Importance of Portfolio Rebalancing - VRK100 - 15Sep2020

Birds poop out just before take-off in order to weigh less during flight. Likewise, in financial markets, it's sometimes better to lighten up one's positions (rebalancing) in order to take advantage in future.

Rebalancing and market timing are two different animals. Rebalancing is basically a risk management tool. It's easy and simple to understand and implement. You move in and out of different asset classes, like, bonds, stocks, gold, etc., according to your asset allocation.

With rebalancing, you never go to 0% or 100% with a single asset class. You move the money within your comfortable range, say, 40%-60%. Several assets classes, like, stocks, are subject to heavy losses frequently.

Hence, it's better to rebalance portfolios periodically within your comfortable range. The danger with heavy losses is we would be completely out of market due to fear psychosis.

Market timing is for the sophisticated and it's highly complicated. It's not suitable for green-horns. It doesn't work 97.17% of the time for 99.572% of investors / traders.

- - -

The above blog post is a reproduction of my Tweet thread dated 15 September 2020 >

Birds poop out just before take-off in order to weigh less during flight. Likewise, in financial markets, it's sometimes better to lighten up one's positions (rebalancing) in order to take advantage in future.

— RamaKrishna Vadlamudi, CFA (@vrk100) September 15, 2020

- - -

P.S.:

20Mar2023: Ajay Shah Narottam of XKDR Forum

(earlier with NIPFP) - BQ Prime video - his Twitter handle

-- SVB collapse (Silicon Valley Bank) in the US was mainly due to asset-liability mismatch between short-dated liabilities and long-dated assets leading to interest rate risk; and high concentration of uninsured deposits among venture capitalists

-- the response from the US authorities (the US Treasury, the Fed and FDIC) is unprecedented in the sense that they all deposits of two failed banks (SVB and Signature Bank) whole – in the process insuring even the uninsured deposits (in the case of SVB, uninsured deposits were huge at 93% of total deposits)

-- the US authorities took ‘systemic risk exception’ and insured the uninsured deposits of SVB and Signature Bank

-- when the authorities respond to a crisis in an unprecedented manner, it’s easy to guess something is going to break

-- in the case of SVB, the wholesale depositors (like venture capital firms, startups, etc.) were terrified of their uninsured deposits and started withdrawing deposits in an unprecedented speed; and this was amplified by modern information technology (social media, like, WhatsApp, Twitter and other info sharing platforms) leading to SVB bank run in a rapid manner as the word spread more quickly via social media

-- the speed with which large depositors withdrew money from SVB never happened in history (in just two to three days, SVB bank run led to its collapse)

-- the level of inter-connectedness in the world is higher now compared to 2008 GFC

-- the aim of monetary policy is to break something in the system, so that it would force people to spend less leading eventually to lower CPI inflation

-- the Fed reacted late to hiking interest rates and later they were forced to hike rates with great speed in 2022 – this has set the stage for banks and others to suffer

-- the failure of SVB is a combination of bad management from SVB, Fed tightening rapidly and weak bank regulation

-- banking is still a disaster-prone industry; banks tend to fail often since the 19th century

-- banking can never be safe and secure

-- the developed markets are more inter-connected; but India is backward in certain respects as our markets are not so connected with the rest of the world

-- the network of relationships is complex in the globe

-- felt threatened by the collapse of SVB and Signature Bank, money started moving from smaller banks to bigger banks; and depositors moved money to safer money market mutual funds or MMMFs (that invest only in US Treasury bills)

-- the problems in a few US banks spread to Credit Suisse, which has already been in trouble for several years (much prior to SVB collapse)

-- banking is always a trouble sector

-- Why should we tie our payment systems so tightly to highly-leveraged banking industry, which has been troubled sector for long? Why can’t we allow payments to run via MMMFs and Google Pay, which would be much safer compared to linking payments with banks? Had we linked our payments with MMMFs and Google Pay, we wouldn’t have so much trouble.

-- the monopoly of banks in India in the payment systems needs to be questioned

-- the shareholders and employees of SVB got burnt; but the rich depositors (Silicon Valley firms) got bailed out – prima facie, this seems unfair – it’s politically bad to use public money to save rich people – this unfairness leads to rage against the rich and elite leading to various kinds of political and economic problems

-- we should decrease the banking leverage and we should not allow public money to be used for bank bailouts

-- we should reduce the monopoly of banks in payment systems

-- by making uninsured deposits whole, the US authorities created a moral hazard – now, depositors will continue to think I’ll deposit my money in a bank that gives higher interest rates than another bank that pays lower interest rates – this moral hazard is creating an incentive for depositors to seek higher interest rates as at the back of their minds they would know some day the government will ultimately come and rescue the failed banks

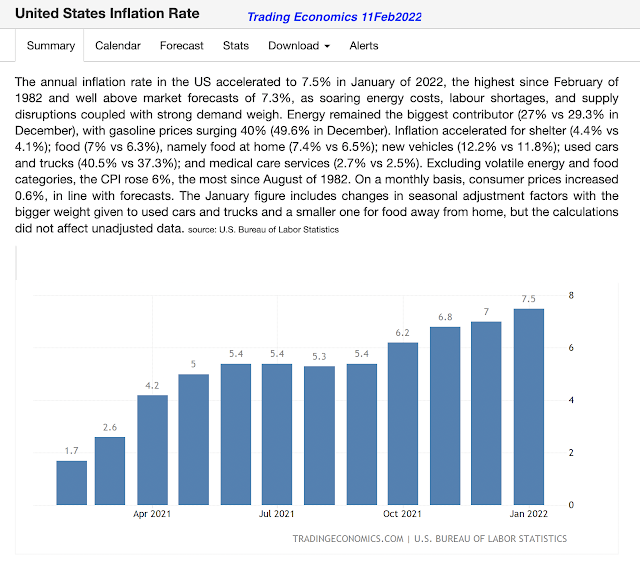

-- inflation in the US is a tough cookie

-- the Fed faces a big challenge between whether to focus on financial stability and to focus on containing inflation; the dilemma is if they continue to raise rates, it could further destabilise the financial system and if they lose focus on inflation control, inflation may not come down

-- I don’t think the US inflation would come down to 2% target before Nov2024 presidential elections

-- the Fed successfully delivered 2% inflation for long in the US and they are proud of it

-- after 2008 GFC, there has been a good monetary policy and financial stability toolkit with the Fed; because of this better toolkit, they are now able to respond to crisis situations in a speedy manner to arrest contagion risk

-- the speed with which the Fed is responding to crises is due to the remarkable work done by Ben Bernanke and his crew at the time of 2008 GFC

-- due to this better toolkit, central banks of developed markets (DMs) are better equipped to deal with crises

-- due to these toolkits, the current crisis may not turn into a big mess

09Mar2023 Fundsmith - Annual Shareholders' Meeting 2023 - stock investing -

04Mar2023 Real Vision Finance - Raoul Pal talks to David Dredge, CIO of Convex Strategies - video recorded on 03Feb2023 - convexity portfolios

09Mar2023 Real Vision Finance - Maggie Lake talks to Doomberg - video - hidden energy opportunities -

