Cera Sanitaryware Buyback Offer 2024

(This

is for information purposes only. This should not be construed as a

recommendation or investment advice even though the author is a CFA Charterholder. Please consult your financial

adviser before taking any investment decision. Safe to assume the author has a vested

interest in stocks / investments discussed if any.)

(Updates 05Sep2024, 22Aug2024, 13Aug2024 and 05Aug2024 are available below. Even though this blog was posted

originally on 30Jul2024, I'll be updating this blog whenever new information is made available on the buyback offer.)

The blog is about Cera Sanitaryware Buyback Offer.

1. Cera Sanitaryware Limited on 26Jul2024 announced, through a BSE

stock exchange filing, that its board of directors would consider a proposal to buy back the company's fully paid-up equity shares at its meeting on 05Aug2024. The details of the

buyback proposal will be known after the board meeting.

The

announcement was made after closure of market hours on 26Jul2024. Yesterday and today,

the stock reacted positively to the buyback proposal announcement and

rose by 3.6 percent and closed at Rs 9,081 per share, with a market cap of Rs 11,800 crore; compared to the closing prices of Rs 8,768.20 (market cap Rs 11,400 crore) on 26Jul2024.

(story continues below)

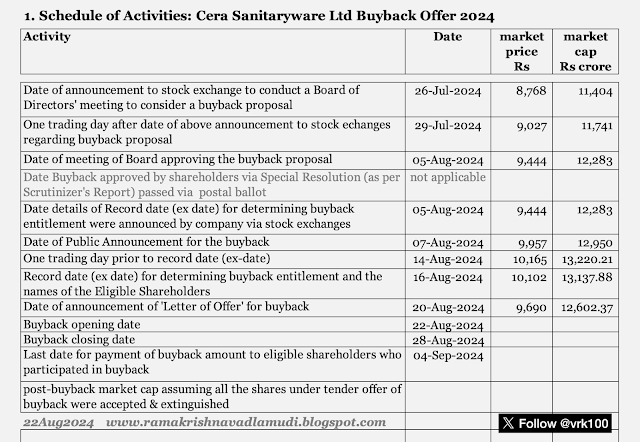

Schedule of activities

2. In general, buyback offers take three to six months to complete depending on which route the company takes for buyback (there

are basically two routes companies take for share buybacks or

repurchases -- one is 'tender offer' route and another is 'buyback in open market via stock exchanges). So,

it's necessary for investors to follow activities related to the

buyback offer throughout the process.

A typical list of activities is

given in table 1 below >

Stock valuation

3. The stock price-earnings (P/E) ratio is 49.4, its price-to-book value (P/B) ratio is 8.8 and the price-to-sales (P/S) ratio is 6.3. All data are as at close of 30Jul2024.

For more on this, please check the following two images >

Previous Buyback Offers

4. To the best of the author's knowledge, there has been no record of buyback offers prior to the current proposal.

Update 05Aug2024: Buyback details

5. As scheduled, the company's Board of Directors met on 05Aug2024 and

announced brief details of buyback (the announcement

was made during the market hours). As on 05Aug2024, the

market price of its stock closed at Rs 9,444 per share with a market cap of Rs 12,280 crore. 6. Limited details of buyback as announced on 05Aug2024 >

7.

As stated in the table above, the company will buy back its fully paid-up

shares of Rs 5 each at a maximum buyback price of Rs 12,000 per share through a

'tender offer.'

8. The maximum buyback size is Rs 130 crore and promoters haven't yet expressed whether they wish to participate in the buyback proposal. As this is a 'tender offer,'

investors who wish to participate in the buyback have to surrender their

shares during the buyback process and the record date / ex-date for

buyback is 16Aug2024.

9. The maximum buyback price of Rs 12,000 is at a premium of 27 per cent to the current market price of Rs 9,444 per share.

10. The buyback size of Rs 130 crore represents 9.68 per cent and 9.66 per cent of company's total paid-up equity capital and free reserves as per standalone and consolidated balance sheet respectively as on 31Mar2024. The number of shares proposed to be bought back are 108,333, representing up to 0.83 per cent of total number of company's equity shares.

11. The promoters' current stake in the company is 54.48 per cent of the total.

Update 13Aug2024: Public Announcement

12. On 07Aug2024, the company made a public announcement giving details of the buyback offer. On the same day, the company published the Board resolution approving the buyback offer.

13. Key highlights from the above are:

The Company's Board or Buyback Committee may, till one working day prior to the Record Date, increase the Buyback Price and decrease the number of Equity Shares proposed to be bought back, such that there is no change in the Buyback Size.

