Compare GDP, Exports and Population

- - -

P.S.:

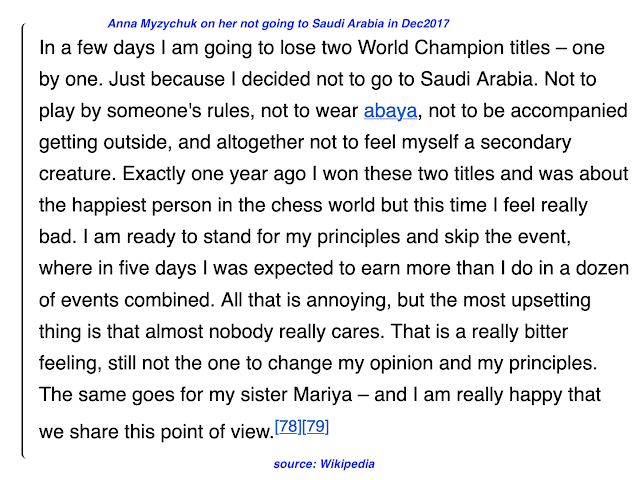

The following images (from old files) are included here from 09Apr2023 for reference purpose > These

images are just for information purposes only, this is not investment

advice. Readers should consult their own advisers for advice before

making any investment decisions:

These images / screenshots / weblinks are sourced from various web sources >

aaa

-------------------

Read more:

Who is Eating my Gold ETF Return? (gold data / gold ETF data)

Corporate Governance Concerns - Indian Companies 13Dec2024 (including family feuds / family disputes)

-----------------------

Jan2026: Indicative NAV or iNAV or real time NAV or intra day NAV of several ETFs

Trendlyne all ETF Volumes, expense ratios and AUM at one place / portfolio overlap

Trendlyne ETF Dashboard - weblinks for ETF volume data

Trendlyne individual ETFs: (data on overview, peer comparison, share price history, etc.) -----------------------

Apr2025: Screener.in weblinks for several Nifty indices and Rupee Vest weblinks for passive funds based on these indices

ETF volume data

India Passive Equity Funds and Their Asset Size >

NSE Market Watch for ETFs (volumes check)

India Flagship Equity ETFs

comparison weblinks: compare funds / compare mutual funds

-----------------------

broad Nifty indices

Smart Beta indices: Factor investing

comparison weblinks: compare funds / compare mutual funds

compare funds - parent versus child indices

select list of smart beta indices and their asset size

select list of smart beta passive funds and their details

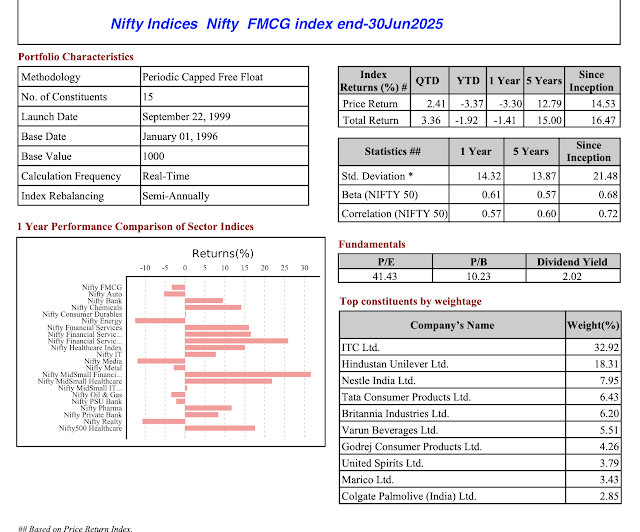

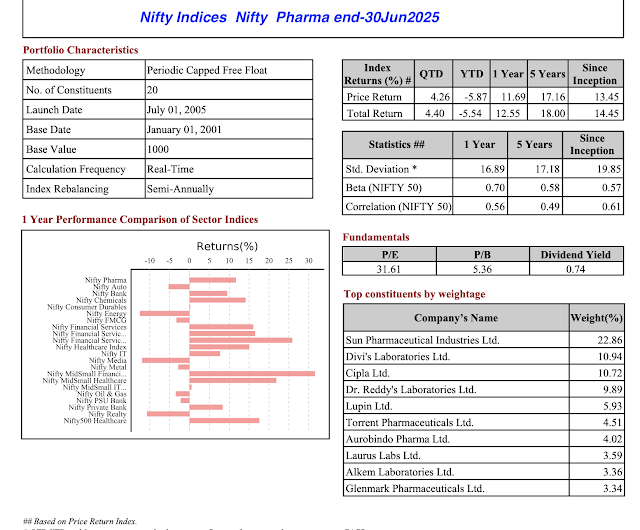

Sectoral / Thematic / Strategy Nifty Indices:

-----------------------

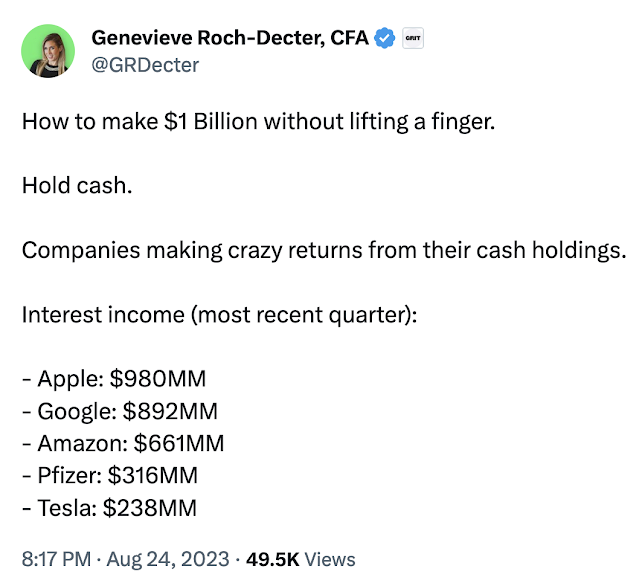

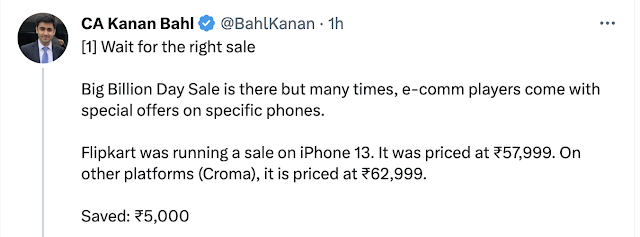

Apr2025: Tweets on stock investing

Jun2025: Tweets on stock investing

-----------------------

Sep2025: Screener.in Industries Overview / Sectors and their stocks weblinks

Nifty Total Market Index (top 750 stocks in India) as on 31Aug2025

Sectors and number of stocks as per Screener.in

-----------------------

Oct2025: Google Finance peer comparison weblinks

-----------------------

Oct2025: Rupee Vest stocks held by mutual funds > for example >

-----------------------

Dec2025: Rupee Vest Mutual funds and their monthly portfolios - factsheets

-----------------------

Super investors

-----------------------

Hollywood Quotes

-----------------------

Jan2026: Indicative NAV or iNAV or real time NAV or intra day NAV of several ETFs, including gold ETFs and silver ETFs > mutual fund weblink for iNAV >

DSP MF

Trendlyne all ETF Volumes, expense ratios and AUM at one place >

Nifty 200 Quality 30 index - NSE weblink of index tracker - real time returns / heatmap of all stocks (Passive funds with low expense ratios are: SBI index fund, SBI ETF and ICIC Pru ETF)

Portfolio overalp, as per fundoo.com, between Nifty 100 Low Volatility 30 and Nifty 200 Quality 30 indices is: (data Nov2025) 33% of portfolio overlap; 10 stocks common to both indices, namey, ITC, Nestle India, TCS, Asian Paints, HUL, Britannia, HCL Tech, Infosys, Bajaj Auto and Pidilite.

Trendlyne ETF Dashboard - weblinks for ETF volume data >

(choose drop down menu for ETFs based on various inidces) - data on volumes, AUM, expense ratio, returns, perfornace over benchmark, etc., are available

Nifty 200 Quality 30 ETFs - ETF volume data (3-month average)

Nifty Midcap 150 Quality 50 ETF - ETF volume data (3-month average)

Nifty Midcap 150 Momentum 50 ETFs - ETF volume data (3-month average)

Nifty Midcap 150 ETFs - ETF volume data (3-month average)

Nifty 100 Low Volatility 30 ETFs - ETF volume data (3-month average)

- ETF volume data (3-month average)

- ETF volume data (3-month average)

Trendlyne individual ETFs: (data on overview, peer comparison, share price history, etc.)

ICICI Prudential Nifty 200 Quality 30 ETF

Aditya Birla SL Nifty 200 Quality 30 ETF

DSP Nifty Midcap 150 Quality 50 ETF

ICICI Prudential Nifty 100 Low Volatility 30 ETF

Kotak Nifty 100 Low Volatility 30 ETF

-------------------

Apr2025: Screener.in weblinks for several Nifty indices and Rupee Vest weblinks for passive funds based on these indices

(see blog "Why are mutual fund investors selling out" for more on mutual funds and weblinks)

India Mutual Funds: Passive funds (ETFs or exchange-traded funds and index funds):

Tweet thread 12Jun2025 Flagship Equity ETFs - AUM, expense ratio, tracking error and volume data (image attached)

ETF Volumes data:

Volumes for ETFs are extremely important to consider before investing.

