Why Are Equity Mutual Fund Investors Selling Out?

Follow @vrk100

(If you want to read this article in PDF form, JUST CLICK:

www.scribd.com/doc/25049815)

This is a curious case of equity mutual fund investors’ encashing their investments even as Indian stock market has gone up in the last five months. Mutual funds seem to be finding it difficult to manage the changed business environment after the capital market regulator, Securities and Exchange Board of India, banned entry loads on mutual funds with effect from August 1, 2009.

The following table will give you a better idea about the redemption pressure in equity mutual funds in India between August and December 2009:

REDEMPTIONS/REPURCHASES (Rs crore): Equity mutual funds:

Net Outflow Net Inflow

From August to December 2009 From January to July 2009

(7,315) 7,432

Data source: AMFI

As can be seen from the above table, between August 2009 (when SEBI banned entry loads) and December 2009, the net outflow from equity mutual funds is Rs 7,315 crore; whereas, net inflow into equity mutual funds is Rs 7,432 crore between January and July 2009. The ban on entry loads seems to have caught the mutual fund industry off-guard.

The criticism leveled against the mutual fund industry is that their business model till July 2009 was distributor-driven at the cost of individual investors. All these 15 years, they were doing their fund business in a particular way. The entry-load ban by SEBI has changed their business complexion completely.

But, the industry is yet to come to grips with the situation. As insurance products (Unit-Linked Insurance Plans, or, ULIPs) are more attractive for distributors, they seem to be pushing ULIPs instead of equity mutual funds. Even though IRDA has changed the structure of ULIPs recently, distributors still find ULIPs more attractive for getting their share of commissions.

It is interesting to see how mutual fund industry would realign itself in view of the changed circumstances. The time has come for them to focus on customer acquisition, which is very expensive in the absence of entry loads. Due to the ban on entry loads, mutual funds are finding it difficult to raise new fund offers (NFOs), through which they used to rake in substantial amounts of funds.

The net assets of equity mutual funds were growing phenomenally mainly due to the NFOs. Now, the NFO route is not possible due to the entry load ban.

More curious is the behaviour of equity mutual fund investors. Let us consider the movement of stock market indices between August and December 2009:

INDEX 31-Dec-09 Growth over 31.7.09

Points %

SENSEX 17 464.81 11.50

MIDCAP 6 717.82 20.60

BSE-200 2 180.25 14.20

From the above table, one can observe that the Sensex has given a positive return of 11.50 per cent against 20.60 per cent by BSE-Midcap index, between July 31st, 2009 and 31st, December 2009. The BSE-200 broader index has recorded a return of 14.20 per cent during the same period.

This clearly indicates that even though the stock markets have gone up steadily in the last five months, investors have preferred to encash their equity MF investments, with net outflow of Rs 7,300 crore (as shown above).

Before August 1, 2009, if you invest Rs 10,000 in an equity mutual fund, the Asset Management Company or AMC used to charge 2.25 per cent or Rs 225 from your money toward entry load and the remaining Rs 9775 (10,000 – 225), they used to invest in equities and allot units to you.

Now after the entry load is banned, if you invest Rs 10,000 in an equity MF, the entire Rs 10,000 will be invested in equities and units will be allotted, based on the prevailing Net Asset Value, to you for the entire Rs 10,000.

Which means, now MF investors will be saving Rs 225 or 2.25 per cent of their money. This is a substantial benefit to MF investors. But, investors are selling out their investments instead of putting more money in mutual funds; even though they are saving up to 2.25 per cent of entry load.

The reasons for the strange behaviour of investors are attributed mainly to:

1. The entry load ban by SEBI wef August 1, 2009

2. Regulatory arbitrage in favour of ULIPs driving distributors towards insurance products

3. Equity investors see the raise in indices as an opportunity to sell out and make small profits in the process. They still seem to be afraid of the panic situation that prevailed in 2008, when equity investors have lost very heavily.

SUMMING UP:

The entry-load ban by SEBI seems to have broken the back of mutual fund industry; as far as raising money through equity new fund offers is concerned. The distributors find it unattractive to push equity mutual funds and instead they are turning towards ULIPs.

