Meltdown in Adani group Listed Stocks

(Updates 24Jan2024, 03Mar2023, 24Feb2023, 08Feb2023, 07Feb2023 and 06Feb2023 are available at the end of the article)

(This is not a recommendation for trading in any stocks discussed here. The author has a vested interest in stocks and other financial instruments. Please consult your own financial adviser before acting).

------------------

Related Blogs:

Adani Stocks Meltdown and Nifty Next 50 Index 15Feb2023

Are Indian Stocks Immune to Adani Stocks Meltdown 08Feb2023

Meltdown in Adani group Listed Stocks 04Feb2023

Why the Divergence Between Sensex and Nifty 50 in Today's Trade? 01Feb2023

------------------

A meme that is floating on Twitter >

A meme is worth more than a 1,000 words!

In the past seven trading days, that is, between 25Jan2023 and 03Feb2023, nine listed stocks of Adani group have lost nearly 50 percent of their market capitalisation (market capitalisation or market cap is market price of a share or stock multiplied by its outstanding equity shares).

The market cap loss for the group is Rs 9.10 lakh crore or about USD 110 billion in the last seven trading days.

This meltdown in Adani group stocks has rattled the confidence of investor community in India. Various stakeholders have started questioning the lead promoter, Mr Gautam Adani, who is seen as close to India's political leaders.

(story continues below)

------------------

Related Blogs:

Why the Divergence Between Sensex and Nifty 50 in Today's Trade?

------------------

Back story

After closure of market hours on 24Jan2023, a US-based forensic financial research firm, namely, Hindenburg Research, released a report on Adani group alleging stock manipulation and accounting fraud.

While the Hindenburg's allegations were dismissed immediately by the Adani group, the stock market had different take on the group stocks.

Reacting negatively to the allegations of the report, all the stocks of Adani group, including their recently acquired cement companies, ACC Ltd and Ambuja Cements, started falling upon the opening of stock exchanges on 25Jan2023.

The release of Hindenburg report strangely coincided with the opening of Rs 20,000-crore further public offer (FPO, also known as follow-on public offer) by Adani Enterprises Limited, one of the flagship firms of Adani group.

The FPO was scheduled to open for public on 27Jan2023 and was to close on 31Jan2023. The offer price band was Rs 3,112 to Rs 3,276 per FPO equity share. Some institutional investors, like, LIC of India, India's biggest life insurance company owned by Government of India, SBI Life Insurance, HDFC Life Insurance and Abu Dhabi Investment Authority had already applied for the FPO shares as anchor investors before the opening of the FPO to the public.

FPO fully subscribed

In the four trading days between 25Jan2023 and 31Jan2023, all the Adani group continued to fall. Meanwhile, the big doubt for all investors was whether the FPO of Adani Enterprises would get full subscription amidst the crash of Adani group stocks.

But luckily for the Adani group, the FPO was subscribed 1.12 times on the last day of the offer, with big help from non-institutional investors from several business groups, like, Reliance Industries, Torrent Pharma group, JSW Steel and Zydus Cadila group. By day's end on 31Jan2023, market participants felt relieved the Adani FPO sailed through at the last minute. But the relief did not last much for there was more drama to come in the Adani Meltdown (more on this later).

I'm curious to know why did these market-savvy investors apply for the Adani FPO in the first place when the offer price (upper band Rs 3,276) was 9 percent higher than the market price (on last day of FPO, the price was around Rs 3,000)?

Can we give any 'benefit of doubt' to them on the presumption that they couldn't have got the shares at the available market price due to high impact cost when investors want to buy shares in large sizes? (it seems to be a case of 'you scratch my back and I scratch yours in return').

Let us now see how the Adani stocks reacted after the release of Hindenburg report -- that is, between 25Jan2023 and 03Feb2023.