NSE Market Watch - Exchange Traded Funds / ETFs (to check volumes)

NSE Indices tracker (new as of Dec2025) - index tracker (dropdown menu)

- Nifty Indices all -

- list of ETFs based on the respective Nifty index

- PE ratio and PB ratio

- real time returns (trailing returns upto 5 years)

- index graph upto 30 years

- heatmap with all stocks and their daily returns

- shareholding pattern of all stocks

- financial results of all stocks

Asset Size (AUM) is also important while considering ETFs: Passive Titans of India: the Top 10 Equity Indices by Asset Size 17Jul2025

Image containing asset size data as of 30Jun2025: India Passive Equity Funds and Their Asset Size >

click on the image to view better >

India Flagship Equity ETFs:

Nifty 50 ETFs (only top 5) with highest AUMs as of 31Mar2025 (ignored ETFs of PSU-owned AMCs)

BSE Sensex ETFs (only top 3) with highest AUMs as of 31May2025 (ignored ETFs of PSU-owned AMCs)

NSE India - LIC MF BSE Sensex ETF

Nippon India BSE Sensex ETF (not traded on NSE)

Nifty Next 50 ETFs (only top 3) with highest AUMs as of 31May2025 (ignored ETFs of PSU-owned AMCs)

Nifty Midcap 150 ETFs (only top 5) with highest AUMs as of 31May2025 (ignored ETFs of PSU-owned AMCs)

(note: you may have observed most of the 14 ETFs illustrated above are from just three fund houses, namely, Nippon India, ICICI Prudential and Mirae Asset -- we ignored PSU-owned ETFs here)

Trendlyne weblinks for ETF volumes:

Nippon India ETF Nifty Midcap 150 (scroll down to check past two months data on volumes, value in rupee terms and number of trades) -- Trendlyne is restricting data to just one ETF - hence, this is not useful

Comparison weblinks: Compare funds / Compare mutual funds:

Nippon India Nifty 50

DSP Nifty 50 Equal Weight

ICICI Pru Nifty Next 50

Motilal Oswal Nifty 500

UTI Nifty 200 Quality 30

DSP Nifty 50 Equal Weight

Nippon India Nifty 50

ICICI Pru Nifty Next 50

Motilal Oswal Nifty 500

Nippon India Nifty 50 Value 20

DSP Nifty 50 Equal Weight

Nippon India Nifty 50

ICICI Pru Nifty Next 50

Motilal Oswal Nifty 500

Sundaram Nifty 100 Equal Weight

| UTI

Nifty 200 Momentum 30 |

| DSP Nifty 50 Equal Weight |

| ICICI Pru Nifty Next 50 |

| Motilal Oswal Nifty 500 |

| Nippon India Nifty 50 Value 20 |

-----------------------------------------------------

To cross check with Nifty Passive Insights (quarterly) about the new passive funds being launched and to track their AUM.

Broad Nifty Indices:

NSE Indices tracker (new as of Dec2025) - index tracker (dropdown menu) - Nifty Inidces all - heatmap with all stocks and their daily returns

Nifty 100 index - Screener.in - full stocks / valuation available

Nifty Midcap 150 - Screener.in - full stocks / valuation availableMotilal Oswal Nifty Microcap 250 Index fund - Rupee Vest

The so-called smart beta indices (where funds based on these indices have reasonable AUM and to assess their volumes also):

See above image for asset size of equity indices "India Passive Equity Funds and Their Asset Size" - data as on 30Jun2025

Portfolio overlap (stocks common to both funds) of two MF schemes can be found here: fundoo.com website -- for example, portfolio overlap between ICICI Pru Nifty 100 LV 30 ETF and Nippon India Alpha LV 30 Index fund is 47% weight with 17 stocks common to both (as checked on 11Apr2025)

Factor Investing in India: Do "Smart Beta" Indices Outsmart Nifty 50 and Nifty Midcap 150? 24Nov2025

Nifty Indices (for Methodology document & research paper)

Nifty Alpha Low Volatility 30 - Screener.in - full stocks / valuation available ICICI Pru Nifty Alpha Low Volatility 30 ETF - Rupee Vest

Nifty 200 Momentum 30 - Screener.in - full stocks / valuation available

Nifty 200 Alpha 30 - Screener.in (stock list not available) Nifty 200 Alpha 30 - Value Research - for PE ratios

Nifty 200 Quality 30 - Screener.in - full stocks / valuation available

Nifty 500 Momentum 50 - Value Research - for PE ratios Nifty 500 Value 50 - Value Research - for PE ratios

Comparison weblinks: Compare funds / Compare mutual funds: Smart beta indices:

Bandhan Nifty 100 Low Volatility 30

UTI Nifty 200 Momentum 30

UTI Nifty 200 Quality 30

ICICI Pru Nifty Next 50

HDFC Nifty 50

Bandhan Nifty 100 Low Volatility 30

UTI Nifty 200 Momentum 30

UTI Nifty 200 Quality 30

Axis Nifty 100

HDFC Nifty 50

UTI Nifty 200 Quality 30

Edelweiss Nifty 100 Quality 30

DSP Nifty Midcap 150 Quality 50

Nippon India Nifty Alpha Low Volatility 30

HDFC Nifty 50

Motilal Oswal Nifty 200 Momentum 30

Motilal Oswal Nifty Midcap 150

Bandhan Nifty100 Low Volatility 30

Nippon India Nifty Alpha Low Volatility 30

ICICI Pru Nifty 50

Motilal Oswal Nifty Midcap 150

Tata NIFTY Midcap 150 Momentum 50

DSP Nifty Midcap 150 Quality 50

UTI Nifty 200 Momentum 30

ICICI Pru Nifty Next 50

Motilal Oswal Nifty 500

Nippon India Nifty 500 Momentum 50

UTI Nifty 500 Value 50

UTI Nifty 200 Quality 30

Tata Nifty 200 Alpha 30

Motilal Oswal Nifty 200 Momentum 30

Kotak NIFTY Midcap 150 Momentum 50

Nippon India Nifty 500 Momentum 50

Bandhan Nifty 100 Low Volatility 30

Motilal Oswal Nifty 500

Motilal Oswal Nifty 200 Momentum 30

Bandhan Nifty 100 Low Volatility 30

Nippon India Nifty Alpha Low Volatility 30

UTI Nifty 200 Quality 30

Motilal Oswal Nifty Midcap 150

UTI Nifty 200 Quality 30

DSP Nifty Midcap 150 Quality 50

Tata Nifty 200 Alpha 30

UTI Nifty 500 Value 50

Motilal Oswal Nifty 500

Nippon India Nifty 500 Momentum 50

Bandhan Nifty 100 Low Volatility 30

DSP Nifty Midcap 150 Quality 50

Nippon India Nifty Alpha Low Volatility 30

ICICI Pru Nifty 50

11) VR comparison of index funds: Final watchlist as on 06Aug2025

Motilal Oswal Nifty Midcap 150

DSP Nifty Midcap 150 Quality 50

UTI Nifty 200 Quality 30

Bandhan Nifty 100 Low Volatility 30

ICICI Pru Nifty 50

UTI Nifty 200 Quality 30

Edelweiss Nifty 100 Quality 30

Axis Nifty 100

DSP Nifty Midcap 150 Quality 50

Motilal Oswal Nifty Midcap 150

Nippon India Nifty 50

DSP Nifty 50 Equal Weight

Nippon India Nifty 50 Value 20

ICICI Pru Nifty Next 50

Motilal Oswal Nifty 500

x) VR comparison of index funds:

x) VR comparison of index funds:

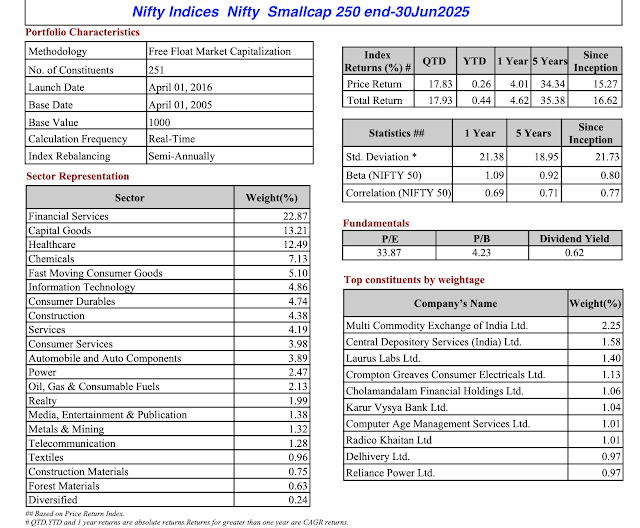

Passive equity funds by asset size - Nifty Midcap 150 and "smart" bet indices - data as on 30Jun2025 > (image from excel sheet 'passive funds' in excel file 'Mutual funds analysis 20xx') >

click on the image to view better >

Select passive funds based on - Nifty Midcap 150 and "smart" bet indices - data as on 30Jun2025 > (image from excel sheet 'passive funds' in excel file 'Mutual funds analysis 20xx') >

click on the image to view better >

Strategy indices - returns, volatility and valuation ratios - data end-31Jul2025 >

click on the image to view better >

Broad based indices - returns, volatility and valuation ratios - data end-31Jul2025 >

click on the image to view better >

-----------------------------------------------------

Sectoral / Thematic / Strategy Nifty Indices:

All weblinks related to passive funds (ETFs + index funds) from NSE / Nifty indices >

NSE Market Watch - Exchange Traded Funds / ETFs (to check price / volumes)

Nifty indices - market data - ETFs or exchange traded funds (to check price)

NSE market watch - all Nifty indices (incl broad based, sectoral, etc) - to check index level, % change, 52-week high and 52-week low

Nifty Indices Index methodology - PDF for Jun2025 - the PDF gives details of which sectors / sub-sectors form part of a particular index -- for example for, financial services index, capital markets index, etc.

