India Second Quarter GDP FY 2021-22

Government of India today announced GDP (gross domestic product or annual income) estimates for the second quarter of financial year 2021-22. The real GDP (at constant prices) for the second quarter is Rs 35.73 lakh crore, showing a growth of 8.4 per cent as compared to the second quarter of FY 2020-21.

-------------------

Read more:

Global bond yields and Interest rates

Do Paint Stocks and Crude Oil Tango?

BSE Broad and Sectoral Indices Returns

Real Estate Stocks and REITs

When Will Federal Reserve Raise Interest Rates?

The Central Triad in Taleb's Antifragile

Weblinks and Investing

-------------------

It is worth noting that India's real GDP for second quarter of FY 2021-22 is Rs 35,73,451 crore as compared to second quarter real GDP of FY 2019-20 of Rs 35,61,530 crore--which amounts to practically zero growth in the past two years.

It

may be noted that the real GDP in Q1 and Q2 of FY 2020-21 contracted by 24.4

per cent and 7.4 per cent respectively due to the draconian lockdown, during March-June 2020, imposed by the Prime Minister Modi government after the outbreak of

COVID-19 pandemic.

Table 1 - Real GDP (click on the image for a better view):

As can be gleaned from the above table, India's national income has not grown at all in the past two years. Even before the Pandemic, India's GDP growth rate had been decelerating due to the failure of the economic polices of the current central government.

It's disconcerting to note that India's per capita income, as per World Bank estimates, is USD 1,950, which is below that of Bangladesh.

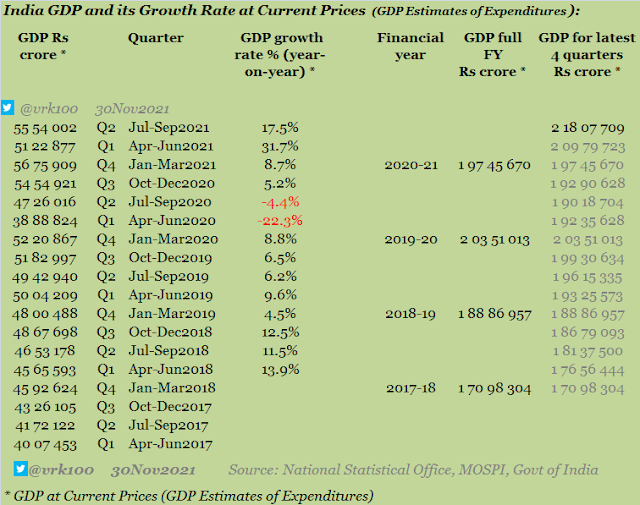

Table 2 - GDP at current prices (click on the image for a better view):

Nominal GDP for the second quarter of FY 2021-22 is Rs 55.54 lakh crore, showing a growth of 17.5 per cent versus second quarter GDP of FY 2020-21. Nominal GDP recorded a contraction of 4.4 per cent in second quarter of FY 2020-21 amidst the Pandemic.

Nominal GDP growth of 17.5 per cent for the latest quarter is driven by inflationary pressures in the Indian economy that have been building up since November 2019.

For October 2021, India's consumer price inflation (CPI) is 4.48 per cent and wholesale price inflation (WPI) is 12.54 per cent. It's an irony during and after the Pandemic that corporates and other businesses have achieved pricing power (as reflected in the steep WPI inflation rate) even though there is demand destruction domestically caused mainly by the COVID-19 deaths, loss of livelihoods in the informal sector and the supply chain bottlenecks globally.

It is hoped the momentum in the Indian economy will continue to hold at least in the next two quarters, despite the deep concerns about the new Omicron variant, which is declared as a variant of concern (VOC) by the World Health Organisation (WHO).

India CPI and WPI inflation figures >

Note: India's financial year starts from April to March of every year. Traditionally, India quarterly GDP figures are compared year-on-year (in contrast to the US where they are compared quarter-on-quarter).

References:

MOSPI press note dated 30Nov2021

Trading Economics: India CPI inflation rate

Trading Economics: India WPI inflation rate

Abbreviations used:

GDP - gross domestic product

USD - US dollar

Disclosure: I've vested interested in Indian stocks and other investments. It's safe to assume I've interest in the financial products discussed, if any.

Disclaimer: The analysis and opinion provided here are only for information purposes and should not be construed as investment advice. Investors should consult their own financial advisers before making any investments. The author is a CFA Charterholder with a vested interest in financial markets.

CFA Charter credentials - CFA Member Profile

CFA Badge

He blogs at:

https://ramakrishnavadlamudi.blogspot.com/

Twitter @vrk100