(The views expressed here are for information purposes only and should not be construed as a

recommendation or investment advice. While the author is a CFA Charterholder

with nearly 25 years of experience in financial markets, this content

is intended to share general insights and does not constitute financial

guidance. Please consult your financial

adviser before taking any investment decision. Safe to assume the author

has a vested

interest in stocks / investments discussed if any.)

Most of us in India tend to stick close to home when it comes to investing. We love our HDFC Banks, Bajaj Finances, and Wipros (called home bias in investing parlance).

On a five-year and 10-year basis, Indian stocks have provided solid returns, rewarding equity investors in India. But in the past nine to 10 months, Indian equities have been underperforming global markets.

In times like these, it's not a bad idea to look for international diversification. Asset classes are cyclical, and so are individual stock markets. The performance of each market varies from another in a particular period of time.

When one market zigs, the others tend to zag. This is the nature of global markets. As you may have observed, the US stocks have done better than their Indian counterparts in 2025.

Let us compare Indian and US stocks.

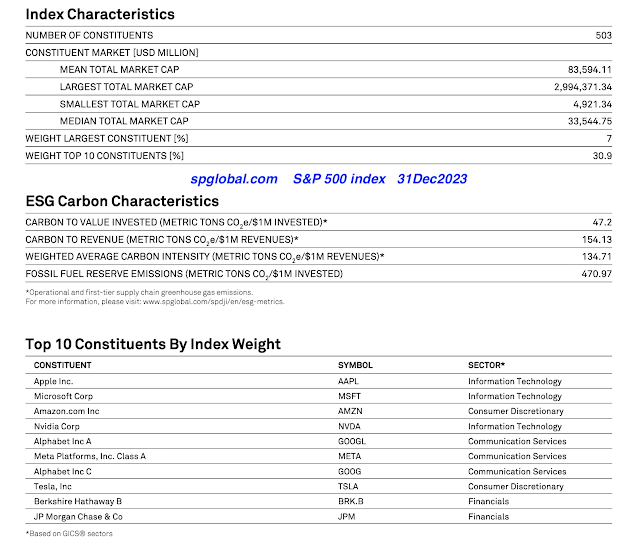

Here's a comprehensive analysis of the BSE 500 and S&P 500 Indices. The following tables provide information, as on 30Jun2025, about

how India's BSE 500 and the US' S&P 500 indices stack up.

(write-up continues below)

------------------------

Related blogs on US stocks / ETFs / Mutual Funds:

Compare ETFs based on S&P 500, Russell 2000 and MSCI EM 26May2022

BSE 500 versus S&P 500 Indices 31Dec2021 ------------------------

2. Similarities

BSE 500 index represents nearly 90 per cent of the India's total market capitalisation. Whereas, for the S&P 500 it's approximately 80 per cent of US market.

So, both can be termed as representative of their respective markets.

Both indices weigh constituents based on their market capitalization adjusted for publicly available (free-float) shares — ensuring a more investable and realistic view of the market.

Large- and mid-cap stocks form part of both the indices.

Mutual funds in their respective countries use both the indices for offering passive funds to investors -- but S&P 500 is more widely used by mutual funds and others for offering passive funds.

3. Comparing their fundamentals

Returns:

On a 1-year basis, S&P 500 significantly outperformed BSE 500. BSE 500 delivered only 5.1 per cent versus 15.2 per cent for S&P 500 (see table 1 below).

3-year: BSE 500 outperformed slightly on a CAGR basis.

5-year: BSE 500 clearly outperformed S&P 500.

10-year: BSE 500 performed marginally better over the long term.

Despite recent underperformance (1-year), BSE 500 has outperformed S&P 500 over 3-, 5-, and 10-year horizons, likely driven by India’s strong structural growth and wider participation from both domestic institutional and domestic retail investors.

The S&P 500 may have 500 companies, but lately it feels like it’s riding on the backs of just seven — the so-called ‘Magnificent 7’. These tech behemoths—Nvidia, Microsoft, Apple and friends—make up a third of the index and have been doing most of the heavy lifting.