Nifty Indices return profile (incl total return, historical return)

Select sectoral / thematic / strategy Nifty indices

Nifty India digital index - factsheet, methodology, etc. Nifty India digital index fund - stocks and sectors - Rupee vest (only 2 passive funds) Nifty India digital index stocks valuation - Screener.in Nifty India digital index - NSE market watch - components / price / volumes

Nifty MidSmall Healthcare index fund - stocks and sectors - Rupee vest (only 2 passive funds) Nifty MidSmall Healthcare index - NSE market watch - components / price / volumes

Nifty MidSmall IT & Telecom fund - stocks and sectors - Rupee vest (only 1 passive fund)

Nifty MidSmall financial services fund - stocks and sectors - Rupee vest (only 1 passive fund)

Nifty MidSmall India consumption fund - stocks and sectors - Rupee vest (only 1 passive fund)

Nifty India new age consumption fund - stocks and sectors - Rupee vest (only 1 passive fund)

Nifty EV and New Age Automotive fund - stocks and sectors - Rupee vest (only 3 passive funds)

Nifty Capital Markets fund - stocks and sectors - Rupee vest (only 3 passive funds)

Nifty India tourism fund - stocks and sectors - Rupee vest (only 3 passive funds)

Nifty Services Sector index fund - stocks and valuation - Screener.in (no passive funds)

Nifty Growth Sectors 15 fund - stocks and sectors - Rupee vest (only 1 passive fund)

-----------------------------------------------------

Apr2025: Tweets on stock investing, Indian economy, India macro factors: (some of these are added to My Notebook in Screener.in on 25Apr2025 and other dates on Nifty 50 page):

Tweet thread 09Jul2025 Promoter stake sale / promoter exit / insider exit / promoter selling in BSE 200 companies in the past four years

Tweet thread 16Dec2024 Funds raised by India Inc via QIPs or qualified institutional placements - QIP placement - QIP vs BSE market cap (image) - promoter selling / insider exit - PE exit - QIP fund raising - QIP fundraising

Tweet thread 15May2024 (thread continued even on 15Jun2025) on US trade protectionism - trade war - bogey of national security - US China trade war - IBM - Microsoft - Nippon Steel vs US Steel - Dubai Ports - Biosecure Act - China EV - TSMC - CATL - AI Chips - AI diffusion order - Canada Mexico tariffs - Trump reciprocal tariffs - Trump tariffs - (new thread wef 23Jul2025 - Tweet thread on Trump trade deals)

Tweet thread 19Jan2024 US 10-year 2-year Treasury yield spread - Fed interest rate cut - negative spread - negative yield spread - positive yield spread - US dollar index or DXY / USDX

Twee thread 30Jan2024 - India cement sector consolidation - mergers and acquisitions

Tweet thread 27Apr2025 Promoter share pledge; example of Orchid Chemicals & Pharmaceuticals promoter K Raghavendra Rao (four images) - promoter pledge - promoter pleding

Tweet thread 23Apr2025 India steel sector - trade protectionism and safeguard duty - China anti dumping fear Tweet thread 16Apr2025 Indian stocks seem to be overvalued; stocks with high PE ratios are rising more

Tweet thread 12Apr2025 US bond market concerns, rising Treasury yields, lack of global investors for US Treasuries and FPI flows to India

Tweet 06Mar2025 PM Modi govt may not reverse increase in LTCG / STCG taxes; pre-conditions to attract FPI / FII flows to India - another thread 29Sep2025 on unfairly charging both STT and LTCG tax on equities, why frame of reference matters, front-loaded vs back-ended; wages vs investment income

Tweet thread 04Mar2025 dangers of overexposure to capital market related stocks; launch if Nifty Capital Market Index

Tweet thread 04Sep2024: Kiril Sokoloff: "China was leading in 54 of the 63 critical technologies." (image)

Tweet 29Aug2024 promoter selling can be good (e.g., Gangwal family in Indigo Airlines)

Tweet 11Jul2024 India premium - factors driving Indian stock market multiples

Tweet thread 17Jun2024 timeline of events of 1991 Forex Crisis and Gold Pledge

Tweet 08May2024 Dow Jones Industrial Average (DJIA) history - 25 years zero return Tweet thread 29Apr2024 How Nifty Next 50 Index changes over four months

Tweet thread 26Mar2024 India rupee natural depreciation - factor influencing it

Tweet thread 21Feb2024 University of Brutal Markets, indiscipline, lavish spending, human emtion, income-generating assets, Las Vegas and excitement

Tweet thread 19Jan2024 Indian stock market frenzy / euphoria, QIPs, over valuation, PM Modi taking credit for PSU / railway stocks rise, Modi ministers taking credit, SEBI caution / studies on day trading, MNC selldowns and others

Tweet thread 30Nov2023 India market cap - BSE market cap of all companies - continues in Jun2025

Tweet thread 22Sep2023 market breadth of BSE 500 index - advance decline ratio or ADR

Jun2025: Tweets on stock investing, Mutual funds in India, Indian economy, India macro factors: (some of these are added to My Notebook in Screener.in on 16Apr2025 and other dates on Nifty 50 page):

Tweets in Jul2026 - Handle WhyDan4

Tweets in Jun2026 - Handle WhyDan4

Tweets in May2026 - Handle WhyDan4

Tweets in Apr2026 - Handle WhyDan4

Tweets in Mar2026 - Handle WhyDan4

Tweets in Feb2026 - Handle WhyDan4

(till 28Jan2026)

opening track of 2001 Hollywood film Ghost World is "Jaan Pehechaan Ho" > Song by Mohammed Rafi - Hindi movie "Gumnaam" (1965) - Lyrics: Hasrat Jaipuri - Music: Shankar-Jaikishan - Heineken ad

Gains from decontrol: Article by Ajaj Shah

Ananth Narayan for India's transition to residence-based tax regime

The so-called mother of all deals India EU trade deal FTA

Social media ban > digital majority law

TACO Tracking: Trump Carries Out One in Four Tariff Threats

Job losses / layoffs Pinterest

Update GCC India GCCs vs legacy IT firms

FDC Drugs 🧵 fixed-dose combination drugs

Investors need to do some critical thinking gold silver

Economic freedom or monetary control? gold silver

Boycott America seems to be working

Process is Punishment Raj in India

The US economy expanded at an annualized rate of 4.4%

parabolic nature of the price graphs of gold & silver

the effective average US tariff rose from 2.5% in 2024 to 15.6%

Socialism under Trump

Gautam Adani bribery charges

India EU trade deal mother of all deals / EU withdrawal of GSP

Europe owns Greenland, it also owns US Treasuries Deutsche Bank's George Saravelos

Trump the more windmills a country has, the less GDP growth it will have

To avoid paying taxes, Eduardo Saverin, Facebook co founder migrated to Singapore

Europe may go for a "nuclear option" the EU's Anti Coercion Instrument (ACI)

US Economic Coercion under Trump

EU pulls tariff preferences GSP on 87% of Indian exports ahead of FTA

Denmark pension fund sell its US Treasury holdings of USD 100 million

Capital wars Wall Street impacted by Trump’s Greenland annexation threat

Polish Central Bank Approves Plan to Buy 150 Tonnes of Physical Gold

Peter Thiel invested USD 500,000 in Facebook in 2004

Growth of USD ETF AUM in USD trillion

Amazon’s European sovereign cloud launch AWS

Gold USD 35 Berkshire Hathaway USD 19

India Supreme Court capital gains Tiger Global stake sale in Flipkart to Walmart

Tax sovereignty

State Street to invest Rs 580 cr for 23% stake in Groww AMC

Global investing International diversification

Mirae Asset Nifty Midcap 150 ETF

History of an impulsive trader in one line

Time for rebalancing? gold Nifty 50

India City gas distribution (CGD) sector national gas grid

Hollywood quote

Japan Government Bond (JGB) yields

Taleb Turkey Problem Recency bias in Indian gold investors

New labour codes impact India IT sector

RBI forex intervention

Checks and balances in the US clean energy grants

WhatsApp leak of UPSI is not new Hatsun Agro Operational risk ICICI Lombard

US price controls under Trump >

Powerful Words (internal poster of The Plaza Hotel, New York)

Indicative NAV (iNAV) or real time NAV of gold / silver ETFs

Steve Wozniak is the engineer who quietly built Apple Here are 26 ideas

proposed California wealth tax

The 'magical' blue flower butterfly pea flower (Aparijitha)

US Fed "independence" Fed chair Powell says The threat of criminal charges

another narrative tailwind pushing the dollar gold / silver prices higher

listed space in Textiles sector (export oriented) contrarian opportunity?

Checks and balances US Senate rebukes Trump - Venezuela

NYT interviews Trump international law doesn't matter

RBI selling US dollar Because US Treasury securities most liquid assets

When you want to sell your assets, which assets will you sell the most?

Unforgotten Brands: Nutrine

Despite his maxim of 'everything flows' Nifty 50 index

Nostalgia Grape varieties in Hyderabad

Iran protests

Trump Signs Order Pressing Defense Firms to Cut Buybacks

NSE (Nifty Indices) is implementing weight capping of top three stocks in Nifty Bank

Gold / Silver mania continues... new all time highs gold ATH silver ATH

Maruti Suzuki Dzire Becomes Best-Selling Car In India

Anecdote: Nisha Patil, a Bombay housewife bequeathed her entire estate to Sanjay Dutt

Boots-in-the-air US policy under Trump

US captures president Nicolas Maduro

Demerger process (can be lengthy at times) depends on NCLT efficiency

Derivatives trader uses Rs 40 crore margin credited mistakenly by Kotak Securities

India equity funds with high share of foreign stocks (international stocks)

India equity funds with high share of foreign stocks (international stocks) >

Global investing > 2026 Buy List for 2026 from Mr Elfenbein >

Not Alpha Managers!

