Nifty 50 Index Yearly Movement 31Dec2023

(This

is for information purposes only. This should not be construed as a

recommendation or investment advice even though the author is a CFA Charterholder. Please consult your financial

adviser before taking any investment decision. Safe to assume the author has a vested

interest in stocks / investments discussed if any.) In

the past one year, there have been slight changes in the composition of

Nifty 50 index. As on 31st of December, 2023, top five stocks in the index have a

weight of 40.3 per cent, more or less the same a year ago.

And

top 10

stocks in Nifty 50 have a weight of 57.6 per cent as at the end of

December 2023, which is almost the same as at the end of December 2022.

My previous blog on the topic is available here.

(write-up continues below)

------------------------

Related blogs on Indian Stock Indices:

Nifty 50 Index Quarterly Movement 31Mar2023

Nifty 50 Index Yearly Movement 31Dec2022

NSE Indices Comparison 31Dec2022

BSE 500 versus S&P 500 Comparison 31Dec2022

Nifty 50 Index quarterly movement Jun2022

Nifty 50 Index Evolution 2011 to 2021

------------------------

Top 10 Stocks

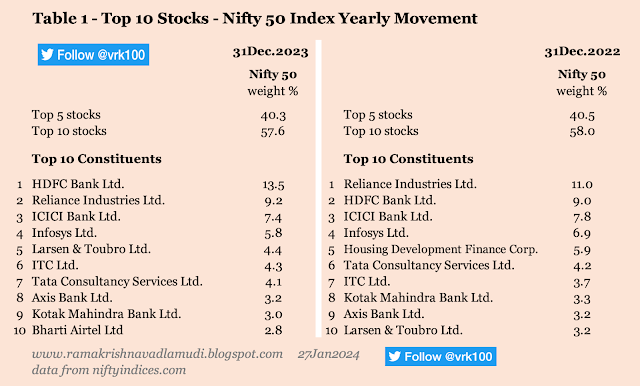

Table 1 gives details of top ten stocks' movement during the year 2023 >

Please click on the image to view better >

As revealed in Table 1, HDFC Bank with a weighting of 13.5 percent became the number one in Nifty 50 index dethroning Reliance Industries' stock, which is at second place with a weight of 9.2 percent.

As HDFC Ltd was merged (in Jul2023) with HDFC Bank Ltd, Bharti Airtel climbed to top 10 in the index. While Larsen & Toubro, ITC and Axis Bank gained in the ranks, TCS Ltd and Kotak Mahindra Bank lost a notch each in their rankings in the Nifty 50.

Top 10 Sectors

Table 2 gives details of top ten sectors' movement during the calendar year 2023 >

Please click on the image to view better >

As delineated in Table 2, sector concentration in Nifty 50 has come down in 2023, as banking / financial sector lost its weight. Financial Services' sector weight fell to 35.3 percent from 37.7 percent a year ago.

HDFC Bank stock price grew by only 5 percent in 2023 versus Nifty 50 rise of 21.3 percent (total return, including dividends) and Nifty Bank rise of 13.3 percent. The weakness in HDFC Bank is reflected in the Financial Services losing its weight in the Nifty 50 index.

Oil & Gas and Information Technology sectors have lost weight slightly; while FMCG and Auto sectors gained weight in 2023.

Summary

To sum up, the composition of indices always changes as some sectors attract the fancy of investors while others lose their limelight.

Even though the composition of the Nifty 50 index changes year to year or even quarter to quarter, the top sectors in Indian for more than a decade continue to be Financial Services, Information Technology, Oil & Gas, FMCG and Automobile.

As such, large institutional investors, like, foreign portfolio investors (FPIs), domestic mutual funds and domestic insurance companies continue to focus their energies on the top three or five sectors in the Nifty 50 index.

However, some structural changes have taken place in the past five to eight years, with domestic institutional investors (DIIs) and retail investors dominating the Indian stock market, while FPIs' dominance has been fading over the years (you may check the author's previous blogs to track the changes).

With stock valuations seemingly high in India, the next two to three years will be interesting for investors as it's increasingly hard for retail investors to make alpha, that is extra returns over and above the indices.

- - -

References:

Additional tables, giving Nifty 50 movements of stocks and sectors between 2011 and 2021, from previous blog >

Nifty 50 Index factsheet > Raw data >

------------------------------

Read more:

BSE Broad and Sector Indices Returns 31Dec2023

BSE Broad and Sector Indices Market cap 31Dec2023

Disclosure: I've vested interested

in Indian stocks and other investments. It's safe to assume I've interest in the financial instruments / products discussed, if

any.

Disclaimer: The analysis and

opinion provided here are only for information purposes and should not be construed

as investment advice. Investors should consult their own financial advisers

before making any investments. The author is a CFA Charterholder with a vested

interest in financial markets.

CFA Charter credentials - CFA Member Profile

CFA Badge

He blogs at:

https://ramakrishnavadlamudi.blogspot.com/

https://www.scribd.com/vrk100

X (Twitter) @vrk100

No comments:

Post a Comment