Significantly, these top three companies each have more than USD 3 trillion market cap (in fact, Nvidia's market cap is USD 4 trillion+), driven by the artificial intelligence (AI) fever.

Compare that to India’s BSE 500, where the top names are spread out across banks, information technology, energy and more. It’s like the US is betting big on Silicon Valley.

Key detail: BSE 500 returns are rupee-based, whereas S&P 500 returns are in dollar terms. As you know, Indian rupee is a depreciating currency versus the dollar for several decades. Investors need to adjust their expectations correcting for rupee depreciation.

Risk measures:

3-year Standard Deviation: BSE 500 is slightly less volatile. Standard deviation is 13.6 per cent for BSE 500, whereas for S&P 500, it's 15.8 per cent.

Standard deviation is a statistical tool to calculate volatility.

3-year Sharpe Ratio: S&P 500 had better risk-adjusted returns.

Longer-term risk metrics are not available for BSE 500.

The S&P 500 offered better risk-adjusted returns in the short term, though BSE 500 had lower volatility.

Valuation:

P/E or price earnings ratio (trailing): Comparable valuations. PE ratio for BSE 500 is 25.7, whereas it's 25.9 for S&P 500.

P/B or price to book value ratio: Slightly cheaper for BSE 500.

Dividend Yield: S&P 500 offers marginally higher yield.

Number of stocks: Nearly identical index breadth.

Overall, valuations are similar, but BSE 500 lacks forward estimates and has slightly lower dividend yield.

Table showing risk, return and valuation parameters of the two indices:

4. Top 10 stocks

BSE 500 has less concentration versus the S&P 500. Top 10 stocks account for 33.6 per cent in BSE 500, whereas in S&P 500, top 10 stocks account for as much as 38 per cent (refer table 2 below).

S&P 500: suffers from higher concentration in mega-cap tech stocks.

Top three Stocks:

BSE 500: HDFC Bank, ICICI Bank and Reliance Industries (Financial Services & Energy focus). Reliance Industries lost its first rank to HDFC Bank two years ago.

S&P 500: Nvidia, Microsoft and Apple (Technology dominance). This year, Apple stock is struggling, with Nvidia replacing it for the first position in S&P 500.

S&P 500 is more concentrated in tech giants, making it more sensitive to tech sector movements. BSE 500 is more diversified across financials, consumer discretionary and industrials.

Table showing top 10 stocks and their weights in the indices >

Please click on the image to view better >

Tech Dominance vs. Financial Powerhouse: As of mid-2025, the BSE 500 is heavily backed by financials, while the S&P 500 is all-in on tech. From banks and oil to software and semiconductors, here’s how each index stacks up — and what it means for investors (see table 3 below).

S&P 500 is led by Information Technology (33.1 per cent), largely due to the Magnificent 7 (Nvidia, Microsoft, Apple, etc.).

BSE 500, in contrast, has Financial Services (30.8 per cent) as its largest sector — banks, NBFCs and insurance companies.

Information technology used to have 15 per cent share in BSE 500 four years ago. It has fallen to 8.7 per cent now.

The US market is driven by innovation and global tech adoption, while India’s equity market is anchored by its financial system, reflecting a developing economy’s focus on credit growth and capital access.

Combined Energy (8.0 per cent) and Commodities (7.9 per cent) is nearly 16 per cent in BSE 500.

In S&P 500, Energy is just 3.0 per cent, with no major commodity exposure.

The BSE 500 is more exposed to cyclical, real-asset sectors, which can benefit from infrastructure spending, commodity cycles and domestic growth themes. But this also makes it more sensitive to inflation and global commodity prices.

The US market has greater exposure to defensive sectors, like, healthcare and communication services, offering some downside protection in uncertain times. India, while consumption-driven, has less healthcare exposure at scale.

S&P 500 has 9.8 per cent in communication services (Alphabet, Meta and Netflix).

BSE 500 has only 3.3 per cent — mostly traditional telecoms like, Bharti Airtel and others.

