Governments and banks are working on central bank digital currencies (CBDCs)—programmable, trackable, controllable forms of money. Unlike the cash in your wallet, a digital currency can be restricted, expired, or frozen with the push of a button. The future is a world with real-time monitoring and tracking, not science fiction but the actual direction we’re heading.

Here’s where gold comes back in: it’s the last market that remains outside of the system. It leaves no digital footprint. That makes it dangerous to those who want total visibility and control. Governments won’t need to confiscate gold physically—they’ll just regulate it out of daily use, making it irrelevant. Control, in the 21st century, comes by making you think it’s not worth the risk to use what you own. This pattern repeats: when power centralizes, it tries to suppress whatever it can’t control.

The world is shifting from gold-backed to government-backed code. Once code is the medium of exchange, who writes the code writes the rules. Trust cannot be printed, coded, or legislated. Once people sense that trust is just being replaced by control, the illusion breaks. That’s when panic sets in—not just short market dips, but civilization changes.

Freedoms that once came from gold are now vulnerable. If people stop agreeing on value—even gold loses its purpose. Imagine the global economy as a giant balance sheet: on one side, hard assets; on the other, promises and digital entries that now greatly outnumber real things. Gold was once the governor keeping this in check; now, when decree replaces scarcity, the engine overheats and the system is at risk.

When nations remove the constraints on money, it leads to excessive credit, which inevitably creates bubbles, and every bubble seeks a scapegoat. Gold will be that scapegoat. When the next monetary contraction comes, leaders will blame those who hoard gold or avoid digital currencies. Regulations and taxes will follow, all justified as reforms.

Still, you can regulate gold out of the market, but you can’t remove scarcity from human nature. When governments replace natural value with artificial rules, they invite the very crisis they’re trying to avoid. After gold declines, there will come a deceptive calm, with the world celebrating digital stability—until people forget the real meaning of trust. When that calm ends, the collapse will be fast.

But there is a way through. Wealth isn’t in metal or code but in how we think about value—measured by people willing to trust each other. Lose that trust, and nothing can replace it. Money is a story about the future—a promise that tomorrow will honor what we do today. When governments manipulate that story, they erode the faith that empowers it.

The global economy now runs on easy money: quick fixes, more debt, more promises. But a system can’t run on promises forever; it eventually collapses. Gold will be the first casualty, its value eroded through policy and perception until it’s irrelevant for most people.

Even then, don’t despair. When gold loses relevance, something new is born to take its place. The future of money will go to those who create real, visible value—through productivity and integrity. In a world run by machines and algorithms, human trust and resilience will matter most.

So, what to do? Own things that last. Own skills and ideas that multiply. Don’t bet your future on symbols of wealth, but on your ability to generate value in any system. When investing, look for lasting stories and real solutions to enduring problems. If you serve genuine needs, you’ll outlast any crisis in currency.

As I’ve often said: “Be fearful when others are greedy, and greedy when others are fearful.” That’s not about timing markets, but about staying disciplined and facing reality. The problem facing gold is a mirror of what’s already happened to society—a trade of discipline for convenience, scarcity for abundance, independence for dependency. The bill for that trade always comes due.

But America has a knack for rediscovering itself under pressure. We’ve survived depressions, wars, technological upheaval. Trust fails and returns. Young people, don’t chase shiny objects or speculation. Build your future on service, skill, and integrity. If you do, you won’t have to worry about gold or the dollar. Real value, once created, cannot be confiscated by any government or algorithm.

My father told me during the Great Depression: “You can lose your job, your savings, or even your house, but if you keep your word and keep learning, you’ll never be broke.” That’s still true. The world may change fast, but human character is timeless. Gold may fall and currencies may change, but honesty and diligence always rise in value.

So, when I say something terrible is going to happen to gold, understand that I’m talking about a test of faith—faith in money, in leaders, and in ourselves. The way forward isn’t to run, but to rebuild the trust that gold used to symbolize. In the end, it’s not gold that holds up civilization: it’s people, work, and integrity. Keep your focus on those, and you’ll be stronger than gold ever was.

