Brief History of India's 1991 Forex Crisis and Gold Pledge

(Timeline of events, key players in the drama, book and other references, screenshots and sources of information for writing the blog are given at the end of blog).

India’s foreign exchange crisis of 1990/1991 had been brewing for some time and it was waiting to happen. Its origins could be traced back to loose fiscal policies adopted by Government of India in the 1980s.

Twin Deficits

India’s fiscal deficit had been extremely high in the 1980s. Fiscal deficit of the Central government rose from 5.4 per cent of GDP (gross domestic product or national income) in 1981-82 to 8.1 per cent by 1989-90.

If you combine Central and State governments, the fiscal deficit rose to as much as 10 per cent of GDP by the late 1980s and further rose to 12 per cent of GDP by 1990-91.

Moreover, India had seen four prime ministers and two Parliamentary elections between 1989 and 1991. Frequent leadership changes between 1989 and 1991 and unsustainable fiscal policies by successive governments in the 1980s had a negative impact on Indian economy.

For much of the late 1980s, India’s current account deficit was more than 2 per cent of GDP. It may be noted India was a completely closed economy in the 1980s though some feeble attempts were to open up the economy in mid-1980s.

The political leadership in New Delhi had ignored warnings, of fiscal profligacy and dwindling forex reserves, from Reserve Bank of India (RBI), India’s central bank.

The 1991 forex crisis is also known as Balance of Payments (BoP) crisis. Gulf War added fuel to India’s forex crisis, with Iraq invading Kuwait in August 1990. Crude oil prices shot up due to the Gulf War, making India’s import bill higher. India typically depends on imported oil for more than three-fourths of its needs.

Foreign remittances from Non-Resident Indians (NRIs) from the Gulf region plummeted adding to India’s woes in the external sector. In addition, NRIs were withdrawing money from their Indian accounts.

The actions and inaction of successive governments in the 1980s compounded the issues facing Indian economy. India’s exports suffered during the period. These have culminated with India facing serious forex crisis in 1990/1991.

India’s foreign exchange reserves were dwindling rapidly in 1990 and 1991. India had to take a loan from International Monetary Fund (IMF) under conditionalities imposed by IMF.

As of Mar1990, India's foreign exchange reserves were just enough to cover two months of India's imports.

The import cover of reserves further declined to three weeks of imports by the end of Dec1990.

Political crisis

In Feb1991, Rajiv Gandhi’s Congress (I) party withdrew support to Chandra Shekhar government. Chandra Shekhar formed a minority government only in Nov1990 with unconditional support from Congress (I), but the minority government had to go in a short period of time.

The government even could not present a full budget as the Chandra Shekhar’s party lacked majority in Lower House of India's Parliament. Finance minister Yashwant Sinha could only present an interim budget as Parliamentary elections were called.

It was a caretaker government, under prime minister Chandra Shekhar, that took the decision to mortgage India’s gold and raise foreign exchange, with a view to ameliorating the country’s foreign exchange position.

If you combine Central and State governments, the fiscal deficit rose to as much as 10 per cent of GDP by the late 1980s and further rose to 12 per cent of GDP by 1990-91.

Moreover, India had seen four prime ministers and two Parliamentary elections between 1989 and 1991. Frequent leadership changes between 1989 and 1991 and unsustainable fiscal policies by successive governments in the 1980s had a negative impact on Indian economy.

For much of the late 1980s, India’s current account deficit was more than 2 per cent of GDP. It may be noted India was a completely closed economy in the 1980s though some feeble attempts were to open up the economy in mid-1980s.

The political leadership in New Delhi had ignored warnings, of fiscal profligacy and dwindling forex reserves, from Reserve Bank of India (RBI), India’s central bank.

The 1991 forex crisis is also known as Balance of Payments (BoP) crisis. Gulf War added fuel to India’s forex crisis, with Iraq invading Kuwait in August 1990. Crude oil prices shot up due to the Gulf War, making India’s import bill higher. India typically depends on imported oil for more than three-fourths of its needs.

Foreign remittances from Non-Resident Indians (NRIs) from the Gulf region plummeted adding to India’s woes in the external sector. In addition, NRIs were withdrawing money from their Indian accounts.