I divide the period into two:

-- first, between 25Jan2023 and 31Jan2023 -- two important dates being the release of Hindenburg report and the closure of Adani FPO

-- second, between 31Jan2023 and 03Feb2023 -- the dates being the closure of Adani FPO and the last trading day.

Table 1: Rout in First 4 Trading Days:

Between 24Jan2023 and 31Jan2023:

(please click on the image to view better)

What Table 1 reveals is:

-- in the first four trading days, that is, between end-24Jan2023 and end-31Jan2023, Adani group stocks lost 29 percent or Rs 5.60 lakh crore of their market cap

-- while the original seven firms of Adani group lost 30 percent or Rs 5.33 lakh crore of their market cap, the remaining two firms, namely ACC Ltd and Ambuja Cements, lost only 18 percent or Rs 26,300 crore of their market cap

-- the market seemed to have made a distinction between the highly indebted original seven Adani group firms and the zero-debt two cement firms (ACC and Ambuja Cements)

-- the insight here is stock market treats companies with high leverage differently from companies with low- or zero-debt

-- the biggest loser among the nine listed firms was Adani Total Gas, which lost more than 45 percent of its value in just four trading days, while the smallest loser was Adani Enterprises with 13.6 percent fall and the next smallest loser was ACC with 15.7 percent loss

-- the relevant question for investors and other stakeholders is why did Adani Enterprises (which was in FPO) stock lose only 13.6 percent of its share price while other original Adani group stocks lost between 20 percent and 45 percent of their value?

-- why did the stock of Adani Enterprises not fall in line with other group firms' stocks and who are the traders and / or investors backing the stock?

-- but for the support of some mysterious investors, the stock of Adani Enterprises would have fallen in line with the fall of other group stocks

-- in hindsight, it appears some investors artificially supported the stock of Adani Enterprises so that its FPO would sail through smoothly

-- had the stock of Adani Enterprises fallen 30 percent or 40 percent between 24Jan2023 and 31Jan2023, its FPO would have failed to get subscription

-- in table 2 below, I provide details of stock reaction between 31Jan2023 (closure of Adani FPO) and now

-- by observing how the Adani Enterprises stock reacted before the closure of FPO and after the FPO, you, as intelligent investors, can come to your own conclusions as to whether there is any artificial support for the stock during the FPO period

Table 2: Rout in Last 3 Trading Days:

Between 31Jan2023 and 03Feb2023:

(please click on the image to view better)

What Table 2 reveals is:

-- in the last three trading days, that is between 31Jan2023 (last day of Adani FPO) and now (03Feb2023), the nine Adani groups stock lost 26 percent or Rs 3.52 lakh crore of their market cap

-- as shown already in Table 1, the stock market again showed a clear distinction between the seven original Adani firms and the two recently Adani-acquired firms, namely, ACC Ltd and Ambuja Cements

-- in my opinion, investors should not take this fine distinction as granted; the situation may change in the next several days / weeks -- if the other seven stocks are further subject to more selling pressure, the outlook for the two cement stocks might weaken depending on the future fund raising capacity of the group

-- in the last three trading days, the seven original firms lost 27.8 percent or Rs 3.45 lakh crore market cap, while ACC and Ambuja Cements combined lost just 5.3 percent Rs 6,200 crore of their market cap

-- the biggest loser, in the last three trading days, of the nine firms is Adani Enterprises, which lost 47 percent or Rs 1.60 lakh crore of its market cap -- for a Nifty 50 index stock, such a loss is huge

-- another relevant question for the market and the regulatory authorities is why did Adani Enterprises (which is part of the Nifty 50 index) lose almost 50 percent of its share price in just three days, while its share price mysteriously showed resilience till the closure of its FPO on 31Jan2023?

