--------------------------------------------------------------

Update 27Jan2026: Chart 173:

RBI Gold Holdings as at the end of Nov2025: RBI

gold reserves are part of India's forex reserves maintained by RBI on

behalf of Government of India >

References:

Central Banks Fuel Gold Speculation, Risking Pain for Ordinary People 23Dec2025

Who is Eating my gold ETF return? 25Jan2022 (updates 20Jan2025 and other latest ones are available -- recency bias)

For more on RBI gold holdings, see blog dated 07Mar2022

Gold’s 2025 Rally Is Not a Central Bank Story:

As of 27Jan2026, gold has shattered records, recently crossing the historic USD 5,000 per troy ounce mark.

Central banks are not the marginal buyers setting gold prices, even though they matter for long-term credibility.

In calendar year 2025, global central bank gold buying slowed (compared to CY 2024). And, India's central bank, Reserve Bank of India (RBI), added only about 4 tonnes, which confirms they were not driving the rally (see chart below). Central banks buy slowly, often off-market.

Based on the purchases data, one could safely surmise that RBI took a strategic decision not to add anything further to its gold reserves, once international gold price crossed USD 2,800-3,000 per ounce level in Dec2024-Jan2025.

One caveat: While some central banks, notably China, may under-report or delay disclosure of gold purchases, available data suggest official buying was not the marginal driver of gold prices in 2025.

Gold prices move mainly on financial demand, not on slow-moving official central bank accumulation.

Since mid-2025, ETF (exchange traded fund) inflows, futures positioning and trend-following funds turned decisively bullish and pushed prices higher.

A few billion dollars of financial inflows can move gold prices far more than tens of tonnes of central bank purchases.

At the same time, markets may be pricing in weaker growth and falling real interest rates, which is historically the strongest driver of gold.

Private investors and institutions increased gold exposure as a hedge against currency risk, sanctions risk and portfolio volatility.

Geopolitical risks are adding a persistent risk premium to gold.

Ongoing but slower central bank buying provided a downside floor, encouraging speculative and leveraged long positions.

Poland central bank’s announcement that it plans to add 150 tonnes of gold, on top of its existing 550-tonne holdings, is a long-term strategic signal rather than evidence of near-term demand.

With no specified timeline, such purchases are typically spread over years and often executed discreetly, making them unlikely to drive sharp price moves.

These announcements mainly reinforce a downside floor for gold by validating official-sector support, but they do not explain the rapid price acceleration since mid-2025.

In short, the 2025–26 gold rally is being driven by financial investors and macro expectations, not by central banks.

Gold surge driven by currency debasement?

One of the strongest arguments propounded by gold investors is the currency debasement. In simple terms, debasement is the "hidden" erosion of a currency’s value caused by, ultra-loose monetary policies, excessive money printing and high government debt.

Government debt has gone up substantially over the years, especially, after the 2007/2008 Global Financial Crisis (GFC). Post-COVID fiscal stimulus in the US and Europe, funded by money creation, reinforced fears of long-term dilution of fiat currencies.

Rising and arguably unsustainable public debt levels in the US, Japan and Europe have further amplified the currency debasement concerns.

But what about bond markets and currencies?

Inflationary expectations currently are low. Bond yields also do not reflect any excessive stress from inflationary or geopolitical concerns (except in Japan, where bond yileds are rising recently driven more by political and fiscal uncertainty).

Inflation expectations remain relatively low, weakening the classic argument for gold as a pure inflation hedge. If inflation is not the driver, investors must ask what risk gold prices are actually signaling.

One interpretation is that markets are pricing in the possibility of major geopolitical conflict. Yet much of the global stress has not fully surfaced in sovereign bond markets or major currencies. The dollar index is down roughly 11 percent over the past year but is broadly unchanged over the past decade despite significant volatility.

This

points to short-term dollar weakness rather than an outright collapse

of the currency system. The gap between relatively stable long-term

currency trends and surging gold prices suggests fear of future regime

shifts rather than present-day data.

Sceptics of the debasement theory argue that gold’s recent surge is driven more by temporary speculative mania and geopolitical jitters than a permanent collapse of the monetary system.

Furthermore, history shows that central banks have successfully used interest rate hikes and quantitative tightening to tame inflation in the past, proving that fiat systems may be more resilient than gold enthusiasts suggest.

Ultimately, viewing gold as a diversified insurance policy rather than an inevitable replacement for currency helps temper the extreme narratives often found in the market.

Investors need to do some critical thinking:

What are the second-order and third-order effects of gold and silver prices reaching new all time highs (ATH) every day?

Will sovereign governments sit on their hands while their monetary sovereignty is threatened relentlessly?

Chart showing calendar year gold holdings of RBI, yearly growth and growth in per cent - world gold price is added to guess at what price RBI bought gold >

Chart 173 click to view better >

--------------------------------------------------------------

Update 22Jan2026: Charts 171 and 172:

India FDI flows: Foreign Direct Investment flows : Gross FDI flows and net FDI flows data (old blog 25May2022, Tweet thread 25May2022, Tweet thread 19Jan2024 and Tweet thread 16Jun2025 >

(see Update 08Sep2025 with good analysis)

(see Update 16Jun2025 with charts 91 and 92 below)

Net foreign direct investment (FDI) Flows to India: Net FDI rebounded sharply in the first 8 months of FY 2025-26 (see chart below for data):

A. Gross FDI to India:

Gross FDI to India rose to USD 64.7 billion in the first 8 months of financial year 2025–26, up 16.1 per cent over the same period last year.

This suggests renewed foreign investment interest at the entry level -- some of the growth is from huge foreign ownership interest in India's financial sector in 2025.

Mar2025: Singapore's Temasek takes 10% stake in India's Haldiram's for USD 1 billion. A few weeks later, Haldiram sold part stakes to IHC and Alpha Wave Global.

Global technology giants pledges:

US tech giants announced a lot of investmetns in India, such as:

> Amazon Inc / AWS committed investments of USD 35 billion by 2030 in cloud / AI infrastructure > Google / Alphabet to invest USD 15 billion in AI hub (data centre) in Visakhapatnam

These commitments suggest a strong pipeline of FDI inflows to India in the next five years.

B. FDI Repatriation / disinvestment declined but remains structurally high:

FDI repatriation fell 4.2 per cent year-on-year to USD 37.0 billion, indicating some easing of exit pressure. However, the absolute level remains large, confirming that private equity (PE) and venture capital (VC) exits and disinvestments are a dominant feature of India’s FDI cycle.

FDI repatriation mainly refers to the withdrawal of equity investments, including the return of invested capital, proceeds from selling shares and repatriation of reinvested earnings.

Foreign multinational companies (MNC) selldowns in Indian stock market in 2024 include: Hyundai Motors India (USD 3.3 bn IPO), BAT in ITC (USD 2.0bn), Whirlpool in its India arm (USD 0.5bn), Timken, Singtel-Bharti Airtel, Vodafone-Indus Towers and ZF Com Veh Control Systems India.

FDI repatriations in 2025: LG Electronics India (via USD 1.7 billion IPO) and PE firms exiting via IPOs of Lenskart Solutions, Meesho Ltd and Pine Labs.

IPO boom as an exit accelerator for foreign investors:

The roaring IPO market in India during 2024–25 and 2025–26 has likely acted as a powerful enabler of FDI repatriation, especially for PE and VC investors seeking public-market exits.

While not the sole driver, strong IPO valuations and deep domestic absorption have made it easier to monetise earlier FDI investments and repatriate capital.

C. FDI to India improved sharply from a low base:

FDI to India (gross minus repatriation) jumped 61.6 per cent to USD 27.7 billion. This improvement is driven more by lower repatriation than by a surge in fresh inflows, highlighting that FDI is highly sensitive to exit behaviour.

D. Outward FDI by Indian firms also accelerated:

FDI by India increased 34.9 per cent to USD 22.1 billion, reflecting stronger overseas investment by Indian corporates. This offsets a significant portion of inbound FDI.

Outward FDI by Indian firms include (some of them are yet to fructify):

> Tata Motors acquires Iveco (Italian truck maker) for USD 4.45 billion (final closing is subject to regulatory / funding approvals)

> Bharti Airtel's parent company, Bharti Global, invested USD 4 billion to acquire a 24.5% stake in BT Group

> Sun Pharma invested USD 829 million into its Netherlands subsidiary and has successfully acquired Checkpoint Therapeutics

> Dec2025: IT services giant TCS Ltd acquires 100% stake in US-based Coastal Cloud for USD 700 million

> Oct2025: Lupin Ltd announces plan to build a manufacturing plant in Coral Springs, Florida, USA at a cost of USD 250 million

> Aug2025: Zydus Wellness Ltd, a subsidiary of Zydus Lifesciences, on 29Aug2025 announced acquisition of UK-based Comfort Click Ltd (CCL) for a cash consideration of USD 320 million

E. Net FDI remains modest despite sharp percentage growth:

While the past three financial years (FY2023 to FY2025) have been a disaster (check the yearly data chart given below), net FDI flows to India stands at only USD 5.6 billion, though up more than seven times year-on-year due to a very low base last year.