15Mar2023 Federal Reserve - the US Fed Monetary Policy Tools - new policy tool "Bank Term Funding Program" or BTFP set up on 12Mar2023 in response to SVB collapse and Signature bank collapse - BTFP terms and conditions

13Mar2023 Blockworks Macro - SVB collapse - video - Joseph Wang talks about curent bank bailout and moral hazard - another video 14Mar2023 by Joseph Wang -

13Mar2023 Wealthion - SVB collapse - video - Adam Taggart talks to Joseph Wang, former Federal Reserve insider - excellent points by Joseph Wang (@FedGuy12)

12Mar2023 Tweet - SVB collapse - other banks too suffered heavily admist SVB Collapse -

SVB Financial Group (SIVB) (-60%)

PacWest Bancorp (PACW) (-54%)

Signature Bank (SBNY) (-36%)

Western Alliance Bancorp (WAL) (-32.4%)

First Republic Bank (FRC) (-31.3%)

Customers Bancorp Inc (CUBI) (-23.5%)

First Foundation Inc (FFWM) (-20.3%)

Other banks too suffered losses in their share prices, except big banks like, JP MOrgan, Bank of America and Wells Fargo

Big seems to be getting bigger

12Mar2023 SVB Collapse - SVB Financial Group tweeted on 06Mar2023: "Proud to be on @Forbes' annual ranking of America's Best Banks for the 5th straight year and to have also been named to the publication's inaugural Financial All-Stars list." -- Forbes 2023 list of America's Best banks -

By 10Mar2023, the bank collapsed!

08Mar2023 SEBI circular - Gazette of India - Buyback route through open market via stock exchanges - curbs on bids, price and volume

MoneyControl and Business Standard

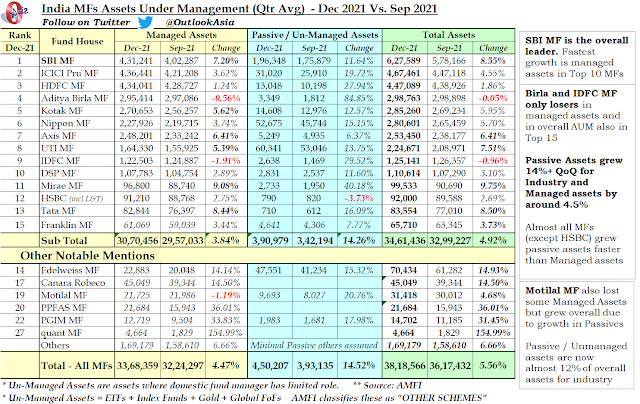

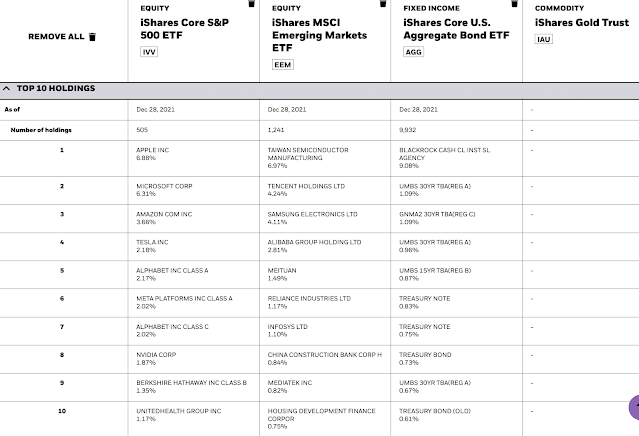

06Mar2023 Vanguard - US ETFs data:

-- the first ETF in the USA was launched in Jan1993

-- AUM is assets under management

-- industry MF AUM in the US is USD 16.2 trillion (31Dec2022); net cash flow to inudstry MF is minus USD 958 billion in the 10-year period (2013-2022)

-- ETF AUM in the US is USD 6.5 trilion (31Dec2022); net cash flow to ETFs is USD 4.1 trillion in the 10-year period (2013-2022)

-- while inudstry MF has negative flows in the 10-year period (2013-2022); ETFs have positive cash flows

-- in the 10-year period (2013-2022), the average expense ratio of Vanguard ETFs decreased from 0.14% in 2013 to 0.06% in 2022

-- ETFs in the US accounted for more ethan 30% of exchange volumen in 2022

28Feb2023 India market cap to GDP raio is 94.74 percent as on 28Feb2023 -- based on BSE market cap of all BSE firms Rs 257.73 lakh crore and estimated India GDP for FY 2022-23 of Rs 272.04 lakh crore

05Jan2023 School of Athens by Raphael - video - Renaissance - Vatican fresco - Plato Aristotle Euclid Heraclitus Ptolemy Pythagaros Socrates - "none of them were Christians" - Diogenes Zeno Epicurus Parmenides Boethius - painting

04Mar2018 School of Athens by Raphael - video - painting - Wikimedia Commons -

23Jan2023 ET - Tata Motors' ADR to be delisted effective 23Jan2023 - American Depositary Receipt - delisting

08Oct2022 Sahil Bloom The most powerful life hacks I've found -

21Feb2023 Stanley Pignal - most hyped technologies - will Chat GPT be one of them? - similar to Iridium?

21Feb2023 Bank of Baroda vs Adani group - Fun - humour -

23Jan2023 Fake news vs real news - fake news from Reuters Pitchbot juxtaposed real news from Reuters - people easily believe the fake news in this case because it's so believable -

20Jan2023 Kunal Shah talking to Romeen Sheth - suitcases and weddings - Indian eithos - low trust society - living room vs bath room -

17Feb2023 StLouis Fed -Fed balance sheet expansion and contraaction - QE and QT (QT is withdrawal of liquidity or reduction of Fed balance sheet) -

1) From 03Sep2008 (GFC or global financial crisis) to 14Jan2015, Fed's balance sheeet expanded from USD 905.25 billion to USD 4,516.08 billion (five times increase)

2) From 14Jan2015 to 28Aug2019, Fed B/S contracted from USD 4,516.08 billion to USD 3,759.95 billion (16.74 percent decrease)

3) From 28Aug2019 to 26Feb2020 (COVID-19 outbreak), Fed B/S expanded from USD 3,759.95 billion to USD 4,158.64 billion (10.60 percent increase)

4) From 26Feb2020 (COVID-19 outbreak) to 13Apr2022 (QT started), Fed B/S ballooned from USD 4,158.64 billion to USD 8,965.49 billion (116 percent increase)

5) 13Apr2022 (QT started) to now (15Feb2023), Fed B/S contracted from USD 8,965.49 billion to USD 8,384.77 billion (6.5 percent decrease)

Fed balance sheet expansion - from 18Dec2022 to 15Feb2023 >

02Feb2023 NDTV - New income tax regime versus old tad regime - 08Feb2023 Livemint - why nex tax regime has limited appeal

10Feb2023 - household finance - household savings - financial assets - savings rate - investment rate -

24Aug2017 RBI report of Household Finance Committee - PDF copy - RBI data flow of financial assets & liabilities -

21Jan2022 Ila Patnaik and Radhika Pandey - cut taxes to spur demand - standard deuction - 10Jun2019 savings and capital formation by Ila Patnaik and Radhika Pandey - 29Jan2019 tax incentives influence household financial savings by Ila Ptnaik, Radhik Pandey and Renuka Sane

