Compare ETFs Based on S&P 500, Russell 2000 and MSCI EM

(This is for

information purpose only. This should not be construed as a recommendation.

Please consult your financial adviser before taking any dive.)

(please check update dated 15Nov2023 at the end of the blog)

Passive funds consisting mainly of index and exchange-traded funds, popularised by mutual fund industry doyen Jack Bogle of the Vanguard Group, have gained traction globally in the past seven or eight years trumping the performance of actively managed funds.

Exchange-traded funds (ETFs) have gained massive assets and they are more popular than index funds. Passive

funds include both ETFs and index funds. The

speciality of ETFs is they are traded on stock exchanges, like, stocks.

Investors can directly buy them through stock exchanges, unlike index

funds which have to be transacted directly through mutual funds.

(story continues below)

-----------------------

Related Articles:

-----------------------

Compare ETFs

Here, I compare four ETFs based on S&P 500, Russell 2000 and MSCI Emerging Markets Indices; and I've also included a gold ETF for comparison purposes. All these ETFs are traded in the US and managed by BlackRock Inc, the world's largest asset manager. Their brief details are:

(i) iShares Core S&P 500 ETF (symbol / ticker IVV) - its underlying benchmark index is the S&P 500 index and it seeks to track the investment results of an index composed of large-capitalization U.S. equities.

(ii) iShares Russell 2000 ETF (IWM) - its underlying is the Russell 2000 index and it seeks to track the investment results of an index composed of small-capitalization U.S. equities.

(iii) iShares MSCI Emerging Markets ETF (EEM) - its underlying index is the MSCI Emerging Markets index and it seeks to track the investment results of an index composed of large- and mid-capitalization emerging market equities.

(iv) iShares Gold Trust (IAU) seeks to reflect generally the performance of the price of gold.

The comparison is given in the following images obtained from iShares website (for the latest comparison, input the symbols of your favourite ETFs):

1. Overview of the four ETFs: The latest net assets of IVV are USD 288 billion and those of IWM are USD 52 billion. Expense ratio of IVV is just 0.03 per cent as compared to 0.19 per cent for IWM.

2. NAV and portfolio characteristics: The beta and standard deviation of IWM are higher compared to IVV, reflecting higher risks for the small-cap based IWM versus the large-cap based IVV.

3. Equity PF characteristics and MSCI ESG fund rating: Valuation ratios, P/E and P/B, are lower for IWM as compared to IVV--thus IWM looks more attractive.

4. Top 10 holdings: IVV has 504 components, dominated by Apple Inc (6.5% weight in the ETF), Microsoft (5.8%) and Amazon (2.7%).

Whereas, IWM has 2,006 small-cap stocks. The stock with the biggest share in the ETF is Ovintiv Inc, with a stake of just 0.55 per cent, followed by Antero Resources (0.49%) and Chesapeake Energy (0.44%).

This tells you that IVV ETF is highly concentrated as compared to IWM, because S&P 500 index is dominated by technology and communication giants.

5. Sector breakdown: Top three sector concentration for IVV is 52.8%, consisting of IT (26.6%), Health Care (14.9%) and Financials (11.2%). Whereas, the top three sector concentration for IWM is 47.4%, consisting of Financials (16.8%), Industrials (15.6%) and Health Care (15%).

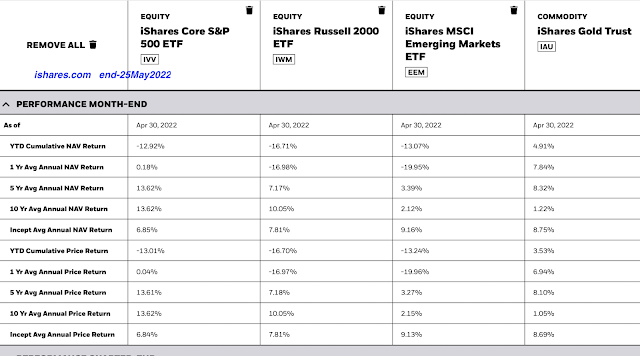

6. Month-end performance as on 30Apr2022: On a one-year basis, IVV generated a return of 0.18%, whereas IWM provided a negative return of 17%. On a 10-year basis, IVV has 13.6% compounded annual return and IWM has 10.1%.