Equity mutual funds have become cheaper by 2.25 per cent compared to previously. As such, investors would be better off putting in more money into equity mutual funds according to their risk appetite, asset allocation and convenience taking their long-term interests into consideration.

It’s time for them to invest based on the following considerations:

1. Long-term track record of three or five years of the particular fund;

2. It is a myth to assume that NFO with Rs 10 net asset value is better than an existing fund with an NAV of Rs 100 or more. The NAV of Rs 150 (of a fund with growth option) indicates that the fund started with an NAV of Rs 10 and since inception its value has grown by 15 time.

For example, the present NAV of Reliance Growth fund (growth option) is Rs 437. It indicates that the NAV of this fund has gone up by 43.7 times since its inception in October 1995. Its annualized return (CAGR) since inception is 30.32 per cent!; and,

3. See the track record of the fund manager also whether she is able to protect your money during any downturns. The fund manager should be able to generate sustainable performance – not only during bull markets but protect our money during bear markets as we have seen in 2008.

If you select your equity funds based on the above time-tested principles, you are likely to generate decent returns provided the India Growth Story is intact for the next five to ten years.

- - -

Disclosure: I've vested interested in Indian stocks and other investments. It's safe to assume I've interest in the financial products discussed, if any.

Disclaimer: The analysis and opinion provided here are only for information purposes and should not be construed as investment advice. Investors should consult their own financial advisers before making any investments.

He blogs at:

https://ramakrishnavadlamudi.blogspot.com/

P.S.:

The following weblinks are included here after 15Aug2021 for reference purpose >

Mutual Funds Comparison weblinks:

Rupee Vest - Mutual Fund Portfolio Tracker (past 4 months holdings)

Rupee Vest Factsheets - Parag 1, Parag 2, Parag 3, Franklin 1, Franklin 2, Quantum 1, Quantum 2, Quantum 3

Trendlyne (previous holdings for the past 2 / 3 years) - Parag1, Parag 2, Parag 3, Franklin 1, Franklin 2, Quantum 1, Quantum 2, Quantum 3, Nifty 50

Parag Parikh Flexi cap fund 2025 - Morningstar India (ISIN number is available) - Parag 1, Parag 2, Parag 3, Franklin 1, Franklin 2, Quantum 1, Quantum 2, Quantum 3, Nifty 50

Parag Parikh Flexi cap fund 2025 - Value Research

Rupee Vest Portfolios 2025 - Parag 1, Parag 2, Parag 3, Franklin 1, Franklin 2, Quantum 1, Quantum 2, Quantum 3, Nifty 50

Compare debt funds 2025 (gilt, conservative hybrid, dynamic bond, debt hybrid and hybrid dynamic asset allocation ) Value Research

Dec2025 Compare Midcap funds - Baroda, Invesco, Kotak, Edelweiss and Franklin India

Compare funds 2025 Daylynn Pinto, Bandhan AMC - VR

2024 Funds Compare weblinks

International funds MS - including Japan, US, etc.

International funds VR - including Japan, US, etc.

Compare gold, gilt, liquid, midcap and largecap funds MS

Compare gold, gilt, liquid, midcap and largecap funds VR

MS category performance (e.g., for large-cap, ELSS or liquid fund categories)

MS category risk measures, like, Sharpe ratio (e.g., for flexi cap, govt bond or index funds)

2023 Funds Compare weblinks (ICICI Pru Nifty 100 Low Vol 30 ETF)

Comparison of Nifty 50, Nifty 50 Equal Weight, Nifty Next 50 and Nifty 500 index funds Value Research

Compare MNC funds of ABSL, UTI, ICICI Pru, HDFC and Kotak - value research - compare 2023 - Morningstar India

VR including SBI Magnum Global

RBI Notes from HBIE (pages 401 to 404) - HBIE explanatory notes on tables - mutual fund name changes - MF mergers and takeovers (details of various fund house changes given here)

VR mutual fund AMCs and size of AUM - size of assets - fund size - fund asset size - 43 AMCs as of 07Feb2024

Axis Direct - AUM movement for past five years - historical AUM - historical assets - asset size

Morningstar India - AUM movement for the past quarter - average AUM - all AMCs in single page - asset size growth - historical also (drop down menu)