The Board had not sought the approval of the shareholders of the Company since the Buyback Offer Size is less than 10 per cent of the total paid-up equity share capital and free reserves of the company.

14. As this is a buyback offer via tender offer route, promoters are eligible to participate in the buyback. In this regard, seven out of nine members of the Promoter Group have expressed their intention to participate in Buyback. This is interesting.

Two members of the promoter group, namely, Pooja Jain Somany (with 1.54 per cent stake) and Madhusudan Industries Ltd (0.14 per cent) do not want to participate in the buyback.

Promoters who want to participate in the buyback are >

15. Reasons for buyback as stated by the company are:

a) The buyback will help the company to return surplus cash to its shareholders holding Equity Shares, thereby, enhancing the overall return to shareholders

b) The buyback offer via tender route reserves 15 per cent of the number of Equity Shares to be bought back for the "small" shareholders -- giving benefit to a large number of small shareholders

c) The buyback may help in improving its return on equity, by reduction in the equity base, thereby leading to long term increase in shareholders’ value

d) The buyback gives the option to shareholders either to participate in the buyback and surrender their shares as per their eligibility or not to participate in the buyback

16. The buyback price has been arrived at after considering various factors including, but not limited to the trends in the volume weighted average prices and closing price of the Equity Shares on the Stock Exchanges where the Equity Shares of the company are listed.

For more details, please see the screenshot below >

Update 22Aug2024: Letter of Offer

17. On 20Aug2024, the company made a Letter of Offer to eligible shareholders under its buyback programme (web archive). The buyback offer under tender offer route opens on 22Aug2024 and closes on 28Aug2024.

If

you are eligible to participate in the buyback offer, you need to

surrender the shares to the company during the buyback period provided

you are willing to participate in the buyback. Indicative buyback

entitlement ratio for reserved category (small shareholders) is 1 share

out of every 22 shares held by them as on record date and the same is 1

share for every 135 shares held by the general category.

Tables 6 and 7 give details of calculation of Entitlement Ratio >

18.

If you are eligible and participating in the buyback programme as

mentioned in para 17 above, the cash consideration offered by the

company in lieu of your eligible shares will be credited to your bank

account on or before 04Sep2024.

The

company's stock price has slightly come down after the record date is

over. The share is now quoting at Rs 9,797 per share with a market cap of Rs 12,700 crore as of today (intra-day 22Aug2024).

If you want to track the BSE Bid details and BSE demand schedule concerning the buyback offer, please check here and here.

Updated Table 1 with Schedule of Activities >

Update 05Sep2024: Post-buyback announcement

19. The company today made a BSE filing with post-buyback public announcement (web archive) on 05Sep2024, giving details of bids accepted, post-buyback shareholding and others.

Accordingly,

the tables relating to: details of bids accepted in tender offer,

percentage of equity capital extinguished, promoter holding and schedule

of activities are updated and are given below for future reference:

Table 8: The shareholder response to the buyback is quite good; with small shareholders bidding 14.93 times of their actual holding while general category bidding 94.65 times of the holding -- with total bids of 82.69 times.

Table 1: The stock today (05Sep2024) closed at Rs 9,200 per share with a post-buyback market cap of Rs 11,866 crore. Between the date of announcement on 26Jul2024 and now, the stock provided a modest gain of 4.93 per cent -- though in between, the stock reached a level of Rs 10,420 (09Aug2024).

Table 4: The percentage of shares cancelled in this buyback is just 0.83 per cent of total shares. This kind of small percentage of buyback seems to be an exercise in futility.

Tables 2 & 3: The details of all buybacks so far. The company in its history has undertaken buyback only once.

20. Valuation ratios and peer comparison of the company as on 05Sep2024 as per Screener.in:

(As the buyback process is completed, there will no longer be any updates on this.)

- - -

------------------------

Reference shelf:

Top image: Google Gemini AI image------------------------

Read more:

Why RBI Won't Favour A Strong Rupee

The Little Secret Behind Nifty Next 50 Index's Recent Success

Disclosure: I've got a vested interest

in Indian stocks and other investments. It's safe to assume I've interest in the financial instruments / products discussed, if

any.

Disclaimer: The analysis and

opinion provided here are only for information purposes and should not be construed

as investment advice. Investors should consult their own financial advisers

before making any investments. The author is a CFA Charterholder with a vested

interest in financial markets.

CFA Charter credentials - CFA Member Profile

CFA New Badge

CFA Badge

Viewing Options for this blog in different formats:

He blogs at:

https://ramakrishnavadlamudi.blogspot.com/

https://www.scribd.com/vrk100

X (Twitter) @vrk100

No comments:

Post a Comment