India real estate REIT sector thread 🧵 >

digital arrest cyber scam impersonation

Low-sugar fruits

9 healthiest fruits for a longer life - Low-sugar, high vitamin fruits

The Aravalli Hills range

South Korean e-commerce firm Coupang announces a compensation deal data leak

Thailand was at the epicentre of the 1997–1998 Asian Contagion

How the UK-based NRI invests his money?

Export value of toys to the US last year

Asset price distortion

Some reasons why asset prices are distorted

Govt of India's ‘One State-One RRB’ policy

India banking sector thread 🧵 >

Why would happen if you're put in a cryogenic chamber (deep freeze)...

CME Group raised margin requirements for silver, copper

RBI introduced External Benchmark Based Lending (EBLR) in Sep2019

What was considered luxury once is now a need

India hosts 20% of the world’s data but only 3% of its storage data centres

neem tree Dieback disease

Self Help the land of you-are-on-your-own

positive feedback loop

Classic self-reinforcing cycle > Rupee depreciates > Foreign investors sell

There is some confusion with terms used in BoP data.

More banking liquidity injection by RBI

The lower the profit, the higher the market cap!

The case for global investing for Indians

The Four Primary Routes for Global Investing

Timeline of Trump tariffs in 2025

Why did Infosys ADR surge 56% NYSE

Kahlil Gibran

Adani Cement Empire The three-way merger approved

Latha Venkatesh talks to Ananth Narayan

"Dual Speed" Export Market

Trump tariffs and India exports

cyber crime cyber fraud WhatsApp

Standard Chartered Bank widens fraud probe after Rs 80 crore HNI funds diversion

Foreign ownership in Indian financial sector / NBFCs

RBI forex intervention data RBI currency intervention

India New CPI series 🧵 >

Kotak Nifty 100 Low Volatility 30 ETF

GDP back series >

Background to new GDP series

Examples of Indian companies that suffered high financial leverage / equity multiplier

NSE Indices tracker - index tracker (dropdown menu) - Nifty Indices all

Dupont analysis

Follow-up on asset turnover ratio >

Compare midcap funds > funds comparison

Ambri apples variety origin Kashmir apple varieties

A beautiful story Queen Didda (Catherine of Kashmir) Sangram Raja

The worst Sensex declines were

The biggest rupee drops occurred during

Private sector in space / nuclear power

South Korea economist Ha-Joon Chang India needs trade protectionism

India Targets Space Economy by Private Firms RDI scheme

Trump Eyes Tariffs Over Canadian Fertiliser, Indian Rice

Checks and balances in the US Trump ban on wind power overturned

Indian retail investors seem to be finding more opportunities in

A new baby always attracts greater attention IPO market

China’s trade surplus topped a record USD 1 trillion

9 ‘healthiest’ fruits for a longer life

Kenneth Andrade businesses with dollar exposure (with image)

20 biggest data breaches cyber security data leak

Louis-Vincent Gave of Gavekal Research gold silver hedge (with image)

M&A deals They often fail because of

Netflix Inc to buy Warner Bros

Bloomberg reported this story ‘India’s Digital Dream, Hacked’

Martina Navratilova told Maria Sharapova's father that her daughter had talent (with image)

Maria Sharapova There's no match point in business

exemplary sportsman ship Serena Williams Maria Sharapova

Maria Sharapova I don’t want to be a sad version of my old self

EV Charging infra

QIP funds raised by India Inc

Pronab Sen India Inc is not sharing data

India market cap GDP ratio

Ken Burns

Thomas Jefferson liberty freedom slaveowner

mandatory Sanchar Saathi government app mobile phone

LME copper prices

Classic Legends - Yezdi trademark patents IPR

Tweet thread 01Dec2025 India exports - Trump tariffs negative impact - EU withdrawal of GSP preferences

Classic Legends - Yezdi trademark patents IPR

regressive SIM binding ditective chaos

India is an electoral autocracy

IMF C grade for India GDP data

new phrase enclave growth

Human greed

trading of futures options halted CME

India’s de jure exchange rate arrangement - IMF crawl like

US govt stakes in private sector bogey of national security

Lovely Green Flags in a Man's Apartment

Marico Ltd's digital brands acquired ones

A Swath of Bank Customer Data hack / cyber security

New Labour Codes notified by govt

Pradip Shah of IndAsia Fund Advisors (with image)

India climbdown on Quality Control Orders

Risk allocation should precede asset allocation Markowitz

PPFAS To Enable Easy Access To US Stocks Via Two New GIFT City

SEBI caution Online Bond Platform

India is a hard-soft state YV Reddy

Diabetes capital Dengue capital

No Relief for Bata, Liberty - Crocs

World's Road Accident Capital

Czech National Bank has purchased digital assets

The US stopped minting one-cent coin

Trump reciprocal tariffs climbdown >

Cocoa futures prices

legislators treat Indian citizens like jokers

Global maritime power

Australia ban on social media for children under 16 / Denmark too

Peter Thiel Capitalism is not working for a lot of people in NYC

Tesla pay package for Elon Musk

new phrase Keyboard crusader

Share of Global IP5 Patents > Patent > Innovation

The biggest culprits in job cuts / layoffs in recent years

"Humanity learns slowly" James Robinson Why Nations Fail

Tata Group Fracas Mehli Mistry

Left slice of India

World's toxic capital? forever chemicals

#Clientalism under Erdoğan is similar to what Thiru PM Modi... Turkey

How the US Economy Has Defied DD Predictions on Tariffs

Oyo Scraps 6,000:1 Bonus Share Plan

Oracle Corp's market cap now is more sober

Problems with eSIM / eSIMs > mobile phones >

Prof Jeffrey Sachs video on how China is trying to dismantle US hegemony

India jewellery sector - social media Boycott / outrage

Ajit Ranade: India's Households Are Borrowing More & Saving Less

Irony is during both QT and QE, stock markets rise, contrary to

apple banana coconut puzzle / math problem

secret to equity investing - consistency, patience and long term orientation - power of compounding

The "killer" for Apple Inc is growth in services business

Point to point returns (CAGR) from 31Oct2000 to 31Oct2025 - 25 years

Top 15 Equity MFs >

stock holdings of Indian politicians will be made available on Perplexity Finance

Henley passport index

cashew apple

DeepFake example

US firms structure investor decks around facts, trends and forward-looking analysis

Tweet thread 10Oct2025 Official central bank gold reserves - countries holding US Treasuries - moving gold out of the US? Poland versus Venezuela - capitalism socialism in one chart

AWS is slow in the AI race

Childhood / Children / kids games

India Passive Equity Mutual Funds suitable for youngsters - high risk appetite

Alphabet Inc (Google) - first-ever USD 100 billion revenue quarter

Stress-induced flowering > Stress from dry season- samanea saman / rain tree -

World's top 10 companies by market cap >

Under GST 2.0, roughly 62.4% of the CPI basket (by weight) is taxed at 0%

India’s CPI - selective GST design insulate inflation from tax changes

Marks and Spencer ends contract with TCS ltd to run its IT service desk

China seems to be ahead of Canada in quoting Ronald Reagan on tariffs >

Global migration - exodus from Europe to GCC / Dubai / Abu Dhabi >

Energy transition > Fossil fuels to RE > European Union >

Amazon Web Services outage

a striking contradiction in investment behaviour - gold vs stock

Why some nations achieve prosperity - by Duvvuri Subbarao

India's Supreme Court rejects Swiss Roche AG's plea seeking Natco Pharma

JSW Steel chair Sajjan Jindal - Lack of Innovation / R&D spend in India

Indian household financial assets > total wealth

Total market cap in USD trillion > Equities / bonds / gold / crypto

Debanking: What you need to know

Coforge Public Library, Kondapur

Gold asset class 🧵> Gold "market cap" or gold asset size >

Equity stakes in more companies by US gov't?

Three Factions: Shapoorji Pallonji - Noel Tata - Mehli Mistry

To access individual weights of all stocks, in real time, like Nifty Services Sector index

checks and balances in the US - limits to Trump's executive powers

China tightens export rules for crucial rare earths

three mutual fund houses halted fresh investments silver ETF FOF

Google Vizag investment USD 15 billion data centre

Most Investments are Actually Bad. Here’s Why. By Lyn Alden

Dutch govt takes control of Nexperia - China

Qantas Airways says customer data breach - cyber security - privacy

Google to ChatGPT - Cartoon by Harley Schwadron > fun

India household assets / total wealth > Gold holdings 34,600 tonnes (USD 3.8 trillion)

silver ETFs in India are quoting at a premium to their NAVs

entrepreneurs are considering moving to a new country. Singapore is their top option - global migration

Qatar Air Force facility to be built at US Air Force

India pharma CDMO sector - US Biosecure Act

In financial markets, there is no substitute for original, data-driven research conducted independently

China imposes new curbs on rare earth minerals

Indian household gold holdings

Gita Gopinath US Trade balance not improved - US manufacturing footprint remains same

media-glorified Tata group

Why carmakers are falling back in love with petrol

Vietnam upgraded to emerging market status

global migration, people exodus from UK to UAE -

Tweet thread 09Oct2025 Russia forex reserves frozen - west daylight robbery - Russia Ukraine War Tweet 09Oct2025 cyber attack - cyber security - Britain - Jaguar Land Rover - Marks & Spencer - Scattered Spider

Tweet 2Oct2025 Estate tax in the US is 40% - Estate tax in Europe is NIL - UCITS funds in Ireland / Lux - Europe ETFs - estate planning