Morningstar India - AUM movement for the past quarter - average AUM - AMC wise - historical also (dropdown menu) - scheme wise growth data

Trendlyne - Parag cons hyb, (doesn't show REIT holdings) Quantum Dyn Bnd, ICICI Gilt, HDFC Gilt, Parag liquid, quantum liquid

PPFAS MF introduces instant access facility (IAF) wef 28Dec2023 in its Parag Parikh Liquid fund -- instant credit up to Rs 50,000 per day via IMPS to bank account

Parag Parikh Conservative Hybrid fund compare 2023 with other debt funds - Morningstar India (ISIN number is available)

Parag Parikh Conservative Hybrid fund compare 2023 with other debt funds - Value Research

Parag Parikh Conservative Hybrid fund - Rupee Vest (shows REIT holdings also)

ABSL Ajay Garg - Morningstar India (Ajay Garg on 28Dec2021 was replaced by ABSL MF)

ABSL Ajay Garg - Value Research

HDFC Chirag Setalvad - M

HDFC Chirag Setalvad - V

HDFC Amit Ganatra - M (Amit Ganatra moved back, in Jan2022, to Invesco India MF)

Canara Robeco Shridatta Bhandwaldar -V

BNP Paribas Karthikraj Lakshmanan & Abhijeet Dey - M

BNP Paribas Karthikraj Lakshmanan & Abhijeet Dey - V

JM Sanjay Chhabaria - MJM Sanjay Chhabaria - V

SBI R.Srinivasan - M

SBI R.Srinivasan - V - fund compare 2023 (his other funds include, SBI Flexicap, SBI Multicap and SBI Magnum Children's Benefit fund)

Union Vinay Paharia 1 - M

Union Vinay Paharia 2 - M

Union Vinay Paharia - V

UTI Ajay Tyagi - M

UTI Ajay Tyagi - V

Kotak Harish Krishnan - M

Kotak Harish Krishnan -V

Mirae Asset Neelesh Surana & Gaurav Misra - M

Mirae Asset Neelesh Surana & Gaurav Misra - V

ITI George Heber Joseph - M

ITI George Heber Joseph -V

Axis Anupam Tewari - M

Axis Anupam Tewari -V

Tata Meeta Shetty - V

Tata Meeta Shetty - M

L&T Venugopal Manghat - M

L&T Venugopal Manghat - V

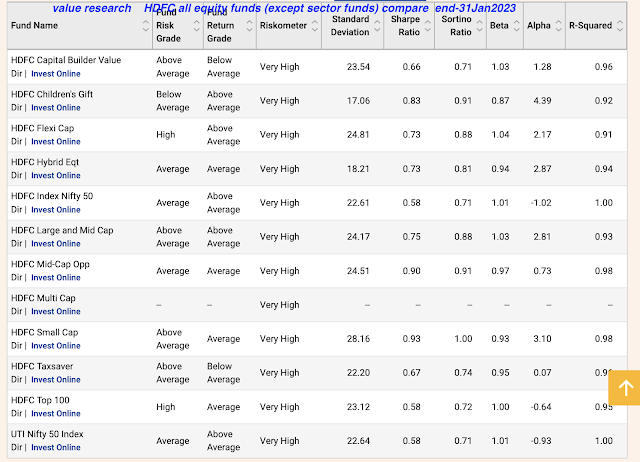

HDFC Equity funds all (other than sector funds) comparison 01Feb2023 -VR

select HDFC equity funds comparison - MS

Pharma ETFs / Healthcare ETFs - V

Pharma funds / Healthcare funds - V - both index funds and ETFs

Aggressive Hybrid plans (analysed 14Aug2021) or Equity-oriented Balanced funds - M

Aggressive Hybrid plans (analysed 14Aug2021) or Equity-oriented Balanced funds -V

MNC funds -M

MNC funds - V

BSE 500 and NSE 500 passive funds compare 2024 - M

BSE 500 and NSE 500 passive funds compare 2024 (only index funds) - V

ETF compare Blog - Nifty BeES vs Junior BeES

Value Research ETF compare - Nifty 50 vs Nifty Next 50 funds (Nifty BeES vs Junior BeES) --> to check ETFs based on Nifty indices, click on the weblink of List of ETFs - India ETFs (Twitter handle India ETFs) - volume data of NSE ETFs (India ETFs) - volume data of NSE ETFs (NSE) -