05Sep2017 Business Standard - pension as mandatory savings by Renuka Sane - NPS -

25Jan2023 Adani Enterpirses FPO - as per this, LIC of India, SBI Employees Pension Fund and life insurers are investing as anchor investors in the FPO

31Jan2023 Adani Enterprises Ltd follow-on public offer (FPO) sails through- as per Business Standard article 31Jan2023, the FPO was bailed out by non-institutional investors (NIIs). They include, Reliance Industries, JSW Steel, Bharti Airtel, Torrent Group and Zydus Cadila Group. "This includes names like Ambanis, Sajjan Jindal, Sunil Mittal, Sudhir Mehta and Pankaj Patel." - AdaniFPO - Adani FPO -

images from the article >

31Jan2023 BSE demand schedule for Adani Enterprises FPO

Fun - Meme on Adani Enterprises FPO

25Oct2022 Mehdi Hasan - Rishi Sunak / 'Desi' prime minister memes are genius - fun - meme -footwear -

29Dec2022 India current account defcit - TE - India CAD reached 4.4 percent of GDP as of 30Sep2022

06Mar2023 music video - web archive video - web archive lyrics and sung by Leonard Cohen - 'Everybody Knows'

Everybody rolls with their fingers crossed

Everybody knows that the war is over

Everybody knows the good guys lost

Everybody knows the fight was fixed

The poor stay poor, the rich get rich

That's how it goes

Everybody knows

Everybody knows that the boat is leaking

Everybody knows that the captain lied

Everybody got this broken feeling

Like their father or their dog just died..."

Music video - web archive - Piano Music by Claude Debussy for Relaxation - with paintings by Monet, van gogh, Manet, Pissarro, Degas, Renoir, Degas, etc. - classical music - impressionism -

Q: Coin has become quite large with assets under management of Rs 33,000 crore. What’s your plan to monetise the platform in the long term?

Zerodha's Nithin Kamath: In July last year, there was a Sebi circular that users have to move money separately to buy stocks and mutual funds. Earlier, they could use the money in their trading accounts to buy MFs. So, that has ruined customer experience on Coin a little bit. We see Coin as an execution platform, not a discovery platform. (Coin is a platform for investing in direct plans of mutual funds).On Coin, what we're saying is people who come to Coin already know what funds they are trying to buy. We want to make that as simple and easy as possible. Eventually, the longer term plan is that we have to figure out a way to build an advisory business -- either directly or partnering with a startup-- and Coin will play the role of a foundational block.

10Jan2023 Fed - Fed Chair Jerome Powell's speech "Central Bank Independence and the Mandate -- Evolving Views"

- monetary policy - bank supervision - climate policies -

-- Fed Chair categorically stated that the US Federal Reserve believes in central bank independence and would not go beyond what is mandated by the US Congress

-- specifically, he told Fed would not expand its scope to issues relating to climate change and their perceived social benefits

-- "We are not, and will not be, a 'climate policymaker.'"

17Sep2022 Tweet - Derek Guy - How to look better is a suit

- look better in outerwear - look better without exercise - style - dress better - clothes - tailoring -

03Jan2022: #Quote #Poverty #Wealth

"Poor and content is rich, and rich enough..." ~ Shakespeare, Othello

31Dec2022 FS blog - The best podcasts of 2022

- farnam street - Shane Parrish - The Knowledge Project -

02Jan2022 video - 7-year old Drew Barrymore - TV show - Johnny Carson - Hollywood - ET - Steven Spielberg - good laugh -

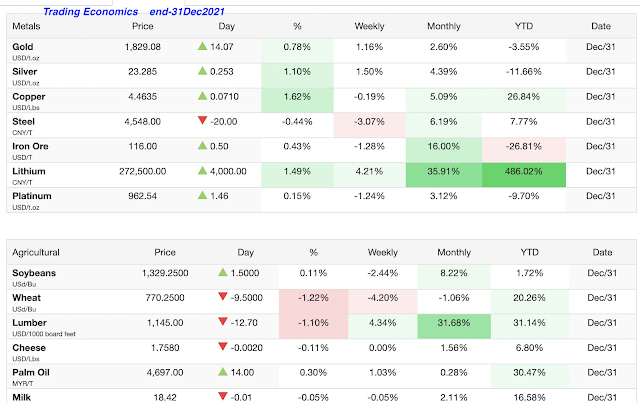

31Dec2022 TE - data - macro indicators - bitocin - ethereum - crypto assets - inflation - interest rates - bond yields - top S&P 500 by market cap

TheIdeaFarm Tweet 20Dec2022 - tope 20 investing podcasts of 2022

Tweet 22Nov2022 - Telugu family when you show no interest in emigrating to the United States - meme - fun -

Tweet 21Dec2022 - save the planet - upma with greenpeace - green peas - fun - meme -

Mark Brooks Tweet thread 30Dec2022 - 100 tweets - management - strategy - people - culture -

BBC documentary - a wonderful documentary on Friedrich Nietzsche by @bettanyhughes > Bettany Hughes > Genius of the modern world > philosophy - BBC - video

BSE holidays 2023 - NSE holidays 2023 - stock market

12Nov2022: I walked along KBR Park outer walkway (Banjara Hills, Hyderabad) this afternoon and I took some photographs along the way >

Hyderabad police control room, beside TRS headquarters >

TG 15Nov2022 - 2023 Holidays under NI Act in Telangana state - bank holidays

JP Morgan India in 2023 - Balancing Growth with Statbility

- India GDP growth rate in FY 2022-23 could be nearly 7%, but below pre-pandemic potential trend

- FY 2023-24 GDP growth rate could be lower, due in part to lower exports due to global slowdown

- corporate and bank balance sheets are in better shape in recent years

- capex cycle / investment cycle will take time to fructify

- consumption receovery still remains below its pre-pandemic trend

- corporate debt-GDP ratio in FY 2020-21 is at 30%, the lowest level since 2006 (due to years of delveraging)

- manufacturing utilisation rates are still at 76% (giving less hope for immediate capex revival)

- the limited capex upcycle is being driven more by the public (government) rather than the private sector

- much of nominal bank credit growth is explained by elevated inflation

- real policy rates may become positive in FY 2023-24

Tim Ferriss video 28Jun2022 - 2nd part - Tim talks to Edward Thorp (Ed Thorp) - How to Think for Yourself - transcript - life - probability -

- Schaum's Outlines is a simple book on basic statistics

- 1st part video 25May2022 - Beating Blackjack and Roulette - Beating stock market - #Investing - stock investing - transcript -

- Tim Ferriss talks - all transcripts -

30Dec2022 BSE - In a BSE filing , Bandhan said that:"the Bank has transferred its Group Loan and SBAL technical written-off portfolio amounting to Rs. 8,897 crores to an ARC, pursuant to Swiss Challenge Method, for a consideration amounting to Rs. 801.00 Crore, on Security Receipt consideration basis. ARC along with Investor has subscribed to 51.70% of Security Receipts amounting to Rs. 414.04 Crore whereas Bandhan Bank has subscribed to 48.30% of Security Receipts amounting to Rs. 386.96 Crore."

