Global Market Data 30Jun2024

(This is for information and educational purposes only. This should not be

construed as a recommendation or investment advice even though the author is a CFA

Charterholder. Please consult your financial adviser before taking any

investment decision. Safe to assume the author has a vested interest in stocks

/ investments discussed if any.)

Quarter-to-date global market data, as on 30 June 2024, of stocks, bonds, currencies and commodities is as follows:

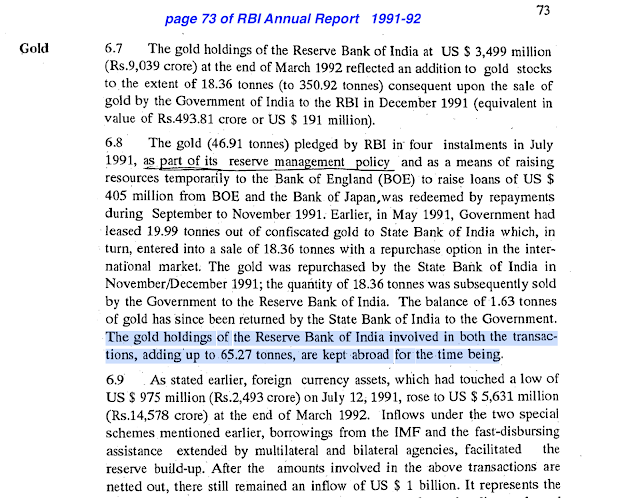

Table 1: (please click on the image to view better)

The global stocks are a mixed bag during the Apr-Jun2024 quarter. While the Dow Jones Industrial Average (DJIA) is down 1.7 per cent for the quarter, Nasdaq Composite and S&P 500 are up 8.3 and 3.9 per cent respectively.

Of the major indices, Nasdaq Composite index has delivered the best performance as artificial intelligence-powered stocks, like NVIDIA, have done well.

Hang Seng, FTSE 100 and Sensex have delivered positive results, but Nikkei 225, Shanghai Composite and Dax 30 indices delivered negative returns for the Apr-Jun2024 quarter.

India 10-year Government Bond yield is down 5 basis points (one percentage point equals 100 basis points), while the US 10-year Treasury yield is 18 up basis points for the quarter.

Crude oil is down slightly for the quarter. But silver has outperformed most commodities with a quarterly return of more than 17 per cent. Gold delivered 3.6 per cent with its price reaching all-time highs during the quarter.

After a stellar 66-per cent return in the first quarter, Bitcoin disappointed with a negative return of 13 per cent during the second quarter.

There is not much movement on the currency front, with the US dollar index gaining 1.3 per cent for the quarter -- all of the gain is due to severe weakness in Japanese Yen. The USD gained 6.3 per cent versus the JPY, while British Pound, Euro and Indian rupee remained stable during the second quarter.

Year-to-date (past 6-month returns) global market data as on 30Jun2024 are presented below:

Table 2: (please click on the image to view better)

Global stocks during the calendar year 2024 are generally positive, except for Shanghai Composite which declined by 0.3 per cent during the period.

Of the major indices, Nikkei 225 delivered the best returns of 18.3 per cent during the first half of 2024. Nasdaq Composite, S&P 500 and Nifty 50 indices are positive with 18.1, 14.5 and 10.5 per cent returns respectively.

Mid- and small-cap stocks continue to do well in India, with the BSE Mid cap index delivered a powerful 25 per cent return during the period.

Major commodities are on the upswing with crude oil rising by 12 to 14 per cent; gold by 12.8 percent and silver by 22.6 per cent. Bloomberg commodity index is up 2.4 per cent for the quarter.

One could say silver is the best asset class in 2024, other than crypto currencies.

After giving one of the best performance in 2024 due to rising inflows into Bitcoin spot ETFs (exchange-traded funds), Bitcoin has cooled down a bit in the past one or two weeks.

The US dollar index (DXY) gained 4.4 per cent during the first two quarters of 2024; most of the gain is due to sharp fall in JPY. Indian rupee is remarkably stable -- due to obvious foreign exchange intervention by Reserve Bank of India (RBI), India's central bank.

At the start of 2024, it was expected the US Federal Reserve would resort to three or four federal funds rate cuts in 2024. But there has been no rate cut so far; and now market seems to be expecting only one rate cut for the rest of the year.

This has resulted in a bit of disappointment for the market with investors selling of US Treasury notes / bonds. The US 10-year Treasury yield rose by 52 basis points in 2024 (bond yields move in opposite direction to bond prices, meaning rising prices result in falling yields and vice versa).

Wrap up

Most of the global stock indices, like in the US and India, are at all time highs or close to them. The outlook for the next quarter will depend on how the Federal Reserve will react to future data flow.

In second quarter, the European Central Bank, for the first time in five years, cut its interest rate by 25 basis points to 3.75 per cent; and the Swiss National Bank (SNB) cut its interest rate by 25 basis points to 1.25 per cent.

SNB's rate cut in Jun2024 followed a rate cut in Mar2024.

It remains to be seen whether the US Federal Reserve and Bank of England (BoE) will cut their interest rates too, following the example of SNB and ECB, in the third quarter. But market seems to be expecting rate cuts from the Fed and BoE.

The way currencies are debased across the globe; crypto currencies, like, Bitcoin and Ethereum, might do well in the next few years -- though their stomach-churning volatility is too big a pain to bear for most of the common investors.

The US presidential elections are due in less than five months and the presidential aspirants have shown no inclination to reduce the humoungous and ever-rising US government debt. Such unsustainable debts and fiscal profligacy in the US and Europe are likely to be positive, ceteris paribus, for crypt currencies.

(This should not be considered as a recommendation or investment advice -- investors should consult their own financial advisors before taking any investment decisions)

- - -

------------------------

The Reference Shelf:

Top image: AI-image from Google Gemini (ISS)

------------------------

Read more:

Why RBI Won't Favour A Strong Rupee

The Little Secret Behind Nifty Next 50 Index's Recent Success

How to Buy Nifty Midcap Index 03May2024

Disclosure: I've got a vested interest

in Indian stocks and other investments. It's safe to assume I've interest in the financial instruments / products discussed, if

any.

Disclaimer: The analysis and

opinion provided here are only for information purposes and should not be construed

as investment advice. Investors should consult their own financial advisers

before making any investments. The author is a CFA Charterholder with a vested

interest in financial markets.

CFA Charter credentials - CFA Member Profile

CFA Badge

Viewing Options for this blog in different formats:

He blogs at:

https://ramakrishnavadlamudi.blogspot.com/

https://www.scribd.com/vrk100

X (Twitter) @vrk100