Compare funds 2022 mid cap funds - M

Compare funds 2022 mid cap funds -V

Tweet 15Jun2020 - Compare funds 2020 - equity mutual funds - multi-cap funds, large-cap and large & mid-cap funds

MoneyControl weblinks: stocks & recent changes

Parag Parikh flexi cap, Parag Parikh tax saver, Conservative Hybrid fund (shows REIT holdings also) - Rajeev Thakkar

ABSL Ajay Garg funds

ABSL frontline equity, focussed equity, pure value - Mahesh Patil

UTI Swati Kulkarni, UTI flexi cap

Mirae large cap Neelesh Surana

Mirae tax saver, Mirae emerging bluechip, Mirae hybrid equity, Mirae great consumer

Franklin India Prima, taxshield, smaller companies, opportunities, flexi cap, equity advantage - R Janakiraman

Franklin Anand Radhakrishnan

Axis Jinesh Gopani

Axis flexi cap, mid cap, Bluechip - Shreyash Devalkar

HDFC Chirag Setalvad

Quantum long term equity value, tax saver - Nilesh Shetty, Sorbh Gupta

Union multi cap, value discovery, small cap, equity savings - Vinay Paharia

Canara Robeco emerging equities, bluechip equity, flexi cap, equity hybrid - Shridatta Bhandwaldar

Tata flexi cap, equity PE, young citizens, India consumer - Sonam Udasi

Tata large cap, India tax savings, mid cap growth, ethical, infrastructure

BNP Paribas Karthikraj Lakshmanan

Invesco India large cap, growth opportunities, contra fund, tax plan

DSP tax saver, India TIGER, equity opportunities, small cap, mid cap - Vinit Sambre, Rohit Singhania

Kotak emerging equity, small cap, equity hybrid - Pankaj Tibrewal

Principal multi cap - Ravi Gopalakrishnan (to be taken over by Sundaram MF)

L&T flexi cap, emerging businesses, midcap, large and midcap, tax advantage, hybrid equity - Venugopal Manghat, Vihang Naik (to be taken over by HSBC MF)

SBI Bluechip, SBI Magnum Midcap - Sohini Andani

SBI equity hybrid, focussed equity, small cap - R Srinivasan

HDFC MF Prashant Jain - Top 100, Flexi cap, Balanced Advantage, Hybrid Debt

Nippon India Sailesh Raj Bhan - Multicap, largecap, pharma

Nippon India Flexicap, Growth, Balanced Advantage, Smallcap - Manish Gunwani, Samir Rachh

IDFC MF Flexi cap, Infrastructure, Equity Savings - Sachin Relekar

LIC MF Yogesh Patil - large cap, flexi cap, large and mid cap, tax plan, equity hybrid

HDFC Amit Ganatra - taxsaver, capital builder, multi asset

UTI MF Ajay Tyagi - Flexi cap, Regular Savings

Debt Mutual Funds taxation wef 01Apr2023

On 24Mar2023, PM Modi government brought some last-minute amendments to Finance Bill, 2023 in the Indian Parliament. One of the negative surprise from the amendments is the removal of tax benefit that debt mutual funds (debt MFs) currently enjoy with regard to long term capital gains (LTCG) tax.

Comprehensive article dated 25Mar2023 on the above subject

Bharat Bond ETFs (2023, 2025, 2030, 2031 & 2032) Comparison:

Compare BB ETFs - VR

Compare BB ETFs - RV

Nifty Indices - Target Maturity Index - Nifty Bharat Bond Indices and others - methodology document -

- e.g., Nifty Bharat Bond Index - April 2032 -- its factsheet -- its portfolio

Freefincal 06Jul2020 article - Bharat Bond ETF risks - Price - NAV disparity is quite high (liquidity risk) -

Target Maturity Funds (TMFs) Comparison:

