Understanding Real Sensex and Currency Debasement

(This

is for information purposes only. This should not be construed as a

recommendation or investment advice even though the author is a CFA Charterholder. Please consult your financial

adviser before taking any investment decision. Safe to assume the author has a vested

interest in stocks / investments discussed if any.)

(Even though the article was written on 14Mar2024, the following updates dated 07Jul2024 and 24Mar2024 are added at the end of the blog)

In late 1923, a loaf of bread in Germany was costing around 200 billion marks -- yes, you read it right, it was 200,000,000,000 marks.

People literally had to carry a cartload of money to buy a loaf of bread in Germany in 1923.

After the First World War, Germany experienced high inflation. During 1922 and 1923, it turned out to be hyperinflation, which is known as Weimar inflation that happened during the Weimar Republic. The highest currency note printed at that time was in the denomination of 50 trillion marks, according to Wikipedia.

Countries, like, Zimbabwe, Venezuela, Austria, Brazil, Hungary and Argentina too have undergone episodes of hyperinflation.

Inflation means rise in prices and it reduces the standard of living for consumers, unless their wages too rise proportionately. There are times when rise in workers' wages will be much lower than increase in prices of goods and services.

Inflation is a silent killer. It's robbery by stealth. With persistent inflation, purchasing power of money comes down. Inflation hurts everybody, except the governments.

(blog continues below)

-------------------

Related blog:

-------------------

Currency debasement

“Lenin is said to have declared that the best way to destroy a capitalist system was to debauch the currency,” wrote John Maynard Keynes.

“By a continuing process of inflation, governments can confiscate, secretly and unobserved, an important part of the wealth of their citizens,” he further added.

With high budget deficits, large doses of money printing and enormous debt levels, governments both in the developed and developing world have been inflating away the economies imposing heavy burden on common people.

When governments and central banks print money recklessly, what they do is they increase money supply without any corresponding increase in productive capacity of economies.

As a result of increases in money supply, citizens chase the same amount of goods and services with more currency or bank notes. This results in high inflation afflicting the pockets of people like you and me.

Lowering the value of currencies continually in economies leads to currency debasement.

Currency debasement is not a modern phenomenon. It has been going on for almost 2,000 years.

In the first century CE, Roman emperor Nero diluted the Roman currency by reducing the weight of silver coins; and by diluting the silver used in such coins with a base alloy. This is currency debasement for you.

The relentless rise in prices of crypto currencies, like, Bitcoin and Ethereum, is one of the after-effects of massive currency debasement of fiat currencies engineered by fiscal and monetary authorities around the world.

Paper currencies we use today are called fiat currencies, because governments can create them by fiat. In the olden days, currency coins used to be backed by precious metals, like gold and silver. This is no longer the case.

In a way, the advent of crypto currencies, which have a total market cap of USD 2.75 trillion as of today, as an asset class is a kind of rebellion against fiat currencies, that are getting diluted every day.

You may be aware the supply of Bitcoins, for example, is controlled and as such it's seen as a counter to debasement of fiat currencies.

However, we don't know how long this arrangement continues for Bitcoin and how the fiscal and monetary authorities respond to the rise of crypto assets. Significantly, the US SEC has recently approved spot Bitcoin ETFs in the US.

Now, let us discuss how Sensex looks like in real terms, that is, when adjusted for inflation.

Real Sensex

A few days ago, India's benchmark stock market index, Sensex, reached a record high of over 74,000. Equity investors are in high spirits. Naturally. Sensex has risen from a level of 38,000 five years ago, almost doubling in value.

There is a catch here. What investors see here is only in nominal terms, but not in real terms. Real terms means we need to adjust or correct Sensex for inflation.

Cumulative consumer price inflation (CPI) in India in the past five years is around 32 percent, as per official numbers declared by Government of India. (It may be noted the official inflation figures declared by governments are manipulated to suit the finances of the governments. Actual inflation will be much higher than the official numbers).

If you adjust the 74,000 Sensex level with 32 percent inflation, you will get a level of nearly 57,450 for Sensex. It means, real Sensex in the past five years has grown from 38,000 to 57,450, an annualised return of 8.62 percent (51.4 percent absolute return) in real terms.

But in nominal returns, which everybody observes, Sensex has given an annualised return of 14.26 percent (94.7 percent absolute return).

The difference between 94.7 percent nominal Sensex return and 51.4 percent Sensex real return is 43.3 percent in the past five years.

Investors feel comfortable looking at the nominal return, while ignoring the real return adjusted for inflation. The difference of 43.3 percent in the past five years is eaten away by inflation monster.

"Plots of historical stock price indices in the media are almost invariably shown in nominal terms, not the real (inflation-corrected) terms," wrote Robert Shiller in his epic book "Irrational Exuberance."

We are unable to appreciate the impact rising prices have on our finances. We only see things in nominal values, not in inflation-corrected real terms.

CPI inflation is nothing but rise in prices of a basket of goods and services consumed on average by households. Of course, the basket keeps on changing from time to time -- depending on changes in consumer preferences.

