Mutual Funds Asset Class Returns 31Mar2022

(A new blog post dated 08Jul2022 is available here with an update of the information as of 30Jun2022)

This is an update of an earlier blog

published on 02Jan2022. I present the data as at the end of 31st of March, 2022. The data contain select categories of mutual funds in India, numbering fifteen, from equity, debt and gold categories.

Table 1: Asset return matrix - annual returns - top to bottom returns in 2021 >

Please click on the image to view better >

In calendar year 2021, funds belonging to equity small cap category have delivered the highest returns at 63 per cent, following by mid cap equity at 45 per cent and flexi cap with 32 per cent.

You can check the bottom return categories also. Table 1 provides the insights into the cyclical nature of returns of these mutual fund categories.

Gold (in rupee terms) provided the worst returns in calendar year 2021, though it did well in 2019 and 2020. In 2022 (so far till 31Mar2022), gold has delivered the best returns of all mutual fund categories presented above.

(the blog continues below)

-------------------

Read more:

BSE Broad and Sector Indices Returns

BSE Broad and Sector Indices Market Cap

When Will Foreign Investors Stop Selling Indian Stocks?

India Forex Reserves in Four Charts

Global Bond Yields Suge

Rise of Retail Investors and Demat a/cs in India

RBI Announces USD-INR Sell/Buy Swap Auction

Foreign Investors Waning Interest in Indian Stocks

Indian Equity ETF Risks and Returns

Do Paint Stocks and Crude Oil Tango?

Weblinks and Investing-------------------

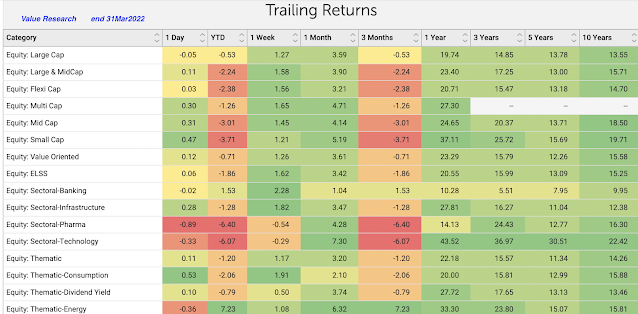

Table 2: Asset return matrix - trailing returns - 10-year returns top to bottom >

Please click on the image to view better >

On a trailing basis for 10 years, equity small cap category (19.7 per cent CAGR) is on the top of the heap, followed closely by equity mid cap funds at 18.5 per cent CAGR and equity flexi cap funds at 14.7 per cent CAGR.

The key takeaway for mutual fund investors is to take exposure to different mutual fund categories based on their investment goals and personal needs and have a proper asset allocation.

- - -

Additional data

Table3: Asset return matrix -- annual returns - same as Table 1 but in alphabetical order >

Table4: Asset return matrix -- trailing returns - same as Table 2 but in alphabetical order >

Abbreviations used:

CAGR -compounded annual growth rate

Disclosure: I've vested interested in Indian stocks and other investments. It's safe to assume I've interest in the financial instruments / products discussed, if any.

Disclaimer: The analysis and opinion provided here are only for information purposes and should not be construed as investment advice. Investors should consult their own financial advisers before making any investments. The author is a CFA Charterholder with a vested interest in financial markets.

CFA Charter credentials - CFA Member Profile

CFA Badge

He blogs at:

https://ramakrishnavadlamudi.blogspot.com/

Twitter @vrk100

No comments:

Post a Comment