The Pitfalls of Market Timing – And Why FOMO is Your Worst Financial Adviser 12Jul2025

(The views expressed here are for information purposes only and should not be construed as a

recommendation or investment advice. While the author is a CFA Charterholder with nearly 25 years of experience in financial markets, this content is intended to share general insights and does not constitute financial guidance. Please consult your financial

adviser before taking any investment decision. Safe to assume the author has a vested

interest in stocks / investments discussed if any.)

Nobel Prize winner Daniel Kahneman was a pioneer in behavioural finance, which tries to explain why people sometimes make irrational financial decisions. Behavioural finance combines psychology and economics.

Through his seminal books "Thinking, Fast and Slow" and "Noise," Daniel Kahneman exhorted investors to make fewer, more deliberate decisions and to avoid the cognitive pitfalls—such as overconfidence and noise—that often lead to poor outcomes in market timing.

Daniel Kahneman once said that we're not as rational as we think when it comes to money--and I couldn’t agree more. His work on behavioral finance makes us aware of our own biases and helps us in understanding our own behaviour in times of market booms and busts.

I was reminded of this all too clearly in my own investing journey, particularly with my long-held position in a telecom stock.

2. Frustration, Regret and a Missed Multibagger

In many cases, it seems almost inevitable—a stock often explodes right after we sell it.

Let me recount a personal experience. I held Bharti Airtel stock for nearly a decade. The stock underperformed for much of that time, and like many long-term investors, I grew frustrated. In 2019, I finally gave up and sold my shares at Rs 340 a piece, thinking I had cut my losses and moved on.

But then, something unexpected happened: Airtel stock surged. Over the next six years, the stock multiplied almost six times—a painful reminder of what I had missed.

But Airtel wasn’t the only one. Several other stocks in my portfolio have taught me similar lessons—about patience, timing and the emotional cost of investing.

Behavioral Finance in Action

Looking back, many of my mistakes weren’t analytical—they were emotional:

I acted out of exasperation and fatigue, not fundamentals.

Loss aversion: I was more focused on the years of underperformance than the long-term potential.

I fell into recency bias, letting short-term pain cloud long-term thinking. Market timing feels rational in the moment, but it's often driven by emotion and short-term thinking. In my case, it meant exiting just before the real returns began.

Anchoring bias: Once I sold, regret and anchoring kept me from re-entering. I was anchored to my sell price of Rs 340. Every new price felt "too high," even though the fundamentals had changed. Having made a decision, I subconsciously wanted to "stick with it" to avoid admitting I was wrong.

Daniel Kahneman’s work, especially in Thinking, Fast and Slow, now resonates deeply:

“We are prone to overreact to short-term noise and under-appreciate long-term trends.”

"All of us would be better investors if we just made fewer decisions."

While I’ve made clear errors, such as selling Bharti Airtel prematurely, the overall resilience of my equity portfolio shows the power of staying invested. Over the long term, the portfolio has outperformed the market by almost 10 percentage points—a reminder that patience and discipline often beat perfect timing.

Key takeaways:

> Better to avoid emotional selling and buying

> Making fewer, deliberate decisions outfoxes frequent, reactive ones

> Stay invested in quality and let compounding do the magic for you

> Mistakes are part of the journey, but staying invested for long time pays off

3. Pitfalls of Market Timing

Let us assume I'm prone to market timing. What assumptions I'm making here?

> I can forecast when the market will go up or down (despite overwhelming evidence that even professionals can't consistently predict short-term market moves)

> I'll be able to get in and out before the crowd (in a stampede, everyone gets trampled including the ones who thought they were ahead)

> I’ll know when to sell and when to get back in (as the story of Abhimanyu fighting in the Padmavyuham reminds us—-getting in may be easy, but getting out safely is another matter altogether)

> Timing the market will outperform buy-and-hold investing (long-term data show most market timers underperform simple buy-and-hold strategies)

I know I’m susceptible to biases—overconfidence, loss aversion and the temptation to time the market—but I’ve learnt to recognise their patterns in my investment decisions. While I can’t eliminate them entirely, I strive to manage them, and that awareness has made me a more grounded investor over the years.