Tweet thread 04Oct2025 India moves to internationalise rupee - de-dollarisation - dedollarization - rupee internationalisation Tweet thread 26Sep2205 Nvidia added USD 4 trillion market cap in 5 years - top world semiconductor companies - market concentration - fabless chip designers, foundries, integrated device manufacturers Tweet 26Sep2025 master class in letter writing English language - Azim Premji to Karnataka CM on traffic chaos

Tweet 24Sep2025 Confidential IPO draft papers with SEBI - pre-filing process

Tweet thread 23Sep2025 Nvidia to invest USD 100 billion in OpenAI for data centres Tweet thread 22Sep2025 EU carbon border adjustment mechanism (CBAM) - steel and aluminium exports

Tweet thread 20Sep2025 - India in soup - everhting connected - 50% tariffs, Iran port, USD 100,000 fee for H-1B visa, etc. - INSTC - comparative advantage - Trump expanding his ambit

Tweet thread 20Sep2025 Protectionist US immigration policy - labour protectionism - USD 100,000 fee for H-1B visas Tweet thread 18Sep2025 Nvidia to buy USD 5 billion stake in Intel

Tweet thread 18Sep2025 Groww IPO hype - Satya Nadella - disruption, innovation, Clayton Christensen's The Innovator's Dilemma Tweet 15Sep2025 New Tax Regime Section 87A tax rebate - tax slabs FY 2025-26 - TDS - senior citizens

Tweet thread 11Sep2025 The South North Divide - inequality, delimitation, federalism, etc. - also from D Subbarao, former RBI governor

Tweet thread 11Sep2025 OpenAI and Oracle sign USD 300 billion cloud computing deal - Stargate project Tweet thread 04Sep2025 India's multi-rate GST structure - Arvind Subramanian - 45 distinct GST rates

Tweet 02Jun2024 India GDP and GVA gap in numbers; GDP methodology, coalition government growth better

Twee thread 01Sep2025 GDP calculation anomaly - GDP deflator - WPI and CPI - PPI or producer price index - NSO GDP methodology

Tweet thread 18Jul2025 - global stock indices at all time highs (ATH)

Twee thread 31Jul2025 India impact minimal from Trump tariffs - kid story - 11 crows - second order effects

Tweet thread 29Aug2025 rupee at record low - USD INR exchange rate - dollar appreciation vs rupee appreciation

Tweet thread 19Jun2025 How FTAs with UK, EU impact India's farm trade - India US trade talks collapsed

Tweet thread 23Aug2025 - US govt takes 10% equity stake in Intel - socialism in the US? - US govt in private sector -

Tweet thread 24Aug2025 thaw in India China relations / India-China-US triangle

Tweet thread 26Aug2025 global personal wealth / private wealth - EMILLI

Tweet thread 17Dec2025 India New GDP series - new base year for GDP FY 2022-23 - ACNAS - timeline for GDP releases - GDP revision - Revised GDP - GDP back series

Tweet thread 17Dec2025 India New CPI series - CPI base year - CPI basket revision - Revised CPI - GDP / CPI data quality - CPI new base year 2024 - data collection from e-commerce websites Tweet thread 25Aug2025 Ecommerce, quick commerce and inflation control / MOSPI scrapping ecommece prices for CPI data - CPI basket revisions - CPI basket weights - CPI revision - ISP index of services production

Tweet thread 25Aug2025 RBI review of Monetary Policy Framework (MPF) - background to MPF - Urjit Patel panel on MPF - FIT or flexible inflatin targeting - CPI basket rvisions - CPI basket weights - CPI revision - Tweet thread 25Aug2025 CPI inflation - CPI basket rvisions - CPI basket weights - CPI revision - food CPI - CPI basket changed post-COVID-19 - inflation underestimation -

Tweet thread 04May2025 Trade protectionism India-ishtyle - India trade polcies Tweet thread 25Aug2025 Varun Berry of Britannia Industries - UPI - shrinkflation - round number price points - India is still cash economy -

Tweet thread 20Aug2025 government regulation / legislation killing sectors - online gaming platforms, city gast distribution, etc. - impact on FDI flows

Tweet thread 15Aug2025 premature exhilaration - GST rate cut hopes - GST Council skewed composition Tweet thread 27Sep2021 Realt estate / REIT stocks - REITs - new REIT issues

Tweet thread 18Aug2025 India US trade talks - Peter Navarro - Scott Bessent - Russian oil - Secondary tariffs Tweet thread 17Jan2025 ADR / ADS / GDR - Infosys ADR and Reliance industries GDR and others -

Tweet 26Jul2025 for sustainable development, what countries should focus on

Tweet thread 24Jul2025 new thread on IEX or Indian Energy Exchange - CERC norms on market coupling

Tweet thread 24Jul2025 India retail sector peer comparison - Reliance Retail, Blinkit, Amazon India, Dmart, etc.

Tweet thread 23Jul2025 Trump trade deals - trade protectionism - trade war -

Tweet Thread 07Dec2021 Direct vs Regular plans - direct plans vs regular plans -

Tweet thread 09Mar2025 private equity deals - PE deals - PE acquisitions

Tweet thread 11Jul2025 Trump threatens India Russia energy trade - secondary tariffs - Western sanctions

Tweet thread 20May2024 LME copper prices - price divergence between US copper prices and LME copper prices - industrial metal copper

Tweeth thread 29Mar2024 Daniel Kahneman's book "Noise" - stock investing - market psychology - investor behaviour - investing process - decision making - human judgment - Tweet thread 18Mar2025 Field of Dreams - If you build, I'll come - big companies vs small companies - big companies buy out small, mimble and innovators

Tweet thread 08Jul2025 SEBI study: 90% of individual traders lose money in F&O / derivatives trading - their losses have been increasing over the years - retail investors have zero edge against whales

Tweet 08Jul2025 Niall Ferguson talking to Consuelo Mack of Wealthrack (image)

Tweet thread 04Jul2025 Jane Street saga - SEBI ban on Jane Street Group - Tweet thread 19May2023 Stock market history - eternal wait - sampling bias - Japan Nikkei 225, Italy FTSE MIB, France CAC 40, Hong Kong Hang Seng, Portugal PSI 20, etc.

Tweet thread 26Jun2025 India energy short and no energy security - strategic petroleum reserves (SPR) - India SPR locations / facilities - world top 10 oil consuming nations and SPR (image) -

Tweet thread 14Jun2025 Regime change possible in Iran? - Israel offensive against Iran - crude oil prices - Fordow nuclear facility -

Tweet thread 21Mar2024 SNB ZIRP or zero interest rate policy - negative yielding bonds - negative yield bonds - negative yielding debt - negative yield debt - negative interest rates - negative bond yields -

Tweet thread 23Jun2025 Energy basket of Top 10 countries - India rank low in crude oil production / reserves, but high in consumption - share of coal, oil, natural gas, hydro, renewables, nuclaer, etc.

Tweet thread 18Jun2025 Israel attacks Iran - US bombs Iran nuclear facilities - Middle East - crude oil - Strait of Hormuz - War mongers -

Tweet thread 08Mar2024 NATO new members - Europe defence spending - European security - NATO expansion -

Tweet thread 13Oct2024 weight loss / diabetes drugs - Eli Lilly - Novo Nordisk - Zepbound Mounjaro Ozempic Wegovy - GLP-1 drugs - new thread 28Jul2025

Tweet thread 07Jun2025 Multi cap funds vs Flexi cap funds - background to evolution of Multi / Flexi cap funds; return / risk measures over three years

Tweet thread 06Jun2025 Counterintuitive points - RBI cuts CRR and Repo rate - Negative impact on Bank depositors, Bank Disintermediation, Flow of resources to private sector, monetary policy transmission (MPT), Rakesh Mohan, etc.

Tweet thread 25Apr2022 Are Gilt Funds attractive - India interest rate path - Treasury bills - RBI terminal rate - G-Sec bond yields rising while RBI cutting rates is similar to Fed and US interest rates

Tweet thread 04Jun2025 Gilt funds vs Dynamic Bond funds - comparison of returns and risk parameters, data interpretation, implications of wider range of dynamic bond funds vs narrow range of gilt funds

Tweet thread 04Jun2025 Chasing maximum returns, dopamine rush, ending up with sub-optimal returns, wide range of returns

Tweet thread 04Jun2025 Flexi cap vs Large Cap funds - wide range of returns on a 1-, 3- and 5-years basis; return / risk measures over three years

Tweet thread 04Jun2025 Aggressive Hybrid vs Equity large cap funds - downside

protection, Best & Worst period returns from Value Research,

standard deviation range, risk parameters from Morningstar, etc.

Blog 03Jun2025 Mutual Fund Asst Class Returns with similar returns as on 02Jun2025 -

Tweet thread 03Jun2025 Flexi Cap funds vs Equity Savings funds - Best & Worst period returns - drawdown higher for flexi cap funds; return / risk measures over three years

Tweet thread 03Jun2025 Equity Savings funds (hybrid category) vs Dynamic Bond Funds - on a trailing basis over 1- to 10-year periods, Equity Savings funds generated superior returns vs Dynamic Bond funds - standard deviation range from Value Research, data interpretation, etc.

Tweet thread 02Jun2025 Conservative Hybrid funds vs Equity Savings funds (both hybrid category) - downside protection, Best & Worst period returns from Value Research, standard deviation range, risk parameters from Morningstar, etc.