-- to repeat: between 24Jan2023 and 31Jan2023, the stock of Adani Enterprises lost just 14 percent in four trading days (till FPO closure), while the stock crashed almost 50 percent (between 31Jan2023 and 03Feb2023) in the next three trading days after the closure of FPO

-- is there any artificial support for the stock of Adani Enterprises till 31Jan2023 and who has provided such a support if any? -- these are the questions that have been bedeviling the minds of market participants

-- these questions need to be answered by the regulatory authorities concerned urgently in the interest of the integrity of markets

-- the smallest loser is ACC Limited, which lost just 2.2 percent of its market cap in the same period

-- while Ambuja Cements fell by 6.8 percent, other Adani firms lost between 14 percent and 24 percent of their market cap

-- due to steep fall in prices of Adani group stocks, India's stock exchanges have, in the past few days, put several stocks of Adani group under additional surveillance measures (ASM is a mechanism mandated by the capital market regulator to control any excess volatility in stock prices)

-- some of these stocks are also under different circuit filters (which are standard stock exchange practices put in place to control volatility in stock prices) -- for example, Adani Wilmar is under 5% circuit filter while Adani Green Energy stock is under 10% circuit filter

-- a stock circuit filter is a safety mechanism established by stock exchanges to arrest volatility in stocks -- for example, a stock on 10% circuit filter will not be allowed to rise or fall by more than 10 percent in a single trading day

-- the combined market cap of the two cement firms is just 11 percent of the total market cap of nine Adani group listed firms as at the end of 03Feb2023 -- this is relevant because if the high-debt companies of Adani group were to suffer any liquidity or solvency issues going forward, the heavyweight stocks of Adani group may have outsized impact on the the two cement firms, which were acquired by the Adani group from Holcim group in 2022

-- here, I'm not suggesting that the Adani group would face any liquidity or solvency issues in future; but investors and other stakeholders should keep an open mind on the topic

-- the next table reveals how the stocks performed between 25Jan2023 and 03Feb2023 combining the above two periods we've examined so far

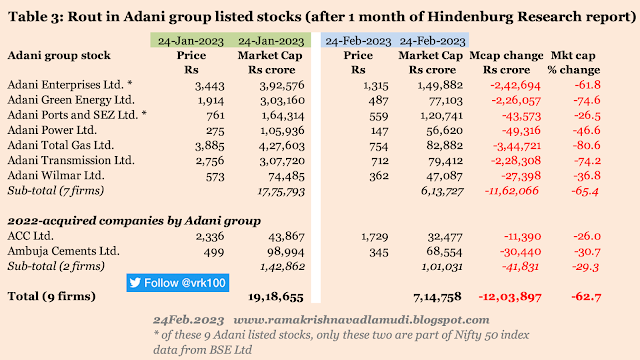

Table 3: Rout in Last 7 Trading Days:

Between 24Jan2023 and 03Feb2023:

(please click on the image to view better)

What Table 3 reveals is:

-- in just seven trading days between 24Jan2023 and 03Feb2023, the total loss in market capitalisation of nine Adani group stocks is nearly 50 percent or Rs 9.10 lakh crore

-- these are big numbers for Indian stock market

--

the biggest losers in the last seven trading days are Adani Total Gas

(down 58 percent) and Adani Enterprises (down 54 percent)

--

it may be repeated that Adani Enterprises stock for some mysterious

reasons fell only 13.6 percent before the FPO, but once the FPO sailed

through the stock lost 46.8 percent of its market cap

--

as investors, we need to be alert and do our own diligence and ask

questions as to why a stock issuing an FPO showed resilience during the FPO period

and it fell precipitously once the FPO was fully subscribed

-- the seven original Adani firms lost 49.5 percent or Rs 8.78 lakh crore since the release of Hindenburg report, while their two sister firms in the cement industry lost just 22.7 percent or Rs 32,500 crore of their total market cap