21Dec2022 Reuters - India to bolster carbon trading market with stabilisation fund - carbon credit - emission - carbon market financing - net zero - green energy - trading certificates - sector wise share of India carbon emissions >

18Feb2022 Business Standard - Startups, IPL auctions & the Veblen effect - by Sandeep Goyal of Rediffusion

- Julius Caesar - how to become famous - ransom demand - Romans - Rome - economist Thorstein Veblen

- Veblen effect: market behavior: consumers purchase higher-priced goods when similar low-priced substitutes are available - caused by the belief that higher price means higher quality, or by the desire for conspicuous consumption

20Jan2023 Zuk - cybersecurity - recent WhatsApp takeover frauds - how it works -

13Dec2022 BSE - Bihar Sponge Iron Ltd, in a BSE filing after market hours, says its servers are under cyberattack and the company is "struggling to get back its entire data" - #ransomware - ransom ware - cybersecurity

04Feb2023 - CPI inflation - Euro are / eurozone - Netherlands - Trading Economics data -

31Jan2023 - CPI Inflation of major economices TE -

Australia CPI inflation - Japan CPI inflation - Egypt CPI inflation -

27Nov2022 TE - UK inflation, Japan inflation and EU inflation - European Union - CPI inflation in these countries is at record highs

10Nov2022

- Gwalior Rayon Silk Manufacturing (Weaving) Company Ltd was

incorporated in 1947. Its name was changed to Grasim Industries Ltd

effective 22Jul1986. It now belongs to Aditya Birla Group. #Investing

RBI 02Apr2007 - Monetary Policy Transmission in India

(Paper presented by Dr.

Rakesh Mohan, Deputy Governor, RBI, at the Deputy Governor's Meeting on

"Transmission Mechanisms for Monetary Policy in Emerging Market

Economies - What is New?" at Bank for International Settlements, Basel

on Dec 7-8, 2006.) #MPT

- Traditionally, four key channels of monetary policy transmission are identified, viz., interest rate, credit aggregates, asset prices and exchange rate channels... In the recent period, a fifth channel – expectations – has assumed prominence in the conduct of forward-looking monetary policy

RBI 27Jun2012 - RBI Working Paper Series No. 11

Monetary Policy Transmission in India: A Peep Inside the Black Box - Jeevan Kumar Khundrakpam and Rajeev Jain #MPT

- A few attempts have been made to examine the channels of monetary policy transmission for India.

RBI 15Nov2012 - Lost in Transmission? Financial Markets and Monetary Policy - (Speech delivered by Michael Debabrata Patra, Deputy Governor, Reserve Bank of India - November 12, 2022 - in the Treasury Heads’ Seminar organised by the Reserve Bank at Lonavala)

- "Lost in Translation" (2003) Hollywood movie quoted

- Prisoner's Dilemma

- transmission and distribution losses

- Monetary Policy Transmission (MPT)

- key channles of monetary polilcy transmission

10Oct1985 David Chaum - Security without Identification Card Computers to make Big Brother Obsolete

- cyber security - privacy - data protection - individuals

- digital signature - blind signatures

- payment systems -

- cryptography - cryptographers - crypto -

31Oct2022 ESMA - The European Securities and Market Authority announces withdrawal of recognistion of six central counterparties (CCPs) in India - the withdrawal is effective 30Apr2013 - as these CCPs have not met the ESMA conditions

The six CCPs are: CCIL, ICCL, NSCCL, MCXCCL, IICC and NICCL.

Of the 41 third country CCPs (TC-CCPs) recognised by ESMA, only these six CCPs from India are derecognised by ESMA now.

As per ET article dated 03Nov2022, ESMA withdrew recognition to these six CCPs due to: "the Reserve Bank of India (RBI) and SEBI are not comfortable letting these CCPs come under the scrutiny and inspection of overseas market regulators... The trades that would be affected are foreign currency forwards --- where a bank hedges the currency risk of a client buying or selling dollars or any other foreign currency; interest rate swaps in which two entities exchange fixed interest payment vis-à-vis floating rate payment to cover interest rate risks; and custody businesses of some of these MNC banks handling secondary stock and bond market trades of foreign portfolio investors and local institutions like mutual funds."

Real Vision Finance videos - three part series on Italy - Here, Grant Williams talks to Steve Diggle, founder of Vulpes Investment Management -

06Sep2019 - video part 1 of 3 - History of Italy's Broken Banking System - Florence, Tuscany, Italy

- Florence is the centre of Italian banking in the 14th, 15th and 16th centuries

- Italy and France have beautiful, gentle , bucolic countryside

- the Ponte Vecchio (an old bridge on Arno river in Florence) has the gold sellers because if you had your business on the bridge, you didn't have to pay your full municipal taxes because you weren't actually inside the city walls. So the reason why London Bridge and these ancient medieval bridges used to be full of merchants is because they were actually avoiding paying tax - #anecdote

- Florence is synonymous with Medici

- double-entry bookkeeping, a 15th century financial revolution, was brought by Medici

- lending for interest and profit was banned by Church (in old days) in the rest of Europe, but in Florence banking was a respectable profession - (though lending was banned by Church, the minorities especially the Jews were involved in lending)

- Florence (a town of merchants) is in the middle of Italy, so commerce to and fro the South and North had to pass through Florence on Arno river

- Florence was a fair place to do business - florin was their currency, backed by gold

- Florence was the first capital of united Italy (1870)

- Even now, Italy is a loose federation with several independent identities and differences

- historically, regional identities have been very strong in Italy - national identity in Italy is weaker

- South Italy is poorer compared to North Italy, which feels they are subsidising the South

- there is anger and resentment against Brussels

- Since 1999 (birth of Euro), Italy's economy has not strengthened causing resentment against the EU

- Italy's pathetic bureaucracy kills businesses

- Florence's duomo is the city's most iconic landmark. Capped by Filippo Brunelleschi's red-tiled cupola, it's a staggering construction whose breathtaking pink, white and green marble facade and graceful campanile dominate the Renaissance cityscape - #architecture

- The Medicis (in Florence) did not seize power. At their pinnace of power, they weren't involved in banking at all anymore. They got out of the banking business. Instead, they got into the pope business and the owning-the-town business. Politics was definitely a more steady profession than banking.

- because Italy is part of the Euro and the EU, it has to follow the EU's diktats and suffers from EU's bureaucracy - compared to Britain, Italy is more integral to the EU project and as such Quitaly (Italy quitting EU, similar to Brexit) is not happening

- For Italy, leaving the Euro may be easier than leaving the EU

- it being part of EU, Italy has no monetary flexibility and as such sometimes, interest rates are lower when Italy's economy is hot and interest rates are high when when Italy's economy is in downturn (against principles of standard monetary economics) - so, at times, Italy is deprived of the self-correcting mechanism of capitalism

- empires are inflexible, EU is like an empire

07Sep2019 - video part 2 of 3 - Siena - Will Italy be the next country to leave EU?

