The Little Secret Behind Nifty Next 50 Index's Recent Success

(article continues below)

------------------------

Nifty Next 50 index's one-year return is 59 per cent, against Nifty 50’s 22 per cent and Nifty Midcap 150’s 52 per cent.

Nifty Next 50 index consists of mostly large-cap stocks and its strong one-year performance of 59 percent (versus Nifty 50’s 22 per cent) is a bit of surprise; because both indices comprise large-cap stocks.

Moreover, Nifty Next 50 has outperformed even Nifty Midcap 150 on a one-year basis (all the return data in this section are as of 10May2024).

2. Break-up of Nifty Next 50

Traditionally, we used to look at top 10 stocks and sectors of an index and decide whether the risk exposures match our needs while investing in passive funds based on a particular index.

On the contrary, if you look closely at the actual composition of Nifty Next 50, you will find a few surprising things:

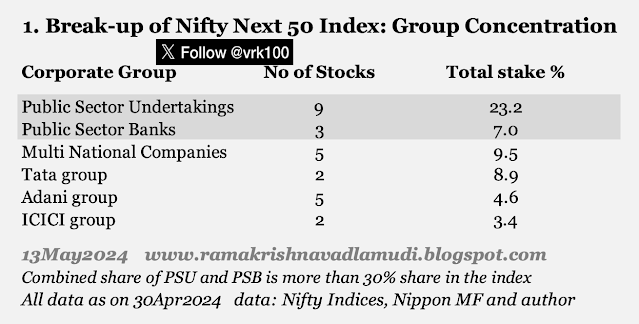

1) As of 30Apr2024, more than 30 per cent of the index consists of state-owned enterprises or majority-owned by Government of India.

2) Of the above, 23.2 per cent of the total consists of public sector undertakings and the share of public sector banks (PSBs) is 7 per cent.

3) As stocks of PSUs and PSBs have done well in the past four to six quarters, the outperformance of the Nifty Next 50 index is explained by the recent success of the PSU and PSB stocks. One-year returns for the Nifty PSE and Nifty PSU Bank indices are 107 and 80 per cent respectively.

As the Nifty Next 50 is stuffed with PSU and PSB stocks (a combined share of more than 30 per cent), the outperformance of PSU and PSB stocks has largely contributed to the recent success of Nifty Next 50 index.

Group concentration risk: Table 1 delineates the concentration risk of Nifty Next 50 index along the lines of groups, like, PSU, PSB, Adani group, Tata group, multi-national companies (MNCs) and ICICI group >

4. What of the future?

Investing is all about the future, to use a cliche. What would happen if the market perception of PSU and PSB stocks were to change for the worse in the next few quarters?

Naturally, the Nifty Next 50 will suffer relatively more if PSU and PSB stocks were to fall sharply. This is the concentration risk of owning stocks belonging to a particular sector or a corporate group.

It’s not that if you own non-PSU and non-PSB stocks, your portfolio would be fine in the event of any sharp fall in PSU and PSB stocks.

Everything is

inter-connected in markets. For the past four to five quarters, the Indian stock

market rally has been led by PSU, PSB, defence sector stocks, mid- and small-cap

stocks.

Any sudden change in perception of the potential of the recent winners is going

to impact the overall market including non-PSU, non-defence and non-PSB stocks.

In fact, Nifty Next 50 index suffered heavily in the first half of 2023 as Adani group stocks with 10.3 per cent share in the index faced meltdown after the Hindenburg Research report.

5. Index providers

While investing in passive funds, we assume index providers, like, NSE Indices

Ltd and S&P Global, are doing an adequate job of selecting stocks, sectors and

corporate groups wisely from a diversification and concentration risk mitigation point of view.

But if you look at the group concentration risk of Nifty Next 50, it is not clear whether NSE Indices Ltd is taking group concentration risk into consideration while selecting the stocks.

Sectoral concentration data, but not corporate group-wise data, is given by mutual

fund data aggregators, like, Rupee Vest, Value Research and Morningstar India.

As Investors, because our hard-earned money is on the line, we’ve to take care of our

money ourselves. Nobody will do a better job than yourself in wealth creation

and preservation.

It’s our duty to take care of what we’re buying. We need to analyse the data and find out what companies are there in an index

before buying passive funds passively,

Some active research of passive funds before buying them blindly will help us

in riding the recurring bouts of market volatility and will help you in staying the course under market crises.

Just because a group of stocks has done well in the past doesn’t mean it

will continue to do well in future. Stocks and other assets are often subject

to mean reversion.

Active funds, in theory, can derisk their portfolios by staying out of

controversial corporate groups or state-owned PSU / PSB groups belonging to the

Government of India.

But overall a majority of active funds have been doing a poor job in wealth creation and hence the need for a focus on passive funds for wealth preservation.

The problem with passive funds is investors don’t bother to check the individual constituents of the underlying index. This could pose problems for passive investors if they don’t know what they own.

It’s time data providers gave data based on corporate groups and PSU / PSB baskets.

Market obviously knows the actual composition of the Nifty Next 50 index, but it pretends to ignore the dangers of group concentration risk until the day of reckoning comes.

Are you comfortable owning an index with a big share of state-owned enterprises (SOEs), which are vulnerable to politically-motivated decision-making, misaligned capital allocation, opacity, inherent inefficiencies, bloated staff, high pension liabilities and unproductive assets?

As you know, cash flows of SOEs are directed to satisfy the needs of the Government of India resulting in capital mis-allocation and heartburn of minority shareholders.

Some investors with high risk tolerance and recency bias may see SOEs as an opportunity, but a majority of investors including the author may not share the same enthusiasm for SOEs.

It's better to know what you buy before you buy them.

-------------------

-------------------

Disclosure: I've got a vested interest in Indian stocks and other investments. It's safe to assume I've interest in the financial instruments / products discussed, if any.

Disclaimer: The analysis and opinion provided here are only for information purposes and should not be construed as investment advice. Investors should consult their own financial advisers before making any investments. The author is a CFA Charterholder with a vested interest in financial markets.

CFA Charter credentials - CFA Member Profile

CFA Badge

He blogs at:

https://ramakrishnavadlamudi.blogspot.com/

X (Twitter) @vrk100

No comments:

Post a Comment