Collateral damage

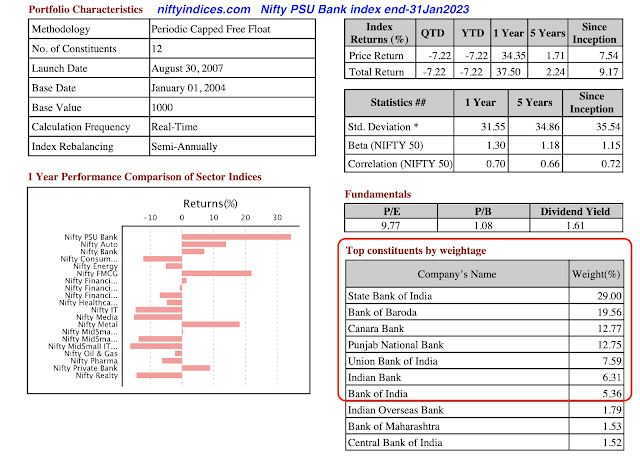

In any event like the Adani stocks meltdown, there is bound to be collateral damage. The meltdown has resulted in fall in stock prices of public sector banks (PSBs) and Life Insurance Corporation of India -- which are majority owned by the Government of India.

The PSB and LIC of India stocks have fallen due to the fact that they have exposure to the equity shares and debt instruments of Adani group of companies, both listed and unlisted. Though the government, the bank management and LIC management have tried to allay the concerns of the investors and wider public, these stock prices continued their downfall.

Let us see the extent of collateral damage from Adani stock rout to the stocks of PSBs and LIC.

Table 4: Fall in prices of PSB stocks and LIC of India

Between 24Jan2023 and 03Feb2023:

(please click on the image to view better)

What table 4 reveals is:

-- the seven public sector banks (PSBs) including State Bank of India, Bank of Baroda and Canara Bank have suffered a total market cap loss of 7.7 percent or Rs 66,700 crore during the period from 25Jan2023 to 03Feb2023

-- these seven PSBs have a weighting of more than 90 percent in Nifty PSU Bank index - hence, I've used only these seven PSBs for the analysis

-- Nifty PSB Bank index suffered a loss of 7.2 percent - in contrast, Nifty Private Bank index fell by just 2.3 percent in the same period

-- the damage to the stock price of LIC of India is almost double that of PSB stocks - LIC lost a market cap of 14.7 percent or Rs 65,000 crore

-- the total market cap loss of the seven PSBs and LIC is 10 percent or Rs 1.32 lakh crore

Adani Meltdown versus the overall market

Though the meltdown of Adani group stocks (except ACC and

Ambuja Cements) has a trickle down effect on stocks of public sector

banks and LIC of India -- which have exposure to the debt and equity of

Adani group companies -- the overall stock market has so far seems to

have taken the meltdown in its stride.

The loss in market cap of the overall market is not significant (this is till yesterday, and I don't know whether the current overall market resilience to Adani meltdown will continue in future).

As at the end of 03Feb2023, the market cap of all BSE listed firms is Rs 266.73 lakh crore (end-24Jan2023, it's Rs 280.40 lakh crore and end-31Jan2023, it's Rs 270.23 lakh crore).

The total loss of market cap of all BSE listed firms is only 4.9 percent or Rs 13.67 lakh crore in the last seven trading sessions (for comparison purposes, I repeat: the nine Adani group stocks lost 47.5 percent or Rs 9.10 lakh crore of market cap).

Big assumption

It may be

mentioned that the balance sheets of ACC and Ambuja Cements are quite

healthy and they generate stable cash flows as their track

record demonstrates.

The market seems to be thinking that any liquidity problems the Adani group firms might encounter in future may not materially impact the fortunes of ACC and Ambuja Cements.

But the Adani group has huge plans to expand the capacities of the cement firms -- it remains to be seen how the group will be able to provide for their future capital expenditure in the next two to three years.

In financial markets as in life, we need to question all the assumptions we make because we don't know what the future holds for companies / business conglomerates and heavily-indebted firms like the seven original Adani group listed companies.

All our current assumptions may prove wrong in future if the Adani group were to find it hard to raise additional capital to expand its nascent and well-established businesses.

However, in markets we go by probabilities.

