(Update 01Apr2023 is available)

(write-up continues below)

------------------------

Related blogs:

NSE Indices Comparison 31Dec2022

Nifty 50 Index Yearly Movement 31Dec2022

Nifty 50 Index Evolution 2011 to 2021

------------------------

Fundamentals:

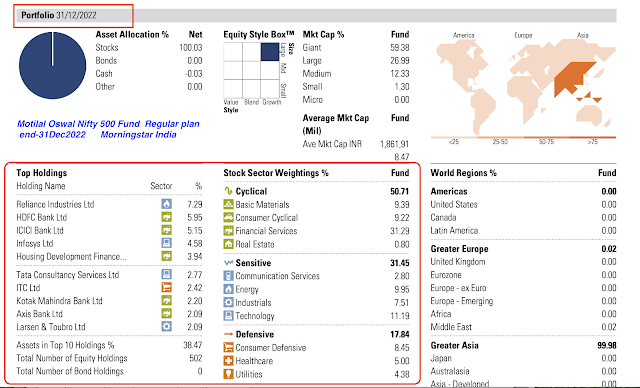

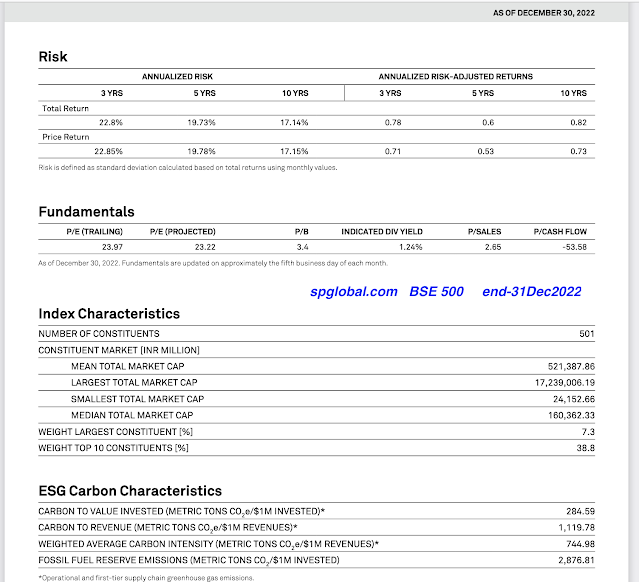

Table 1: Risks, Returns and Valuation parameters >

As US stocks took a nosedive in 2022 with a loss of 18.1 percent (total return including dividends), the S&P 500's total returns for 3-, 5- and 10-years are lower than those of BSE 500. The outperformance of BSE 500 versus S&P 500 is nearly 23 percent in 2022 alone.

However, investing in BSE 500 entails higher risk as measured by standard deviation. The BSE 500 index is able to do better than S&P 500 on a risk-adjusted return basis (Sharpe ratio) for the past 3- and 5-year periods.

Indian stocks, as presented by BSE 500, are more expensive than the US stocks based on relative valuation measures, such as, price-earnings, price-book value and other ratios. The US stocks fetch higher dividend yield.

Top 10 Stocks:

On both the top 5 and top 10 stocks concentration basis, Indian indices continue to be more concentrated as has been the case over the years. Top 10 stocks of BSE 500 have a share of 38.5 percent versus S&P 500's 24.3 percent, which a big difference of about 14 percentage points.

Table 3: Top 5 Sectors and Concentration Risk >

Sector concentration is similar for BSE 500 and S&P 500 -- the top 5 sectors have a concentration of about 71 percent. In the S&P 500, sectors, like, consumer discretionary and communication services have lost ranking, while financials and industrials climbed up the ladder.

Here, I made an attempt to compare these two indices based on various measures. Investors can compare the end-2022 data and with end-2021 data and can draw their own conclusions and gain insights in order to be better investors over time.

References:

S&P Dow Jones Indices - S&P 500 and other US indices monthly factsheets, index methodology and others

S&P Dow Jones Indices - BSE 500 and other BSE indices monthly factsheets, index methodology and others

BSE 500 index monthly factsheet - S&P Global

S&P 500 index monthly factsheet - S&P Global

Motilal Oswal Nifty 500 fund - monthly factsheet

iShares Core S&P 500 ETF - monthly factsheet

ICICI Pru BSE 500 ETF - Morningstar India

Raw data as on 31Dec2022 >

-------------------

Read more:

Nifty 50 Index Yearly Movement 31Dec2022

India Up the Ladder in MSCI EM Index

New Rules on Ex-date and Record date

Mutual Fund Asset Class Returns 31Dec2022

BSE Broad and Sector Indices Market Cap 31Dec2022

Global Market data 31Dec2022

BSE Broad and Sector Indices Returns 30Dec2022

Crisil Report - Big Shift in Financialisation

Global bond yields, negative real interest rates and soft landing

Indian Energy Exchange Buyback Offer 2022

Larsen & Toubro Infotech & Mindtree Merger Effective 14Nov2022

Indian Energy Exchange Limited - Brief Analysis

JP Morgan Guide to the Markets

Indians' Love For Cash Continues Unabated

-------------------

Disclosure: I've vested interested in Indian stocks and other investments. It's safe to assume I've interest in the financial instruments / products discussed, if any.

Disclaimer: The analysis and opinion provided here are only for information purposes and should not be construed as investment advice. Investors should consult their own financial advisers before making any investments. The author is a CFA Charterholder with a vested interest in financial markets.

CFA Charter credentials - CFA Member Profile

CFA Badge

He blogs at:

https://ramakrishnavadlamudi.blogspot.com/

Twitter @vrk100

No comments:

Post a Comment