Tweet thread 02Jun2025 Hybrid mutual funds capital gains taxation

Tweet thread 25Nov2024 Nifty Indices Trailing Returns - Nifty 50 pedestrian returns - Nifty 50 TRI - Nifty sectoral indices

Tweet thread 01Jun2025 OBBBA - One Big Beautiful Bill Act - trade war to capital war? - tax on foreign capital - revenge tax - lower returns for US Treasuries - negative for dollar assets - Section 899 of US tax code -

Tweet thread 05May2025 IBC / CIRP - India Supreme Court quashed JSW Steel's Rs 19,700 crore resolution plan for Bhushan Power and Steel - background - dirty dozen - IBC / CIRP subverted -

Tweet thread 20May2025 RBI route for sorting out issues at troubled banks in India - foreign banks are saviours> - LVB / DBS Bank - CSB Bank / Canada's Prem Watsa - Yes Bank / SBI / SMBC Bank - what about IDBI Bank (to Emirates NBD Bank?) -

Tweet thread 20May2024 NSE India - NSE F&O stocks - list of stocks in derivatives segment (futures and options) and NSE indices

Tweet thread 16May2023 - Share buyback offers and weblinks - data on share buybacks by various companies updated

Tweet thread 01Apr2025 - World's top 10 companies by market cap - Microsofit, Nvidia, Apple, Amazon, Google, Tesla, Berkshire Hathaway, Meta, etc.

Tweet thread 27Dec2024 corporate actions - demergers - spin offs - scheme of arrangement - demerged / resulting company

Tweet thread 08May2025 Adding war premium (India Pakistan sabre rattling) to equity risk premium or ERP; factors driving ERP and implications for Indian stock market valuations

Tweet thread 17Jan2021 How mutual funds performaed between Jan2018 and Jan2021 - notes on equity risk premium or ERP

Tweet thread 03May2025 Tragedy of Indian stock markets - lack of share buybacks vs the US and Japan

Tweet 09Apr2025 retaliatory tariffs and NTBs or non tariff barriers (to Trump reciprocal tariffs)

31Mar2025 Nifty 50 / Nifty Next 50 / Nifty Midsmallcap 400 internals / their relative riskiness (image)

Tweet 15Nov2024 safest airplane to fly after a crash “The Drop” Hollywood movie

Sep2025: Screener.in Industries Overview / Sectors and their stocks weblinks

Nifty Total Market Index (top 750 stocks in India) as on 31Aug2025:

Tweet 05Sep2025 with image

Top 5 sectors account for 59% of total weight

Top 6 sectors two-thirds

Top 10 sectors 82%

Top 15 sectors 96%

Top 15 sectors with their weight %:

1. Financial Services 29.99

2. Information Technology 7.95

3. Oil, Gas & Consumable Fuels 7.27

4. Automobile and Auto Components 7.24

5. Fast Moving Consumer Goods 6.63

6. Healthcare 6.57

7. Capital Goods 6.21

8. Consumer Services 3.98

9. Metals & Mining 3.31

10. Telecommunication 3.27

11. Power 3.15

12. Consumer Durables 3.08

13. Construction 2.92

14. Chemicals 2.31

15. Construction Materials 2.21

Explanation about sectors, consumer services and services (as classified by Nifty Indices) can be found in my blog 'Stocks and Peer Comparison by Industry.' (look for update 05Sep2025 at the end of this blog)

Sectors and number of stocks as per Screener.in

FMCG other agri products 76 (include basmati rice, seeds)

FMCG other agri products 76 (include basmati rice, seeds)

Oil & Gas LPG / PNG / CNG / LNG 9 (CGD or city gas distributor)

(idustrial products inlcude, metals steel products, packaging, plastic products,

castings & forgins, metals others, wires & cables, refractories, pumps & engines,

abreasive & bearings, glass industrial, etc.)

Capital goods industrial manufacturing 174 (includes industrial products, ship building, industrial machinery, railway wagons, etc.)

Consumer services all 233

Oct2025: Google Finance peer comparison weblinks

Internet / digital stocks (power exchange, digital marketplace B2B, prepaid cards, marketing services)

ADR ADRs Infosys, Wipro, DRL, Nifty IT, Nasdaq

Oct2025: Rupee Vest stocks held by mutual funds > for example >

Dec2025: Rupee Vest Mutual funds and their monthly portfolios - factsheets

Mar2025: Super Investors

Feb2024: Super Investors

Nalanda India Equity Fund - Sridharan Anand or Buggy Human - tends to hold for long term

Anil Kumar Goel (shows past nine quarters data) - tends to hold for long term

Hollywood Quotes > IMDb > Hollywood > Quotes >

"My daddy, he'd walk for 40 miles for liquor and not 40 inches for kindness." ~ Ruby in "Cold Mountain" (2003)

"It's funny your friends disappear when you need them the most." ~ "She Rides Shotgun" (2025)

Hollywood Quotes > IMDb > Hollywood > Quotes >

at around 17:30 into the movie "Elizabeth: The Golden Age" >

Sir Francis Walsingham: "William, you look dreadful, they are not feeding you in Paris.

"You can't learn the secrets of the universe on an empty stomach."

"Don't get emotional about real estate."

~ real estate broker Rick Carver (Michael Shannon)

- 99 Homes (2014)

"Don't be soft. Do you think America give a flying rats ass about you or me? America doesn't bail out the losers. America was built by bailing out winners. By rigging a nation of the winners, for the winners, by the winners." ~ real estate broker Rick Carver (Michael Shannon)

- 99 Homes (2014)

"When you work for me, you're mine.' ~ real estate broker Rick Carver (Michael Shannon)

- 99 Homes (2014)

---------------------------------

Tweet 28Jan2026: Ananth Narayan @ananthng, former SEBI executive director, argues for India's transition to residence-based tax regime

"source based tax followed by India is problematic"

"LTCG tax be removed for FPIs"

"reduce fixed-income and other asset class LTCG taxes to equity levels"

Exempt Budget from long-term capital gains tax regime for foreign investors

For years, our government has propelled the economy with its focus on infrastructure investments. However, for sustainable public debt and sustained capital formation, the investment baton must pass on to the private sector.

This requires a conducive, competitive, and stable tax regime that treats capital as a partner, not a target.

When a global major invests in a semiconductor fab, an artificial intelligence (AI) data centre or electronics assembly under the Production Linked Incentive (PLI) scheme, it brings patented processes, integration into global supply chains, research and development, and other specialised skills that can drive future growth. Fostering investment, therefore, remains a top national priority.

Global investment, particularly in AI, remains resilient. Yet, net foreign investments into India have struggled. While gross foreign direct investment (FDI) inflows are robust, high repatriation has weakened net FDI.

Net Foreign Portfolio Investment (FPI) flows have also disappointed. In a competitive global context, we aren’t giving capital enough reasons to stay.

Despite manageable current account deficits by historical standards, weak net capital flows have also pressured India’s external balance.

The withholding irritant

While several issues impact foreign flows, the elephant in the tax office is the withholding tax on capital gains.

Major jurisdictions adopt the Organisation of Economic Cooperation and Development-recommended residence-based taxation, under which any capital gains tax incidence arises only in the investor’s home jurisdiction.

However, India follows source-based taxation.

Despite treaties between India and other countries, many investors therefore see India as a taxation outlier, with legal uncertainties, upfront withholding, and friction in obtaining tax credits.

Taxes withheld in India are a drag for investors exempt from capital gains taxes in their country. In other cases, FPIs struggle to get credit for Indian taxes because our withholding categories do not map onto their own tax credit regimes.

Finally, computing gains in rupee terms amid rupee depreciation adds significantly to their drag.

To compete for global savings and attract investment, the upcoming Budget should consider moving to a residence-based tax regime, exempting foreign investors from long-term capital gains (LTCG) tax in India.

If such a blanket move were to raise fears of misuse by some, we could at least start with investors identified under the recently introduced SWAGAT-FI (Single Window Automatic and Generalised Access for Trusted Foreign Investors) framework.

Comprising objectively identified institutions like sovereign wealth funds and regulated public retail funds, SWAGAT-FI potentially covers over 70 per cent of FPI assets under management.

While adding to complexity, such an approach could provide risk-based tax relief to major investors.

The government could then consider a calibrated increase in the Securities Transaction Tax (STT) for some segments for revenue compensation, without penalising patient, long-term investors. The STT was originally designed as an alternative to LTCG tax.

In the wake of the Tiger Global Supreme Court judgment, researchers Ajay Shah and Renuka Sane have also argued for a residence-based tax regime.

Durably adopting this, in line with global best practice, should help attract and retain global savings.

Asset-agnostic domestic reform

Alongside, we must address issues faced by domestic investors. The current tax framework interferes with risk-based asset allocation.

By taxing equity LTCG lower than fixed income, we are telling retirees: “Take more risk than your appetite allows, or watch inflation eat your principal.”...

Taxing interest without indexation is not an income tax – it is a wealth tax. For a senior citizen living on fixed income returns, a 6 per cent interest rate amid 5 per cent inflation yields a 1 per cent real return.

Taxing that 6 per cent interest at a 30 per cent slab rate leaves the investor with a negative real return, even before expenses.

Additionally, even when investing in fixed income, the investor bears market and credit risk, both crucial for capital formation....

The solution is not to raise LTCG tax on equity — that would dampen investment — but to reduce fixed-income and other asset class LTCG taxes to equity levels.

Indexation and risk-taking arguments justify lower, uniform LTCG taxes across asset classes, even if interest expense is deductible at the borrower level.

Furthermore, as in the US, introducing a 0 per cent tier for all LTCG across asset classes up to a reasonable threshold (say, ₹12 lakh, the current effective income tax-free limit), followed by the current 12.5 per cent tax tier, would encourage small savers and pensioners to invest in capital formation.

