The author is a data dog, likes to work with data instead of compelling narratives as practised by several market participants.

In a market flooded with narratives and opinions, this blog stands apart by grounding its insights in hard data. We're diving deep into the numbers that define India's passive equity landscape, offering a balanced perspective.

Within a vast pool of equity mutual funds in India, passive equity funds have carved out a niche, yet their distribution and dominance vary widely across different indices.

This blog aims to dissect these variations, providing a comprehensive analysis of the top passive equity indices by their AUM. We'll explore the concentration of assets, the influence of large institutional investors like the Employees' Provident Fund Organisation (EPFO) and the regulatory curbs shaping this sector.

For those who value data over stories, this exploration offers a factual, nuanced understanding of India's passive equity market. Let's delve into the numbers that tell the real story.

If data isn't your preference, you might want to skip this blog.

2. The Big Picture

India’s mutual fund industry has seen remarkable growth, with total AUM or assets under management crossing Rs 74 lakh crore as of 30Jun2025, with active equity funds alone managing Rs 33.47 lakh crore (excluding equity portion of hybrid funds), as per data from mutual fund industry body AMFI.

Of the total AUM of Rs 74.15 lakh crore, passive equity vehicles—comprising ETFs and index funds—hold around Rs 9.36 lakh crore, as per Rupee Vest data. There are a total of 104 unique equity benchmark indices upon which passive equity funds, both ETFs as well as index funds, are based.

The total number of passive equity funds are 411 as at the end of Jun2025.

Of the total passive, equity ETF assets are Rs 7.45 lakh crore dominating with 80 per cent of total passive; while equity index funds asset size is Rs 1.91 lakh crore with 20 per cent share (see table 1 below).

Equity indices with less than Rs 2,000 crore AUM:

There are 170 passive equity funds—both ETFs and index funds—that together manage the Re 29,556 crore in AUM spread across indices with less than Rs 2,000 crore assets locked in each equity index.

The Rs 29,556 crore AUM is merely 3.2 per cent of the entire passive equity AUM — meaning over 96 per cent of passive AUM is concentrated in larger indices with more than Rs 2,000 crore AUM.

In other words, while a large number of funds exist in these niche or mid- and small-cap indices, their combined asset size is negligible compared to the major index funds and ETFs that dominate with over 96 per cent of the assets.

In practical terms:

Out of the total 104 benchmark indices underlying passive equity funds, only a small handful have significant adoption. The rest—indices with less than Rs 2,000 crore in assets—collectively account for a very small sliver of the overall pie.

What does this reveal?

Passive investing in India is highly concentrated around a few big indices—mainly Nifty 50, Sensex, CPSE and Bharat‑22. Retail or niche-mandate indices have much lower traction, even though there are many of them.

This underlines a structural imbalance: most passive equity assets are locked in established, large-cap indices, while a wide array of other indices—despite being available for investment—hold minimal AUM individually or collectively.

Compare data: The blog is an update of earlier blog titled "India Passive Funds and Their Asset Size."

To compare, the AUM of passive equity funds grew from Rs 6.65 lakh crore as of 31Mar2024 to Rs 9.36 lakh crore as on 30Jun2025, a growth of over 30 per cent in the past 15 months -- the growth is attributed to a combination of 13 per cent increase in Nifty 50 index and increased net inflows to passive funds during the period.

Table 1: Big picture - India passive equity funds and their asset size:

3. India Top 10 Passive Equity Indices and Assets Size

A peculiar feature of India's passive landscape is the heavy skew towards a few benchmark equity indices. The passive fund size is heavily skewed toward the top 10 passive indices controlling more than 90 per cent, or Rs 8.46 lakh crore, of total passive AUM.

As mentioned above, passive equity funds track 104 equity indices.

The asset concentration is so massive, the top two equity indices account for 73 per cent of total passive AUM.

This is mainly due to massive EPFO investments (see update 19Jun2025 with charts 51 to 55) in Nifty 50, Sensex, CPSE and Bharat 22 ETFs.

Key Observations from Table 2 below:

1. Dominance of Nifty 50 Index:

AUM: Rs 4.56 lakh crore (48.8% of total passive AUM).

Total number of passive funds: 41

ETF vs Index Fund split:

ETFs: Rs 3.71 lakh crore (82%)

Index funds: Rs 0.85 lakh crore (18%)

Conclusion: This index dominates India's passive investing space and is the clear market leader in both ETF and index fund formats.

2. BSE Sensex:

AUM: Rs 2.27 lakh crore (24.2% of total passive)

Total number of passive funds: 22

Heavily ETF-focused (94.4% of AUM in ETFs).

Shows investor preference for ETFs in flagship indices, Nifty 50 and BSE Sensex.

3. Concentration in Two Indices

Nifty 50 and Sensex together account for Rs 6.83 lakh crore, which is 73 per cent of the total passive equity AUM. The rest eight indices make up only 17.5 per cent of the total.