In my opinion, based on the current market conditions, there is a fair chance the group may weather the liquidity problems it faces now -- with a caveat there are no guarantees in markets and I've not fully studied the Adani group firms and their businesses.

If market conditions change in future, I'll be forced to change my opinion as the future unfolds.

Cancellation of fully-subscribed FPO

Once the FPO is fully subscribed, market participants thought the rout for Adani group stocks was over. But they were wrong. The stocks of Adani group continued to crash on 01Feb2023, the day after the closure of FPO.

After closure of market hours on 01Feb2023, in a surprise development, Adani Enterprises announced the withdrawal of its FPO saying it would return the money it collected to FPO subscribers due to adverse market conditions.

This further exacerbated the fall in Adani group stocks on 02Feb2023. The fall in the stocks continued till about mid-day on 03Feb2023 and in the second half of the trading day, a few of the Adani group stocks recovered from their intra-day low prices.

Stock manipulation?

The resilience, till 31Jan2023, of the stock price of Adani Enterprises amidst free fall in other group stocks, and its subsequent crash post-FPO have created doubts among the investors and other stakeholders.

They have been anxiously looking for answers from Adani group. In addition, most of the serious allegations are yet to be assuaged by the Adani group.

Big questions for investors

While the rout in Adani groups stocks continues unabated, investors are raising questions about the long-term expansion plans of the group.

Investors are also questioning the studied silence of the regulatory authorities. Late yesterday, India's central bank issued a boiler-plate announcement saying the banking sector remains resilient and stable.

Will the Adani group stocks recover?

One key maxim in markets is: don't catch a falling knife -- meaning it's not worth our money to buy into stocks that are plunging on a daily basis. It may sound trite.

But the evidence in global markets indicates once an asset or an asset index loses its value excessively, say suffers a fall of 60 or 70 percent, it is hard for such an asset or index to recover their values. For example, Japanese Nikkei 225 is still nearly 30 percent below its Dec1989-peak of 39,000.

Even if they recover, it may take years. I'm not suggesting Adani group stocks won't recover in the near future. My guesstimate is the probability of Adani group stocks recovering their lost value fully is low to moderate in the next one to two years, because they had had a meteoric rise prior to 24Jan2023 and stocks tend to follow their own trends -- lower or upper or sideways.

My view could go wrong. (I've been often been wrong about markets in the past).

Summary

The Adani group has been put under pressure by the market in the past 10 days with the group losing almost 50 percent of its market value. For a growing firm and / or group, financial markets are vital from a capital raising viewpoint.

The higher the market value of a firm, the greater its solvency because firms with high market values can raise money from markets with ease and rapidity and at lower cost of capital.

Once the market confidence is shaken, it's hard for firms to raise new money from markets. If the ability of a firm to raise equity capital is high, then the risk for the firm's bondholders is low. When the market values of firms fall suddenly, it then could lead to higher risks for bondholders.

Markets are integrated -- what happens to stocks impacts bonds and vice versa. (here, I've not covered what is happening to bond values of Adani group)

Without doubt, market confidence in Adani group stocks is shaken if not in the conglomerate's business models.

What I have touched upon here is only a small fraction of the issues that are on the minds of market participants. I hope the big questions I've highlighted above will be answered by the authorities in due course.

The developments and news flow that are coming out relating to Adani group is fast and it takes time for us to understand and digest the news and the implications thereof. As such, we need to be cautious and watch the future events closely.

- - -

The following brief notes / images added after publishing the above article on 04Feb2023:

P.S. 10 dt 24Jan2024: After one year:

It is exactly one year since the peak of Adani Group stocks -- that is, after the Hindenburg Report on Adani Group was released on 24Jan2023 (Adani group stocks started their plunge on 25Jan2023).

As on 24Feb2023 (one month after the Hindenburg Report), the Adani group stocks lost Rs 12.04 lakh crore or 62.7 percent of their market cap. But since then, some of the stocks have recovered -- limiting the loss in the past one year to Rs 4.65 lakh crore (USD 56 billion) or 24.3 percent of market cap in the past one year.