Addressing the sceptics

This is admittedly an involved and emotive subject. Critics can point to three issues: Fiscal considerations, inequity and market volatility.

First, with increased spending needs in education, skilling, and defence, every tax rupee counts. However, in the medium-term, a stable, investment-friendly tax regime as proposed should raise collections through increased activity, investment, and value addition.

Second is the risk of inequity. One concern is the optics of appearing to offer foreigners LTCG ‘exemptions’ while taxing domestic investors.

However, besides aligning with residence-based principles, foreigners would remain liable for taxes in their home jurisdictions; the issue would be one of comparing our LTCG regime with that of other nations.

Then there is the optical inequity of lower uniform LTCG tax versus higher income tax rates. Without indexation, however, higher LTCG tax effectively becomes a tax on wealth and risk-taking. We must reward investments.

Finally, easing LTCG tax might prompt fears of short-term market volatility. In the medium run, however, rebalancing would ensure asset allocations mirror investor risk appetite rather than tax considerations.

This should also channel more savings into fixed income and critical hybrid instruments like InvITs (Infrastructure Investment Trusts) and REITs (Real Estate Investment Trusts).

The Budget 2026 mandate

To become a global economic superpower, we must stop seeing long-term investment primarily as a taxable event and start treating it as a crucial national resource.

Shifting to a residence-based tax regime for foreign investors, and an asset-agnostic, risk-appreciative LTCG regime for domestic investors would be pro-investment, in line with global best practices, and would strengthen financial stability.

For predictability, these underlying principles should be affirmed for the next decade. This would stop us from hitting the brakes just as we look to press the investment accelerator.

---------------------------------

12Jan2026 Grant Williams:

The Regime Shift No One is Prepared For: Grant Williams on the 100 Year Pivot: YouTube video

12Jan2026: Grant Williams talking to Excess Returns

YouTube video > https://www.youtube.com/watch?v=jBIrOkyTZcM

Highlights from the above video >

The kind of change we're talking about is the kind of change that happens once every 80 to 100 years. And if that environment has changed and not just changed but reversed, you know, what went down went up, it stands to reason that if for 40 years the default has been to make money and all you had to do was be there and stay out the way. If everything's reversed, it stands to reason that the next 40 years can be really hard to make money. If you are set up for how the world has been and these changes that we're talking about are real and they're happening. They continue to happen. There is no chance in hell that what worked in that previous environment works the same way going forward.

You're watching Excess Returns. I'm Matt Ziggler.

It's Grant Williams. Welcome back, Grant.

What is the 100-year pivot?

Well, it's a it's a great question and and the good news and the answer is you don't have to be a finance person for this to for this to mean something.

People lose trust in institutions and we're seeing that whether it's the institution of politics not just in America but here in the UK and across Europe and everywhere you know trust in politics has gone.

Trust in each other is kind of falling apart thanks to social media and trust in institutions you look at something like you know NATO perfect example. NATO is an institution that's been there our entire lives. And now NATO is heading to a break up of sorts.

The United Nations, the World Bank, the IMF, all these institutions are not in good condition.

Between the global financial crisis (2007/2008 GFC), COVID-19, the seizing of Russian assets and now Venezuela (US capturing Nicolas Maduro) and those all kind of feel linked to me as like a continuation of this institutional breakdown and institutional decay.

Can you sort of connect through and I really do want to laser in on the financial crisis to the seizing of the Russian assets. I think how you frame that's so useful to understand what this decay looks like as it actually happens.

After the 2007/2008 GFC, we lost trust in banks and bankers. So trust in the bankers went first.

President Barack Obama failed to put notorious bankers in jail and the bankers were not punished at all. It was terrible missed opportunity by Obama administration.

(On 15Aug1971, president Richard Nixon effectively ended the direct convertibility of the US dollar into gold. This event is famously known as the "Nixon Shock.")

Since 1971, we’ve been living in a purely fiat currency world. Earlier, currencies were backed by gold. But, they are now backed by nothing.

We trusted money before 1971 because it was backed by gold. Now, that trust is money (fiat currency) is gone due to lack of gold backing.

And so as the trust broke down in a purely fiat world where everything is built on trust, you have to trust the money because there's nothing behind it whatsoever. It's the full faith and credit of the United States government.

And of course, you know, faith is faith is trust.

And then we get to 2022, where when Russia crossed the border in Ukraine and started the war there, one of the first responses from the US Treasury, it's important to say to point out, was to freeze Russian assets (forex reserves) within the Swift system.

And the second they did that, I wrote a piece at the time called the end of the financial world as we know it.

By sanctioning those assets, by freezing them, what America did was basically say you can no longer trust in us as a partner for state level national sovereign reserves. And what that meant was that every single central bank in the world had a decision to make because they've all got holdings of dollars because dollars are the currency that oil and energy is transacted in.

Now, every central bank in the world say, "Okay, we can no longer absolutely trust in America to look after our money."

Central banks have been buying a lot of gold since then.

And this is a problem for America at a time where obviously it has massive budget deficits. It needs to fund. It needs buyers for treasuries. And so that that move I called it the end of the financial world as we know it. And and I don't think that was hyperbole.

I think that has changed everything because if you can't if you can't trust the issuer of the reserve currency, you've got some very tricky decisions to make. And it doesn't mean the dollar's going away tomorrow.

It doesn't mean the dollar's finished. But what it does mean is now every central bank in the world is incentivized to find alternatives to being completely captive within the dollar system.

By capturing Nicolas Maduro from his bedroom in Venezuela, Trump has basically said, "I don't need international laws."

You've lost faith in the fact that if something is done against you, then international law is going to apply and there will be recourse for you through some sort of court action. And the solution to all these problems on a financial level at a state level is gold.

You own gold in a vault underneath your own central bank and you don't have to worry about any of these things unless you get invaded and someone takes it.

Suez crisis in 1956 is an important history lesson for people to understand.

And if we've got time, I I'll just give you a quick recap of it.

Give us the recap because this was hugely insightful to me.

Yeah. So after World War II when the Brettonwoods conference happened and the Brettonwoods system was put in place with the dollar fixed to gold at USD 35 an ounce and then every other currency revolving orbiting around the dollar.

When that happened at the time 1943 the pound sterling had basically 75% of sovereign reserves. the dollar was 22% and there were you know the French franc and the Deutsch mark.

In 1956 the president of Egypt Gamal Abdul Nasser nationalized the Suez canal which had been built by the French and the British in during the colonial days.

He nationalized the Suez canal creating all kinds of chaos and this was done after the US and the UK decided to pull funding to build the Aswan dam. So that was a US-led decision to pull funding. And that was what led to this moment in time.

And that's important to understand because what happened was the British, the French and the British basically started a a war with Egypt. the pound was coming under pressure and the prime minister at the time Anthony Eden went to his friends in Washington and said hey guys look I need some help here can you either lend us some dollars or at least put your enthusiastic support around the pound.

The US which had been part of the fermentation of this crisis by pulling that funding saw an opportunity and they said No, we're not going to do that. We are not going to support you unless you pull out of Egypt.

And had Britain not pulled out of Egypt, there would have been a full-blown sterling crisis. The country's finances were in a mess after the war after the end of World War II, obviously.

So, Britain was forced to back down and it became clear to the world that the US the UK was not a powerful country anymore. In fact, the United States held the upper hand. And from that point on, dollar supremacy began taking off.

And by 1973, the dollar was I think 87% of foreign exchange reserves.

And the reason I recapped the story was a to make people understand that that no sovereign reserve currency in history has survived. They've all gone away.

You know, at one time it was the Portuguese escudo, the Dutch Guilder, the French Frank, the Spanish Peseta, all gone. The British pound largely irrelevant now. And the dollar will go that way too. It could be years in the making, but it's headed in that direction.

The point about the Suez Canal crisis that's so important is that Britain was struggling. It had a lot of debt after the war. It was in bad financial shape. And America saw an opportunity to advance its own cause at the expense of a once powerful nation that was hegemonic and it took it. Special relationship or no special relationship.

America plunged the knife in and it was the right thing to do from a political standpoint. I called it a Machiavellian master stroke.

It really was. And that paved the way for the dollar-based system. We see today the swift system, the payment system, you know, 60% of sovereign reserves are in dollars. 88% of transactions, FX transactions have a dollar cross in them. It's extraordinary.

But through that period from 1956 when the US pulled that Machiavellian masterstroke to now, they haven't really had any challenges.

And so you throw into the mix Donald Trump in the White House who is an agent of change/chaos depending on your political leanings and you have every ingredient you need for an enormous amount of uncertainty and a and the potential for a complete reordering of the financial system.

To save itself, the United States will have to print a ton of money. If this goes the way it went for the Brits and while they can do that, it will trash the dollar. It will send interest rates through the ceiling. It will send inflation, all the things that we know would be bad if the dollar was no longer a reserve currency.

So, it's a big sweeping change.

This this financialization of everything has been a massive tailwind for a long time. But I but I think in 2020 after COVID came through all that changed.

You know, if you look back from 1980 to 2020, we had rising stock prices, rising bond prices, rising house prices, falling rates, falling inflation, globalisation. We had the biggest tailwinds the world has ever seen.

That's changed. You know, we don't have rising bond prices.

The volatility is coming back, and there's a very strong chance that some of these things are going to start to fall. We've certainly seen higher inflation. We've certainly seen rates go up and they tend to lead. So that environment has changed and and if that environment has changed and not just changed but reversed.

You know, what went down went up, it stands to reason that if for 40 years the default has been to make money and all you had to do was be there and stay out the way. If everything's reversed, it stands to reason that the next 40 years can be really hard to make money and you can't just have your money in the markets. you need to make decisions and be out at the right time and understand that markets can go sideways for 20 year periods in nominal terms.

