EPFO Investments in Stocks via ETFs

(updates 15Jan2024, 12Dec2023 and 14Aug2023 with new data are available at the end of the blog post)

Employees' Provident Fund Organisation (EPFO) is a statutory body established by the Government of India. EPFO collects, administers and manages provident funds and pension funds of various employees in India.

EPFO used to invest, on behalf of its subscribers and pensioners, most of its funds in debt securities of Government of India, State Governments and private sector firms. But in 2015, EPFO started investing in Indian stock market via exchange-traded funds (ETFs). This is a significant development, not only for EPFO but also for Indian stock market.

(story continues below)

------------------

Related Blogs:

Who is Eating My Gold ETF Return?

------------------

Since August 2015, EPFO's gross investments (does not include redemptions) amount to Rs 159,300 crore till 31Mar2022. This is just face value of the gross investments made by EPFO. The market value of these equity ETF investments was Rs 226,000 crore as on 31Mar2022.

Due to large-sized investments from EPFO, the ETF assets in India swelled from Rs 28,800 crore in Dec2016 to Rs 497,000 crore in Dec2022 (data include both equity and debt, but exclude gold ETFs).

Table 1: EPFO Investments in Equity ETFs >

Of the total investments of Rs 18.31 lakh crore (face value) of EPFO as on 31Mar2022, only 8.70 percent or Rs 1.59 lakh crore is invested in equity market and the rest is in various fixed income / debt securities.

Table 2: Timeline of EPFO Equity Investment Pattern >

As shown in table 2 above, EPFO started investing, in August 2015, five percent of its incremental flows in a year in equity ETFs. In Sep2016, EPFO increased it to 10 percent and in May2017, further raised the maximum limit to 15 percent of fresh accretions in a financial year.

EPFO restricts itself to equity ETFs based on Nifty 50, BSE Sensex, CPSE and Bharat 22 indices. Moreover, its Nifty 50 and Sensex ETF investments are restricted to just two mutual fund houses, namely, SBI MF and UTI MF -- both belonging to the public sector (for more: see pages 76 to 79 of EPFO Annual Report 2020-21).

Table 3: AUM of ETFs in Which EPFO Invested >

The assets under management (AUM) of the six ETFs (table 3) in which EPFO invested is Rs 3.21 lakh crore -- which accounts for about 80 percent of total AUM of Rs 3.97 lakh crore of about 130-odd equity ETFs of Indian mutual fund industry (data from Rupee Vest).

Such a high concentration of AUM in just six ETFs is due to the fact that EPFO restricts its ETF investments to just these six ETFs.

As delineated in table 3 above, SBI Nifty 50 ETF, SBI Sensex ETF and UTI Nifty 50 ETF are the top three equity mutual funds schemes by AUM among all equity MFs (active equity funds, equity index funds and equity ETFs).

The regular flows from EPFO have helped these ETFs gain AUM in the past six to seven years. Most of the ETF investments are restricted to SBI Nifty 50 ETF, SBI Sensex ETF, UTI Nifty 50 ETF and UTI Sensex ETF.

EPFO Equity Investments Initiated in 2013:

The then finance minister P Chidambaram in his 2013-14 budget speech on 28Feb2013 announced that EPFO would enlarge its investments to exchange traded funds and others. A screenshot of the relevant budget speech >

Though the reform process originated in Feb2013, it took more than 30 months for EPFO to start investing in Indian stock market. One government initiated the process and the next government picked up the thread and started the investments.

The point is economic reforms in India are a continuum; they can't be attributed to a single person / government.

To Sum Up

EPFO's investments in Indian equity market have led to the faster development of passive mutual fund industry. This has helped in the rise of Indian stock market also, with domestic institutional investors working as a bulwark to any large-scale equity outflows from foreign portfolio investors (FPIs).

Instead of confining itself to just two mutual fund houses, namely, SBI MF and UTI MF, it would be better if EPFO, which works under the Ministry of Labour and Employment, expands its horizon to other mutual fund companies also.

- - -

P.S.: The following data / image are included after the blog was published on 18Mar2023 >

Update 15Jan2024: The Updated charts are available with new data incorporated as per FY 2022-23 annual report of EPFO > pages 79 to 90 of the PDF for equity investments and investment pattern details > PIB press release dated 11Dec2023 :

Table 1: Gross investment by EPFO in equity ETFs:

Total gross investments made by EPFO in equity ETFs or exchange-traded funds from August 2015 till 31Oct2023 are Rs 261,649 crore.