The actions and inaction of successive governments in the 1980s compounded the issues facing Indian economy. India’s exports suffered during the period. These have culminated with India facing serious forex crisis in 1990/1991.

India’s foreign exchange reserves were dwindling rapidly in 1990 and 1991. India had to take a loan from International Monetary Fund (IMF) under conditionalities imposed by IMF.

As of Mar1990, India's foreign exchange reserves were just enough to cover two months of India's imports.

The import cover of reserves further declined to three weeks of imports by the end of Dec1990.

Political crisis

In Feb1991, Rajiv Gandhi’s Congress (I) party withdrew support to Chandra Shekhar government. Chandra Shekhar formed a minority government only in Nov1990 with unconditional support from Congress (I), but the minority government had to go in a short period of time.

The government even could not present a full budget as the Chandra Shekhar’s party lacked majority in Lower House of India's Parliament. Finance minister Yashwant Sinha could only present an interim budget as Parliamentary elections were called.

It was a caretaker government, under prime minister Chandra Shekhar, that took the decision to mortgage India’s gold and raise foreign exchange, with a view to ameliorating the country’s foreign exchange position.

It was a political crisis combined with forex crisis that threatened to jeopardise India's economic future.

Rating downgrade

Standard & Poor’s on 29May1991 downgraded India’s sovereign credit rating from BBB- (investment grade) to BB+ (below investment grade). Only in Jan2007 did S&P upgrade India from BB+ to BBB-.

IMF withdrawals

Amidst the crisis, RBI was not sitting quiet. RBI tried to raise resources from abroad to tide over the forex crisis. They approached International Monetary Fund (IMF). Between Jul1990 and Sep1990, RBI withdrew balances it held with IMF in the form of Special Drawing Rights (SDRs). More withdrawals from IMF facilities were made by RBI in Jan1991 and Jul1991.

Gold revaluation

In Oct1990, RBI revalued the gold in its forex reserves to international market rates – with gold holdings rising from USD 520 million at the end of Sep1990 to USD 3.68 billion by the end of Oct1990. This revaluation enabled RBI to boost its forex reserves (gold is part of RBI’s forex reserves) from USD 3.51 billion at end-Sep1990 to USD 6.21 billion at end-Oct1990.

Till 16Oct1990, gold was valued by RBI at a fixed rate of Rs 84.39 per 10 grams – the revaluation of gold effective 17Oct1990 was done at a market price of Rs 1,991.64 per 10 grams.

Government of India had to issue an ordinance to facilitate RBI for the gold revaluation. All the gold revaluation and IMF withdrawals were not sufficient to keep India's external sector in order.

Under these dire circumstances on the external front, RBI has to take drastic steps in consultation with Government of India.

Among the measures taken during 1990 / 1991 was the decision to pledge gold holdings held by RBI in international market and raise valuable foreign exchange to meet India’s needs. Pledging of gold was a hard political decision, but Chadra Shekhar government took a bold decision to save India from the foreign exchange crisis.

Such tough actions were necessary because India’s credibility was at stake and tough actions were imperative. India could not afford to default on its foreign obligations. At that time, India was in desperate need of foreign exchange to make payments to foreign lenders and to import oil and other essentials.

RBI had undertaken two transactions of gold pledge during 1991 under two different Central Governments.

The first was during May1991 when Yashwant Sinha as finance minister authorised State Bank of India (SBI) to sell 20 tonnes of gold with an option to repurchase it later.

The second was to pledge 46.91 tonnes of gold during Jul1991, when Manmohan Singh was finance minister, in the international market.

First transaction – SBI sold confiscated gold and bought it back after six months

In May 1991, finance minister Yashwant Sinha, after consent from prime minister Chandra Shekhar, permitted State Bank of India (SBI) to sell 20 tonnes of gold on the condition that SBI should return the gold to the government within six months.

This was done as Parliamentary elections for Lower House were being held (May and June 1991).

The 20 tonnes of gold sold by SBI was confiscated gold. In those days, gold smuggling into India was rampant due to curbs on gold imports, which were restricted as India was short of precious foreign exchange. You may have to see Bollywood movies of 1970s to appreciate the gold smuggling phenomenon. 😁

Customs authorities used to confiscate gold and the government used to keep the confiscated gold with SBI, which would sell the gold in the market.