Crisil Limited - Benchmark indices for TMFs - methodology document for Index Linked Products PDF dated 04Aug2022 - web archive - the PDF contains details of index construction, historical securities and their weights in the index and maturity dates of the index

Target Maturity Funds compare 2022 - Value Research

Debt: Medium to Long Duration funds

Debt: Gilt funds

Debt: Medium Duration funds

Value Research 17Jan2021 - part 1 - part 2

Morningstar article 13Oct2021

FAQs by freefincal 28Feb2022

Pros and Cons by WSJ 03Feb2019 - "Target-maturity funds-(not to be confused with target-date funds, which gradually shift assets from stocks to bonds to increase safety as the target date approaches)—tackle these problems by purchasing bonds maturing at about the same time."

Prime Investor undated

FMPs vs Target Maturity Funds >

Debt Mutual Funds Comparison:

SEBI circulars on Categorization and Rationalization of Mutual Fund Schemes

SEBI circular on valuation of money market and debt instruments

SEBI circular on multi cap funds asset allocation

Compare debt funds 2024 (gilt, conservative hybrid, dynamic bond, etc) VR

Gilt funds compare 2023 - VR - weblink for all gilt funds

Gilt funds compare 2023 - MS - weblink for all gilt funds

Gilt funds fund screener 2023 RV (RV provides average maturity, yield to maturity and modified duration for better comparison)

Gilt funds compare 2023 - MC

Mix of debt funds 2023 - VR - conservative hybrid, gilt, dynamic bond, etc.

Conservative hybrid funds 2023 screener Rupee Vest

Conservative hybrid funds 2023 compare - VR - weblink for all conservative hybrid funds

Conservative hybrid funds 2023 compare - MS - weblink for all conservative hybrid funds

Dynamic Bond Funds compare 2023 (this provides fixed income maturity breakdown for 1 to 3y; 3 to 5y etc) Morningstar India - weblink for dynamic bond funds (modified duration is provided in the factsheet)

Dynamic Bond Funds screneer 2023 Rupee Vest (RV provides average maturity, yield to maturity and modified duration for better comparison)

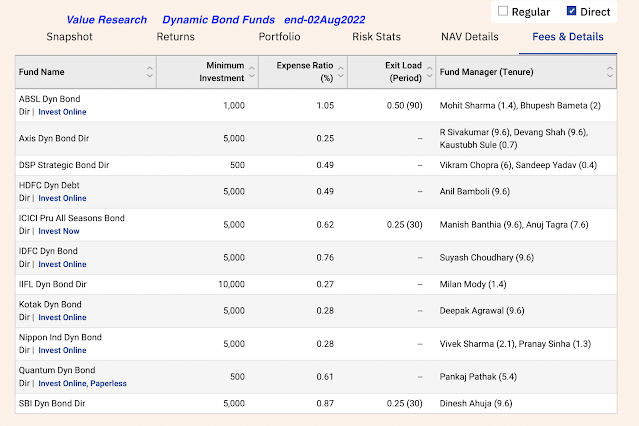

Dynamic Bond Funds compare 2023 Value Research - weblink for all dynamic bond funds (VR doesn't give modified duration data in comparison tables)

-- images as on 03Aug2022

Debt Mutual Funds issues in India:

Franklin Templeton India - Debt Fund closure - six debt funds winding up - Franklin Fiasco - Tweets from 10Aug2020 to 21Jan2021 - Value Research timeline -

Prof Jayant Varma argues for some sort of a sovereign backstop for debt mutual funds in India - Tweet 29Apr2020

Occasionally, liquid funds deliver negative returns for very brief periods, e.g., between 2009 and 2021 - Tweet 01Apr2021 -

Why Corporate bond funds generate lower returns compared to Gilt funds? - Tweet 19Mar2021

Impact of write down of Vodafone India debt papers on debt mutual funds - AGR dues - Supreme Court - Tweet 18Jan2020 - Tweet 15Nov2019 -

Impact of downgrade of Simplex Infrastructure on HDFC credit risk fund - Tweet 31Dec2019

Franklin India Debt funds holdings debt of Essel Infraprojects - Tweet 12Dec2019

Shenanigans of debt mutual funds - Tweet 27Nov2019

SEBI mandate of 20% minimum G-Secs / Treasury Bills investment for liquid and overnight funds - Tweet 20Sep2019