Table 3: AUM of Equity ETFs in which EPFO Invested:

As on 31Dec2023, the total AUM (assets under management) of all equity ETFs in which EPFO invested is Rs 412,602 crore -- which is 77.7 percent of total AUM of all equity ETFs. The total AUM of all equity ETFs is Rs 530,733 crore as per Rupee Vest data.

But for the investments by EPFO in equity ETFs since Aug2015, the amount of equity ETFs in India would have been significantly lower.

Table 4: Growth in total AUM of all ETFs for the last 10 years:Total AUM of all ETFs (includes debt and equity, but excludes golt ETFs) in India grew by 25 percent in calendar year 2023 to Rs 612,022 crore as on 31Dec2023. This is the lowest growth in AUM in the past 10 years, even as the benchmark stocks indices, Sensex and Nifty 50, have been scaling new highs in recent months.

The growth in total AUM of ETFs is mainly driven by investments in debt and equity ETFs by EPFO for more than eight years.

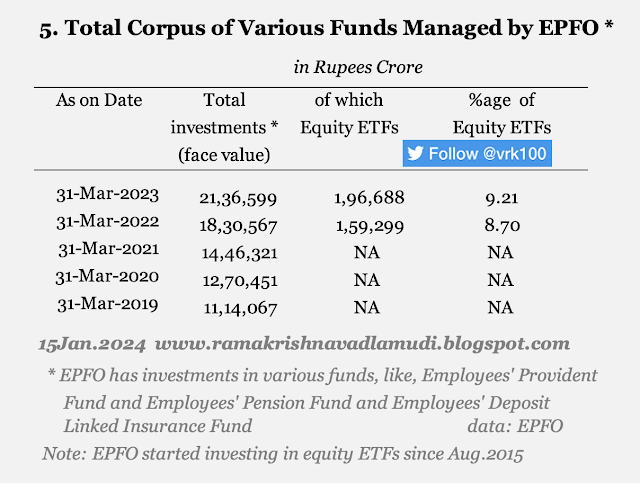

Table 4: Total Corpus of EPFO investments:

Total corpus of investments (face value) made by EPFO in various schemes is Rs 21,36,599 crore as on 31Mar2023 -- of which total corpus of ETF investments (face value) is Rs 196,699 crore, which is just 9.21 percent of the total corpus. However, this has been going up steadily in recent years. The percentage of ETF investments in total was 8.70 percent of the total as on 31Mar2022.

Update 12Dec2023: The investments of EPFO into stock market via ETFs from Apr2023 to Oct2023 are Rs 27,105 crore as per PIB press release dated 11Dec2023

Update 14Aug2023: The investments of EPFO into stock market via ETFs (from 2015-16 till Jul2023) are in the enclosed chart >

Total EPFO investments in equity ETFs from Apr2015 till Jul2023 are Rs 2.47 lakh crore.

References:

Tweet 14Jan2018 on EPFO ETF investments

Tweet 15Oct2022 Chidambaram 2013 budget speech

EPFO Annual Reports

Additional data: investment pattern of EPFO >

-------------------

Read more:

When Will US Federal Reserve Stop Hiking Interest Rates?

Adani Stocks Meltdown and Nifty Next 50 Index

Are Indian Stocks Immune to Adani stock Meltdown?

Meltdown in Adani group Listed Stocks

JP Morgan Guide to Markets

Why the Divergence Between Sensex and Nifty 50 in Today's Trade? Indian Stock Market Moves Fully to T+1 Settlement

NSE Indices Comparison 31Dec2022

BSE 500 vs S&P 500 Indices Compare 31Dec2022

India Up the Ladder in MSCI EM Index

New Rules on Ex-date and Record date

Crisil Report - Big Shift in Financialisation

Weblinks and Investing-------------------

Disclosure: I've vested interested

in Indian stocks and other investments. It's safe to assume I've interest in the financial instruments / products discussed, if

any.

Disclaimer: The analysis and

opinion provided here are only for information purposes and should not be construed

as investment advice. Investors should consult their own financial advisers

before making any investments. The author is a CFA Charterholder with a vested

interest in financial markets.

CFA Charter credentials - CFA Member Profile

CFA Badge

He blogs at:

https://ramakrishnavadlamudi.blogspot.com/

https://www.scribd.com/vrk100

Twitter @vrk100

No comments:

Post a Comment