- world's oldest bank Banca Monte dei Paschi di Siena S.p.A. (Banca MPS or BMPS) - Monte dei Paschi in English means 'mount of piety' - in existence since 1472 - but the bank is in financial trouble now (November 2022) -

- wrong / misaligned incentives in Banca MPS (the bank went public 1999 and since then it has three government bailouts)

- at its peak in May2007, the share price of BMPS was Euro 1,085 and now (03Nov2022) it's quoting at Euro 1.86 (it has lost 99.83% of its value from May2007) - great lesson in 'not averaging down'

- Siena and Florence were rival trading centres (they used to employ the English, Germans, etc., for fighting)

- why is everything (buildings, architecture, etc.) intact in Siena? because there is no growth - when you stop growing, your preserve things -

- the scale of ambition (in olden days) in Siena is amazing

- adverse demographics in Italy

- unsustainable, unserviceable and high debt in Italy

- zombie banks in Italy

- JM Keynes said, "If you're a banker, the one thing you must never do is fail idiosyncratically. Always fail together." #anecdote #quote

- Italy is frustrated with Brussels (European Union)

- the sovereign debt of Italy is now littered across Europe

- Italy is beautiful (world's 5th most visited country)

- though a G7 nation, Italy's metrics are extremely poor in: 1. ease of starting a business, 2. corruption, 3. low rank in getting credit, 4. low rank in paying taxes, 5. high bureacracy (all these negatives suffocate entrepreneurial flair)

07Ssep2019 - video part 3 of 3 - Cortona and Lake Trasimene

- Fate of Italy's Future

- Battle of Lake Trasimene - Hanibal's Cunning Ambush - largest military ambush in history - Hannibal of Carthage defeats Romans here massacring thousands of Roman soldeirs - it was Rome's worst defeat in history -

- Three mistakes by Romans in Battle of Lake Trasimene: 1. Roman general Flaminius acted hastily, 2. He rushed to battle (instead of rushing, one should prepare well) and 3. He underestimated the enemy (these mistakes have significant contemparaneous message)

- Why aren't flashy cars, like, Ferraris, Maseratis, etc., there on these roads? Because four or five years ago, in order to increase tax revenues, the Italian government sent out the traffic police to stop any really nice cars on the roads and asking them how much tax they paid last year. Afraid of the policemen, Italians sold their expensive cars very cheaply at that time. #Anecdote

- flashy cars and terrible roads (Italian dilemma: you can have private wealth in public squalour)

- Italy has a tax collection problem

- you can't get a cappuccino in Italy in the afternoon, you get it only in the morning - you've to drink tea in the afternoon

- Woman fertility rate in Italy is low at about 1.2 or 1.3 (adverse demographics)

- Italian economy is weak and so is its banking system; as such, leaving the Euro is a pipe dream for Italy

- things are cyclical in history; today, Europe has a common currency, open borders and same interest rates; and these things may change in future because of resentment against the EU and inflexibility of the EU - what if you invested in Italy and one day in the next few / several years, Italy switches back to Lira and what will happen to your asset values in Italy? #Quitaly

- EU's inflexibility may lead to its own downfall in future

02Nov2022 NASA - James Webb Space Telescope launched on 25Dec2021 - astronomy -

- Webb Telescope orbits the Sun (solar orbit) and it is 1.5 million kilometers away from the Earth (it's actually 3.9 times more distant than Moon is from the Earth)

- in contrast, Hubble Telescope orbits the Earth and is just 570 kilometers far from the Earth

30Oct2022 CNBC Marathon - documentary - video - How Cars Keep Americans Safe

- Ralph Nader

-#Anecdote Swedish car company Volvo made history in 1959 when engineer Nils Bohlin invented the three-point car seatbelt. Volvo essentially gave the design away for free, allowing for its widespread adoption.

- Korean automaker Hyundai unveiled an airbag concept called the Hyundai Hug. The bag is deployed from the passenger seat and is made of air filled chambers and tethers that draw the bag around the body of the passenger. The idea is to hug the passenger in place and protect them from a collision in any direction. - Hug airbags - male dummy - femaly dummy - dummies may cost between USD 100,000 and USD 1,000,000 -

- We are here at Humanetics outside Detroit, Michigan, and this company is the largest maker of crash test dummies in the world. Humanetics controls about 90% to 95% of the crash test dummy market.

- some dummies have 138 sensors

- car safety vs false sense of security

- Car manufacturers really weren't interested in talking a lot about safety. If we talk about safety, then we have to acknowledge that cars might not be safe.

21Oct2022 Family of Sangita and Sajjan Jindal (JSW Group):

Their children are:

Tarini Jindal Handa, Managing Director, JSW Living Pvt Ltd (Furniture stores Forma)

Parth Jindal looks after JSW Cement and JSW Paints

Tanvi Jindal looks after educational initiatives

Sajjan Jindal is son of Om Prakash Jindal or OP Jindal. OP Jindal's four sons are Prithviraj Jindal, Sajjan Jindal, Ratan Jindal and Naveen Jindal.

JSW Group companies (JSW originally meant Jindal South West):

JSW Steel

JSW Energy

JSW Holdings

JSW Cement

JSW Paints

JSW Living

12Oct2022 FT - India looks to move up tech value chain with iPhone plant deal

- Apple - manufacturing in India -

Three Taiwanese companies that already work for Apple in India — Foxconn, Pegatron and Wistron — will be putting the iPhone 14 together at their sites in the country’s south, two people familiar with the secretive US company’s operations said.

10Oct2022 BBC - India facing a pandemic of antibiotics-resistant superbugs

- silent pandemic - superbug - drug resistance - antibiotic resistance -

Antibiotics, for example, cannot cure viral illnesses like flu or common cold. Patients with dengue - a viral infection - and malaria - caused by a single-celled parasite - often receive antibiotics. Antibiotics continue to be prescribed for diarrheal diseases and upper respiratory infections for which they have limited value.

As prices of antibiotics fall and diagnostics remain expensive, doctors prefer to prescribe drugs rather than order tests. "Doctors are sometimes not sure what they are treating, and they want to treat everything by using broad-spectrum drugs," says Dr Walia.

Hospital infections are also to blame. Patients are often pumped with antibiotics to compensate for poor hygiene and sanitation, "because no doctor wants to lose a patient because of an infection".

13Oct2022 Supreme Court - judgment copy - Aishat Shifa vs State of Karnataka - split verdict by SC - Justice Hemant Gupta and Justice Sudhanshu Dhulia - Hijab case - Dairy number 8344 of 2022 -

- Lawyer Gautam Bhatia article on the above - Discipline vs Freedom -Article 12 - Article 14 - Article 15- Article 21 - Article 25 -

- related: Bijoe Emmanuel & Ors vs State Of Kerala & Ors - Tweet 18Dec2018 and Tweet thread 03Dec2016

17Oct2022 BEML Limited - Apportionment of Cost of Acquisition of equity shares after demerger of BEML Land Assets Ltd from BEML Ltd - BEML demerger -

- cost of acquisistion is dividend into as follows: BEML Ltd 99.54% and BEML Land Assets Ltd 0.46% (this is for income tax purposes)

Scheme of Arrangement - demerged co (BEML Ltd) and resulting co (BEML Land Assets Ltd) - MCA order copy BSE filing 02Aug2022 -

- ex-date for the demerger was 08Sep2022 (record date 09Sep2022)

(Previously, the land assets of Tata Communications Ltd -- erstwhile VNSL -- were spun off creating a separate entity at the time VSNL was sold to the Tata group by Govt of India - the resulting company is Hemisphere Properties India Ltd. Hemisphere holds 740 acres of land. Hemisphere was listed on BSE and NSE on 22Oct2020, and Govt of India now holds 51% in this company.)