> I can forecast when the market will go up or down (despite overwhelming evidence that even professionals can't consistently predict short-term market moves)

> I'll be able to get in and out before the crowd (in a stampede, everyone gets trampled including the ones who thought they were ahead)

> I’ll know when to sell and when to get back in (as the story of Abhimanyu fighting in the Padmavyuham reminds us—-getting in may be easy, but getting out safely is another matter altogether)

> Timing the market will outperform buy-and-hold investing (long-term data show most market timers underperform simple buy-and-hold strategies)

I know I’m susceptible to biases—overconfidence, loss aversion and the temptation to time the market—but I’ve learnt to recognise their patterns in my investment decisions. While I can’t eliminate them entirely, I strive to manage them, and that awareness has made me a more grounded investor over the years.

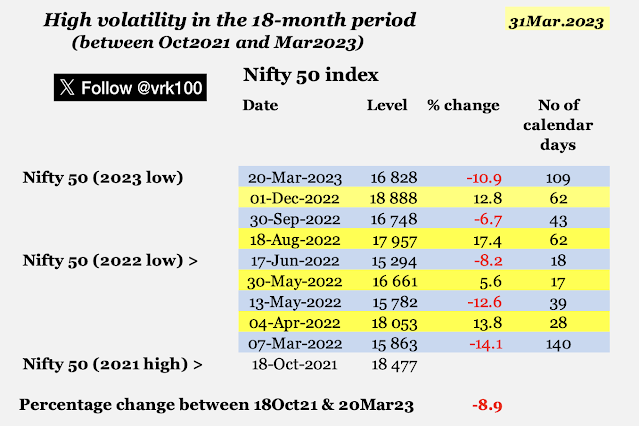

4. Market timing in action with Nifty 50 volatility

Between Oct2021 and Mar2023, the Indian stock market (reference: flagship index Nifty 50) played a psychological tug-of-war with investors. First came the all-time highs, then a slow, painful decline.

Volatility was the norm. Every time it looked like the market might stabilise, it threw another tantrum. Many investors, understandably, were shaken out--emotionally and financially.

But here’s the kicker: just when most people gave up or sat on the sidelines, the market quietly began a one-way recovery from Mar2023 onwards.

But here’s the kicker: just when most people gave up or sat on the sidelines, the market quietly began a one-way recovery from Mar2023 onwards.

By Sep2024, Nifty 50 had hit new highs — and a lot of investors missed it.

Just check the Nifty price chart from Jan2021 to Dec2023, with high volatility between 18Oct2021 and 20Mar2023:

(click on the chart to view better)

Timing the Market? Or Just Getting Played?

Let’s be real: market timing sounds smart in theory — buy low, sell high, right? But in practice, it often becomes buy high out of FOMO, sell low out of fear.

Graph showing high volatility period of 18 months between Oct2021 and Mar2023:

Between Oct2021 and Mar2023, the Nifty 50 index didn’t really go anywhere. Over that 18-month stretch, it was actually down about 9 per cent.

Here’s what the average investor might have felt during this period:

Oct2021: When Nifty 50 hit 18,477 in the third week of Oct2021, every investor was euphoric as stocks rallied spectacularly from Mar2020 COVID-19 lows. We thought equity market was unstoppable and would scale new heights (see chart above for details).

Mar2022: Denial & anxiety: But market tanks 14.1 per cent from all-time high to a low of 15,863. Fear kicks in. “Better get out before it gets worse.”

Apr2022: Market bounces back in just 28 calendar days--with Nifty 50 rising by 13.8 per cent to 18,053. Regret sets in. “Why did I sell?”

Apr2022: Market bounces back in just 28 calendar days--with Nifty 50 rising by 13.8 per cent to 18,053. Regret sets in. “Why did I sell?”

May2022: Fear & panic: Market falls again by 12.6 per cent to 15,782 in just 39 days. "Thank god, I sold early."

Aug2022: Big rally of 17.4 per cent, in 62 days, with Nifty 50 touching 17,957 on 18Aug2022. “Should I get back in now?”

