This is an update of an earlier blog -- dated 01Apr2023 -- on the topic, in which the various aspects of broad-based indices, namely S&P BSE 500 and S&P 500, of India and the US are discussed.

As calendar year 2023 came to an end, the following tables provide information, as on 31Dec2023, about

how India's BSE 500 index and the US' S&P 500 index stack up. It may be noted 29Dec2023 is the last trading day of 2023.

(write-up continues below)

------------------------

Related blogs on US stocks / ETFs / Mutual Funds:

Compare ETFs based on S&P 500, Russell 2000 and MSCI EM 26May2022

BSE 500 versus S&P 500 Indices 31Dec2021

NSE IFSC Introducing Trading in US Stocks for Indian Investors 10Aug2021

------------------------

Related blogs on Indian Stock Indices:

Nifty 50 Index Yearly Movement 31Dec2023

Nifty 50 Index Quarterly Movement 31Mar2023

------------------------

Fundamentals:

Table 1: Risks, Returns and Valuation parameters >

Please click on the image for a better view >

On a

1-year, 3-year, 5-year and 10-year basis, BSE 500 index has provided superior returns (total returns, including dividends) compared to S&P 500. On a risk-adjusted basis too, BSE 500

provided superior return (3-, 5- and 10-year Sharpe ratios). (BSE 500 returns are in

Indian rupee terms, whereas those of S&P 500 are in US dollar

terms).

If you look at the valuations parameters, like, price-earnings or PE ratio, forward PE ratio and dividend yield, India's BSE 500 is more richly valued compared to S&P 500. The consensus view is Indian stock market may continue to do well driven mainly by optimism about India's prospects in the emerging markets -- but be wary of consensus views.

Rebalancing of stocks is done semiannually in June and December of every year for BSE 500, whereas for S&P 500 it's done quarterly in March, June, September and December.

You can also study comparison of NSE indices, like, Nifty 50 and Nifty 500, versus the BSE 500 index analysed here.

Top 10 Stocks:

Table 2: Top 10 stocks and Concentration Risk >

Please click on the image for a better view >

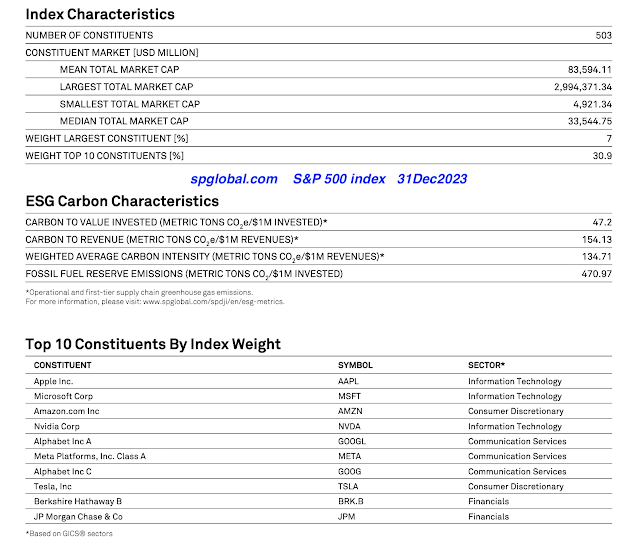

As shown in table 2 above, top five stocks in BSE 500 account for 25.2 percent share, whereas top five holdings in S&P 500 account for 22.5 percent; and top 10 holdings in BSE 500 and S&P 500 have a share of 35.9 and 30.8 percent respectively -- indicating higher concentration risk with BSE 500 index versus S&P 500.

HDFC Bank, Reliance Industries and ICICI Bank are at the top of the league for BSE 500, whereas Apple, Microsoft and Amazon are the top three stocks for S&P 500 as at the end of 2023.

Concentration of top five and 10 stocks is slightly lower for BSE 500 as on 31Dec2023, compared to a year ago period. But with S&P 500, concentration risk is higher as of 31Dec2023 compared to 31Dec2022 -- combined share of top 10 stocks in S&P 500 is 30.8 percent as on 31Dec2023 (24.3 percent as on 31Dec2022).

The higher concentration of S&P 500 is due to the so-called Magnificent Seven stocks -- namely, Apple, Microsoft, Google, Amazon, NVIDIA, Meta and Tesla -- which have provided spectacular returns in 2023 (it may be added they fared badly in 2022).

NVIDIA Corp made a spectacular entry into top 10 of S&P 500 in 2023, surpassing technology giants, like, Meta Platforms (formerly Facebook) and Tesla Inc. Its current stock price is USD 610 a share, with a market cap of USD 1.50 trillion.

NVIDIA has taken a giant leap by taking a paramount position in designing semiconductors / chips used in artificial intelligence (AI), a hot sector since Nov2022.

It may be added Microsoft, a few weeks ago, dethroned Apple as the top stock in the S&P 500. As of 25Jan2024, Microsoft's weight is 7.3 percent in S&P 500 versus 6.9 percent for Apple as per data from iShares.

Top 10 Sectors:

Table 3: Top 5 Sectors and Concentration Risk >

Please click on the image for a better view >

Table 3 above reveals the sector concentration risk inherent in BSE 500 and S&P 500 indices. Based on share of top three and five sectors, concentration risk for BSE 500 is lower compared to S&P 500.

Compare to end of 2022 figures, the share of top three and five sectors is lower for BSE 500 as on 31Dec2023 -- however, sector concentration risk has increased for S&P 500 compared to a year ago period.

For example, the weight of top five sectors in S&P 500 is 74.2 percent as on 31Dec2023 versus 71.7 percent as on 31Dec2022.

If you look at the specific sectors: Information technology, financials, health care and consumer discretionary dominate the US stock market (represented by S&P 500, which is a guage of the US market) traditionally, with the technology sector itself accounting for almost 30 percent share in S&P 500.

In India, the bellwether sectors are: financials, information technology, fast moving consumer goods (FMCG) and Oil & Gas -- with financial sector itself accounting for almost 30 percent weight in BSE 500.

Passive Funds

There are only a few passive funds (three ETFs and two index funds) based on S&P BSE 500 and Nifty 500 indices -- namely, ICICI Prudential S&P BSE 500 ETF, Motilal Oswal Nifty 500 Index fund, Motilal Oswal Nifty 500 ETF, HDFC S&P BSE 500 Index fund and HDFC S&P BSE 500 ETF (ETF is exchange trade fund).

But the assets of these passive funds are minimal -- indicating lack of investor interest and low-key promotion by mutual funds in India.

It may be added the composition of stocks and sectors in BSE 500 is similar to that of Nifty 500.

There are plenty of passive funds, especially ETFs, based on S&P 500 index in the US, to choose for investors.

- - -

------------------------------

References and Additional data:

Screenshots of BSE 500 and S&P 500 factsheets >

Nifty 500 sectors and BSE 500 sectors >