17Oct2022 BSE - Maharashtra Seamless Ltd: At its Board of Directors' meeting on 17Oct2022, the company approved issue of bonus shares in the ratio of one bonus equity share for every one equity share held (record date will be intimated later) -- however, at the same Board meeting, the Board did not approve sub-division (share split) of shares -- at the same Board meeting, the company declared Jul-Sep2022 quarterly results (company presentation) --

-- it may be recalled, the company on 12Oct2022 informed that its Board would ocnsider issue bonus shares and stock split at it Board meeting being held on 17Oct2022

06Oct2022 TE Bond inclusion postponed: The yield on the Indian 10-year government bond jumped as much as 12 bps to approach a two-month high of 7.5% on 06Oct22, after JPMorgan Chase did not include India to the GBI-EM Global Diversified index, as investors cited investment hurdles that need to be resolved, including a lengthy investor registration process and the operational readiness required for trading, settlement and custody of assets onshore. The bank's decision disappointed investors who have been hoping for an inclusion of India in the emerging markets debt index early next year, which would boost capital inflows.

Tweet dated 29Sep2020 on possible bond inclusion

22Sep2022 Supreme Court India judgment copy - Daiichi Sankyo Co Ltd vs Osca Investments Ltd - Diary No 18187 of 2017 - Special Leave Petition (Civil) No 20417 of 2017 in Supreme Court - Ranbaxy - Fortis Healthcare - IHH Malaysia - Related case is Vinay Prakash Sings vs Sameer Gehlaut & Others -

Supreme Court on 22Sep2022 sentenced Malvinder Singh and Shivinder Singh to 6-month prison - SC also directed Delhi High Court to appoint forensic auditors in share sale deal of Fortis Healthcare Ltd -

Fortis Healthcare Holdings Pvt Ltd (FHHPL) was a holding co of Malvinder Singh and Shivinder Singh brothers and family - FHHPL held shares in listed subsidiary Fortis Healthcare Ltd (FHL) - FHHPL pledged shares of FHL in favour of Indiabulls Housing Finance -

Old tweet thread dated 31Jan2018 on the case > Delhi High Court - "Fishing Expeditions" - damages calculation based on present value method (NPV) -

21Sep2022 Livemint - ‘It’s important for us to look at our non-ratings business’

Ramnathan Krishnan, MD and Group CEO of ICRA Ltd: "We have subscribed to an early warning system. There is an external vendor who aggregates data from multiple sources and then feeds the information to us on a daily basis. This is mapped to our portfolio. So, if we have got X number of credits that we rate, these X number of credits are bucketed as a portfolio, and those are tracked by that vendor. They look at GST filings, PF deposits, negative news, litigation, changes in auditors, and changes in directors, among others. They aggregate all this data, and then there are alerts that are sent to the analysts on a daily basis."

Ramnathan Krishnan on lack of timely access to corporate loan default data from banks: "Credit rating agencies have been requesting RBI to allow access to its Central Repository of Information on Large Credits (Crilc) platform for picking up default numbers. We do not have access to that yet. So, at the moment, the process that we follow is to seek confirmation from banks and from borrowers."

22Jun2022 Twitter - (How to Tweet properly)

I went viral 3 times in my first 30 days on Twitter.

Huge hack: Formatting your tweets.

Here's how I do it

25Jun2022 Twitter - Ten of the most useful websites on the internet

04Aug2022 Twitter - Ten incredible free websites, like, Simple Wikipedia, Open Culture, Google Arts & Culture, Visual Capitalist, Project Gutenberg, etc., that will make your more intelligent

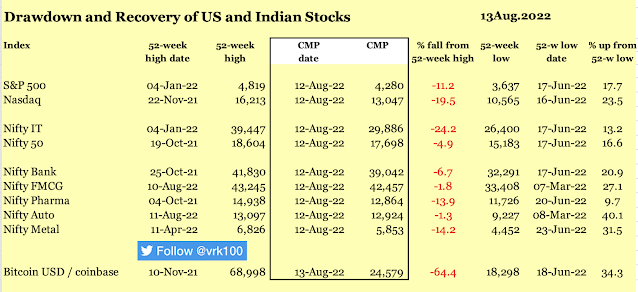

19Aug2022 Twitter - there will be a lot of thunderstorms and it's good to be prepared for them

-- lot of events that impact markets negatively, from Suez Canal crisis, Oil Shock to COVID-19 Pandemic > crisis > event >

28Oct2022 WaPo - Rishi Sunak shows the growing influence of Indian talent in the West

"The success of Indian-origin talent is at this point overwhelming. Significant CEOs of Indian origin include Sundar Pichai of Alphabet, Satya Nadella of Microsoft, Parag Agrawal of Twitter (possibly not for much longer), Shantanu Narayen of Adobe, Arvind Krishna of IBM, Raj Subramaniam of FedEx, Sonia Syngal of the Gap, and (soon) Laxman Narasimhan of Starbucks. All this is happening in an America that is arguably the greatest generator of managerial talent the world has ever seen. These individuals are hardly succeeding in a weak or uncompetitive environment."

12Sep2022 ET -- Indian talent - 26 companies in the US have Indian Origin CEOs which constitutes 5% S&P 500 index and 13% of total Mcap, according to Economic Times > Major companies include, Microsoft, Google, Adobe, Linde, IBM, Starbucks (yet to take over), Vertex Pharma and FedEx > Satya Nadella, Sundar Pichai, Shantanu Narayen, Arving Krishna, etc. >

14Sep2022 BT - Tata Group market cap as on 13Sep2022 is Rs 21.70 lakh crore from 28 listed companies >

China GDP growth rate TE - China full year GDP growth - China's gross domestic product grew by 8.1 percent in 2021, accelerating from a 2.2 percent expansion in 2020 and beating the government’s target of “above 6 percent”.

03Feb2023 Jason Zweig of WSJ - improve your writing - three-part series - writer - write well -

part one - getting started

part two - sharpening your tools

part three -becoming a writer

16Aug2022 video - David McCullough's 8 x 12-foot writing shed > he used to call this his 'world headquarters' - he died on 07Aug2022 - Tweet 12Aug2022 - #history #author #writer #historian - write well -

David McCulloough wrote all his books using a Royal typewriter, which he bought for $25 in 1965 - He said, “Everything that I’ve ever written, I’ve written on that typewriter …

And after a while, I began to think, maybe it’s writing the books. So I

didn’t dare switch.” - two images >

15Aug2022 SBI - SBI FD rates / term deposit rates raised slightly wef 15Aug2022

SBI Wecare deposit for senior citizens till 30Sep2022 >

20Feb2023 NMDC Steel Ltd was listed on NSE and BSE today. The closing price of NMDC Steel Ltd today was Rs 31.75 per share (market cap Rs 9,304.67 crore). NMDC stock closed today on NSE at Rs 118.95 (market cap Rs 34,859.56 crore).