Other popular ETF based on Russell 2000 index is Vanguard Russell 2000 ETF (VTWO), with assets of USD 5.5 billion and expense ratio of 0.10 per cent.

There are various ETFs based on S&P 500 index -- you can find them here and here.

Conclusion:

Overall, IVV ETF based on S&P 500 index is highly concentrated dominated by technology and communication giants in the US. It has lower expense ratio and entails lower risk as reflected in beta and standard deviation measures.

IWM ETF based on Russell 2000 index does not suffer from concentration risk. But, it has higher expense ratio and riskier (measured by beta and standard deviation) than IVV ETF. IWM has a more balanced portfolio, by stocks and sectors.

Both these ETFs have decent trading volumes as per data accessed on 26May2022 from ETF.com website.

Many experts in the US are of the view that going forward, the small-cap US stocks may do well. They are expecting the phenomenon of 'mean reversion' (the tendency of assets to revert to their mean) to catch up with the technology giants in the S&P 500 index; and due to the mean reversion, the technology giants' outperformance of the past 10 years may not continue in future.

Based on the relative under-performance of small-cap stocks versus the technology giants in the past five to 10 years, the market veterans are optimistic about the small-cap stocks in the US. The implication for the investors is IWM ETF based on Russell 200o index may do better than IVV ETF, provided the investors are able to stomach higher risks involved with the IWM ETF. This is just my personal opinion, and this should not be construed as investment advice--this is just for information purpose only. Prospective investors should consult their registered investment adviser before making any investment decision.

References:

- - -

-------------------

P.S.: The following are added after the blog was written on 26May2022:

Update 15Nov2023: Eighteen months ago, I expected Russell 2000 index (small caps) would do better than S&P 500 index (large caps) going forward. But after 18 months since the blog was written, S&P 500 rose by 13%, Russell 2000 remained same, MSCI EM index was down 4.7%, gold up 6.2% in the past 18 months.

My view proved to be wrong.

In markets, patience is the least appreciated trait. Russell 2000 index has been testing patience of investors. On 14Nov2023, Russell 2000 (small caps) index rose by 5.4% vs S&P 500's rise of 1.9%.

The thesis of beaten down US small caps doing better than large caps may take some more time to play out.

Interestingly, as per ishares.com, Microsoft is the biggest stock in S&P 500 index with a weight of 7.35% versus second-placed Apple Inc's 7.33% as at the end of 13Nov2023.

Top 10 stocks' weight in the S&P 500 (considering Google's A and C shares as one) is 33.4%.

Images of comparison of ETFs as per iShares as at the end of 14Nov2023 >

-------------------

Read more:

Slowing Foreign Direct Investment to India

JP Morgan Guide to Markets

Rant on Tata Steel Ltd

A Quick Glance at UPL Limited

What is Cooking Behind LT Foods' Share Price Rise? A Rundown on Prince Pipes & Fittings

Primer on Credit Rating Scales

When Will Foreign Investors Stop Selling Indian Stocks?

Indian Mutual Funds and The Art of Ripping Off Investors Do Paint Stocks and Crude Oil Tango?

Weblinks and Investing-------------------

Disclosure: I've vested interested

in Indian stocks and other investments. It's safe to assume I've interest in the financial instruments / products discussed, if

any.

Disclaimer: The analysis and

opinion provided here are only for information purposes and should not be construed

as investment advice. Investors should consult their own financial advisers

before making any investments. The author is a CFA Charterholder with a vested

interest in financial markets.

CFA Charter credentials - CFA Member Profile

CFA Badge

He blogs at:

https://ramakrishnavadlamudi.blogspot.com/

https://www.scribd.com/vrk100

Twitter @vrk100

No comments:

Post a Comment