Top three sectors, as on 31Aug2023, are FMCG (7 stocks), healthcare (4 stocks) and financial services (4 stocks) -- with a total weight of 51.5 percent. The index is fairly diversified across sectors.

Compared to Nifty 50 and Nifty 100 indices, this Low Volatility index provides better diversification in terms of sectors. But Nifty Next 50 index offers superior portfolio diversification compared to Nifty 100 Low Volatility 30 index.

6. Top

10 stocks (31Aug2023) >

As of 31Aug2023, the top five stocks in the index are Sun Pharma, Cipla, NTPC, Dr Reddy's Labs and ICICI Bank. The portfolio diversification is decent with top 10 stocks having a weight of 37 percent.

The Nifty 100 Low Volatility 30 index provides better diversification compared to Nifty 50 (top stocks have 58.4 percent weight) and Nifty 100 (top 10 stocks have 50.2 percent weight).

But Nifty Next 50 index with 30.8 percent weight for top 10 stocks provides better diversification compared to this Low Volatility index.

7. Returns

and fundamentals (31Aug2023) >

The index's price-earnings (P/E) ratio is 23.8, price-book value ratio is 5.2 and dividend yield is 1.7.

8. List

of 30 stocks and their weights (31Aug2023) > Table 1 >

It may be noted there are 31 stocks in the index as on 31Aug2023 -- the one extra stock is Jio Financial Services. As Jio Financial Services was demerged from Reliance Industries last month, the stock forms part of the index temporarily.

The stock will probably be removed from the index by the end of

30Sep2023, so that the index will continue to have 30 stocks.

There are four ETFs based on Nifty 100 Low Volatility 30 index -- these are from: ICICI Mutual Fund, Kotak MF, Mirae Asset MF and HDFC MF. From these four, I've chosen the ETF from ICICI stable because it has the highest assets and the longest track record of more than six years.

9. ICICI Prudential Nifty 100 Low Volatility 30 ETF

The portfolio stocks and their sector weights in the ETF are already discussed above, while discussing the underlying index -- so, I'm not repeating the details here.

10. Assets and expense ratio

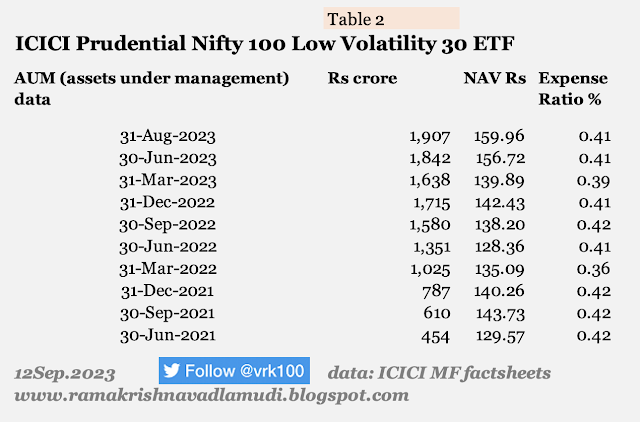

The ETF has assets under management (AUM) worth Rs 1,900 crore as of 31Aug2023, with an expense ratio of 0.41 percent. The expense ratio is more or less stable in the past two years, even as its assets are swelled by almost four times in the same period (table 2 below).

However, compared to assets of Rs 1.59 lakh crore of SBI Nifty 50 ETF (expense ratio is only 0.04 percent), the assets of this niche ETF are tiny. Of course, ETFs based on Nifty 50 index have the advantage of getting EPFO investments regularly.

Compared to ETFs based on most popular indices, like, Nifty 50 or Sensex, the expense ratio of ICICI Pru Nifty 100 Low Volatility 30 ETF is much higher.

Table 2 >

11. Risk and return comparison

The following tables 3, 4 and 5 provides details of assets, inception date, fund manager, trailing returns (both short and long term) and risk ratios such as, Sharpe ratio, Sortino ratio and Beta. The data are from rupeevest.com and as on 12Sep2023.

The tables also provide data about comparison with other smart beta indices and mainstream indices, like, Nifty 50, Nifty Next 50 and Sensex. The data also include comparison with foreign stock indices.

On a one-year, two-year and five-year trailing returns basis, ICICI Pru Nifty 100 Low Volatility ETF has outperformed its parent index ETF (LIC MF Nifty 100 ETF). But on a three-year basis, it underperformed the parent index (Nifty 100).

Compared to other smart beta ETFs, such as, Nifty Alpha Low Volatility 30, Nifty 200 Quality 30 and Nifty 50 Value 20, the ICICI Pru Nifty 100 Low Volatility ETF's performance is mixed -- in the sense, in some years, it gives superior returns and in others inferior.

Compared to Nifty 50 ETF also, the ICICI Pru Nifty 100 Low Volatility 30 ETF's record is mixed.

The Sharpe ratio for the ETF is much higher compared to Nifty 100 ETF (1.3 versus 0.7) and Nifty 200 Quality 30 ETF (1.3 versus 1.1). But its Sharpe ratio is lower compared to that of Nifty Alpha Low Volatility 30 ETF (1.3 versus 1.4).

Sharpe

ratio is a measure that describes the return earned per unit of risk

taken to earn the returns. The higher the ratio, the better for the

investor.

The other data in tables 3, 4 and 5 (please click on the images to view better) are self-explanatory.

12. Liquidity / Volumes

An important factor while choosing an ETF is volumes traded on stock exchanges. As you know, ETFs are traded on stock exchanges in real time (in contrast, index funds are not traded on stock exchanges, one needs to buy them directly from mutual funds).