4. Break-up of Passive Equity Assets by Fund Type:

Of the top 10 equity indices AUM of Rs 8.46 lakh crore, AUM of equity ETFs is Rs 7 lakh crore (number of ETFs 67), while that of index funds is Rs 1.46 lakh crore (84).

Table 2: India Top 10 Passive Equity Indices by Fund Size:

(please click on the image to view better)

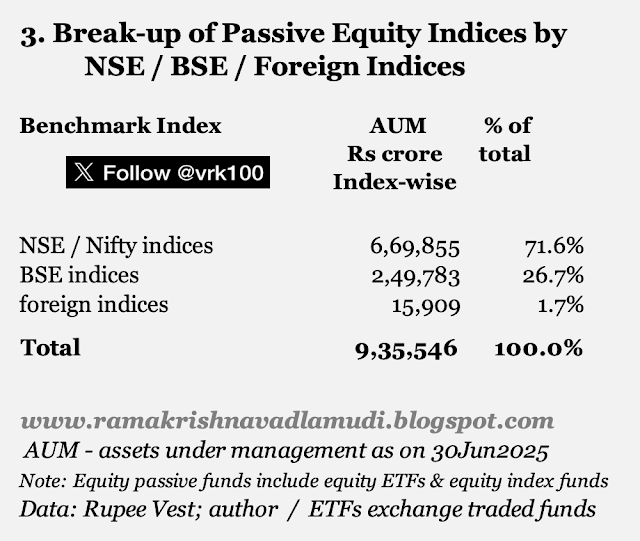

4. Break-up of Passive by NSE / BSE / Foreign Indices

Who’s Running the Show: NSE vs BSE vs Foreign Indices:

a). NSE / Nifty indices collectively account for Rs 6.70 lakh crore (71.6 per cent of total) of passive equity AUM.

b). BSE indices oversee around Rs 2.50 lakh crore (26.7 per cent).

c). Foreign indices—like Nasdaq‑100—make up just under Rs 16,000 crore (just 1.7 per ent) of the mix.

Despite the availability of international passive equity options, foreign indices represent just about 1.7 per cent of total passive equity AUM in India—making international investing far from mainstream.

This low participation stems from multiple factors. Some of those are:

1. Strong home bias among Indian investors (not unique to India):

Both retail and institutional investors overwhelmingly favor domestic assets.

2. RBI- and SEBI-imposed restrictions on overseas MF investments:

The RBI and SEBI currently limit mutual fund investments in overseas equity securities to USD 7 billion industry-wide; and further caps overseas ETF investments to USD 1 billion industry-wide.

3. Regulatory bottlenecks and lack of fresh inflows:

With both the overall overseas equity and overseas ETF limits hit, fund houses have stopped accepting new investments into international schemes unless redemptions free up space.

Fund houses have appealed repeatedly to RBI to raise limits, but there is no clarity on easing the restrictions. India's Finance Ministry too maintains a stony silence on this.

As a result, passive investments in foreign indices remain negligible in India—despite global market appeal, the structure simply doesn't support meaningful scale.

Table 3: Break-up of passive equity indices by NSE / BSE / Foreign Indices:

5. India Top 10 Passive Equity Funds by Assets:

As has been highlighted by the author repeatedly over the years, India's passive landscape is heavily tilted: the top 10 passive equity funds command two-thirds of all passive equity assets under management.

As stated in Section 3 above, their dominance is not random but heavily driven by large EPFO investments in just four ETFs tracking Nifty 50, Sensex, CPSE and Bharat 22.

Out of the total, six passive funds based on Nifty 50 have assets of Rs 3.97 lakh crore (63 per cent of total), three funds based on Sensex have assets worth Rs 1.93 lakh crore (31 per cent) and one CPSE ETF accounts for Rs 0.36 lakh crore (6 per cent) of assets.

Of these top ten funds, eight are ETFs holding around 93 per cent of the total AUM, while just two index funds make up the remaining 7 per cent.

Table 4: India Top 10 passive equity funds by assets:

6. Finally

India's flagship equity indices, Nifty 50 and Sensex dominate the passive equity landscape in India—nearly three-quarters of the total passive assets are tied to these large-cap benchmarks.

Mid-, small-cap and smart‑beta indices (like Nifty 50, Midcap, Smallcap, Momentum) are gaining traction but still represent a relatively smaller slice.

India’s passive equity fund universe is rapidly scaling up, but it’s still heavily skewed toward large-cap tracking. While indices like Nifty Next‑50 or mid-, and small‑cap options are gradually climbing the ladder, the majority of the pie remains with Nifty 50 and Sensex-linked strategies.

For investors, this signals both opportunity and imbalance—there’s room to diversify beyond top 50 heavyweights.

