Indian Stock Market Moves Fully to T + 1 Settlement from 27Jan2023

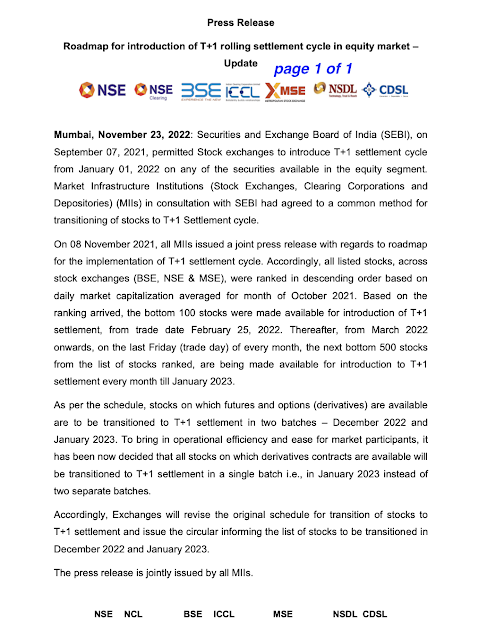

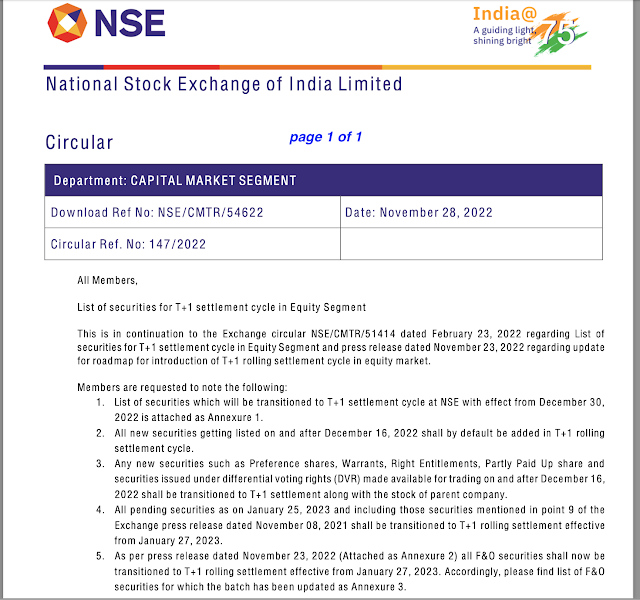

In an interesting development, all stocks in Indian stock market will fully move, effective 27th of January, 2023, toward T+1 settlement cycle from the earlier T+2 settlement. The process of moving, in a phased manner, toward T+1 settlement cycle started in February 2022 as per norms laid out by India's capital market regulator Securities and Exchange Board of India (SEBI).

This is a positive step for all financial market participants as they will be able to get access to their money within one day of trade. Similarly, you can get access to the shares you bought within one day of trade.

T+1 settlement cycle means if you buy a stock today, the particular stock would be credited to your demat account one trading day later, that is, tomorrow; while your bank account would be debited on the trading day, that is, today, for the amount traded. T+1 simply means trading day plus one day.

(Don't miss to read the related blog mentioned below to know about implications of the new settlement cycle on ex-date and record date)

(article continues below)

------------------------

Related blog:

New Rules on Ex-date and Record date 06Jan2023------------------------

- - -

References:

List of securities available for trading -- T+1 settlelment

SEBI amendments of Oct2022 moving all stocks from T+2 Settlement to T+1 Settlement effective 01Jan2023

Article 16Jan2023 on Blue Chips move to T+1 Settlement from 27Jan2023

Article 14Dec2022 on T+1 Settlement cycle introduction

Article 23Nov2022 on transition of all F&O stocks to T+1 settlement

Article 23Nov2022 on T+1 settlement for F&O stocks

SEBI (LODR) Regulations, 2015

SEBI amendments in 2015 for record date-------------------

Read more:

NSE Indices Comparison 31Dec2022

BSE 500 vs S&P 500 Indices Compare 31Dec2022

Nifty 50 Index Yearly Movement 31Dec2022

India Up the Ladder in MSCI EM Index

New Rules on Ex-date and Record date

Mutual Fund Asset Class Returns 31Dec2022

BSE Broad and Sector Indices Market Cap 31Dec2022

Global Market data 31Dec2022

BSE Broad and Sector Indices Returns 30Dec2022

Crisil Report - Big Shift in Financialisation

Global bond yields, negative real interest rates and soft landing

Indian Energy Exchange Buyback Offer 2022

Larsen & Toubro Infotech & Mindtree Merger Effective 14Nov2022

Indian Energy Exchange Limited - Brief Analysis

JP Morgan Guide to the Markets

Indians' Love For Cash Continues Unabated

-------------------

Disclosure: I've vested interested in Indian stocks and other investments. It's safe to assume I've interest in the financial instruments / products discussed, if any.

Disclaimer: The analysis and opinion provided here are only for information purposes and should not be construed as investment advice. Investors should consult their own financial advisers before making any investments. The author is a CFA Charterholder with a vested interest in financial markets.

CFA Charter credentials - CFA Member Profile

CFA Badge

He blogs at:

https://ramakrishnavadlamudi.blogspot.com/

Twitter @vrk100

No comments:

Post a Comment