Table 6 >

Table 6 provides details of volumes of the ETF for the past three years. The three-year data are bifurcated into 12 quarters, each quarter starting/ending from/in the middle of a month; each quarter has 62 trading days; and raw data are from 14Sep2020 to 11Sep2023.

Only data from NSE India is considered for the analysis -- data from BSE Limited are ignored as the BSE volumes are low.

The table gives details of total volumes, daily average volumes, minimum / maximum daily average volume on a single day, number of trades and value of volumes for each quarter.

The average daily volume improved from 54,325 in Sep-Dec2020 quarter to 117,864 in Jun-Sep2023 quarter -- it may be noted the daily average volumes in 2021 and 2022 were much higher.

The average daily volume (value) improved from Rs 55 lakh in Sep-Dec2020 quarter to Rs 189 lakh in Jun-Sep2023 quarter.

Table 7 provides the data for the three-year period from Sep2020 to Sep2023 (the same data as presented in table 6, but on aggregate basis) >

13. Action Button

Ultimately, any financial analysis should result in investment action. So, should retail investors consider the ICICI Prudential Nifty 50 Low Volatility 50 ETF for investment?

ETFs have a long history since 1993, when Standard & Poor's started SPDRs (pronounced spiders) or Standard & Poor Depository Receipts. The first ETF launched by S&P was based on S&P 500 index.

As detailed in SPIVA reports every half-year, active funds fail

to beat passive funds, due mainly to higher expenses of active funds,

index hugging and inability of active managers to hold superior and

differentiated investment strategies.

Passive funds (index funds and ETFs) offer better opportunities for majority of investors, who do not have time and required expertise to analyse and monitor the financial investments.

As we have seen, ETFs based on smart beta indices are a niche area and are suitable only for a small group of investors, who need exposure to specific investment strategies, who have expertise and who have high risk appetite to stomach the market volatility.

The following six criteria area are important while choosing ETFs and they are: suitability, portfolio diversification, size of assets, expense ratio, tracking error and liquidity.

a) Suitability: First of all, any investment decision must start with the question whether a particular investment is suitable to the individual investor, be it, a small retail investor and big investor with high net worth. This depends on each individual.

In my opinion, a majority of small retail investors can ignore the ICICI Prudential Nifty 50 Low Volatility 30 ETF because its return and risk ratios are mixed (para 11 above).

b) portfolio diversification: The purpose of a passive fund is defeated if it fails to provide decent portfolio diversification. Many ETFs suffer from high concentration risk.

As detailed in paras 5 and 6, the ETF offers superior portfolio diversification to ETFs based on Nifty 50 and Nifty 100 indices, based on both stocks and sectors. Most of these stocks and giant- and large-caps.

However, the ETF's underyling stocks, like, Sun Pharma, ITC, Larsen & Toubro, Dabur India, Asian Paints, Marico, Hindustan Unilever and Torrent Pharma look expensive on a forward price-earnings (P/E) ratio basis.

c) size of assets - the ETF has Rs 1,900 crore assets under management (AUM), good enough size from retail investors' viewpoint (para 10 above).

d) expense ratio: The superiority of ETF investing comes mainly from its lower costs, that is, lower expense ratio. Compared to Nifty 50 ETFs, this ETF has higher expense ratio at 0.41 percent, as detailed in para 10 above.

e) tracking error: Tracking error is a statistical tool that denotes the difference between the net asset value (NAV) as declared by the mutual fund daily* and its price on the stock exchanges.

Tracking

error shows how closely the ETF is able to track the performance of the

underlying index. A lower tracking error indicates that the ETF is able

to match the performance of the underlying index with a smaller

deviation.

The lower the error, the more desirable the ETF from the investor's viewpoint.

As prices on a stock exchange are dynamic in nature, depending on investor interest and liquidity, ETF prices differ from its NAV, which is the per unit value of the ETF's underlying assets.

The ETF's tracking error is 0.04 percent as on 31Aug2023; this is on a par with ETFs based on Nifty 50, Sensex and Nifty 100 indices.

(* it may be noted mutual funds should declare intra-day or indicative NAV or iNAV of ETFs on a continuous basis, in 15-second intervals, on stock exchanges on all trading days)

f) liquidity: To know whether a stock or an ETF offers liquidity, one needs to analyse trading volumes on the stock exchanges.

Volumes of the ETF

are decent enough for small / retail investors (para 12 above).

But the volumes

are not enough for big / institutional investors (however, they have the

option of buying ETF units directly form the mutual fund via a

mechanism called 'creation unit').

14. Finally

Risk and return ratios are discussed in para 11 above. After the index was introduced, it was claimed that the Low Volatility index provided superior return and risk ratios (back-tested results), offering superior risk-adjusted returns.

But the actual record of the ICICI Prudential Nifty 100 Low Volatility 30 ETF is patchy, as discussed in para 11 above. While the ETF scores well on parametres of portfolio diversification, size of assets, tracking error and liquidity, it scores poorly in terms of cost and risk / return ratios.

One could have considered the ETF if the expense ratio were to be reduced to less than 0.20 percent, as the ETF offers good liquidity and better portfolio diversification.

In my opinion, many retail / small investors are better off sticking to ETFs based on broad market indices, such as, Nifty 50, Nifty Next 50, Sensex or BSE 500.

Equity investments are high risk for people who cannot tolerate sharp movements in stock prices.

This blog on the ETF should not be considered as investment advice. This is just for educational purposes. The author does not have any position in the ETF.

No comments:

Post a Comment