Dec2022: Hope & re-entry: Market hits 18,888. FOMO peaks. “I can’t miss this run!”

Mar2023: Frustration & whipsaw: Boom, back to 16,828! Down 10.9 per cent. “What just happened?!”

This constant back-and-forth is what Kahneman described so well. We’re not reacting to fundamentals. We’re reacting to emotion—to fear, to greed, and to what just happened yesterday.

In the high-volatility phase (Oct2021 to Mar2023), many investors:

> Cut their monthly investment plans (shun dollar-cost averaging)

> Pulled out money “to re-enter later”

> Pulled out money “to re-enter later”

> Caught on the wrong side of every market correction

> Some investors considered quitting stocks for good

Then, during the smooth and steady rally (Mar2023 to Sep2024), they:

> Waited for a dip that never came

> Told themselves “it’s overvalued now"

> Finally re-entered late--after the easy gains were made

5. The Problem with FOMO

FOMO (Fear of Missing Out) makes you act like a momentum chaser. You buy when everyone’s buying, and sell when everyone’s panicking. In a market ruled by cycles, you could end up always one step behind with FOMO.

It's like this: You're scrolling through Instagram, and everyone seems to be heading to the Coldplay concert. They’re posting pics, talking about how amazing it’s going to be—and suddenly, I feel this pull to join them. But in the rush to get there, I could end up caught in traffic gridlock and miss the concert entirely.

This is exactly how FOMO plays out in investing. You watch people posting about their portfolio gains—-and it feels like you have to get in. The fear of missing out makes you act impulsively, but in the process, you might end up getting caught in the chaos of market volatility.

This is exactly how FOMO plays out in investing. You watch people posting about their portfolio gains—-and it feels like you have to get in. The fear of missing out makes you act impulsively, but in the process, you might end up getting caught in the chaos of market volatility.

What Actually Works?

Here’s the boring-but-effective truth:

> Consistency beats timing

> Dollar-cost averaging works for many--if you don't panic every time the market drops

> Volatility is normal, not a red flag

> The market rewards patience, not panic

> Volatility is normal, not a red flag

> The market rewards patience, not panic

6. Indian stocks resilience

Interestingly, while the Nifty 50 was swinging up and down during those 18 months—from Oct2021 to Mar2023—it actually held up a lot better than global markets--with the S&P 500, Nasdaq and most European indices experiencing heavy drawdowns during the same period. Technology stocks in the US were hit hard. Growth names collapsed.

And yet, Indian equities showed surprising resilience. That probably added another layer of confusion for investors trying to time the market. You’d sell thinking things are about to get worse, only to watch Indian stocks stay steady while the rest of the world fell apart.

And yet, Indian equities showed surprising resilience. That probably added another layer of confusion for investors trying to time the market. You’d sell thinking things are about to get worse, only to watch Indian stocks stay steady while the rest of the world fell apart.

Or you’d stay out waiting for a crash that never really came.

This “wait and watch” mindset often turns into “wait and miss.” And as Kahneman reminds us, our brains love to find patterns—even when none exist. We overreact to recent moves, anchor to past highs and assume what happened in the US or Europe will automatically happen here.

This “wait and watch” mindset often turns into “wait and miss.” And as Kahneman reminds us, our brains love to find patterns—even when none exist. We overreact to recent moves, anchor to past highs and assume what happened in the US or Europe will automatically happen here.

But markets don’t follow our narratives. They do what they want—and usually at the exact moment we least expect.

From the lows of Mar2023 till the all-time-highs of Sep2024, Nifty 50 index surged by a staggering 56 per cent, moving from 16,800 to 26,200 within just 18 months.

The first 18-month stretch—from Oct2021 to Mar2023—was honestly exasperating and felt like eternity. Markets were all over the place. One month up, the next month down. No clear direction, just a lot of noise.

But here’s the irony. That bout of volatility—the kind that tempts you to sell, trade more often or sit on the sidelines with oodles of cash—was exactly what set the stage for the next bull phase.