So, the investment style that served you very well for 40 years, the one that has been ingrained in you over and over again, buy the dip, buy the dip, buy the dip has worked, but I don't think that's going to work in the next 10 years and possibly not in the next 20.

You know, every country in the world has done the same thing and outsourced everything. Every country in the world, every sorry, that's not correct. Every Western country who outsourced their supply chains to cheaper labor is in the same boat.

Canada has the natural resources, United States has the resources. Britain doesn't have the resources. France doesn't have the resources.

China has very solid relationships with Brazil in terms and Australia in terms of buying all their commodity offtake that has enabled a country like Brazil or Australia to grow massively over these last 20 30 years.

The New "Monroe Doctrine":

The quid pro quo that sustained the Petrodollar—US security guarantees in exchange for oil priced in dollars—is evaporating.

Energy Independence: The US has transitioned from the Gulf’s biggest customer to its biggest competitor as a leading oil exporter.

Strategic Withdrawal: An overt US shift toward prioritizing the Western Hemisphere. This leaves Middle Eastern nations in a difficult position: if forced to choose between a withdrawing security partner (USA) and their primary customer (China), the decision is no longer a "no-brainer." (Grant Williams thinks the Middle East nations will shift toward China against the US if push comes to shove).

So, in the midst of all this, we find ourselves with this little invention called AI.

With AI, there is a hunt for resources. We got to power all these data centers and these things if we're going to use it. Then also the promise of all this growth.

You really need to sit down and re-examine everything. It's not this is not just yeah maybe we rotate out of cyclicals into momentum. It's not that it may be in a part of your portfolio, but the kind of change we're talking about is the kind of change that happens once every 80 to 100 years.

And if you get it right, if you if you if you completely reorient yourself for this next cycle, you have the advantage of the kind of period that we've just been through where it it's you've got these great tailwinds, but you have to be set up correctly.

And for me, you know, that is commodities that all the basically all the things that have been out of favor that have been unloved through this period. Again, on some level, this is actually pretty easy because what's happening on most level is a reversal. It's interest rates are going up.

Interest rate are not going down anymore. Trust is going down.

You probably need to own commodities now. If you didn't own any gold, gold's done really well. You probably need to own some gold. If you were massively overweight US stocks, that's done extraordinarily well. Are you right to be overweight US stocks in this environment? I suspect probably not.

You can't borrow from someone else's lived experiences.

---------------------------------

11Jan2026rant Williams: "There is no Safe Haven, it's an Illusion"

Talking to Reinvent Money on YouTube on 11Jan2026:

Trump is an agent, he's also an agent of chaos

Trump is prone to changing his views rapdily; and goes in completely opposite direction

You don't know what's going to happen; so don't invest with any certainty

Be wary of certainty

Having certainty is the biggest danger to investors

I don't change my investment thesis now with the turn of global events

my investment thesis is playing defence; it's different from many young investors

I don't my portfolio to lose value; I want to protect my purchasing power

I've enough money and I focus on keeping its purchasing power intact

How should I protect my purchasing power in the light of Governments becoming more confiscatory and Government Debt levels are more unmanageable now

I don't want to punt on things at the stage of my lifecycle

There are no safe havens, it's an illusion and there has nevera been a safe haven -- I mean there are relatively safe havens -- US dollar and US Treasuries have been relatively safe for a long time -- gold is a safe haven even though the price can move up or down -- everybody should start with the premise that there is no safe haven.

the biggest worry for investor is the loss of purchasing power of money in the backdrop of loose monetary policies

I kept buying gold since 2003, I have never sold any -- even though the price is at record highs, I'm not selling any of my gold -- gold has become a substantial part of my portfolio

Nicolas Maduro thought he had a safe haven, a panic room until two people from a Black Hawk descended on his palace and cut open the door with a 3000-degree cutters in the middle of the night -- so there is no safe haven

The turning for central bank gold buying was -- the West (the US and Europe) freezing the dollar assets of Russia in 2022; and the same asset freeze is responsible for central banks doubting the safe haven aspect of US Treasuries

And the West freezing Russia forex reserves has become a "national security" imperative for other countries

So, now sovereign nations have lost trust in the US treasuries and switching their money to gold -- we have lost trust in countries, societies and governments

I would agree with Marc Faber's assertion that crude oil is cheap

In my opinion, copper is cheap

Perfecting ownership of tangible things, copper, gold, oil, silver, etc., is the in-thing

the less tips we take, the better we are

we need to think through things, generate more ideas ourselves

crypto is not suitable for me

---------------------------------

Tweet 26Feb2020: 21Aug2006: Beyond Markowitz: A Comprehensive Wealth Allocation Framework for Individual Investors

Beyond Markowitz: A Comprehensive Wealth Allocation Framework for Individual Investors

SSRN Paper: The Journal of Wealth Managment, 21 Aug 2006

By Ashvin B. Chhabra, Institute for Advanced Study

In sharp contrast to the recommendations of Harry Markowitz's Modern Portfolio Theory (MPT), a vast majority of investors are not well diversified. This paper attempts to provide a solution to this "diversification paradox," by expanding the Markowitz Framework of diversifying market risk to also include the concepts of Personal Risk and Aspirational Goals.

The Wealth Allocation Framework enables individual investors to construct appropriate portfolios using all their assets, such as their home, mortgage, market investments and human capital. The investor may choose to accept a slightly lower "average rate of return" in exchange for downside protection and upside potential.

The resulting portfolios are designed to meet individual investors' needs and preferences, as well as to protect individuals from Personal, Market and Aspirational risk factors.

The Wealth Allocation Framework attempts to bring together MPT with aspects of Behavioral Finance through a single pragmatic Framework.

For the individual investor, Risk Allocation should precede Asset Allocation.

Portfolio diversification:

In order to achieve a truly diversified portfolio, one must also diversify within each asset class.

For example, equity portfolios should be composed of a large number of minimally correlated stocks; bonds should be diversified across both maturities and credit ratings. According to MPT, diversification minimizes non-systematic risk, and diversification, combined with the use of a utility function, provides the investor with the right balance between risk and reward.

Lack of diversification leads to the danger of one's investments becoming worthless, as happened during the 1990s Internet / Dotcom bubble when investors heavily exposed to technology stocks sustained massive losses and never recovered.

However, a small but influential group—overrepresented among the wealthy—became rich by defying diversification. Ironically, many would not have achieved such wealth had they followed conventional diversified strategies.

Examples include highly leveraged property investors, corporate executives who concentrated in their own company’s stock and options and entrepreneurs who reinvested heavily in a single business.

In each case, success produced outsized gains, while failure led to severe or total loss—highlighting that undiversified strategies create extreme outcomes, not reliable ones.

The need for securing our own financial future:

Longer life expectancy, pension changes (from defined benefit to defined contribution) and globalised markets (with increased correlation among asset classes) have shifted financial responsibility to individuals, making sound investing the key determinant of retirement security and long-term financial success.

Individuals need to deal with two issues:

1) we need to maintain our lifestyle needs regardless of market conditions

2) we have the risk of living too long and outliving one's assets (longevity risk)

As we experienced in the past, there is a good probability of us not being able to meet the above two things.

While Markowitz's MPT deals market risk only, the Wealth Allocation Framkework deals with personal risk and aspirational risk in addition to market risk.

Three risk profiles (three buckets approach):

1) Personal Risk (Safety): The risk of a life-changing drop in lifestyle. This should be a fail-safe bucket that protects standard of living with downside protection and some investment types are: human capital, cash, TIPS, CDs, T-bills, primary residence, traditional annuities (to hedge longevity risk), health insurance and asset insurance.

2) Market Risk (long term growth): Systematic risk that can't be diversified away. This aims to maintain wealth and grow with the economy. Examples of investments are diversified equity funds, bond funds (diversified across credit quality and duration), cash (reserved for opportunistic investing) and commodities (the "Markowitz" part).

3) Aspirational Risk (moonshots): This aims to achieve great wealth or legacy goals, with high-concentration risk for high-upside potential. Examples include private business, concentrated stock, private equity, hedge funds, rental property and others.

More on "Risk allocation should precede asset allocation":

In traditional finance, people often jump straight to asset allocation—deciding what percentage of their money goes into stocks versus bonds or other asset classes. Chhabra’s framework argues this is putting the cart before the horse.

Risk allocation is the process of defining your goals and determining which "type" of risk you are willing to take to achieve them before you ever look at a ticker symbol.

Chhabra suggests that risk should be allocated in a specific hierarchy. You don't move to the next level until the previous one is "fully funded" or stabilized.

Personal Risk (The Floor): This is the first allocation. You allocate enough low-risk assets to protect against "ruin." This is not about beating the market; it's about avoiding poverty. This bucket should aim for a guaranteed cash flow.

Market Risk (The Engine): Once your floor is secure, you allocate risk to the broad markets. This is your "diversified" wealth meant to keep pace with inflation and economic growth.

Aspirational Risk (The Upside): Only after the first two are satisfied do you allocate risk to concentrated bets (like a single stock, a private business, or crypto). This bucket comes with the risk of loss of substantial capital.

Components of Personal Risk:

Cash flow: The investor’s current and foreseeable cash flow is at least as important as his/her asset allocation.

Lifecycle stage: Someone at the peak of his/her earning capacity may be able to take on more risk than someone approaching retirement. On the other hand, a wealthy person in retirement seeking to achieve an ambitious legacy goal may want to take on more risk with a portion of the portfolio.

Ability to weather shortfalls (longevity risk): How does one protect against outliving one’s assets, e.g., living 10-15 years longer than life expectancy?