Macro takeaway—FDI headline strength masks underlying churn:

The data show a high-churn FDI regime: strong gross inflows coexist with heavy repatriation and rising outward FDI.

For foreign exchange markets and the rupee, this means limited net dollar support despite healthy-looking gross FDI numbers.

Additional data:

PE exits from India in USD billion as per EY report:

22.2 in Jan-Jul2025

28.1 in 2024

24.9 in 2023

18.3 in 2022

39.6 in 2021

6.0 in 2020

Two charts showing gross FDI, FDI repatriation, FDI to India, outward FDI by India and net FDI flows: Data from 2006-07 to 2025-26 >

Data: RBI DBIE and author

Chart 171 click on the image to view better >

Chart 172 click on the image to view better: data from 2006-07 to 2025-26 >

--------------------------------------------------------------

Update 16Jan2026: Chart 170:

FPI Equity Flows to India: India

FPI Flows to Indian stock market, DII Flows to Indian stock market and

Individual Investor flows to India stock market - both in rupee terms as

well as dollar terms - calendar-year wise data from 2013 to 2025 > (old blog 10Jul2022) >

After

a gap of six years, individual investors turned negative (data up to

31Dec2025) in calendar year 2025. DIIs invested a record USD 89.6 billion (Rs 7.81 lakh

crore) in Indian equities in CY 2025.

Whereas,

FPIs exited Indian stocks worth USD 18.9 billion (Rs 1.66 lakh crore) in 2025, more than full calendar year outflows in 2022. Going by the past trend, FPIs

may turn positive in 2026 subject to a win-win trade deal between India

and the US, rupee stabilising and other factors.

In

the past five years, FPIs net outflow from Indian stocks is nearly USD 10.8 billion (Rs 90,000 crore); whereas DIIs net inflows in the same period are USD 222.9 billion (Rs 18.61 lakh

crore).

Calendar year 2025 data are upto 31Dec2025 (full year).

FPIs are foreign portfolio investors.

DIIs are domestic institutional investors.

According to NSE India, DIIs include Banks, Insurance companies, Mutual Funds, Domestic Financial Institution (Other than banks & insurance), Domestic Venture Capital Funds, AIFs, PMS clients, New Pension System (NPS) and NBFCs.

Individual

investors data for NSE secondary market only. Individuals include

individual /proprietorship firms, HUF (Hindu Undivided Family) and NRIs

(Non resident Indians).

Chart 170 click on the image to view better >

--------------------------------------------------------------

Update 11Jan2026: Chart 169:

MSCI EM Index - China and India weights: Quarterly changes between Dec2024 and Dec2025: (for old data, see old blogs dated 07Jan2023 and blog 03Aug2021 and previous charts below)

India's position in the MSCI EM Index continues

to be in third rank, as India has been underperforming grossly since

the beginning of 2025. China and Taiwan continue to dominate the index

as of 31Dec2025.

Overview of MSCI EM Index (as of 31Dec2025)

The MSCI Emerging Markets Index remains broad-based with 24 countries and just under 1,200 securities. Market capitalisation has risen sharply to about USD 10.2 trillion, reflecting both price appreciation and currency effects versus 2024 and early 2025.

Valuations have moved higher but are still moderate by historical EM standards.

Index Size and Breadth

The number of countries has been stable at 24 across all periods shown. The number of securities declined from 1,252 at end-2024 to 1,197 by end-2025, suggesting ongoing consolidation, delistings or stricter inclusion criteria.

Market Capitalisation Trend

Market cap increased from USD 7.7 trillion at end-2024 to USD 10.2 trillion by end-2025. This is a strong recovery and expansion phase for EM equities.

After a gap of four years, MSCI EM index outperformed MSCI World index in calendar year 2025 -- with MSCI EM index delivering 30.6 per cent return versus 19.5 per cent for MSCI World.

Valuation Metrics and Income

Forward P/E ratio rose from 11.9 at end-2024 to 13.5 by end-2025. Price-to-book increased from 1.8 to 2.2 over the same period.

These moves show clear valuation re-rating, though EM valuations remain below developed-market levels. Dividend yield has declined from about 2.6 percent to 2.3 percent, reflecting higher prices rather than weaker dividends.

Country Weights: Concentration and Shifts

China remains the dominant country but its weight fell to 27.6 per cent from peaks above 31 percent earlier in 2025. Taiwan’s weight increased to 20.6 per cent, reflecting strength in semiconductors.

India stands at 15.3 per cent, lower than its Dec2024 peak, but still structurally higher than in prior years.

South Korea's share increased to around 13 per cent, led by technoogy companies. Brazil continues to be the largest Latin American exposure at just over 4 per cent.

Overall, the top three countries account for more than 60 percent of the index, highlighting concentration risk.

Company Weights: Technology Dominance

TSMC is the single most important constituent at nearly 12 per cent, significantly higher than a year earlier. Tencent remains the second-largest holding at just under 5 per cent. Samsung, Alibaba and SK Hynix round out the top five.

Technology and related hardware dominate the index leadership, reinforcing the EM index’s sensitivity to the global semiconductor and China tech cycles.

India has only two companies in top 10, namely, HDFC Bank (rank 6th) and Reliance Industries ( rank 7th).

Key Implications for Investors

The index shows a clear valuation re-rating in 2025 alongside strong market cap growth, led by large-cap technology and North Asian markets.

Concentration risk remains high, particularly in TSMC and China–Taiwan exposure. Dividend income is becoming less attractive as prices rise.

Overall, EM appears to be in a cyclical upswing rather than a deep value phase, with returns increasingly dependent on earnings delivery and global tech demand rather than multiple expansion alone.

Click on the chart to view better >

--------------------------------------------------------------

Update 10Jan2026: Charts 166 to 168:

Major Foreign Holders of US Treasury Securities:

Three charts here are:

1. Top 20 Countries Holding US Treasuries:

2. India's Holdings of US Treasury Securities:

3. Comparing RBI holdings of US Treasuries, Foreign Currency Assets and Gold: Diversification Strategy of RBI Forex Reserves:

According

to the data published by the US Treasury, the total holdings of US

Treasury Securities held by all foreign residents are USD 9,243 billion

as at the end of Oct2025.

There

is an increase of USD 549 billion or 6.3 per cent, of US Treasury

holdings by foreign entities, versus a year ago. See Chart 1 below.

Japan

continues to be the biggest holder of US treasuries with holdings of

USD 1,200 billion, followed by the UK (878), China (689), Belgium (469) and Canada (419). The share of these top five countries in total

holdings are 13, 9.5, 7.5, 5.1 and 4.5 per cent respectively as at the end of Oct2025.

US Treasury Securities held by Foreign Residents:

As

of Oct2025, the US Treasury Securities held by Foreign Residents are

USD 9,243 billion. Of these, USD 3,880 billion are held by Foreign

Official sources and the remaining USD 5,363 billion are held by foreign

private entities.

Foreign Official Holdings: This

includes the holdings of foreign governments, central banks (like the

BoE, BoJ, PBOC, RBI) and other official institutions (like sovereign

wealth funds).

Foreign Private Holdings: This includes all other foreign investors. This is a very diverse group and includes:

Foreign commercial banks,

Foreign corporations,

Foreign pension funds and insurance companies,

Individual foreign investors, and

Other private entities and investment funds.

India holdings of US Treasury Securities:

As of Oct2025, India's holdings are USD 190.7 billion, compared to USD

241.4 billion as of Oct2024, a year on year fall of nearly 21 per cent. Indeed, this is a steep fall.

Of the total foreign holdings of US

Treasuries of USD 9,243 billion, India's share is 2.1 per cent now

compared to 2.8 per cent a year ago. Even in percentage terms, India's share has fallen significantly.

It may be noted India's central bank, RBI, holds offficial forex reserves on behalf of Government of India.

Proper perspective on India's UST holdings:

Past one year data on US Treasury holdings by India have been volatile. Recent peak for India's holdings of US Treasurys was USD 247.2 billion as at end of Sep2024.

From USD 241 bn in Oct2024, the holdings fell to USD 219 bn by Dec2024, but rose to USD 240 bn by Mar2025. In Apr2025, the holdings fell but rose in May2025, but declined again in Jun2025.

So, there is no clear pattern of selling or buying (here, we've not analysed the movement in the underlying dollar values of US Treasuries, which have seen dramatic volatility in recent years).

From Jun2025, the decline is sharp, with holdings falling every month till Oct2025. The holdings fell from USD 227 bn in Jun2025 to USD 191 bn in Octe2025.