It is remarkable that Adani Power stock gained 91 percent in the past one year, while Adani Ports & SEZ gained 47.7 percent in the same period.

The biggest losers in the past one year are: Adani Total Gas (74 percent loss), Adani Energy Solutions (formerly Adani Transmission, 62 percent loss) and Adani Wilmar (39 percent loss).

ACC lost 4.4 percent, while Ambuja Cements gained 5.9 percent in the past one year.

See two tables and compare them >

P.S. 9 dt 03Mar2023: In an interesting development, Adani group promoters on 02Mar2023 sold part of their stake in four of their listed companies (details in the two images below) via secondary market -- the buyer is a foreign investment firm, namely, GQG Partners

As the Adani group is facing a cash crunch, they are forced to sell their 'world class' assets at deep discount of between 40 and 84 percent.

(it's a universal law that we're forced to sell our best or most liquid assets when faced with liquidity / debt problems).

For example, Adani Transmission stock reached its all time high of Rs 4,238 last year; and yesterday the promoters were forced to sell 3.43 percent of their stake at Rs 668 per share at a deep discount of 84 percent.

In total, the total sale value is Rs 15,446 crore from four companies, and the entire money would go to the Adani promoters -- who may use the amount to retire their personal debts raised to acquire several companies in the past.

Here are the details of all four stocks that were sold in secondary market by Adani group promoters to GQG Partners.

P.S. 8 dt 24Feb2023: This is analysis of the Adani group stock meltdown after one month of the publication of the Hindenburg Research report:

Since 24Jan2023 when Hindenburg published its report, Adani group stocks (nine listed firms) have continued to plunge in the market wiping out Rs 12.04 lakh crore market cap for the group and a combined Rs 1.87 lakh crore market cap loss for public sector banks (PSBs) and LIC of India.

The total market cap loss for Adani group is nearly 63 percent, while the Nifty PSU Bank index lost 13.7 percent in the past one month. Nifty Private Bank lost 6.1 percent while Nifty 50 lost 3.6 percent in the same period.

LIC stock lost 16.7 percent in the past one month, whereas State Bank of India, Bank of Baroda and Canara Bank have lost 12 percent, 13 percent and 15 percent respectively in the same period.

Stocks of Adani Total Gas, Adani Green Energy and Adani Transmission each have lost more than 74 percent in one month, while ACC, Adani Ports and Ambuja Cements have lost around 30 percent each.

Of the total BSE market cap loss of Rs 20.39 lakh crore in the past one month, 68 percent or Rs 13.91 lakh crore is from Adani group, PSBs and LIC combined.

In just one month, Adani group stocks have lost nearly 63 percent or USD 150 billion market cap -- its total market cap is just USD 86 billion now.

Four Adani stocks, namely, Adani Enterprise, Adani Green Energy, Adani Total Gas and Adani Transmission continue to be in ASM group as on date.

BSE Midcap and Smallcap have lost 3.4 and 2.9 percent respectively in the past one month -- indicating their immunity from Adani rout. But Nifty Next 50 lost more than 10 percent as the index is stuffed with Adani group stocks.

Of the 22 trading days in the past one month, only for seven days the market breadth (advances-declines ratio of BSE 500 index) has been positive -- meaning two-thirds of the time, overall market breadth is negative.

Looking at the overall figures, one gets the impression that Indian stocks in the one month since the start of Adani rout seem to to be immune to Adani rout. But I doubt whether the resilience of the overall Indian stock market to Adani meltdown will continue in future.

