When Will Federal Reserve Raise Interest Rates?

(please check Updated blog 25Feb2023)

Since February of 2021, financial markets have been expecting a rise in US interest rates. In reaction to this, the US 10-year Treasury yield rose from 1.20 per cent to 1.75 per cent by March 2021, before cooling off to 1.34 per cent by last Friday (see graph below).

For the past two months, the US Federal Reserve has been hinting at tapering of its bond purchases, without giving any definitive timeline to the tapering. The Fed has also hinted at raising interest rates by the end of 2022 or by start of 2023.

Past Rate Hike Cycles

Since 1999, there were three rising rate cycles from the US Federal Reserve:

First: Fed Chair Alan Greenspan started raising federal funds rate from 4.75 per cent in Jun1999 to 6.50 per cent in May2000 (175 basis points increase in 11 months). The first rising rate cycle coincided with the DotCom Bubble.

----------------------

Read more:

Fed Tapering is Postponed

Why is US inflation low? 04Oct2013

Decoding the US Government Shutdown 27Sep2013

Why did US Fed raise discount rate? 20Feb2010

US Fed rate cut and its impact on financial markets 17Dec2008

Second: Greenspan started raising fed funds rate from 1.00 per cent in Jun2004; followed by Bernanke till 5.25 per cent in Jun2006 (425 bp increase in 24 months). The second cycle coincided partially with booming stock markets globally.

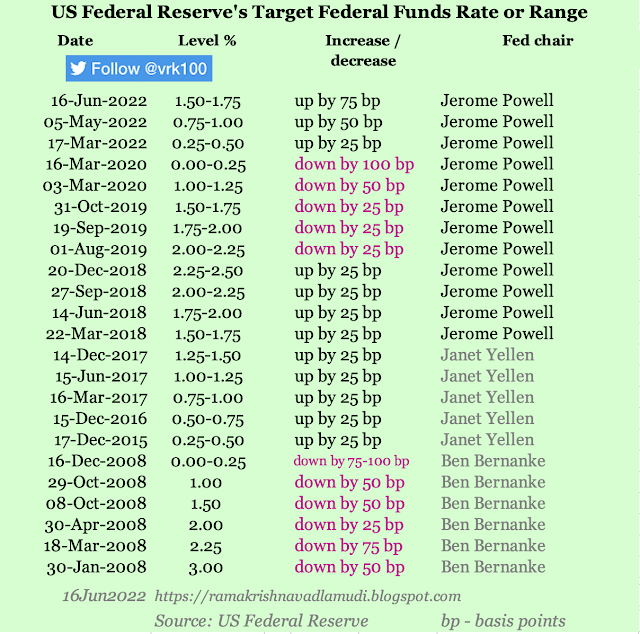

Third: Fed chair Janet Yellen started hiking fed funds rate from 0.00-0.25 per cent range in Dec2015; followed by Jerome Powell till 2.25-2.50 per cent range in Dec2018 (up by 225 bp in 36 months). For seven years between Dec2008 and Dec2015, Fed funds rate remained steady at nearly zero bound (that is, 0.00-0.25 per cent) without a single change.

You can check the images below for a detailed timeline of Federal Funds rate (fed rate) revisions.

Economic indicators

The US CPI (consumer price inflation) is above two per cent since March of this year. For the month of July 2021, its print is at 5.4 per cent (graph below), the highest since July 2008.

PCE or personal consumption expenditure inflation, a measure closely tracked by the Fed, is 4.20 per cent for July 2021.

The US unemployment rate is 5.2 per cent for August 2021. It fell from all-time high level of 14.8 per cent reached in April 2020.

The unemployment rate needs to be interpreted in the context of falling labor force participation rate since 2000. The labor force participation rate is 61.7 per cent for August 2021. It fell from a high level of 67.3 per cent attained in January 2000 (graph below).

Non-farm payroll employment rose by 235,000 in August 2021, much below the Bloomberg survey of 725,000.

Many experts have been criticizing the Fed for not initiating the bond tapering even though many economic indicators have been showing signs of good recovery.

The data, however, indicate that there is still considerable slack in the US labor market. Given the levels of unemployment rate, labor force participation rate, PCE inflation, high levels of commodity prices, and other indicators, the Fed may start tapering its bond purchases by the start of 2022.

But when it comes to interest rate rise, what the Fed will do I've no clue. The future interest rate trajectory depends on incoming data. My guess is the next rate cycle may start somewhere in 2023.

Graph 1 - CPI inflation rate:

Fed funds rate - historical; FOMC open market operations

Fred data - US unemployment rate

Fred data - US unemployment level

Fred data - US labor force participation rate

Fred data - US 10-year treasury yield Fred data - US CPI inflation rate (edit it with option 'percent change from year ago')US CPI inflation rate historical 1914 till now

Fred data - US PCE inflation rate (edit it with option 'percent change from year ago')

Fred data - US PCE inflation rate and Core PCE inflation- - -

Disclosure: I've vested interested in Indian stocks and other investments. It's safe to assume I've interest in the financial products discussed, if any.

Disclaimer: The analysis and opinion provided here are only for information purposes and should not be construed as investment advice. Investors should consult their own financial advisers before making any investments. The author is a CFA Charterholder with a vested interest in financial markets.

CFA Charter credentials - CFA Member Profile

CFA Badge

He blogs at:

https://ramakrishnavadlamudi.blogspot.com/

Twitter @vrk100

No comments:

Post a Comment