Maybe, we are consuming a broader range of goods and services in recent decades.

Since hitting a record high of 74,000 on 07Mar2024, Sensex has declined to 72,700 as at close of yesterday.

India's Economic Reforms were started in 1991. So, the following is a table detailing the rise of Sensex since 1990 and its yearly growth in real terms, that is, corrected for inflation:

As shown in above table, Sensex was 781 as on 31Mar1990 and it reached a nominal level of 72,762 yesterday; while the real Sensex grew from 781 to a mere 7,073 in the same period.

The table also shows the real Sensex return for each financial year since 1990. As can be observed from the 34-year data: in real inflation-adjusted terms, Sensex has given positive returns in 20 years, and provided negative returns in 14 years.

Real Sensex growth in 34 years

In nominal terms, Sensex grew from 781 in 1990 to 72,762 now, a compounded annual growth rate (CAGR) of 14.3 percent, which looks impressive over a long period.

But when you adjust or correct Sensex for inflation, real Sensex grew from 781 in 1990 to 7,073 only showing a moderate CAGR of 6.7 percent -- the difference between nominal and real Sensex growth reflects its erosion by inflation.

Consumer price index in the past 34 years has gone up by 10.29 times -- as per official numbers (that is, if you believe them). When you divide the nominal Sensex level of 72,762 by 10.29, you get real Sensex of 7,073.

Table >

What really matters is real Sensex and real returns, that are adjusted for inflation, not the nominal returns we are fed by the media every day.

- - -

P.S.: After writing the blog, the following updates are added with new information / images:

Update 07Jul2024 : After four months of writing the blog, I'm now updating the real Sensex data with latest Sensex figures after adjusting the nominal Sensex with latest available CPI inflation.

On 05Jul2024, nominal Sensex ended at 79,997. After correcting for CPI inflation, the real Sensex is only 7,700. Real Sensex given here reflects the impact of inflation (rise in prices of goods and services) since 1990.

Growth of nominal Sensex between 31Mar1990 and now (05Jul2024) is more than 100 times, but growth of real Sensex in the same period is just 9.86 times -- the difference is due to erosion of Sensex by price rise or inflation.

(please click on the chart to view better)

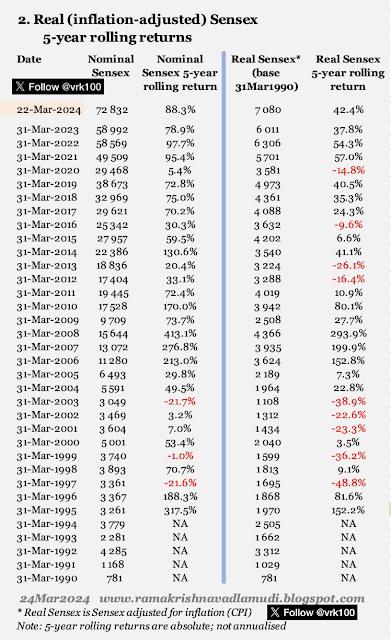

Update 24Mar2024 : How much returns did Sensex and real Sensex give on a 5-year rolling return basis between 1990 and now?

The following table provides the rolling return data as at the end of every financial year between 1995 and now based on data from 1990 >

The returns shown in the table are absolute, not annualised.

As on 31Mar1995, Sensex 5-year return is 317 percent absolute (not annualised). As on 31Mar2020, the 5-year return is just 5.4 percent as global stocks, including those in India, collapsed in Mar2020 due to outbreak of COVID-19 Pandemic.

Of the 30 data points (as per table 2 below), Sensex had given negative returns only three times, that is, as on 31Mar1997, 31Mar1999 and 31Mar2003 -- but real Sensex had given negative returns nine times out of a total 30.

Obviously, this 5-year rolling return data are only from a small sample of data as at the end of a financial year -- if you take 5-year rolling returns for Sensex on a daily or a monthly basis, the data may provide better insights.

(Please click on the image to view better)

-------------------

References and Additional notes:

India's CPI inflation from 1990 to 2023:

Gresham's Law Investopedia - "Bad money drives out good." - during the Revolutionary War in the US, bad paper money drove out all valuable gold and silver coins (good money) from circulation -

-------------------

Read more:

AMFI List of Market Cap: Categorization of Large-, Mid- and Small-Cap Stocks

BSE 500 versus S&P 500 Indices Compare 31Dec2023

Disclosure: I've got a vested interest

in Indian stocks and other investments. It's safe to assume I've interest in the financial instruments / products discussed, if

any.

Disclaimer: The analysis and

opinion provided here are only for information purposes and should not be construed

as investment advice. Investors should consult their own financial advisers

before making any investments. The author is a CFA Charterholder with a vested

interest in financial markets.

CFA Charter credentials - CFA Member Profile

CFA Badge

Viewing Options for this blog in different formats:

He blogs at:

https://ramakrishnavadlamudi.blogspot.com/

https://www.scribd.com/vrk100

X (Twitter) @vrk100