We'are only analysing data of US Treasuries. We

don't know what the RBI holdings in sovereign bonds of other countries

are. For example, does RBI hold any sovereign bonds from the UK, France,

China, Brazil, Japan, South Africa or Nigeria for that matter?

One

needs to analyse the data dispassionately. It seems Indian media come

to the conclusion first and then present the data to suit their

conclusions, without considering the long term data or other connected

areas.

A corporate media yesterday published an article saying "India's UST holdings down by 21%, first time in four years." While this data point is correct, they fail to give a proper perspective to the sharp fall in holdings.

Media focus on recent quarters might exaggerate concern by not acknowledging the volatile holdings in the past one year.

In this context, we need to ask three basic questions?

One is why are India's UST holdings falling. Number two is whether the holdings of Treasuries of other countries are falling. And the third is whether the share of UST is falling in relation to India's foreign currency assets (FCA).

We don't know the answers to the first two questions because the RBI does not give any data on this. We can only speculate on the reasons. But we can definitely provide some context.

The proper context: Let us take the period of recent sharp fall in UST holdings, that is, between Jun2025 and Oct2025.

Between end-Jun2025 and end-Oct2025, India's UST holdings fell from USD 227.4 bn to USD 190.7 bn, a fall of USD 36.7 bn. How does the fall compare with India's FCA?

Between end-Jun2025 and end-Oct2025, India's foreign currency assets (FCA) fell by USD 30.2 bn from USD 594.8 bn to USD 564.6 bn. The share of UST in FCA fell form 38.2 per cent to 33.8 per cent (chart 3 below).

Why have FCA fallen? Because RBI has been selling dollars in the past four months.

How much dollars RBI has sold in four months upto Oct2025? It's a staggering USD 30 billion. This matches with the decline in UST holdings of RBI in the same period.

By the way, why is RBI selling dollars? Because RBI is defending the rupee (from falling too much) by selling dollars from its holdings of FCA.

When you want to sell your assets, which assets will you sell the most? In general, you will sell securities / assets that are most liquid.

This is exactly what RBI has been doing. They have been selling US dollar assets to defend the weakening Indian rupee. Because US Treaury securities are the most liquid assets in the world.

So,

India's central bank, the Reserve Bank of India, has no choice but to

sell the most liquid securities in its holdings, that is, the US

Treasuries.

The entire focus is on forex reserves, not on foreign currency assets (in the same period, forex reserves were up from USD 668 bn to USD 690 bn, due to rise in gold holdings driven by surging gold prices internationally).

(Note: The correct metric to use here is not forex reserves, but foreign

currency assets (FCA). India's forex reserves consist of foriegn currency

assets, gold holding and SDRs or special drawing rights.)

Now, let us come to the third question: How do you compare UST holdings to India's forign currency assets?

As mentioned above, the correct metric to use here is not forex reserves, but foreign

currency assets (FCA).

India's forex reserves are increasingly dominated by gold, hence let us use the FCA metric to compare with India's UST holdings (chart 3 below).

From Mar2022 to Oct2025, UST holdings declined from USD 199.8 billion to 190.7 billion,

while the their share in FCA declined significantly from

37 per cent to 33.8 per cent in the same period. But the UST holdings' share has been volatile in the past five years (chart 3 below).

This isn’t a divestment in absolute terms (holdings remain high), but a relative decline due to:

Gold price surge

Broader reserve accumulation

Possible currency diversification

Essentially, you need to link the fall in RBI's US Treasury holdings to the decline in the RBI’s foreign currency assets (FCA) and the quantity of net US dollar sales from forex intervention.

Without connecting these dots, the macro picture remains incomplete. 😃

Bonus data point: India's foreign currency assets (FCA) have

fallen between Mar2025 and Oct2025 from USD 567.6 billion to USD 564.6

billion. Nobody will tell you that. 😀

Diversification strategy of forex reserves by RBI:

Of course, the Reserve Bank of India (RBI) has been diversifying its forex reserves

in recent years. This is more pronounced since the outbreak of

Russia-Ukraine war in Feb2022. Since the outbreak of Russia-Ukraine

war, RBI holdings of US Treasury Securities have fallen from USD 200 bn to USD 191 bn now.

The value of RBI gold

holdings (due to a combination of sharp rise in dollar gold price

internationally and new physical gold bought by RBI) has increased over

the years and the share of gold reserves in total forex reserves too

has risen.

Significantly,

RBI has not practically bought any physical gold between Mar2025 and Oct2025. Its gold holdings remained stagnant at 880 metric tonnes in the

current financial year (chart 3 below).

However,

the market value of its gold holdings increased from USD 78.2 billion

in Mar2025 to USD 101.7 billion by Oct2025, as the gold has been reaching

all time highs recently (chart 3 below).

The share of market value of gold reserves in forex reserves has

increased steadily between Mar2020 (6.4%) and Oct2025 (14.8%), with value

increasing from USD 30.6 billion (physical gold hlding 653 million tonnes) to USD 101.7 billion (880 mt) -- but the increase is more pronounced since the start

of Russia-Ukraine war.

The value and share of gold holdings are climbing more rapidly, while the share of UST has declined sharply.

This reflects:

Price appreciation of gold (more than 75% rise in three years).

Buying of more physical gold by RBI over the years.

RBI's strategic allocation away from dollar-based assets.

Geopolitical risk hedging by RBI post-Russia-Ukraine war.

data sources:

Table 3: US Treasury Securities held by Foreign Residents

Three charts >

--------------------------------------------------------------

Update 03Jan2026: Charts 164 and 165:

Global market data: Global market data pertaining to stocks, bonds,

commodities and currencies are presented here. The data points are yearly changes and compounded returns from 2015 to 2025, indicating how the values have moved over the years. (old blog dated 12Jan2024 - global market data 2013 to 2023).

(See Update 04Jan2025 with charts 47 to 49)

The

stock market data presented in the table are price returns (not

including dividends) and they are in local currency terms.

Two charts here:

> Global market data: Yearly changes from 2015 to 2025

> Global market data: Compounded annual returns for 3-year, 5-y, 7-y and 10-y periods as at the end of 31Dec2025

You

can find out how the assets classes and currencies have moved over the

years. These charts reveal the cyclical nature of the returns in global

financial markets.

GLOBAL SNAPSHOT 2015–2025

All the analysis is as of 31Dec2025.

The two exhibits together show a decade that splits cleanly into three regimes: a pre-2020 expansion, a 2020–22 shock-and-whipsaw period, and a post-2022 normalisation with higher inflation and rates.

Returns are far more uneven than the headline averages suggest, with the US and India compounding strongly, Europe middling, and China/Hong Kong lagging badly. Volatility, not just growth, is the defining feature of the period.

EQUITIES: WHO WON THE DECADE

US equities dominate on compounding power. The Nasdaq is the standout on every horizon, reflecting the sustained outperformance of growth and technology sectors; the S&P 500 is a strong second.

India is the other clear winner: Nifty 50 and especially BSE MidCap show decent multi-year compounded returns (CAGR), pointing to a long domestic growth cycle plus multiple expansion.

Europe (FTSE 100, DAX 40) delivers modest long-term returns with sharp drawdowns, while Japan does better than Europe but still trails the US and India.

China and Hong Kong are the big laggards: despite occasional strong single years, their 5- to 10-year CAGRs are low to weak, indicating structural and policy headwinds overpowering cyclical rebounds.

EQUITIES: PATH MATTERS MORE THAN AVERAGES

The yearly change chart shows violent reversals: deep equity losses clustered in 2018, 2020 (select markets), and especially 2022, followed by sharp rebounds in 2023–25.

Markets with strong long-term CAGRs (Nasdaq, India MidCaps) also endured some of the worst single-year drawdowns, underscoring that endurance, not timing, drove success.

BONDS AND RATES: THE LOST DECADE FOR DURATION

Bond yields tell a clear story: the long downward trend ended decisively. Over 3-, 5-, 7- and 10-year horizons, the US Treasuries show large upward moves in yields, meaning negative price returns for long-duration bonds.

The worst damage is concentrated in the 2021–22 inflation shock, with only partial relief afterward.

The US Bonds failed as a volatility hedge in this cycle, breaking a key assumption of the prior decade.

India bonds too suffered during the inflation shock period of 2021 and 2022, but recovered later (When bond yields rise, bond prices drop and vice versa).

While US 10-year Treasury note yield rose by 271 basis points (1 percentage point equals 100 basis points); the India 10-year benchmark yield declined by 117 basis points in the past 10 years -- indicating divergent trends.

COMMODITIES: REAL ASSETS REASSERT THEMSELVES

Gold and silver show strong long-term CAGRs, reflecting inflation hedging, currency debasement fears and crisis demand. Energy is far more cyclical: crude oil has poor 3-year CAGR but acceptable 10-year returns, illustrating boom-bust dynamics rather than steady compounding.