7. Action button

So, having discussed the passive equity landscape thoroughly, what are the investment implications?

Portfolio diversification is a key pillar of investing. India's passive equity landscape is still evolving.

Even though passive equity landscape is uneven, investors can explore a variety of indices to start with. Those new to investing can opt for safer alternatives like passive funds based on Nifty 50 and Sensex, depending on your risk appetite, asset allocation, personal situation and return expectations.

A succinct action plan for investors:

> Core part: A large part of your surplus money can be invested in passive funds based on Nifty 50 and Sensex, as India is expected to post reasonable growth rates of 6 to 8 per cent over the next five to 10 years

> Satellite part: Complement the core with a few index funds or ETFs that track Nifty Next 50 or Nifty Midcap 150 to capture broader domestic market participation

> Play money: Just for learning experience and get a grip on market psychology, a very small portion of your surplus money can be invested in the so-called smart-beta indices after thoroughly doing your own due diligence

> It may be mentioned, despite claims to the contrary by the index providers, "smart-beta" indices have not been able outperform their parent indices on a consistent basis

> Smart-beta passive funds still have higher expense ratios, low to medium volumes (for ETFs) and moderate investor interest

> Some smart beta indices gaining traction in recent years are:

-- Nifty 200 Momentum 30 Index

-- Nifty 100 Low Volatility 30

-- Nifty Alpha Low Volatility 30

> As you know, passive funds based on 'momentum' indices are prone to greater volatility and higher risk of losing money

> Global flavour: Regulators permitting, you could add a few passive funds based on foreign indices for international diversification and see how things go

> Most of the sectoral / thematic funds are not suitable for a large majority of investors; as such, these categories should be on your highly-avoidable list

> If you are looking for equity ETFs, make ensure to do your homework on liquidity, bid-ask spread, high ETF volumes and reasonable asset size

> Stay disciplined with rebalancing: Regularly assess and rebalance your allocations to maintain your strategy mix; you could broadly aim for 50–75 per cent large-cap, 10–20 per cent mid-cap, 5 per cent global, and 5 per cent play money

> The asset mix presented here is merely a heuristic — not set in stone; you should determine your own mix based on the various factors discussed elsewhere

In this regard, you may be guided by the following list of articles the author has written in the past two to three years:

Low Expense Ratios, High Returns: Why Passive Equity Funds Matter

How to Buy Nifty Midcap 150 Index

India Passive Funds and Their Asset Size (Big picture view of Passive Equity Funds)

This isn’t investment advice. Even though the author is a CFA Charterholder with nearly 25 years of experience in the financial markets, this is just general insight—not a recommendation.

- - -

Read More:

Additional data:

Table 5: India passive equity funds and their asset size: Top 25 passive equity indices and their asset size with break-up of ETF and Index funds >

(please click on the image to view better)

References:

NSE Passive Funds - dedicated website for passive funds

-------------------

Related Blogs on Mutual Funds (for a comprehensive list of all articles on Mutual Funds, look for section "4 Mutual Funds" in my blog Blog of Blogs Theme-wise):

Low Expense Ratios, High Returns: Why Passive Equity Funds Matter 06Jun2025

Mutual Fund Asset Class Returns 02Jun2025 (Fund categories with similar returns)

Mutual Fund Asset Class Returns 30Sep2024 (Fund categories with similar returns)

Crux of Kotak Debt Hybrid Fund 15Jul2024

The Little Secret Behind Nifty Next 50 Index's Recent Success 13May2024

NSE Indices Calendar Year Returns: 2006 to 2024 05May2024

How to Buy Nifty Midcap Index 03May2024

India Passive Funds and Their Asset Size 29Apr2024 (Big Picture View of Passive Equity Funds)

Guide to Tracking Error of Mutual Funds 27Apr2024

NSE Indices (Nifty 50, Nifty Next 50, Nifty 100 and Nifty 500) Comparison 31Dec2022

Who is Eating My Gold ETF Return?

Mutual Fund Asset Class Returns 31Mar2024 (MF categories with similar returns)

-------------------

Read more:

The Pitfalls of Market Timing and Why FOMO is Your Worst Financial Adviser 12Jul2025

The Elusive Current Account Surplus: What 25 Years Data Reveal About India's Trade Balance 30Jun2025

Low Expense Ratios, High Returns: Why Passive Equity Funds Matter 06Jun2025

Disclosure: I've got a vested interest

in Indian stocks and other investments. It's safe to assume I've interest in the financial instruments / products discussed, if

any.

Disclaimer: The analysis and

opinion provided here are only for information purposes and should not be construed

as investment advice. Investors should consult their own financial advisers

before making any investments. The author is a CFA Charterholder with a vested

interest in financial markets.

------------------------

CFA Charter credentials - CFA Member Profile

CFA New Badge

CFA Badge