The article describes a gold-buying frenzy that mirrors past speculative surges. Gold prices have surged to $4,000/oz, an increase of 50% this year, and demand has reached such a high level that retailers are turning buyers away. Gold has evolved beyond its traditional role as a hedge or safe haven, and is now seen as an emotional trade driven by FOMO (Fear of Missing Out), concerns over financial instability, and political uncertainty. Both retail and institutional investors are being drawn in by these factors.

Key Drivers of the Rally

Central Bank Buying: Central banks, particularly in developing countries, have made record purchases since 2022, trying to diversify away from the US dollar. Central banks now hold nearly as much gold as they do in US Treasury securities, marking a significant shift in the global financial landscape.

Retail and Institutional Demand: Retail interest in gold is at unprecedented levels, particularly in countries like Japan, Turkey, Hong Kong, and the UK. Additionally, $26bn flowed into gold-backed ETFs just in Q3 alone, demonstrating massive demand.

Fear-Based Narrative: A sense of fear permeates the market, with investors concerned about financial Armageddon, the Trump-driven debt explosion, loss of Federal Reserve independence, currency debasement, and the risk of stagflation. This fear is exacerbated by gold-plated FOMO, which is overshadowing rational investment frameworks.

Market Conditions: Expectations of interest rate cuts are lowering the opportunity cost of holding gold, while a weakening US dollar, ongoing political instability, and trade tensions (e.g., with China) are further driving demand.

What Could Stop the Rally?

Return to Macro Stability: If US economic growth remains strong without reigniting inflation, gold prices could fall. A stronger dollar, rising real interest rates, or renewed confidence in government debt could slow or stop the rally.

Profit-Taking / Central Bank Rebalancing: As gold prices rise, some central banks may decide to sell to rebalance their reserves. Retail investors may also lock in profits if they believe gold has reached a peak.

Historical Patterns: Gold is now trading over 20% above its 200-day average, a level that has historically been associated with significant corrections, often between 20–33%.

Loss of Narrative Cohesion: If inflation does not materialize or political risks subside, the fundamental story driving gold’s price rise could collapse, leading to a potential price drop.

Risks of a Bubble

There are several indicators that suggest gold might be in a bubble. These include it being the most crowded trade, as noted by Bank of America, along with panic buying and stockouts at places like the Royal Mint and Japan’s Tanaka Precious Metals. Silver prices are also surging, often seen as a speculative spillover from gold bubbles. Moreover, gold is rising even though real interest rates are increasing, which typically does not align with traditional valuation frameworks.

Geopolitical & Structural Shifts

The gold rush isn’t just a retail phenomenon. There are structural changes underway, such as sovereign diversification away from the US dollar. Concerns about fiscal dominance, where central banks lose their independence due to government pressure, are also playing a role. Countries like Japan, which have experienced decades of deflation, are now feeling the effects of inflation, which is changing household behavior.

Investor Psychology & Behaviour

Gold has become a mirror for global anxiety, with people buying it not necessarily for financial returns but for security, sovereignty, and tangibility—something they can physically hold in their hands. The rally is largely driven by emotion, as one analyst notes, it “defies logic.” This suggests that speculative behavior is fueling the price increases, rather than sound economic reasoning.

How Long Will Gold Mania Last?

Short Term (next 6–12 months): Gold’s momentum could continue if political risks and expectations of interest rate cuts persist. The positive feedback loops from ETF inflows, retail buying, and central bank accumulation may keep the rally going.

Medium Term (1–2 years): The risks of a correction rise as investors reassess the inflation outlook, central banks begin to rebalance their reserves, and sentiment starts to cool. The speculative nature of the rally suggests vulnerability in the medium term.

Long Term (>2 years): If fears over fiat currency debasement or geopolitical fragmentation continue, gold could consolidate at a higher range. However, if economic confidence returns, mean reversion is more likely, leading to a drop in gold prices.

Conclusion: Between Fear, Fundamentals & FOMO

Gold’s current rally is driven by a combination of fear, macroeconomic fundamentals, and speculative enthusiasm. While there are solid drivers such as central bank purchases and the need for inflation hedging, the rally is also heavily influenced by emotion and shows bubble-like characteristics. The future of the gold market depends largely on developments in Fed policy, inflation data, dollar strength, geopolitical events (especially surrounding Trump, China, and the Middle East), retail sentiment, and central bank behavior. As history shows, no mania lasts forever, and gold mania will likely persist as long as uncertainty does.