A quantity of 20 tonnes, out of confiscated gold, was leased to State Bank of India (SBI) by Government of India for a period of six months on the condition the gold be returned to the government. SBI sold the gold with a repurchase option in the international market.

Against the 20 tonnes of gold, RBI received USD 200 million (or Rs 400 crore) of foreign exchange.

SBI repurchased the leased gold in Nov/Dec1991 and returned it to Government of India.

Second transaction – RBI pledged its own gold and bought it back six months later

After consultations with the Central government, RBI decided to pledge, with other central banks, a small part of its own gold.

A quantity of 20 tonnes, out of confiscated gold, was leased to State Bank of India (SBI) by Government of India for a period of six months on the condition the gold be returned to the government. SBI sold the gold with a repurchase option in the international market.

Against the 20 tonnes of gold, RBI received USD 200 million (or Rs 400 crore) of foreign exchange.

SBI repurchased the leased gold in Nov/Dec1991 and returned it to Government of India.

Second transaction – RBI pledged its own gold and bought it back six months later

After consultations with the Central government, RBI decided to pledge, with other central banks, a small part of its own gold.

A decision was made to lease 46.91 tonnes, out of RBI's gold reserves, with Bank of England (BoE) and Bank of Japan (BoJ), central banks of Great Britain and Japan respectively -- in order to raise the much needed foreign exchange.

But the central banks insisted on shipping the physical gold pledged to BoE in London. RBI had no choice but to arrange for airlifting the gold to BoE vaults in London.

But the central banks insisted on shipping the physical gold pledged to BoE in London. RBI had no choice but to arrange for airlifting the gold to BoE vaults in London.

The gold was airlifted from Bombay to London in four consignments in Jul1991. The second transaction involving BoE and BoJ fetched RBI foreign exchange worth USD 405 million.

All these decisions about gold pledging were being done in great secrecy, because India had to protect its economic and strategic interests. But it was not to be.

During the shipment of gold from RBI’s vaults in South Bombay to Bombay airport, one intrepid Indian Express reporter Shankkar Aiyar got wind of it and broke the story. It was a headline story in all 16 editions of Indian Express on 08Jul1991.

It is a different story India pledging gold became a political hot potato in 1991 and finance minister Manmohan Singh had to defend the pledging of gold in Parliament against a tirade from opposition parties.

Turnaround

To the great relief of all, India successfully handled the 1991 forex crisis and there was a turnaround. India was able to augment its forex reserves by 1992.

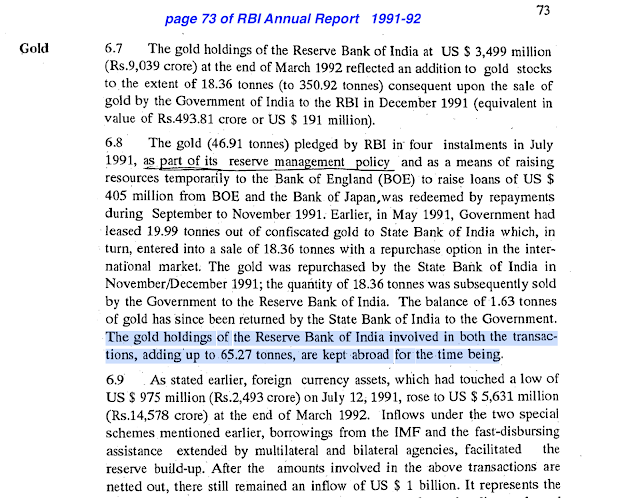

RBI repaid the loan between Sep1991 and Nov1991 and the pledged gold was released.

The gold was repurchased that was involved in both the transactions – one by SBI and the other by RBI.

But RBI took a decision to keep the gold involved in both the transactions, totaling 65.27 tonnes, abroad in Bank of England’s vaults ‘for the time being.’

(Note: the gold has since been in the safe custody of Bank of England vaults in London -- see also Chart 14 in Forex Data Bank)

RBI repaid the loan between Sep1991 and Nov1991 and the pledged gold was released.

The gold was repurchased that was involved in both the transactions – one by SBI and the other by RBI.