This reflects a stark difference in how digital services and advertising scale in each market. US firms monetize global eyeballs and ads; Indian firms are still building out infrastructure.

Both indices are concentrated, but the S&P 500 is more top-heavy (76.6 per cent in top five sectors) — especially due to the tech sector. For investors, this means more sensitivity to sector-specific trends.

Table showing top 10 sectors and their weights in the indices >

Please click on the image to view better >

6. Gist

A slight diversion: If you do a similar analysis between Nifty 500 index and S&P 500, the results will be more or less the same, because the core composition of BSE 500 and Nifty 500 indices bear close resemblance since both are designed by their respective index providers to represent the top 500 companies in India across sectors and market caps.

Three passive mutual fund schemes in India track BSE 500 index, but with six passive schemes, the Nifty 500 index is more popular.

Coming back to S&P 500 vs BSE 400: The Magnificent 7 now drive a disproportionate share of the S&P 500’s performance. If tech stumbles, as happened two years or so ago, the whole index feels the pain.

BSE 500 is a better performer over the medium to long term (3–10 years), with lower volatility and more sectoral diversification compared to S&P 500.

S&P 500 leads in recent performance and risk-adjusted returns, but carries higher tech concentration risk.

Investment Implications

Relying solely on Indian equities (BSE 500 or Nifty 500) ties your portfolio to one economy, one currency and one regulatory regime.

The S&P 500 gives you exposure to global leaders in tech, AI, pharma, and consumer innovation — many of whom earn revenues worldwide.

Investors should not ignore tax implications of capital gains taxes, brokerage charges and other incidental expenses. Post-tax returns are key for investors while comparing returns between two jurisdictions.

Especially for NRIs (non resident Indians) or Indian investors with global ambitions, diversifying into US equities, or for that matter other international destinations, spreads your risk and broadens opportunity.

Balanced investors may want a mix of both: India's structural growth plus US innovation leadership.

Over a 25-year period, Indian rupee experienced a depreciation of 2.7 per cent annually and it's a concomitant gain for the dollar. The dollar gain is a stealth tailwind for Indian investors holding US assets.

A strong core in Indian equities makes sense, but adding U.S. exposure via the S&P 500 helps hedge risks, tap into global innovation, and diversify your portfolio across economies, currencies, and sectors.

This is not investment advice. This is just for educational and informational purpose only. Investors should do their own due diligence before considering any investments.

- - -

-------------------

References and additional data:

Passive funds based on BSE 500 and Nifty 500 Indices:

1. Motilal Oswal Nifty 500 Index Fund - Rs 2,470 crore AUM

2. SBI Nifty 500 Index Fund - Rs 896 crore AUM

3. ICICI Pru BSE 500 ETF - Rs 321 crore AUM

4. Axis Nifty 500 Index Fund - Rs 294 crore AUM

5. HDFC BSE 500 Index Fund - Rs 254 crore AUM

6. Motilal Oswal Nifty 500 ETF - Rs 140 crore AUM

7. ICICI Pru Nifty 500 Index Fund - Rs 27 crore AUM

8. HDFC BSE 500 ETF - Rs 17 crore AUM

six screenshots >

Please click on the images to view better >

Read more:

Passive Titans of India: The Top 10 Equity Indices by Fund Size 17Jul2025

The Pitfalls of Market Timing and Why FOMO is Your Worst Financial Adviser 12Jul2025

The Elusive Current Account Surplus: What 25 Years Data Reveal About India's Trade Balance 30Jun2025

Low Expense Ratios, High Returns: Why Passive Equity Funds Matter 06Jun2025

Disclosure: I've got a vested interest

in Indian stocks and other investments. It's safe to assume I've interest in the financial instruments / products discussed, if

any.

Disclaimer: The analysis and

opinion provided here are only for information purposes and should not be construed

as investment advice. Investors should consult their own financial advisers

before making any investments. The author is a CFA Charterholder with a vested

interest in financial markets.

------------------------

CFA Charter credentials - CFA Member Profile

CFA New Badge

CFA Badge