Broad commodity indices sit in the middle, benefiting from the post-pandemic inflation burst but lacking the sustained momentum of precious metals.

BITCOIN: EXTREME RETURNS, EXTREME PATH

Bitcoin’s long-term CAGR dwarfs every other asset, but the yearly data reveal repeated crashes of 60–70 per cent plus. The message is binary: extraordinary wealth creation for holders who survived multiple near-death drawdowns, and total unsuitability for investors needing stability or predictable income.

It behaves more like a high-volatility venture asset than a currency or commodity.

CURRENCIES: DOLLAR STRENGTH AS A GRAVITY FORCE

Currency CAGRs are small compared to equities and commodities, but the pattern is consistent: the US dollar index trends stronger over most horizons, pressuring EUR and GBP.

INR depreciation is gradual and steady rather than chaotic, while JPY weakness stands out as a structural shift tied to policy divergence. Currency moves quietly but meaningfully shape real returns for global investors.

REGIONAL ROTATION AND CAPITAL FLOWS

Capital clearly favored innovation-heavy, rule-stable markets (the US) and high-growth domestic stories (India). Regions with regulatory uncertainty, demographic drag or geopolitical stress (China/Hong Kong, parts of Europe) saw capital leakage despite occasional rallies.

The data reflect not just economics, but trust, policy credibility and narrative.

PORTFOLIO IMPLICATIONS FROM THE DECADE

Diversification across assets mattered more than diversification within equities. Equities alone delivered uneven outcomes; bonds failed when inflation surged; real assets and gold provided balance; and a small allocation to extreme-growth assets dramatically altered outcomes.

The decade rewards long-term discipline, tolerance for volatility and exposure to structural growth rather than mean reversion bets.

BOTTOM LINE

2015–2025 was not a “smooth CAGR decade” but a stress test of conviction. The winners (like the so-called Magnificent 7 stocks) combined growth, policy credibility and innovation; the losers suffered from structural headwinds despite occasional strong years.

The next cycle will likely look different, but the lesson endures: compounding comes from staying invested in diversified assets with emphasis on proper asset allocation, not from wild speculation or asset / sector rotation.

--------------------------------------------------------------

Update 03Jan2026: Charts 162 and 163:

Dollar Rupee exchange rate: USD INR Exchange Rate: Calendar year-wise and financial year-wise data of the US dollar-Indian rupee exchange rate for the past 27 years (previous blog dated 03Jun2024 on Why RBI Won't Favour a Strong Rupee and preivous blog dated 01Jun2024 on how to calculate currency depreciation and appreciation) >

USD-INR yearly gain / loss

Exchange rate yearly gain / loss

Dollar rupee yearly gain / loss

USD-INR financial-year and calendar-year end data

USD-INR change %: Calendar year-wise: Dollar gain versus Rupee: Data include not only year-wise changes but also 5-year change

(annualised). For example, between end-Dec2016 and end-Dec2021, the

annualised appreciation for USD vs INR is only 1.8 per cent; whereas

between end-Dec2007 and end-Dec2012, it was 6.8 per cent annualised.

For the past 25 years, the USD has appreciated versus INR at an annualised rate of 2.65 per cent. Conversely, the Indian rupee depreciated against the US dollar at an annualised rate of 2.58 per cent.

Data range for CY-wise yearly change

for the past 27 years is: minus 1o.9 per cent to plus 22.9 per cent.

The data range is so wide one can't even predict / forecast the yearly

changes in USD-INR exchange rate.

Of

the 27 calendar years for which data are presented here, Govt of India

and Reserve Bank of India allowed the rupee to appreciate against the

dollar only on eight occasions.

INR-USD change %: (extreme right column in the table below): Column 6 shows how much the rupee has depreciated versus the dollar.

Financial year-wise: Dollar gain versus Rupee: Data include not only year-wise changes but

also 5-year change (annualised). For example, between end-Mar2020 and

end-Mar2025, the USD appreciated by 2.6 per cent annualised rate. And

between end-Mar2011 and end-Mar2016, the annualised USD appreciation vs

INR was much higher at 8.2 per cent.

For the past 25 years, USD has appreciated by an annualised 2.73 per cent versus INR.

Data range for FY-wise yearly change

for the past 26 years is: minus 11.4 per cent to plus 27.5 per cent.

The data range is so wide one can't even predict / forecast the yearly

changes in USD-INR exchange rate.

Of

the 26 financial years for which data are presented here, Govt of India

and Reserve Bank of India allowed the rupee to appreciate against the

dollar only on eight occasions.

Data for USD–INR are from RBI DBIE. All other calculations are by the author.

Explanation for two columns in the two tables presented below >

Column 3 (USD–INR change %): This shows how much the value of one US dollar changed compared to the Indian rupee during the year. A positive number means the dollar became stronger (it took more rupees to buy one dollar). A negative number shows the dollar depreciation versus rupee (dollar became weaker).

Column 6 / extreme right (INR–USD change %): This shows how much the value of one Indian rupee changed compared to the US dollar during the year. A positive number shows the rupee appreciation (one rupee could buy more dollars). A negative number means the rupee became weaker versus the dollar.

--------------------------------------------------------------

Update 02Jan2026: Charts 156 to 161:

FPI Equity Flows to India: India

FPI Flows to Indian stock market and debt market in rupee terms > (old blog 10Jul2022) >

In calendar year 2025, FPI equity flows were negative in eight months. Despite a lot of negatives, Nifty 50 managed a positive return of 10 per cent in CY 2025.

In the debt segment, the flows were better, with FPIs being net positive in nine months. However, during Dec2025, the outflows wee to the tune of Rs 0.16 lakh crore.

Cumulative FPI flows to Indian equity markets are negative in the past five years.

As on 31Dec2025: Rs lakh crore

Past one year FPI equity flows -1.66

Past two year -1.66

Past three year 0.05

Past five year -0.90

Past 10 year 2.20

FPI debt flows are a saving grace for India, especially in the past three years.

As on 31Dec2025: Rs lakh crore

Past one year FPI debt flows 0.62

Past two year 2.28

Past three year 2.94

Past five year 3.06

Past 10 year 3.32

Due to a variety of concerns, FPIs turned negative on Indian stocks, preferring markets, like, South Korea and Hong Kong (basically Chinese stocks).

Market pundits attribute the FPI exit to factors like, India "missing" AI wave of the US (Nvidia, Google, Microsoft, Broadcom and Oracle), some Chinese firms (SMIC, Alibaba and DeepSeek), South Korean firms (Samsung and SK Hynix) and Taiwan (TSMC and Foxconn).

Rupee depreciation and earnings concerns too have weighed on FPIs.

Debt segment: In CY 2025, FPIs were positive with inflows of Rs 0.62 lakh crore (lower compared to CY 2024 flows of Rs 1.65 lakh crore). Despite the positive flows, India 10-year benchmark government bond yield barely moved -- from 6.76 per cent (end-Dec2024) to 6.59 per cent (end-Dec2025).

Concerns about fiscal deficit, supply of new paper and RBI forex intervention* to defend the rupee are negative factors for the bond market.

Massive liquidity injection in the form of OMO purchases, USD INR swaps did not help. And so are Repo rate and CRR cuts.

(* when RBI intervenes in forex market by selling US dollars to defend the rupee, they suck up rupee liquidity -- this too seems to have negatively impacted bond prices)

FPIs are foreign portfolio investors.

Six charts >

India FPI equity flows monthly (15 months)

India FPI equity flows quarterly (15 quarters)

ndia FPI debt flows monthly (15 months)

India FPI debt flows quarterly (15 quarters)

India FPI flows (both equity and debt) financial year wise

India FPI flows (both equity and debt) calendar year wise

Charts 156 to 161 click on the image to view better >

--------------------------------------------------------------

Update 01Jan2026: Charts 154 and 155:

Global market data: Global market data pertaining to stocks, bonds,

commodities and currencies are presented here (old blog dated 29Jun2024).

Quarter-to-date

(QTD) global market data, as on 31st of December, 2025, of stocks, bonds,

currencies and commodities is as follows:

During Oct-Dec2025 quarter (QTD), the stand-out performance is international silver price which delivered a stunning return of 50 per cent, while gold could deliver only 11.6 per cent.

Crude oil logged 8-9 per cent losses during the quarter, while Bitcoin crashed by 23 per cent.

Among stock markets, Japan's Nikkei 225 clocked gains of 12 per cent.

One uncanny data point is: both India 10-year bond yield and US 10-year bond yield rose by one basis point (100 basis points equal one percentage point) -- with the yield spread static at 243 basis points.

Year to date: YTD, silver and gold delivered spectacular returns of 141 and 64 per cent respectively.