But RBI took a decision to keep the gold involved in both the transactions, totaling 65.27 tonnes, abroad in Bank of England’s vaults ‘for the time being.’

(Note: the gold has since been in the safe custody of Bank of England vaults in London -- see also Chart 14 in Forex Data Bank)

To Sum Up

Continuity is the theme of India’s economic reforms. Various governments and personalities have played lead roles in India’s development over the years.

Despite political and ideological differences, all parties in power have contributed to India’s economic reforms in one way or other, though the 1991 Forex Crisis was a product of their own actions and inaction.

It was a combination of fiscal profligacy of the 1980s, Gulf War in 1990 and frequent leadership changes in the late 1980s that pushed Indian Economy to the brink. Luckily, the crisis was successfully handled and India is back in the reckoning.

Though governments in the 1980s messed up India’s finances and consequently India’s credit rating, India has overall done well subsequently.

Even a caretaker government like that of Chandra Shekhar took bold decisions to rescue India out of the forex crisis. And the biggest economic reforms India had ever seen were undertaken by a Congress (I) minority government of PV Narasimha Rao during 1991 and 1993.

Prime minister PV Narasimha Rao and finance minister Manmohan Singh took bold economic decisions to steady India’s economic ship. The economic reforms undertaken by them during 1991 to 1993 were unprecedented in India’s economic history and ultimately paved the way for strong economic growth later.

- - -

--------------------------------------------------------------

Timeline of Events Leading to Gold Pledge by RBI:

1980s: India had high and unsustainable fiscal deficits

1986-1990: For much of the period, India's current account deficit (CAD) was more than 2 per cent of GDP

1989 to 1991: India had seen four prime ministers

Aug1990: Gulf War broke out with Saddam Hussein’s Iraq invading Kuwait

Oct1990: Gold was revalued to international prices

Nov1990: Chandra Shekhar formed the Central government with Congress (I) party’s outside support

Feb1991: Rajiv Gandhi's Congress (I) party withdrew support to Chandra Shekhar government based on some flippant allegations

Mar1991: Chandra Shekhar resigned as prime minister and his government became a caretaker government

Apr1991: Lower House of Parliament was dissolved and elections were called

Apr1991: India decided to pledge / sell 20 tonnes of confiscated gold

May1991: SBI sold 20 tonnes of confiscated gold with an option to repurchase it; raised USD 200 million

21May1991: Rajiv Gandhi was assassinated during an election rally

29May1991: S&P downgraded India to below Investment grade

21Jun1991: PV Narasimha Rao of Congress (I) took over as India’s prime minister

Jul1991: RBI pledged 46.91 tonnes of its own gold and the gold was shipped out of India in four consignments; raised USD 405 million

08Jul1991: Indian Express broke the story of gold moving from RBI vaults to Bombay airport

Sep1991 to Nov1991: the loan taken against gold pledge was repaid by RBI and the pledged gold was released

Nov/Dec1991: SBI repurchased the gold it sold in May1991

Dec1991: RBI decided to keep the 65.27 tonnes of gold abroad

Aug1990: Gulf War broke out with Saddam Hussein’s Iraq invading Kuwait

Oct1990: Gold was revalued to international prices

Nov1990: Chandra Shekhar formed the Central government with Congress (I) party’s outside support

Feb1991: Rajiv Gandhi's Congress (I) party withdrew support to Chandra Shekhar government based on some flippant allegations

Mar1991: Chandra Shekhar resigned as prime minister and his government became a caretaker government

Apr1991: Lower House of Parliament was dissolved and elections were called

Apr1991: India decided to pledge / sell 20 tonnes of confiscated gold

May1991: SBI sold 20 tonnes of confiscated gold with an option to repurchase it; raised USD 200 million

21May1991: Rajiv Gandhi was assassinated during an election rally

29May1991: S&P downgraded India to below Investment grade

21Jun1991: PV Narasimha Rao of Congress (I) took over as India’s prime minister

Jul1991: RBI pledged 46.91 tonnes of its own gold and the gold was shipped out of India in four consignments; raised USD 405 million

08Jul1991: Indian Express broke the story of gold moving from RBI vaults to Bombay airport