If you had stayed invested in NMDC Ltd between ex-date of spin off of NMDC Steel Ltd and now (NMDC Steel Ltd listed today), you'd have made an excellent return of 15.3 percent in just 17 weeks, in an otherwise sideways market.

The calculation > A week back, NMDC Ltd declared a dividend of Rs 3.75 per share -- for which the record date (ex-date) is 24Feb2023. The below calculation did not consider the dividend, because it's prospective.

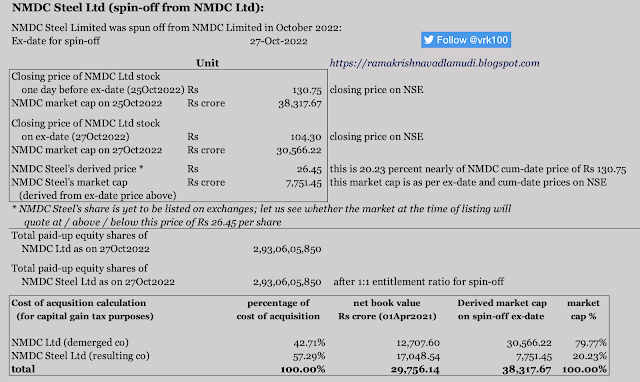

10Nov2022 NMDC Limited - demerger of NMDC - this is calculation of derived value of NMDC Steel Limited (which was demerged from NMDC Ltd in Oct2022) -

- though the net book value of assets of NMDC Steel Ltd (resulting company) constitute 57.29% of the total as on the appointed date, the stock market is just giving a value of just 20.23% of the total to the resulting company as on ex-date of demerger - this is because NMDC Steel is yet to start its commercial operations and it will take some years for the resulting company to make any profits

- the net worth of the demerged company (NMDC Ltd) is 42.71% of the total, but the market cap is nearly 80% of the total as on ex-date of demerger

- please see the following two images for the above calculations and for capital gains tax purposes

27Oct2022 NMDC Limited - ex-date for demerger of NMDC Steel Ltd from NMDC Ltd is 27Oct2022 - the closing price of NMDC Ltd stock one trading before the ex-date (that is, on 25Oct2022) was Rs 130.75 per share (market cap Rs 38,300 crore) - And on ex-date (27Oct2022), the price fell by 20 per cent to Rs 104.35 (market cap Rs 30,580 crore) -- let us see at what price the shares of NMDC Steel Ltd (resulting company) will be listed at a future date

-NMDC Ltd stock traded on NSE and BSE on 25Oct22 and 27Oct22 with heavy volumes

17Oct2022 NMDC Limited - Apportionment of Cost of Acquisition of equity shares after demerger of NMDC Steel Ltd from NMDC Ltd -

- the demerger is tax neutral in the hands of shareholders of NMDC Limited under the Income Tax Act in view of the exemption granted under Section 47(vi d) of the IT Act

- the appointed date of demerger scheme is 01Apr2021

- the date of acquisition of the Equity Shares issued pursuant to the Scheme by NMDC Steel Limited received by the shareholders of NMDC Limited will be the date of acquisition of the original shares of NMDC Limited as per Clause (g) of Explanation I to Section 2(42A) of the IT Act

- the cost of acquisition of the Equity Shares issued pursuant to the Scheme by NMDC Steel Limited, as per Section 49 (2C) of the IT Act, shall be the amount which bears to the cost of acquisition of shares of NMDC Limited, the same proportion as the net book value of the assets transferred in the demerger bears to the net worth of the Demerged Company inunediately before the demerger

- The proportion: net book value of assets (on the appointed date 01Apr2021) of demerged co (NMDC Ltd) is Rs 12,707.60 crore (42.71%) and that of resulting company (NMDC Steel Ltd) is Rs 17,048.54 crore (57.29%)

- the cost of acquisition of the original shares of NMDC Limited held by a shareholder, as per Section 49(2D) of the IT Act, shall be deemed to have been reduced by the cost of acquisition of shares of the Resulting Company (NMDC Steel Ltd)

11Oct2022 NMDC Limited - Scheme of Arrangement - demerger of NMDC Iron & Steel plant at Nagarnar, Chattisgarh - MCA order (for government companies, demerger or 'scheme of arrangmeent' process is decided by MCA or Mistry of Corporate Affars as per Sections 230 - 232 of the Companies Act of 2013 -- for non-gov't companies, such things are decided by NCLT) -

-- demerger ratio: one share of NMDC Steel Ltd (resulting company) of Rs 10 each will be given to every one share held in NMDC Ltd (demerged co) of Re 1

-- record date and ex-date are yet to be decided for the demerger

11Sep2022 Trendlyne - After NMDC Ltd stock was removed from Nifty CPSE index in Aug2022, CPSE ETF sold entire stake of 74.717 million shares in NMDC -- this big stake sale allowed several other mutual fund schemes (like, Parag Parikh Flexi cap and Parag Parikh Tax saver) to buy / accumulate NMDC shares in Aug2022

11Aug2022 Business Standard - HDFC - HDFC Bank merger could set off Rs 48,000 crore churn - "Closer to HDFC and HDFC Bank merger, both stocks are likely to be removed from Nifty 50 index, as per rules of Nifty Indices methodology"

In Aug2022, NMDC Ltd stock was removed from Nifty CPSE index due to a demerger scheme of its Steel and Iron plant

Nifty Indices methodology document Aug2022 (page 177 for Summary of Corporation Action Adjustments, like, merger, demerger, spinoff, etc.)

Tweet 20Aug2020 - Index reconstitution - index eligibility criteria -

Tweet 14Jul2021 - NMDC Ltd decided to hive off Nagarnar Steel Plant

Two images >

05JAN2023 vidoe - David Rubenstein talks to Mike Wirth, CEO of Chevron #Oil - crude oil -

- Oil is a cyclical industry, windfall tax may not bring in more taxes -- President Carter tried windfall profit tax in 1980 and it lowered the tax collection

- oil industry is a price taker

- the US oil output is 12 million barrels per day (mbd) and consumption is nearly 20 mbd

- the US imports oil mostly from Canada via pipelines, trains and ships

- Chevron's worldwide oil output is 3 mbd, out of which 1.2 mbd is from the US

- Chevron has 36,000 employees in 100 countries

- affordable energy is essential for economic prosperity

- energy security is key for national security

31Oct2018 video - David Rubenstein talks to Michael Milken, the former financier who is now chairman of the Milken Institute, a Los Angeles-based think tank - Milken is father of high-yield bonds aka junk bonds - #Anecdote

- In response to a question what their children think of his pleding 50 percent of wealth to charity, Michael Milken responds: "My wife Lori (Anne Mackel) defines wealth as that she can buy any book she wants to and so I think that's been instilled in our children from the very beginning."

