India Debuts 50-Year Sovereign Bond

(This

is for information purposes only. This should not be construed as a

recommendation or investment advice even though the author is a CFA Charterholder. Please consult your financial

adviser before taking any investment decision. Safe to assume the author has a vested

interest in stocks / investments discussed if any.)

1. India 50-year Sovereign Bond

Yesterday, India issued a 50-year sovereign bond. This is the first time Government of India issued a 50-year sovereign bond. The auction was conducted for Rs 10,000 crore and it was fully subscribed.

The bond will be yielding 7.46 percent per year and is effective from 06Nov2023 and will mature on 06Nov2073. Its name is India 7.46% GS 2073 (Government securities or G-Secs in India are named after their yield and year of maturity).

2. Background

In a cryptic statement on 26Sep2023, Reserve Bank of India (RBI) said: "In response to market demand for ultra-long duration securities, it has been decided to introduce a new dated security of 50-year tenor." No further details were given by RBI on this new 50-year bond.

RBI, India's central bank, raises debt from the market on behalf of Government of India.

In its statement of 26Sep2023 on issuance calendar for Oct2023-Mar2024 half-year, RBI said it would be issuing several bonds worth Rs 655,000 crore -- including 50-year G-secs (short for government securities) worth Rs 30,000 crore.

Later, RBI in a notification said it would auction 50-year government bonds worth Rs 10,000 crore on 03Nov2023.

It may be recalled Govt of India issued a 40-year bond for the first time in October 2015. The outstanding liabilities of this 40-year paper (India 7.25% GS 2063) as on 02Nov2023 are Rs 132,000 crore.

(the blog continues below)

--------------------------------------------------

The author has

written, over the years, comprehensively about Indian bond markets. If

you're interested to know more about them, here are the links:

Related Blogs on Bonds, Public Debt, G-Secs or Government Securities:

Inflation Indexed Bonds (IIB)

--------------------------------------------------

3. Why Issue Ultra Long-term Bonds?

It is worth noting the

30-year Treasury bond is the longest-dated debt issued by the US

federal government. In 2019, the US considered issuing 50- and 100-year

bonds, according to former Treasury Secretary Steven Mnuchin. But the US

has not issued them so far.

It is to the credit of Government of India that it finds buyers for its ultra long-term bonds, while major bond markets like the US are reluctant to issue bonds longer than 30 years.

The reasons, for elongating the tenure of G-Secs to 40-year and 50-year, as stated by RBI and Government of India are:

1. "Market (insurance firms and provident funds) is demanding longer term government bonds."

2. "Increasing tenure of bonds reducess rollover risk for the government."

Rollover risk is risk of refinancing of debts issued by governments. Instead of a 20-year paper, you issue 50-year debt so that you need not refinance the debt obligation in 20 years -- you're practically pushing the obligation forward.

Of course, without demand for long tenor papers, governments cannot issue them. Obviously there is demand for ultra long-term bonds in India.

If liabilities of governments are pushed to longer maturity papers, the need for repaying such bonds (loans) in near term does not arise and the burden can be pushed to future generations.

This helps the Indian government in reducing rollover risk for G-Secs and raise more money from the market.

As written a few days ago, insurance companies and pension funds tend to invest for long-dated papers to match their long-term liabilities. This helps them in their asset-liability management (ALM).

Though official reasons are 'higher demand' & 'lower rollover risk', the government is practically pushing its debt burden to future generations, by issuing more papers beyond 30-year (40- and 50-year) tenure.

Some would describe it as: "Stealing from future generations."

With the higher issuance of 40-year and 50-year government bonds, Government of India is burdening the future generations of India.

Let us examine how the weighted average maturity (WAM) of outstanding stock of central government dated securities increased over the years.

At the end of March 2005, WAM of outstanding stocks was 9.63 years and it increased to 10 years by end-Mar2014 and it further surged to 12.18 years by end-Jun2023.

The surge in WAM is mainly due to issuance of 40-year bonds since October 2015 and higher government market borrowing in recent years.

As Government of India started issuing 50-year bonds now, the weighted average maturity of outstanding G-Secs will further go up in future.

A relatively higher level of weighted average maturity (WAM) of debt [also referred to as the average time to maturity (ATM)] implies a lower share of debt that has to be rolled over (lower rollover risk). In plain speak, the government is pushing the burden of repayment to future generations, by increasing the WAM over the years.

Higher debt in future means, not only the principal needs to be refinanced by taxes from future generations, but also the interest that needs to be repaid is pushed forward to future generations.

However, the government has a got a benchmark for weighted average maturity (WAM) of its dated securities, which is 12 years (plus or minus 2 years) -- so, WAM can in theory move between 8 years and 14 years. Let us see whether the government will stick to, in future, its own benchmark.

Table showing the WAM of outstanding stock over the years:

4. 100-year Bonds

There are some instances of countries issuing even 100-year bonds. The British Government in the 18th and 19th Century, for waging Napoleonic wars, issued 'Consols' which carried no maturity date -- meaning principal never required repayment.

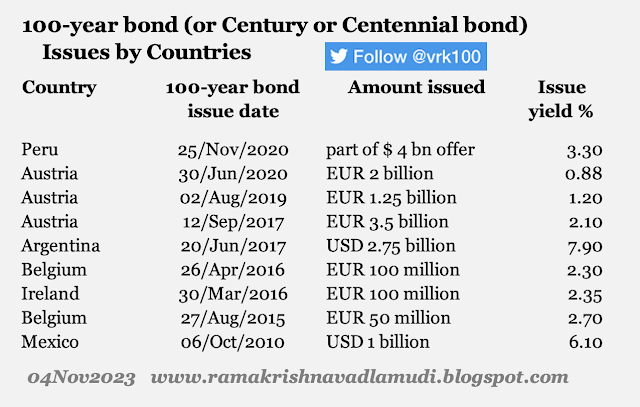

In 2020, Peru borrowed at a premium of 170 basis points to US 30-year bond. In 2017, 2019 and 2020, Austria issued 100-year bonds.

The following is a list of century or centennial bonds issued:

Organisations, like, Oxford University, Wellcome Trust, Coca-Cola, Walt Disney and Massachusetts Institute of Technology too have issued 100-year bonds in the past. Details are:

5. Summary

Government of India issued a 50-year G-Sec for the first time on 03Nov2023. Issuing ultra long-term bonds, like, 40- and 50-year G-Secs helps the government in reducing rollover risk for G-Secs and in widening and deepening government security market in India.

Of course, the government can also raise more money from market. Ultra long-term bond also help life insurance companies and pension funds in matching their assets with liabilities.

However, ultra long-dated bonds burden the future generations with higher government debt and future interest burden.

- - -

(sorry

guys, while uploading the blog, some portions of the blog got removed

without my notice -- the blog was recreated from memory a few hours later)

------------------------------

References:

(the UK issued 50-year bonds for the first time in 2005)

------------------------------

Weblinks and Investing-------------------

Disclosure: I've vested interested

in Indian stocks and other investments. It's safe to assume I've interest in the financial instruments / products discussed, if

any.

Disclaimer: The analysis and

opinion provided here are only for information purposes and should not be construed

as investment advice. Investors should consult their own financial advisers

before making any investments. The author is a CFA Charterholder with a vested

interest in financial markets.

CFA Charter credentials - CFA Member Profile

CFA Badge

He blogs at:

https://ramakrishnavadlamudi.blogspot.com/

https://www.scribd.com/vrk100

X (Twitter) @vrk100

No comments:

Post a Comment