The following 18 months, from Mar2023 to Sept2024, turned out to be hugely rewarding for those who stayed invested.

But here’s the irony. That bout of volatility—the kind that tempts you to sell, trade more often or sit on the sidelines with oodles of cash—was exactly what set the stage for the next bull phase.

The following 18 months, from Mar2023 to Sept2024, turned out to be hugely rewarding for those who stayed invested.

In hindsight, it’s clear: the real test wasn’t about predicting the next move—it was about surviving the rough patch without losing your nerve.

While this blog focuses on the period between Oct2021 and Sep2024, the gut-wrenching volatility witnessed in Indian stocks from Sep2024 to now (from all-time high of 26,277 on 27Sep2024 to 25,150 on 11Jul2025 for Nifty 50) has been on an entirely different scale.

That period probably deserves a separate blog of its own.

7. Final Thoughts

I’m not saying that no one made money by moving in and out of Indian stocks during that volatile episode from Oct2021 to Mar2023. I’m sure some did. Each investor has their own style and their own way of navigating the markets.

And if someone managed to trade those swings successfully—great. More power to them.

But here's the thing: for most people, trying to time the market through that choppy, uncertain phase likely meant missing out on what came next.

But here's the thing: for most people, trying to time the market through that choppy, uncertain phase likely meant missing out on what came next.

As Kahneman warned, high volatility doesn’t just test your portfolio--it tests your investing behaviour. It tempts you into believing that action equals control. That more trades mean more gains. But more often than not, the opposite is true.

If you're prone to market timing mistakes, you can learn a lot from a Switzerland-based money manager Anthony Deden of Edelwiess Holdings plc.

I’ve learnt more from Anthony Deden’s quiet but principled approach than from any flashy fund manager. His focus on scarcity, endurance permanence and independence changed how I view investing—not as a game of timing, but as a long-term practice rooted in capital preservation and quality.

His philosophy gave me the courage to stay invested through annoying stock phases, knowing that the right business will endure if you're patient enough.

If you stayed the course during the tough times, you didn’t just survive--you thrived. But if you let fear or FOMO make decisions for you, the market’s rally likely happened without you.

You don’t need to be perfect. You just need to stay invested. In investing, doing nothing often beats doing something emotional.

This isn’t investment advice. Even though the author is a CFA Charterholder with nearly 25 years of experience in the financial markets, this is just general insight—not a recommendation.

- - -

-------------------

References:

Tweet thread 15Sep2020 Market timing and portfolio rebalancing

Tweeth thread 29Mar2024 Daniel Kahneman's book "Noise"

Tweet 13Mar2020 Anthony Deden talking to Grant Williams of Real Vision

Edelweiss Holdings plc (Anthony Deden) presentation >

-------------------

Read more:

Blog of Blogs Theme-wise

Weblinks and Investing

India Fixed Income Data Bank

Indian Economy Data Bank

India Forex Data Bank

Corporate Groups and Listed Companies 29Dec2024

Corporate Governance Concerns - Indian Companies 13Dec2024

Stocks and Peer Comparison by Industry 16Feb2024

JP Morgan Guide to Markets 30Jun2025

The Elusive Current Account Surplus: What 25 Years Data Reveal About India's Trade Balance 30Jun2025

India Flagship ETFs with Low Fees and Fair Trading Volumes 12Jun2025

Low Expense Ratios, High Returns: Why Passive Equity Funds Matter 06Jun2025

Mutual Fund Asset Class Returns 02Jun2025

Currency Woes Put Pressure on US Equities and Bonds 22Apr2025

JP Morgan Guide to Markets 31Mar2025

Loss of First-mover Advantage

-------------------

Disclosure: I've got a vested interest in Indian stocks and other investments. It's safe to assume I've interest in the financial instruments / products discussed, if any.

Disclaimer: The analysis and

opinion provided here are only for information purposes and should not be construed

as investment advice. Investors should consult their own financial advisers

before making any investments. The author is a CFA Charterholder with a vested

interest in financial markets.

------------------------

CFA Charter credentials - CFA Member Profile

CFA New Badge

CFA Badge

No comments:

Post a Comment