In stocks, Nikkei 225, Hang Seng, Dax 40, FTSE 100 and Nasdaq Composite provided superior returns.

Indian stocks are a disappointment, especially mid- and small-cap stocks.

The year-to-date (YTD) chart is also attached below.

QTD >

YTD >

--------------------------------------------------------------

Update 28Dec2025: Chart 153:

FPI Equity Flows to India: India

FPI Flows to Indian stock market, DII Flows to Indian stock market and

Individual Investor flows to India stock market - both in rupee terms as

well as dollar terms - calendar-year wise data from 2013 to 2025 > (old blog 10Jul2022) >

After a gap of six years, individual investors turned negative (data up to 30Nov2025) in calendar year 2025. DIIs invested a record Rs 7.09 lakh crore in Indian equities in 2025 (11 months).

Whereas, FPIs exited Indian stocks worth USD 16.4 billion in 2025 (11 months), almost matching full year outflow in 2022. Going by the past trend, FPIs may turn positive in 2026 subject to a win-win trade deal between India and the US, rupee stabilising and other factors.

In the past five years, FPIs net outflow from Indian stocks is nearly USD 8.3 billion; whereas DIIs net inflows in the same period are Rs 18 lakh crore.

Calendar year 2025 data are upto 30Nov2025.

FPIs are foreign portfolio investors.

DIIs are domestic institutional investors.

Individual

investors data for NSE secondary market only. Individuals include

individual /proprietorship firms, HUF (Hindu Undivided Family) and NRIs

(Non resident Indians).

Chart 153 click on the image to view better >

--------------------------------------------------------------

Update 26Dec2025: Chart 152:

India Balance of Payments (BoP): BoP data - A clarification on definitions: India

overall balance of payments - goods / merchandise exports and imports,

trade deficit, net invisibles, services exports / imports, services

trade suplus, net transfers, net income, current account deficit (CAD) and others

Update 09Jul2025 with Charts 112 and 113 - yearly BoP data for 11 years with definitions

Update 29Jun2025 with Chart 101 - yearly BoP data - 11 year BoP data with definitions

There is some confusion in the use of terms here in BoP: Terms used by general readers and IMF / World Bank.

The chart below explains some of the terms we use as a global general reader, like:

Goods exports

Services exports

Total goods exports

Goods imports

Services imports

Total services exports

A. Overall trade balance*

B. Net Transfers

C. Net Income

Current account balance# (A+B+C)

Goods trade balance

Services trade balance

Overall trade balance*

* if the overall trade balance is negative, we can call it overall trade defict; if positive, we can call it overall trade surplus

# if the current account balance is negative, we can call it current account deficit; if positive, we can call it current a/c surplus

Likeweise, whenever balance is negative, we call it deficit; when positive, we call it surplus.

Data for 2024-25 are given to get a better understanding of these terms.

References:

GTRI report: 5-year review of India's merchandise trade

Chart 152 click on the image to view better >

--------------------------------------------------------------

Update 24Dec2025: Charts 150 and 151:

US Dollar Sale and Purchase by Reserve Bank of India: RBI Forex Intervention:

Biggest Monthly Sale and Purchase of US Dollars By RBI

Chart structure: The below chart has five columns:

Month (specific month and year),

US Dollar Purchase (amount of US dollars bought by RBI in billion USD),

US Dollar Sale (amount of US dollars sold by RBI in billion USD),

Net purchase (+) / sale (-) (difference between USD Purchase and Sale indicating net buying or selling), and

USD INR exchange rate month-end level

The

table is divided into two sections showing the top eight months with

the largest net sales (negative net purchase) and the top eight months

with the largest net purchases (positive net purchase) of USD by the

Reserve Bank of India between 2000 and 2025.

Key Observations:

Biggest

Net Sale Months (Negative Net Purchase): Nov2024 saw the largest net

sale of USD at negative 20.2 billion with gross purchases of 30.9 and gross sales of

51.1 billion US dollars. Other major net sale months range between

negative 10.4 billion to negative 20.1 billion USD.

All the net USD sale figures occurred between Mar2022 and Oct2025, except Oct2008 (Lehman Bros collapse).

The

USD-INR exchange rate during these sale months ranged from about 49.25

to 88.68, with the highest exchange rate recorded in Oct2025 at 88.68.

The recent months of 2024 and 2025 show some of the largest net sales,

which indicates that the RBI was selling dollars possibly to stabilise

the rupee or manage forex reserves during periods of currency pressure.

Biggest Net Purchase Months (Positive Net Purchase):

Jun2021

had the largest net purchase at 18.6 billion US dollars, followed by

Jul2020 with 16.0 billion USD and Oct2020 with 15.6 billion USD. Net

purchases are generally lower than the biggest net sales but are still

significant, ranging from 12.1 billion to 18.6 billion USD.

The

exchange rate during these months was relatively lower compared to the

net sale months, mostly between 39.32 and 85.75. These months, mostly

between 2020 and 2025, suggest that the RBI was buying dollars to boost

reserves or counteract currency volatility.

Possible Economic Interpretations: When the RBI sells large amounts of US dollars, it is usually trying to support the rupee and stop it from falling too fast. By supplying dollars to the market, the RBI helps reduce pressure on the rupee during uncertain or volatile periods.

When the RBI buys USD in large volumes (net purchase positive),

it may be to build forex reserves or counter currency appreciation. The

data show recent years (2024-2025) have both high net sale and purchase

activity, indicating active forex market intervention by the RBI during

times of volatility.

Additional Notes:

It

may be noted absolute data should be normalised against GDP or forex

reserves for deeper analysis, meaning these raw values might not fully

reflect the economic impact without considering India’s overall economy

or foreign exchange reserves size.

The USD INR month-end level provides context on currency strength or weakness during these interventions.

Summary:

The

chart highlights the RBI’s active management of forex reserves through

large monthly USD purchases and sales. The largest net sales and

purchases mostly occur in recent years, showing dynamic currency market

intervention.

Exchange rates correlate with intervention sizes, with

bigger sales generally happening when the USD is stronger (high INR

rates), and purchases when the USD is weaker or the RBI aims to

accumulate reserves.

Chart 150 click on the image to view better >

P.S.: Update dated 24Dec2025: Normalising USD Sale and Purchase Data with Forex Reserves >

US Dollar Sale and Purchase by RBI: RBI Forex Intervention:

Biggest Monthly Sale and Purchase of US Dollars By RBI as Compared to Forex Reserves:

In the above chart of today, I shared data showing the biggest monthly sales and purchases of US dollars by the RBI. However, that chart showed only absolute figures — which can be misleading because it doesn’t account for the size of India’s forex reserves at those times.

To give you a better perspective, I’ve updated the chart by including two important parameters:

> Forex Reserves at the start of each month

> Net USD sale/purchase as a percentage of Forex Reserves

These additions help us normalise the absolute dollar amounts, showing the scale of RBI’s intervention relative to the total forex reserves available. This means we can now compare months more fairly, even if the forex reserves were very different in size.

For example, a net USD sale of USD 18.7 billion in Oct2008 represents a much larger share of forex reserves (6.5%) compared to other months with bigger absolute sales but larger reserves.

By looking at the net USD sale as a percentage of forex reserves, Oct2008—the time of the Global Financial Crisis (GFC) and Lehman Brothers collapse—stands out as the heaviest month of intervention by far.

This comparison highlights how absolute numbers alone can sometimes mask the true scale of currency interventions when the overall reserve size fluctuates greatly. Oct2008’s intervention was therefore much more impactful in proportional terms, reflecting the severity of the GFC.

This normalised view provides a clearer picture of how significant the RBI’s actions were in context, helping us better understand the dynamics of forex interventions and currency stability.

You can see the updated data in the chart below, which includes these new parameters for a more balanced analysis.

Chart 151 click on the image to view better >--------------------------------------------------------------

Update 24Dec2025: Chart 149:

US Dollar Sale and Purchase by Reserve Bank of India: RBI Forex Intervention: (old blog dated 05Aug2021 with monthly and yearly data for several years) (for quarterly chart, see Update 26Nov2025 with Charts 144 and 145)

Chart showing monthly data of USD sales and purchases by

RBI > Data avilable only till 31Oct2025 as RBI releases official

data on currency intervention with a two month gap >

Oct2025 emerged as one of the heaviest months of RBI forex intervention, marked by gross dollar sales of USD 29.6 billion against purchases of USD 17.7 billion, translating into a sizable net sale of USD 11.9 billion (the net sale figure is the highest in 10 months).

Heavy RBI currency intervention:

Between Jun2025 and Oct2025, RBI has been net seller in all five months,

with total net sale amounting to USD 33.7 billion. Net sales in the past six

months amount to USD 31.9 billion.

Over the past year (Nov2024-Oct2025), the RBI’s forex intervention has amounted to a net USD 67.4 billion sale—the highest on record in a 12-month period.

That said, absolute figures on their own can be misleading, as economies expand over time. To draw meaningful comparisons, such data should be normalised against relevant metrics such as nominal GDP, total forex reserves or similar benchmarks--and expressed in ratio terms.

Year-to-date, the US dollar

gained 4.81 per cent versus the Indian rupee -- conversely, INR lost

4.59 per cent vs the USD. Since the start of 2025, rupee has been

volatile. It even appreciated to a level of 84 during the first week of

May2025.

Even

though, US dollar index (DXY), a gauge of USD versus six major

currencies, has fallen almost 10 per cent YTD, rupee has been under

pressure due to Trump tariffs and RBI currency intervention (or lack of

intervention) strategies.

As of yesterday (23Dec2025), rupee closed at 89.63, recovering from 91.5 level reached a few weeks ago.

Compared

to Oct-Dec2024 period net sales of USD 44.7 billion and net sale of USD 33.7 billion in Jun-Oct2025 period, RBI currency

intervention has been subdued in the period between Jan2025 and May2025.

Chart 149 click on the image to view better >

--------------------------------------------------------------

Update 11Dec2025: Charts 147 and 148:

US Federal Reserve Funds Rate: Fed Funds Rate (for old data see charts below and see here) >

The US Federal Open Market Committee (FOMC) at its meeting on 10Dec025 reduced the federal funds rate (the Fed funds rate) by 25 basis points (100 basis points equal one percentage point) to a range

of 3.50-3.75 per cent.

This is the third consecutive Fed rate cut since Sep2025. This calendar year, the Fed delivered a total rate cut of 75 basis points (see two charts below).

The

rate cut cycle began in Sep2024 and is expected to continue in to 2026. The next FOMC meeting is slated for 28Jan2026.

The past rate hike cycle lasted from Mar2022 till

Sep2024 -- a period of two years and a half.

Fed's QT or quantitative tightening started on 13Apr2022 and ended on 01Dec2025 (see Update 02Nov2025 with charts 141 to 143 below for more).

QE Lite

In a separate statement, the Fed said it would start buying every month US Treasury Bills, as part of its reserve management purchases (RMPs). The first monthly purchase, amounting to USD 40 billion, is starting on 12Dec2025.

The Fed further say the monthly purchases will taper off over a period of time. The amount of monthly purchases is flexible depending on the market conditions.

The market is describing the move by the Fed to purchase US Treasury Bills on a monthly basis as 'QE Lite.'

Chart 5: Fed Funds rate from Jul2024 to till now >

Chart 4: Calendar year-wise changes in Fed rate from 2003 to 2025 >

Charts 147 and 148 click on the image to view better >

--------------------------------------------------------------

Update 03Dec2025: Chart 146:

India current account deficit (CAD) : India CAD data: quarterly CAD data: India current account deficit (CAD) : For India Yearly / Quarterly CAD data, BoP data and others, see:

Update 21Sep2025 with Chart 124 - yearly CAD data

Update 09Jul2025 with Charts 112 and 113 - yearly BoP data for 11 years with definitions

Update 29Jun2025 with Chart 101 - yearly BoP data - 11 year BoP data with definitions

Update 28Jun2025 with Chart 99 - yearly CAD data

Update 03Sep2025 with Chart 121 - quarterly CAD data

Update 02Sep2025 with Chart 120 - quarterly BoP data

Update 30Jun2025 with Chart 102 and related blog - quarterly CAD data with 100 quarters CAD data

India's

current account deficit (CAD) for the Jul-Sep2025 quarter is 1.3 per

cent of GDP, declining from 2.2 per cent of GDP in corresponding quarter of

previous year, as per RBI press release of 01Dec2025.

While the year-on-year current account deficit (CAD) declined, it increased on a quarter-to-quarter basis. India’s CAD for the July–Sep2025 quarter rose to 1.3 per cent of GDP, up from CAD of 0.3 per cent in the previous quarter.

(Note Large Revision of quarterly CAD data: The current account deficit for Q2:2024-25 has been revised upwards from USD 16.8 billion or 1.8 per cent of GDP to USD 20.8 billion or 2.2 per cent of GDP due to downward revision of exports in Customs data. In Q1:2025-26, the current account deficit stood at USD 2.7 billion or 0.3 per cent of GDP).

In the Apr–Jun2025 quarter, India’s current account deficit stood at just 0.3 per cent of GDP, and the Jan–Mar2025 quarter even recorded a surplus of 1.3 per cent of GDP—figures that drew praise from the media and several prominent commentators for India’s effective control over the CAD.

However, when the deficit rose to 1.3 per cent of GDP in the Jul–Sep2025 quarter, the sharp increase from the previous quarter’s low went largely unacknowledged, with the same voices remaining notably silent.

Additionally, the media and several market veterans often overlook the structural trend of a persistently elevated current account deficit. Their reactions tend to be disproportionately positive when a quarter delivers a low reading, reflecting a focus on short-term fluctuations rather than the underlying long-term dynamics.

An examination of 100 quarters of India’s current account data in my previous analysis revealed an important pattern: current account surpluses have historically aligned with episodes of subdued or negative economic growth. This underscores a key structural reality—India requires a moderate current account deficit, ideally below 2 per cent of GDP, to support its growth trajectory.

India needs a CAD below 2 per cent because its investment-driven growth model requires steady but sustainable foreign capital (India is capital-hungry). A moderate deficit can be comfortably financed through stable inflows like FDI, remittances and services exports without creating external sector stress.

When CAD rises above this threshold, it puts pressure on the rupee, raises imported inflation and increases dependence on volatile capital flows. Historically, CAD episodes above 2 per cent have triggered currency instability, while surpluses have typically coincided with weak domestic demand. Thus, a CAD under 2 per cent strikes the balance India needs—strong growth with manageable external risk.

The current account (CA) balance fluctuates quarter to quarter, moving between deficit and occasional surplus.

The two recent surpluses were:

Jan-Mar 2025: +1.17 lakh crore rupees or USD 13.4 billion (1.3% of GDP)

Jan-Mar 2024: +0.38 lakh crore rupees or USD 4.6 billion (0.5% of GDP)

Fluctuating

but persistent deficit: Most quarters show a negative CAD, confirming

India’s tendency to run a current account deficit.

Intermittent surpluses: Surpluses are rare and brief, seen only in two quarters out of the 10 listed (see chart below).

Ten quarters data tell us about short-term volatility, but not much about macroeconomic fundamentals. If you want to analyse long term trends, use long-term CAD data integrating it with external sector fundamentals and other macro economic indicators.

You may be interested in reading a recent blog published on India's elusive current account surplus (data for 100 quarters is analysed).

Forex Reserves:

There was a depletion of USD 10.9 billion to the forex reserves (on a BoP basis) in Jul-Sep2025 quarter as against an accretion of USD 18.6 billion in Jul-Sep2024 quarter.

FDI Flows:

Quarterly data: Foreign direct investment (FDI) recorded a net FDI inflow of USD 2.9 billion in Jul-Sep2025 quarter as against a net FDI outflow of USD 2.8 billion in the corresponding period of 2024-25.

Half-yearly data: Net FDI inflows increased to USD 7.7 billion in first half of FY 2025-26 from USD 3.4 billion in first half of 2024-25.

FPI Flows:

Quarterly data: Foreign portfolio investment (FPI) recorded a net outflow of USD 5.7 billion in Jul-Sep2025 quarter as against a net inflow of USD 19.9 billion in Jul-Sep2024 quarter.

Half-yearly data: FPI recorded net outflows of USD 4.1 billion in first half of FY 2025-26 as against net inflows of USD 20.8 billion in first half of 2024-25.

India quarterly CAD

data (in Rs lakh crore) of CA deficit of CA surplus (as the case may

be) and CAD / CAS as a percentage of GDP: Date from Apr-Jun2023 to Jul-Sep2025 quarters:

Data sources:

RBI press release 01Dec2025: Developments in India's Balance of Payments RBI press release 01Dec2025: Sources and variation in forex reserves RBI DBIE Table 195: India overall BOP quarterly - RupeesRBI DBIE Table 194: India overall BOP quarterly - US Dollars

Chart 146 Click on the chart view better >

--------------------------------------------------------------

Update 26Nov2025: Charts 144 and 145:

US Dollar Sale and Purchase by Reserve Bank of India: (old blog dated 05Aug2021 with monthly and yearly data for several years)

Two

charts showing monthly and quarterly data of USD sales and purchases by

RBI > Data avilable only till 30Sep2025 as RBI releases official

data on currency intervention with a two month gap >

Between Jul2025 and Aug2025, RBI has been net seller in all three months,

with total net sale amounting to USD 18.1 billion. Net sales in the past six

months amount to USD 21.7 billion and for the past one year, net sales

were a staggering USD 64.8 billion.

Year-to-date, the US dollar

gained 4.19 per cent versus the Indian rupee -- conversely, INR lost 4.02 per cent vs the USD. Since the start of 2025, rupee has been

volatile. It even appreciated to a level of 84 during the first week of

May2025.

Even

though, US dollar index (DXY), a guage of USD versus six major

currencies, has fallen almost 10 per cent YTD, rupee has been under

pressure due to Trump tariffs and RBI currency intervention (or lack of

intervention) strategies.

As of yesterday (25Nov2025), rupee closed at 89.23, very close to its lowest in history versus the dollar.

Compared

to Oct-Dec2024 period net sales of USD 44.7 billion, RBI currency

intervention has been subdued in the period between Jan2025 and

Jun2025.

Currency intervention:

During Jul-Sep2025 period, RBI resorted to heavy defence of rupee by

resorting the USD combined sales of 18.1 billion. In the past four months, RBI has net sold every month with the net sale of USD by RBI amounting to USD 21.8 billion.

--------------------------------------------------------------

Update 02Nov2025: Charts 141 to 143:

US Federal Funds Rate Cycles Since 1999 to Now : (old blog dated 25Feb2023):

The three charts below show the following:

> US Fed's Quantitative Easing (QE) and Quantitative Tightening (QT)

> US Fed's Four Interest Rate Hike Cycles Since 1999

> US Federal Funds Rate Cycles Since 1999 to Now

The

current downward interest rate cycle in the US started in Sep2024 and

is continuing now; and it's expected to continue at least for another

six months, subject to incoming data. In the current down cycle,

the

US Fed has decreased the Fed funds rate by 150 basis points so far.

However, Trump's tariffs have complicated the Federal Reserve's efforts to steer US PCE inflation back toward its long-term 2 per cent target.

The

large-scale and sweeping reciprocal tariffs announced by the Trump

administration on 02Apr2025 are creating supply chain

disruption leading to higher consumer prices in the US jeopardising

Fed's efforts to tame inflation.

The US government shutdown (due to political bickering on Capitol Hill) has complicated matters for financial markets, with data not being released on time or delayed considerably.

The FOMC at its meeting on 29Oct2025 announced a further 25 basis points reduction in Fed funds rate, in line with market expectations. However, the Fed chair Jerome Powell's post-Fed meet press conference comments expressing doubt about another rate cut in December next seemed to have spooked global financial markets somewhat.

The

quantitative tightening (QT) cycle started in Apr2022 and is ending on 01Dec2025 as announced by the US Federal Reserve a few days ago. This is good news for markets.

When the Fed reduced its balance sheet size through QT, what it meant was it allowed some of the Treasury securities and mortgage-backed securities (MBS) it held to mature—but it did not reinvest the proceeds into new securities.

Normally, when a Treasury or MBS reaches maturity, the Fed would receive the principal amount back and then buy new securities to keep its balance sheet size steady. During QT, the Fed stopped buying replacements for these maturing securities, so the total amount of assets on its balance sheet gradually shrinks. In essence, the Fed reduced its balance sheet size through QT in a passive way in the past three years and a half.

QT Ending: From 01Dec2025 onwards, the Fed will cease allowing its security holdings to decline and will instead reinvest all proceeds from maturing assets into new government securities. This marks a shift from balance sheet reduction (“runoff”) to maintenance (“reinvestment”), ensuring that the level of central bank money and reserves in the banking system remains stable rather than continuing to fall.

With the Fed ending QT from 01Dec2025, its balance sheet size will no longer contract and is expected to stabilise, with the possibility of gradually increasing over time. This does not automatically mean start of QE by the Fed once again.

What Ending QT Means for Financial Markets Globally:

Increased Liquidity: With the Fed halting QT, more liquidity will stay in the financial system.

Lower Interest Rates: The improved liquidity backdrop may push market interest rates lower, especially supporting longer-duration US Treasuries.

Positive Signals for Risk Assets: Equities and credit markets (investment grade and high yield) could see renewed appetite as liquidity and lower rates support riskier assets.

Impact on Currency Markets: The US dollar could see downward pressure in the near term as liquidity improves. However, dollar strength may persist due to relatively higher US yields, stable economic conditions compared to other regions and global capital flows.

Emerging Markets: More available liquidity may support capital flows to emerging markets, including Indian equities, over the medium term - depending on other factors.

Fed Balance Sheet Contraction: Between Apr2022 and now, the US Fed's balance sheet size decreased from USD

8,965 billion to USD 6,587 billion, a decrease of more than USD 2,378 billion or 26.5 per cent decline.

However,

from the start of QE in Sep2008, the US Fed's balance sheet has grown

from USD 905 billion to USD 6,587 billion now -- an increase of 628 per

cent in 25 years.

Data sources:

Charts 141 to 143 click on the them to view better >

--------------------------------------------------------------

Update 30Oct2025: Chart 140:

US Federal Reserve Funds Rate: Fed Funds Rate (for old data see charts below and see here) >

The US Federal Open Market Committee (FOMC) at its meeting on 29Oct2025 reduced federal funds rate by 25 basis points to a range

of 3.75-4.00 per cent.

This is the second rate cut in 2025 (see chart below).

The

rate cut cycle began in Sep2024 and is expected to continue in to 2026. The next FOMC meeting is slated for 10Dec2025.

The past rate hike cycle lasted from Mar2022 till

Sep2024 -- a period of two years and a half.

Interestingly, Stephen I. Miran voted against the FOMC resolution (who preferred to lowering fed funds rate by 50 basis points). So is Jeffrey R. Schmid, who preferred no change to the fed funds rate at this meeting.

The Federal Open Market Committee (FOMC) decided to conclude the reduction of its aggregate securities holdings on 01Dec2025 -- meaning the Fed is ending the Quantitative Tightening (QT) or balance sheet reduction from that date.

QT started on 13Apr2022 (see Update 27Apr2025 with chart 73 below for more).

Fed Funds rate from Jul2023 to till now >

Chart 140 click on the image to view better >

--------------------------------------------------------------

Update 28Oct2025: Chart 139:

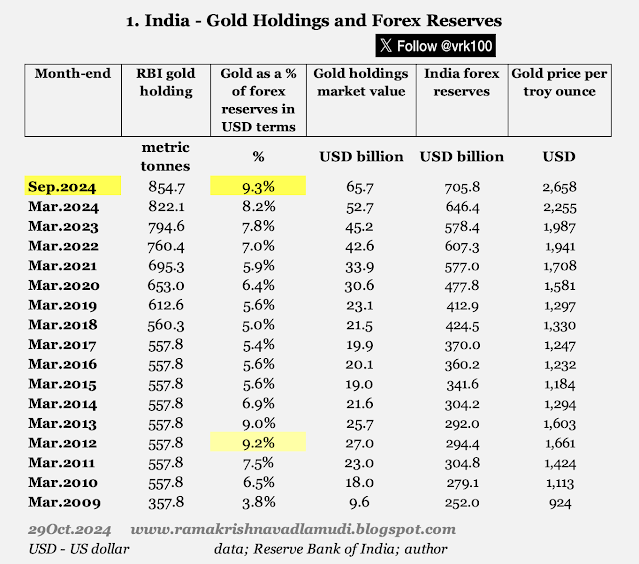

RBI Gold Holdings and Forex Reserves as at the end of Sep2025: RBI

gold reserves are part of India's forex reserves maintained by RBI on

behalf of Government of India (for more on RBI gold holdings, see blog dated 07Mar2022).

Gold

holdings of Reserve Bank of India increased from 879.6 metric tonnes in Mar2025 to 880.2 metric tonnes in Mar2025, an increase of just 0.6 metric tonnes in the past six months. The data are as per RBI's Half yearly report on management of foreign exchange reserves released today.

The

amount of gold holding (in US dollar terms) as a percentage of total

forex reserves of India is 13.9 per cent as of Sep2025 (11.70 per cent as of Mar2025); this is the

highest percentage of gold holdings in the past 16 years.

The value of RBI's gold holdings is USD 97.5 billion out of the total forex reserves of USD 700.1 billion as of Sep2025.

Gold repatriation from overseas vaults

During the period Apr–Sep2025, the Reserve Bank of India (RBI) repatriated around 58 metric tonnes, or one-sixth of the total, of physical gold that had been held abroad with the Bank of England and the Bank for International Settlements (BIS) to its vaults in India. This move increased the gold held domestically to 575.8 metric tonnes as of September 2025, while the gold held overseas declined to 290.4 metric tonnes.

Owing to a combination of fresh gold purchases and the repatriation of gold from foreign vaults, the share of the RBI’s physical gold holdings kept in India rose significantly—from a recent low of 37.8 percent in Sep2022 to 65.4 percent in Sep2025.