Debt funds impacted by Dewan Housing Finance Ltd (DHFL) credit rating downgrade - side pocketing - segregated portfolios - FMPs - Tweet 05Jun2019 - Tweet 05Jun2019 - Tweet 05Jun2019 - debt funds concentration risk Tweet 13Feb2019 -

Lending to promoters (via share pledging) by debt funds via opaque structures - Tweet 19Feb2019 - Tweet 19Feb2019 - exposure to DHFL, Essel group / Zee group Tweet 30Jan2019 -

SEBI circular on creation of segregated portfolios - side pocketing - Tweet 28Dec2018

RBI FSR - Money Market Mutual Funds & their Inter-connectedness with Banks - Tweet 16Oct2018 - network effect of interaction among banks, NBFCs, AMCs (mutual funds) and insurance cos Tweet 24Oct2018

Debt / liquid / short term mutual fund schemes for Franklin Templeton India MF suffered heavily in February 2016 due to credit rating downgrade of securities of Jindal Steel and Power (JSPL) Tweet 02Jul2018

16Feb2016 Franklin Templeton - credit rating downgrade by CRISIL of Jindal Steel and Power (JSPL) debt securities: Tweet 11Mar2018

28Aug2015: JP Morgan AMC's redemption crisis in liquid / short term funds - credit rating downgrade of Amtek Auto by Crisil, Care Tweet 11Mar2018

Ballarpur Industries default and debt funds exposure - Tweet 17May2017 - Taurus MF debt funds lost heavily Tweet 11Mar2018

Lessons for mutual funds from Amtek Auto default - Tweet 07Oct2015

JP Morgan AMC's redemption crisis in debt funds (credit rating downgrade of Amtek Auto by Crisil and Care - Amtek Auto default) - Tweet 28Aug2015 - Tweet 04Sep2015 - JP Morgan's 1% cap on redemption Tweet 02Sep2015 -

Direct MF Plans / Direct MF platforms

15Dec2022 Livemint - "A decade on, how have direct MF plans fared?"

As per the article of 15Dec2022, Zerodha Coin and Kuvera are the biggest direct MF platforms, that provide access to online investors for investing in direct MF plans >

Silver ETF

28Jan2022 BSE - ICICI Pru Silver ETF, India's first Silver exchange-trade fund, starts trading on 31Jan2022 on BSE and NSE - 1) market lot is one; 2) face value is Rs 10; 3) issue price is Rs 67.07* and 4) total number of units allotted on 24Jan2022 are 168.10 lakh units as per BSE notice - the AMC collected Rs 112.74 crore in the NFO or new fund offer -

(* my guess is this allotment price of Rs 67.07 is close to the one gram price of silver as declared by IBJA on its website -- as per IBJA, silver 999 (AM price) per one kilogram is Rs 61,683 as on 28Jan2022 -- as such, each unit price of Silver ETF roughly equals price of one gram of silver)

- benchmark is domestic silver price derived from LBMA AM fixing prices

- iNAV or indicative NAV will be disclosed on BSE / NSE on a continuous basis during trading hours

- no entry load; and no exit load

Tweet 12Dec2020 on Silver ETF - many were waiting for the silver ETF for a long time

06Dec2021 SEBI - ICICI Pru Silver ETF fund of funds - FOF - draft SID - ABSL MF, Nippon India MF and Mirae Asset MF too filed their draft SID with SEBI for proposed launch of Silver ETFs

24Nov2021 SEBI circular - Norms for silver ETFs and gold ETFs

- - -

Disclosure: I've vested interested in Indian stocks and other investments. It's safe to assume I've interest in the financial instruments / products discussed, if any.

Disclaimer: The analysis and opinion provided here are only for information purposes and should not be construed as investment advice. Investors should consult their own financial advisers before making any investments. The author is a CFA Charterholder with a vested interest in financial markets.

CFA Charter credentials - CFA Member Profile

CFA Badge

He blogs at:

https://ramakrishnavadlamudi.blogspot.com/

Twitter @vrk100

No comments:

Post a Comment