Event clustering >

Indian stocks are afflicted by a cluster of events >

1) Adani stocks meltdown,

2) pedestrian Gov't Budget (01Feb2023) proposals,

3) over-valuation, and

4) not so rosy 2023 for earnings

Please check the following four images for full details, including the valuation ratios and other financial ratios of nine Adani group stocks >

P.S. 7 dt 08Feb2023: For second day running, Adani stocks gained market cap overall today. On 08Feb2023, six of the nine Adani stocks gained, with the total market cap of all Adani stocks increasing by Rs 48,500 crore. Updated chart >

P.S. 6 dt 07Feb2023: On 07Feb2023, five of the nine Adani group stocks gained; with the total market cap of all Adani stocks rising by Rs 11,500 crore for the day. Updated chart >

P.S. 5 dt 06Feb2023: On 06Feb2023, most of the Adani group companies continue to lose their market values. The total market cap loss for all the nine Adani group companies today is Rs 27,500 crore. Updated chart >

valuation of Adani stocks end-06Feb2023: P/E, P/B, P/S, debt-equity, CMP, market cap, ROCE, promoter holding, and down % from 52-week, etc. > chart >

P.S. 4: The below chart provides how the Adani group stocks performed year-to-date ahead of the Hindenburg Research report (that is, between 31Dec2022 and 24Jan2023). In the period, all the nine Adani firms combined lost only 2.3 percent of the market cap -- implying that the market had no inkling what was coming.

P.S. 3: Adani Enterprises Limited and Adani Ports & SEZ Limited are part of the Nifty 50 index (with 50 stocks) of the National Stocks Exchange of India (NSE) Limited. But they are not part of Sensex (30 stocks) developed by the BSE Limited. Some market veterans are questioning the decisions of NSE stock selection committee's criteria for Nifty 50 components.

P.S. 2: As on 03Feb2023, all the Adani group stocks, except ACC and Adani Wilmar, are under ASM stage 1 of the stock exchanges. 5% filter for Adani Wilmar, Adani Power and Adani Total Gas. 10% circuit filer for Adani Transmission and Adani Green Energy. No circuit filter for Adani Enterprises and Adani Ports & SEZ as they are part of F&O segment. Even though Adani Enterprises, Ambuja Cements and Adani Ports & SEZ are part of F&O segment; they're now under ASM by stock exchanges (ASM - additional surveillance measures).

P.S. 1: SEBI too, on 04Feb2023, issued a boilerplate statement, similar to RBI's, saying it works for integrity and stability of markets.

Disclosure: The author has been an equity shareholder of ACC Limited for nearly four years. And I've no political leanings and my knowledge of politics is negligible. Disclaimer: This is not a recommendation for any shares or other financial instruments. This is written just for educational purpose. Readers and investors should consult their own financial adviser before making any trade commitments.

-------------------

Read more:

JP Morgan Guide to Markets

Why the Divergence Between Sensex and Nifty 50 in Today's Trade?

Global Market Data: 2012 to 2022

Indian Stock Market Moves Fully to T+1 Settlement

NSE Indices Comparison 31Dec2022

BSE 500 vs S&P 500 Indices Compare 31Dec2022

Nifty 50 Index Yearly Movement 31Dec2022

India Up the Ladder in MSCI EM Index

New Rules on Ex-date and Record date

Mutual Fund Asset Class Returns 31Dec2022

BSE Broad and Sector Indices Market Cap 31Dec2022

Global Market data 31Dec2022

BSE Broad and Sector Indices Returns 30Dec2022

Crisil Report - Big Shift in Financialisation

Weblinks and Investing-------------------

Disclosure: I've vested interested

in Indian stocks and other investments. It's safe to assume I've interest in the financial instruments / products discussed, if

any.

Disclaimer: The analysis and

opinion provided here are only for information purposes and should not be construed

as investment advice. Investors should consult their own financial advisers

before making any investments. The author is a CFA Charterholder with a vested

interest in financial markets.

CFA Charter credentials - CFA Member Profile

CFA Badge

He blogs at:

https://ramakrishnavadlamudi.blogspot.com/

https://www.scribd.com/vrk100

Twitter @vrk100

No comments:

Post a Comment