1. Cocoa Price Drop as a Parallel to Other Commodities:

The report starts by noting a sharp decline in cocoa prices, suggesting a broader pattern where speculative bubbles in commodity markets burst when demand falters, and traders adjust their positions.

The comparison here is to gold, suggesting that similar market psychology—driven by speculative excess—could also be influencing gold prices, which have been rising sharply.

2. Gold’s Rally and the Inflation/Debasement Narrative:

The primary explanation for the rally in gold is the narrative that it serves as a hedge against inflation and dollar debasement, as governments deal with ballooning debt and high inflation expectations.

Ray Dalio and Ken Griffin echo this view, suggesting that investors are moving away from the US dollar as a store of value in response to US policy dysfunction (budget deficits, government shutdowns, etc.).

3. Contradictions in the Debasement Narrative:

One of the main contradictions is that the US dollar has not been debasing. Since April, the dollar index has been relatively stable, and long-term Treasury yields (like the 30-year bond) have shown no signs of inflationary fear or a need to hedge against US debt.

Dario Perkins from TS Lombard dismisses the idea of US dollar debasement altogether, calling it a “bullshit narrative.” He attributes gold’s price rise more to momentum trading driven by speculative forces and market illiquidity rather than fundamental economic pressures.

4. Gold as a Hedge Against More than Just the US:

James Athey and Albert Edwards argue that gold’s rise is not just about the US dollar or inflation within the US but a global shift away from all fiat currencies. This suggests gold is being used as a safeguard against systemic risks in the global financial system, which may be exacerbated by the political and economic uncertainty created by excessive debt in many countries.

Weaponization of the US Dollar: Some analysts, like James Athey, propose that the US’s use of the dollar as a geopolitical tool (e.g., sanctions, trade wars) has made other nations wary of holding US dollars. As a result, countries, particularly in emerging markets, are looking to diversify their reserves into gold and other assets.

5. Gold as a Tail Hedge and a Speculative Play:

Francesca Fornasari suggests that gold may not be a direct bet on inflation or dollar debasement, but rather a “tail hedge”. This is a defensive position taken by investors who are heavily exposed to US assets (e.g., dollars, Treasuries) and want to protect themselves against extreme scenarios where the financial system experiences a major shock (loss of control over inflation, a currency crisis, or a collapse of the dollar’s value).

Another key point is that many investors may expect US debasement to happen but do not want to bet against the Trump administration’s policy of keeping long-term interest rates low. These dynamics add complexity to the decision-making process around gold as a potential inflation hedge.

6. Momentum Trading in Gold:

The piece concludes that the gold rally started as a political event, driven by central banks and geopolitical risk, but has now become a momentum trade. In other words, the gold market is driven more by speculative flows than by real-world inflationary pressures or dollar debasement expectations.

Gold’s price movement is less about any immediate threat to the dollar and more about traders jumping on a trend that seems to be feeding on itself. In that sense, the current rally may be disconnected from its original macroeconomic narratives.

Key Takeaways:

The primary story of gold's rally being driven by inflation fears and dollar debasement is inconsistent with the behavior of the dollar and long-term Treasury yields.

The true driving forces behind the rally may be more speculative and momentum-driven, with political factors (e.g., US fiscal policy, geopolitical tensions) playing a role in fueling demand for gold.

Global central bank actions and the weaponization of the US dollar could also be contributing to gold’s role as a safe-haven asset.

Ultimately, gold may be less about a specific bet on US inflation and more about hedging broader systemic risks in a world where faith in fiat currencies and the financial system is eroding.

This analysis underscores the complexity of the current gold rally, suggesting that it is not just a simple story of inflation protection, but a confluence of speculative behavior, global geopolitical tensions, and changing investor sentiment towards currencies and financial systems.

Gold’s Record Price Surge

Gold has seen an impressive rally, with prices increasing by over 50% in 2025 alone, hitting a record high of $3,940 per troy ounce. This surge can be attributed to several macroeconomic factors: