When Will Federal Reserve Stop Hiking Interest Rates?

(Updated charts from Aug2024 onwards are available in India Forex Data Bank blog)

(Updates 02May2024, 21Mar2024, 02Nov2023 12Aug2023, 27Jul2023, 04May2023 and 23Mar2023 with new information are available at the end of the article)

The big question for global financial markets now is when will the US Federal Reserve (Fed) stop raising interest rates. Before we try to answer the question, let us understand what the Fed has done in the past two decades.

Table 1 below shows the hiking / easing cycles of the Fed:

What does one make of the above table? The question is answered in Table 2 below:

As shown above, we have seen four hiking cycles, three easing cycles and one neutral cycle when the Fed had kept the Federal Funds rate unchanged for seven long years.

(story continues below)

------------------

Related Blogs:

Global Bond Yields, Negative Real Interest Rates and Soft Landing

------------------

It is important to understand another key aspect of a central bank's monetary policy. In addition to the tool of raising (tightening policy) or decreasing (easing policy) interest rates, other key tools used by central banks to rein in inflationary expectations are quantitative easing (QE) and quantitative tightening (QT).

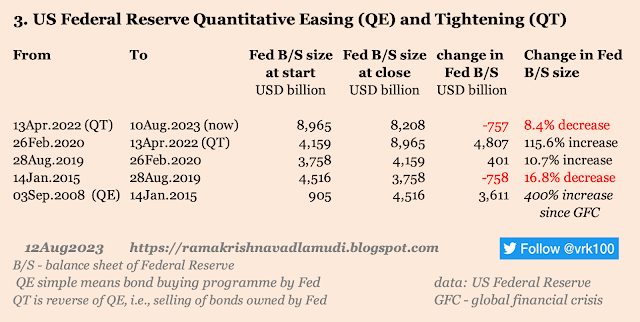

Table 3 below shows how the size of the US Fed's balance sheet has expanded since September 2008 when the financial world was hit by Global Financial Crisis (GFC) and sub-prime crisis.

As delineated in Table 3, the Fed's balance sheet has increased by more than nine times since 2008, resulting in huge liquidity in markets. This massive liquidity has set off its own problems, leading to upsurge in asset prices, mainly those of equities, bonds, select commodities and collectibles.

One has to look at the combined picture of zero-bound interest rates (Table 1 and 2) and unconventional QE tool (Table 3) to understand their impact on financial markets globally. Easy money policies and massive purchase of bonds by the Fed (QE) had resulted in massive asset price rise the world over.

In addition to the above easy monetary policies by the Fed, the US administrations (both under president Trump and president Biden) have provided fiscal stimulus to the US citizens to lessen the impact of COVID-19 Pandemic.

These measures had further boosted the asset prices globally till 2021. Afflicted by the supply chain bottlenecks, massive monetary and fiscal stimulus, Russian invasion of Ukraine, surge in commodity prices, wage pressures and many workers staying out of labour market post-COVID-19, inflation globally had gone up in 2022.

Between 2000 and 2021, the consumer price inflation (CPI) for developed markets (DMs) was 1.5 percent annually, and if you include emerging markets (EMs), it was around 2.2 percent.

But by the end of 2022, global inflation has surpassed 8 percent in most major nations, leading to a steep fall in stock and bond prices -- while some commodity prices, led by oil and gas, remained elevated.

Current Monetary Tightening

The current monetary tightening started on two fronts in March of 2022. In the past 12 months, the Fed funds rate has gone up by 450 basis points to 4.50-4.75 percent range (Table 1 and 2); while the Fed's balance sheet has almost shrunk by USD 600 billion in the same period (Table 3).

The combined impact of higher interest rates and liquidity withdrawal on the global asset prices is severe in 2022. While stocks and bonds were negatively impacted, some commodities, like oil and gas, gained in 2022.

The actual impact of these measures on the financial conditions is still in the pipeline. Monetary policy works with a lag of 12 to 15 months. Its impact is not yet fully reflecting in the earnings of US corporations.

Higher for Longer?

The US CPI reached 41-year high of 9.1 percent in Jun2022, though it cooled off to 6.4 percent in Jan2023. The PCE inflation, the Fed's preferred metric of inflation, is 5.38 percent in Jan2023 -- much higher than the Fed's inflation target of 2 percent.

Though US unemployment rate is at a 40-year low of 3.4 percent (Jan2023), the labour market continues to be tight in the US.

Inverted yield curve: The 10-year US Treasury yield is 3.95 percent, but the 20-year yield is much higher at 4.81 percent -- with a negative spread of 86 percent. Such inverted yield curve phenomenon is considered as a harbinger of a recession.

The current speculation is the US will plunge into a recession in the next 12 months and may not experience a soft landing, according to market observers. However, these things are not predictable.

Much will depend on incoming data as the Fed often says its future policies are 'data dependent.'

Till two months ago, market was speculating that the Fed would stop hiking rates by mid-2023 and by end-2023, it would start decreasing interest rates (the so-called 'Fed pivot').

But the situation has changed in the past one month. As labour market conditions in the US continue to be tight and the US economic data is strong, the markets have stopped factoring in a Fed pivot at least in 2023. This has resulted in the US stocks losing their steam in the past four weeks.

The current market buzzword is:'higher for longer.' Which means the Fed will keep raising rates to rein in persistent inflation and keep the rates higher longer than anticipated by the market.

This is an interesting dichotomy for the markets because: on the one hand, the Fed says it's data dependent; on the other hand, the markets currently believe the Fed's policies will remain hawkish.

The central banks are in the habit of not surprising markets in a nasty manner. They consider market reaction in tandem with the economic data and the prevailing financial conditions and set their policies accordingly. This has been the market experience at least in the past 25 to 30 years.

In my opinion, the stock and bond markets are too pessimistic about the Fed's policies. Let us see how the markets behave in the next two quarters.

- - -

The following brief notes / images added after publishing the above article on 25Feb2023:

P.S. dated 02May2024: The US Fed on 01May2024 kept its federal funds rate unchanged at 5.25%-5.50%.

Yesterday, the Fed said: "... FOMC will continue reducing its holdings of Treasury securities and MBS. Starting in June, FOMC will slow the pace of decline of its securities holdings by reducing the monthly redemption cap on Treasury securities from USD 60 bn to USD 25 billion."

As stated earlier, the slowing down of reduction in Fed balance sheet starting from Jun2024 is positive, in a big picture sense, for the markets.

Simply put, with QE or Quantitative Easing, the Fed expanded its balance sheet by buying of Treasury securities and MBS.

With QT or quantitative tightening, the Fed is reducing its balance sheet via selling of Treasury Securities and agency MBS and most often allowing the bonds to run off on maturity of the bonds.

What the Fed said yesterday was they would slow down the pace of the selling of securities -- which can be positive for bond prices, ceteris paribus.

P.S. dated 21Mar2024: The US Fed on 20Mar2024 kept its federal funds rate unchanged at 5.25%-5.50%. The market sees Fed chair Powell's statement as bullish for both stocks, gold and silver.

S&P 500 index hit all time high y'day, after FOMC decision to hold interest rates steady.

Market interpretation of Fed Chair Powell's press conference comments: the pace of QT (quantitative tightening) will slow 'fairly soon.'

Slower pace of QT could be positive for markets.

P.S. dated 02Nov2023: The US Fed on 01Nov2023 kept its federal funds rate unchanged at 5.25%-5.50%.

P.S. dated 12Aug2023: What is the impact of Fed's monetary tightening on the US economy?

The Fed's current upward rate cycle started in Mar2022 and still continuing. During the period (17 months), the Fed funds rate has gone up by 525 basis points from almost zero percent. Combined with rate hikes, the Fed started quantitative tightening (QT) in Apr2022. In the past 16 months, Fed's balance sheet size decreased from USD 8,965 billion to USD 8,208 billion now, a decrease of just 8.4 percent.

It may be mentioned, during the QE period of Feb2020 to Apr2o22, Fed balance sheet grew by 115 percent -- so the decrease of just 8.4 percent in QT period is piffling. The impact of QT on US economy thus can be characterised as psychological rather than real.

The US CPI inflation peaked in Jun2022 at 9.1 percent. Due mainly to interest rate hikes and QT, the inflation dropped to 3 percent by Jun2023, before increasing to 3.2 percent in Jul2023. From Jul2023, the base effect started and inflation print inched up a little.

By Dec2022, US inflation number dropped to 6.5 percent. So, between now and the end of the Dec2023, one may not expect further steep drop in US inflation -- that too in the backdrop of crude oil prices reaching levels of USD 83 - 87 per barrel, the highest in nine months.

The US unemployment rate barely budged, from 3.6 percent in Mar2022 to 3.5 percent now, during the current monetary tightening cycle -- while labour force participation rate slightly increased from 62.4 percent to 62.6 percent in the same period.

One area where the Fed's monetary tightening has impacted US public is the steep increase in 30-year average fixed mortgage rate -- an increase of 320 basis points from 3.76 percent in Mar2022 to 6.96 percent now. The steep increase has negatively impacted the demand for new houses.

As per media reports repeated incessantly in the past 18 months, the US economy was supposed to experience a recession -- but recession is nowhere to be seen with US GDP real growth growing between 1.5 and 2 percent in recent quarters -- though the recession may knock at the US at some point in future.

There is some link, as seen in the past periods, between recessions and yield curve inversion, at least in the US. Since Jul2022, the US yield curve is in inversion (Fred graph below), meaning, for example, the 2-year Treasury note yield has been higher than the 10-year Treasury note yield continuously for the past 13 months.

Now, the media have stopped talking about inverted yield curve, because their talk of US recession has failed to materialise even after 18 months.

Updated charts of Fed monetary tightening cycles in Table 1, 2 and 3 >

P.S. dated 27Jul2023: The US Fed on 26Jul2023 raised its federal funds rate by 25 basis points to 5.25%-5.50%.

P.S. dated 04MAY2023: The US Fed on 03May2023 raised its federal funds rate by 25 basis points to 5.00%-5.25%.

This is the 10th consecutive rate hike by the Fed since the upward rate cycle started in Mar2022.

P.S. dated 23Mar2023: The US Fed on 22Mar2023 raised its federal funds rate by 25 basis points to 4.75%-5.00%.

References:

-------------------

Read more:

Adani Stocks Meltdown and Nifty Next 50 Index

Are Indian Stocks Immune to Adani stock Meltdown?

Meltdown in Adani group Listed Stocks

JP Morgan Guide to Markets

Why the Divergence Between Sensex and Nifty 50 in Today's Trade? Indian Stock Market Moves Fully to T+1 Settlement

NSE Indices Comparison 31Dec2022

BSE 500 vs S&P 500 Indices Compare 31Dec2022

Nifty 50 Index Yearly Movement 31Dec2022

India Up the Ladder in MSCI EM Index

New Rules on Ex-date and Record date

Crisil Report - Big Shift in Financialisation

Weblinks and Investing-------------------

Disclosure: I've vested interested

in Indian stocks and other investments. It's safe to assume I've interest in the financial instruments / products discussed, if

any.

Disclaimer: The analysis and

opinion provided here are only for information purposes and should not be construed

as investment advice. Investors should consult their own financial advisers

before making any investments. The author is a CFA Charterholder with a vested

interest in financial markets.

CFA Charter credentials - CFA Member Profile

CFA Badge

He blogs at:

https://ramakrishnavadlamudi.blogspot.com/

https://www.scribd.com/vrk100

Twitter @vrk100

No comments:

Post a Comment