The decision to transfer gold back to India is seen as a strategic step by the RBI, undertaken in the context of Western nations such as the United States and European countries imposing economic sanctions on Russia and freezing its foreign exchange reserves following the Ukraine invasion in Mar2022.

RBI's forex reserves consist of:

foreign currency assets (FCA) -- 83% share in Sep2025

physical gold -- 13.9% share

SDRs -- small share

IMF Reserve -- small share

FCA earns returns for RBI, while other don't.

Rate of earnings for FY 2024-25 was 5.31% (See update 01Jun2025 with charts 80 to 82 for data).

RBI gold holdings comprise physical gold in India, physical gold overseas (with BoE and BIS) and gold deposits.

While the physical gold—both in India and overseas—does not generate any income, the gold deposits earn a modest return for the RBI.

Of the 880.2 metric tonnes gold, 14 tonnes is kept as gold deposits.

What are gold deposits?

RBI places a part of its physical gold holdings with foreign central banks or international financial institutions in order to generate returns. Such deposits are called gold deposits.

Gold deposits: RBI “lends” some of its gold reserves to a trusted international institution or another central bank. In exchange, RBI earns a small return for the deposits.

The Gold Deposit Rate (GDR) is very low; it's often paid in physical gold. The annual GDR is in 0.25-0.75% range.

Chart 139 click on the image to view better >

--------------------------------------------------------------

Update 19Oct2025: Chart 138:

FPI Equity Flows to India: India FPI Flows to Indian stock market, DII Flows to Indian stock market and Individual Investor flows to India stock market - both in rupee terms as well as dollar terms - calendar-year wise data from 2013 to 2025 > (old blog 10Jul2022) >

Calendar year 2025 data are upto 30Sep2025.

FPIs are foreign portfolio investors.

DIIs are domestic institutional investors.

Individual investors data for NSE secondary market only. Individuals include individual /proprietorship firms, HUF (Hindu Undivided Family) and NRIs (Non resident Indians).

Chart 138 click on the image to view better >

The above chart reveals:

In calendar year 2025 (up to 30th September), there is divergence between FPIs and DIIs. FPI flows (net) are minus Rs 1.55 lakh crore (minus USD 17.6 billion), while DII flows (net) are positive at Rs 5.79 lakh crore (+ USD 66.9 billion). Individual investor flows (net) are insignificant but positve at Rs 0.19 lakh crore (+ USD 2.2 billion).

Despite heavy foreign outflows in 2025 so far, the Indian stock market appears resilient due to strong DII buying, with individuals contributing modestly. Year to date, Nifty 50 returned +4.1 per cent, while BSE Midcap index delivered negative returns of 3.3 per cent.

FPI Trends: There are Net Outflows in 2022 and 2025:

2025: -Rs 1.55 lakh crore (-USD 17.6 billion)

2022: -Rs 1.21 lakh crore (-USD 16.5 billion)

Strongest FPI Inflows:

2020: Rs 1.70 lakh crore (USD 23.0 billion)

2023: Rs 1.71 lakh crore (USD 20.7 billion)

2013: Rs 1.13 lakh crore (USD 20.1 billion)

DII Trends: They have been consistently Positive Since 2015, except in 2020 (COVID-19 Pandemic outbreak year). Indian stock market has experienced strong DII inflows in 2025, 2024 and 2022.

DIIs are increasingly becoming dominant stabilising forces, likely due to higher retail investor participation, higher role of pension funds like EPFO (see Update 19Jun2025 with charts 51 to 55) and growing SIP (Systematic Investment Plan) flows and mutual fund participation.

Individual Investors trends:

Typically show net outflows in earlier years (2013–2019), turning positive from 2020 onwards. But their participation in 2025 and 2023 was lacklustre.

Retail investors became significant during and after COVID-19, possibly driven by: Easy digital access, lockdown-driven savings and rise of financial literacy and demat accounts.

The smaller figure of 2025 might reflect volatility, profit-booking or shift to other asset classes, like, precious metals (gold and silver).

Comparing FPI inflows of 2023 and 2013 in Rupee and Dollar terms:

Despite similar US dollar values (USD 20.7 billion in 2023 vs USD 20.1 billion in 2013), the rupee values are very different:

2023: +Rs 1.71 lakh crore

2013: +Rs 1.13 lakh crore

That’s nearly 50 per cent higher in rupee terms in 2023.

Why the Difference?

This is due to currency Depreciation — Indian rupee depreciated significantly from 2013 to 2023.

The US dollar-Indian rupee (USD INR) exchange rate as on 31Dec2013 was 61.80 and by the end of 2023 Indian rupee weakened against the dollar to 83.21.

Why This Matters:

For policymakers/regulators: Tracking flows in USD is useful to assess external vulnerability (capital flows in hard currency - see update 28Jun2025 with Chart 100 below for data).

For market liquidity/impact: Rupee values are more relevant — as stock market trades, valuations and investments happen in rupees.

This is a textbook example of currency effect on cross-border capital flow measurement.

One Caveat

In any stock market trade, one party buys and another sells. So, at the transactional level, it’s always a zero-sum exchange of securities. But in the chart above, the sum of all three groups do not add up to zero. Why?

For example, during 2025, the FPI flows are minus Rs 1.55 lakh crore, DII flows are +Rs 5.79 lakh crore and Individual investors +Rs 0.19 lakh crore; net total infows are Rs 4.43 lakh crore (not zero).

The data in the image show net investment flows for three categories of participants only:

FPIs, DIIs and Individual investors (Retail, HUFs, NRIs, etc.).

The market has many more participants than these three, like:

> Corporate / non-corporate promoter trades (promoter buying and promoter selling)

> Private equity / venture capital exits (PE exits)

> Proprietary trading desks (of brokers)

> Non-institutional trades

> Trades of Government sector / Government promoter entities

> Foreign direct investment (FDI) outflows

Net flows from other participants are not shown, and they can absorb or provide liquidity in ways that balance the overall market.

Other excluded groups from the above chart are:

Individual investors include only data from NSE India for secondary market only. So, primary market data (IPOs or initial public offers) from NSE are not included in the above chart. Data from BSE India too are excluded in the above chart.

Off-market deals too are not always captured.

The data from these excluded groups is not readily available, hence these are not reported frequently due to non-availability of aggregated data.

The Indian stock market is a multilayered ecosystem. The data in the above chart show only a slice — albeit an important one. Promoter net selling and PE exits explain much of the discrepancy in net inflows not summing to zero.The promoter / PE exit activities have increased significantly in recent years, especially as markets hit all-time highs and exits became more attractive.

You may check the blog "NSE Ownership Trends in NSE-listed Universe of Stocks" to know about different kind of investors / entities that own the stock market in India.

--------------------------------------------------------------

Update 12Oct2025: Chart 137:

MSCI EM Index - China and India weights: Quarterly changes between Sep2025 and Jun2025: (for old data, see old blogs dated 07Jan2023 and blog 03Aug2021 and previous charts below)

India's position in the MSCI EM Index continues to be in third rank, as India has been underperforming grossly since the beginning of 2025. China and Taiwan continue to dominate the index as of Sep2025.

India has slipped from second in Mar2025 to third rank in Sep2025. Taiwan

regained second rank in Jun2025. There is a see-saw battle between India

and Taiwan for second rank in the past six quarters.

Taiwan's TSMC, with a weight of 10.87 per cent, is at the top as at the end of Sep2025.

It is noteworthy only top five countries account for 80

per cent of the weight in MSCI EM index.

The

chart below looks at the past five quarters data, with valuation

ratios, top five countries and top five companies.

Only two Indian companies are in the top ten of the list.

Changes in the past one year:

China's weight increased from 27.8 to 31.2 per cent between Sep2024 and Sep2025 while that of India decreased from 19.5 to 15.2 per cent (India

suffered heavy selling between Oct2024 and Mar2025). In the same period,

weights of Taiwan and South Korea have gone up.

For

almost five years, Taiwan's TSMC maintains its rank as the number one

company with highest weight in MSCI EM index. TSMC alone accounts for

more than 50 per cent weight for Taiwan.

EM outperformance YTD in 2025: For the first time in five years, MSCI EM index is outperforming MSCI World index year to date, with return of 25.2 per cent versus 16.2 per cent for MSCI World.

In the past 14 years (2011 to 2024), MSCI World massively outperformed MSCI EM in 10 years, while MSCI EM dominated with outperformance in only four years (2020, 2017, 2016 and 2012).

Chart 137 click on the image to view better >

--------------------------------------------------------------

Update 12Oct2025: Chart 136:

US Federal Reserve Funds Rate: Fed Funds Rate (for old data see charts below and see here) >

The US Federal Open Market Committee (FOMC) at its meeting on 17Sep2025 reduced federal funds rate by 25 basis points to a range

of 4.00-4.25 per cent.

This is the first rate cut since Dec2024 (see chart below).

The