Sep1991 to Nov1991: the loan taken against gold pledge was repaid by RBI and the pledged gold was released

Nov/Dec1991: SBI repurchased the gold it sold in May1991

Dec1991: RBI decided to keep the 65.27 tonnes of gold abroad

1992: Forex crisis blows over

--------------------------------------------------------------

Key players in the 1991 Forex Crisis and Gold Pledging drama:

--------------------------------------------------------------

Key players in the 1991 Forex Crisis and Gold Pledging drama:

R Venkataraman was India's president between 1987 and 1992

Chandra Shekhar was India’s prime minister from 10Nov1990 to 21Jun1991

Yashwant Sinha was India’s finance minister from 21Nov1990 to 21Jun1991

PV Narasimha Rao was India’s PM from 21Jun1991 to 16May1996

Manmohan Singh was India’s FM from 21Jun1991 to 16May1996

Yashwant Sinha was India’s finance minister from 21Nov1990 to 21Jun1991

PV Narasimha Rao was India’s PM from 21Jun1991 to 16May1996

Manmohan Singh was India’s FM from 21Jun1991 to 16May1996

Ram N Malhotra was RBI governor between 04Feb1985 to 22Dec1990

S Venkitaramanan was RBI governor between 22Dec1990 and 21Dec1992

Deepak Nayyar was chief economic advisor to Govt of India from 1989 to 1991

Deepak Nayyar was chief economic advisor to Govt of India from 1989 to 1991

--------------------------------------------------------------

References and additional data:

Top image: AI image from Google Gemini

More references were given throughout the blog

Tweet thread (Post X) 17Jun2024 - 1991 Forex Crisis and Gold Pledge

RBI Annual Report 1990-91 - pages 107,117 & 118 - 1991 forex crisis and gold pledge

RBI Annual Report 1991-92 - page 73 - repayment of loan and release of gold pledged in Jul1991

RBI Annual Report 1990-91 - pages 107 & 195 - gold revaluation effective 17Oct1990

Yashwant Sinha article - The Hindu 29Jul2016

C Rangarajan article - The Print 26Nov2022

C Rangarajan article - Indian Express 28Mar2016

Article 25Jul2016 in The Hindu by Deepak Nayyar

Article 04Feb2016 Indian Express

"Secret Sale of Gold by RBI Again" - this NDTV Profit article contains the Indian Express article screenshot

Book references:

"Confessions of A Swadeshi Reformer" by Yashwant Sinha

"Advice & Dissent: My Life in Public Service" By YV Reddy

"Backstage: The Story Behind India's High Growth Years" By Montek Singh Ahluwalia

"Who Moved My Interest Rate: Leading the RBI Through Five Turbulent Years" By D Subbarao

"Forks In The Road: My Days At RBI and Beyond" by C Rangarajan

-------------------

Read more:

Blog of Blogs Theme-wise

Indian Economy Data Bank

You Can Boast About It!

India Forex Data Bank

Big Surge in Number of Shareholders in PSUs

Why RBI Won't Favour A Strong Rupee

Currency Pairs: How to Calculate Depreciation or Appreciation

Sensex versus Gold Price

RBI's Record Surplus Transfer to Govt of India

The Little Secret Behind Nifty Next 50 Index's Recent Success

Rapid Rise of India's PMS Industry

NSE Indices Calendar Year Returns: 2006 to 2024

How to Buy Nifty Midcap Index 03May2024

NSE Emerging Indices Comparison 31Mar2024

India Passive Funds and Their Asset Size 29Apr2024

Global Market Data 31Mar2024

Understanding Real Sensex and Currency Debasement

Select Gilt Funds Performance

Disclosure: I've got a vested interest in Indian stocks and other investments. It's safe to assume I've interest in the financial instruments / products discussed, if any.

Disclaimer: The analysis and opinion provided here are only for information purposes and should not be construed as investment advice. Investors should consult their own financial advisers before making any investments. The author is a CFA Charterholder with a vested interest in financial markets.

CFA Charter credentials - CFA Member Profile

CFA Badge

Viewing Options for this blog in different formats:

He blogs at:

https://ramakrishnavadlamudi.blogspot.com/

X (Twitter) @vrk100

No comments:

Post a Comment