- Micheale Milken and his wife Lori have been married for 50 years

- Milken switched majors at U.C. Berkeley from math and science to business after the 1965 Watts riots in Los Angeles, determined to democratize capital access - he was moved by the denial of financial support to African-Americans after some of them lost everything in Watts riots

- Milken was banned from the securities industry after pleading guilty to securities fraud in 1990. In February 2020, President Trump pardoned him.

- Michale Milken : "I remember we had a presentation on investing in an oil drilling business and an oil exploration business and we wanted to see their data and about an hour into the meeting I asked them what technique they use, they said 'closology' -- I never heard that word and I asked them what it meant and it turned out their drilling technique was they see where others drill and they get as close as possible -- there's no geology there's nothing going on, so we decided not to finance that company."

- Milken was diagnosed with prostate cancer in 1993, in the same month he was released from prison - his cancer is currently (as of October 2018) in remission - He used Ayurveda, meditation, diet (just fruits and vegtables) and hormones to recover from cancer -

- Milken served 22 months in federal prison for criminal violations of securities laws

01Jun2022 video - David Rubenstein talks to Dawn Fitzpatrick, chief executive and chief investment officer of Soros Fund Management - #Anecdote

- As head of George Soros' family office, Fitzpatrick oversees about $28 billion

- Fitzpatrick's view on crypto currency: "It's here to stay and it’s gone mainstream with Fidelity just announcing you can put it in your 401(k). The one caveat I would say is first of all, climate impact is going to become increasingly in focus and in that context, Ethereum is likely to gain some more traction over Bitcoin."

- European Central Bank President Christine Lagarde insisted that male domination of the banking industry made the 2008 collapse of Lehman Brothers more likely. As the Legarde put it if it had been Lehman Sisters rather Lehman Brothers the world might well look a lot different today.

24Aug2022 video - David Rubenstein talks to John Doerr, Kleiner Perkins chairman and author of 'Speed and Scale,' - venture capital - climate change - #Anecdote - philanthropy -

- John Doerr's worst investment mistake: The billionaire chairman of Kleiner Perkins had the opportunity in 2007 to back “an ambitious, slightly crazy entrepreneur” named Elon Musk before he became the world’s richest man, but ultimately decided against it, as new car companies traditionally fail far more often than they succeed.

- Doerr was an early investor in Amazon and Google

- Back in the 1990s, Doerr said: "The internet revolution is under-hyped"

- When Doerr told told Andy Grove that he wanted to leave Intel and join a venture capital firm, Grove negatived the idea saying, "That's a real estate business. That's not a real business."

- Doerr: “Climate science is going to become the new computer science”

- Doerr started in 1975 at “a new small chip company” called Intel Corp. under Andy Grove

- Doerr: “I think it's important for successful venture investors to be entrepreneurs, to have a real connection with the challenges that teams are facing when they're trying to build businesses."

Biggest mistake investors make: Doerr replied, "They're too shortsighted. They sell too early. The great gains in Amazon or Google came long after the company went public."

John Doerr: "Do you remember Al Gore's first movie, 'An Inconvenient Truth'? Well, I took my family and some friends to see that. We went home for dinner and had a discussion. The science wasn't so clear then. But when it came to my 15-year-old daughter, Mary, she looked at me and said, 'Dad, I'm scared and I'm angry. Your generation created this problem. You better fix it.' And the room went silent."

15Mar2017 video - David Rubenstein talks to Duke men's basketball coach Mike Krzyzewski (poularly known as Coach K) -

Mike Krzyzewski: "Good people will make you better"

Mike Krzyzewski: "We sit around and say how we're going to live. We talk about fundamental things: communication, we're going to look each other in the eye, we're going to tell each other the truth, we're going to have each other's back, we're going to show strong faces, we're never going to be late, we're going to be enthusiastic, we're going to win and lose together. Those are great standards."

Mike Krzyzewski: "The key word is to create ownership. Everybody owns it."

Mike Krzyzewski: "Failure is never a destination"

23Mar2022 video - David Rubenstein talks to Citadel founder and CEO Ken Griffin - Griffin runs hedge fund Citadel and founder of Citadel Securities -

#Anecdote

- While studying graduation at Harvard University in 1987, Ken Griffin put a satellite dish on top of the dorm so that he would have access to real time stock quotes for stock trading

- Ken Griffin: "Be a problem solver" and "you've to be a good communicator"

11Aug2022 video - David Rubenstein talks to Anne Wojcicki, 23andMe CEO and co-founder - 23andMe uses technology developed by Illumina for genome sequencing after taking a saliva sample from a user - future health risks - ancestry -

- In 1953, James Watson and Francis Crick published the first description of the structure of DNA molecule (double helix)

- On 26 June 2000, President Clinton, along with British Prime Minister Tony Blair, announced that the international Human Genome Project and Celera Genomics Corporation have both completed an initial sequencing of the human genome - the genetic blueprint for human beings.

- even after more than 20 years of human genome mapping, why not much progress is made in preventing and / or curing several diseases? -- in response, Anne Wojcicki responds: "if I successfully keep you healthy up to 100 years age, you're not a profit centre for healthcare / pharma industry"

- the UK has a Biobank with half a million people consenting to use their genetic information for research - the US has totally fallen behind in this area - China has made made rapid strides with genetics via Beijing Genome Institute -

18Aug2022 video - David Rubenstein talks to Andrew Liveris, Chairman of Lucid Group, an electric vehicle startup - (video shot at Lucid showroom in New York) - Dow - Dupont - chemical engineer - problem solver - he is on the board of Saudi Aramco, IBM, etc. -

- with 832-km range, Lucid Air has got the best range among electric vehicles - Lucid Air can recharged in just 22 minutes for up to 512 km - Lucid Air is a luxury car and aesthetic -

- At Dow Chemical Company, Andrew Liveris used to say they had three functions: "To invent, to make and to sell"

- Andrew Liveris: "When I was 12, I read all the 12 volumes of Encylopedia of Britannica"

13Jul2022 video - David Rubenstein talks to Sam Zell,#Anecdote

-- "liquidity is the theme of the current markets"

-- "we have to reduce liquidity and raise rates to control inflation"

-- "Volcker is the only one Fed Chair, in 50 years, who did what he talked"

-- Zell was building his real estate business during his 4-year undergraduation in a law school

-- After graduation at 24 years of age, he did law practice only for four days and left law to start his own real estate business

-- "I was very successful at listening to my own song and ignore the noise"

-- "I think we put on our pants one leg at a time. We can't extract any more out of anybody."

-- Zell's $39 billion sale of office REIT Equity Office to Blackstone (in 2006) just before the market crashed in 2007 was among the largest real estate deals ever

-- "As the head of a publicly listed company, I'm responsible for the shareholders." (on his decision to sell his company in 2006)

-- "The US can't maintain the supremacy of the US dollar and standard of living while maintaining large deficits"

-- "When poeple ask me when I'm going to retire, and I say 'Retire from what?'"

27Jul2022 video - David Rubenstein talks to Nelson Peltz, Trian Partners CEO and founder partner - activist investor - at young age, he wanted to do skiing, but eneded up managing his father's food distribution business (Peltz was driving trucks initially) - #Anecdote

The best advice I received is: "Sales up, Expenses down" > that was from my father > image >

14Apr2022 video - David Rubenstein talks to Sylvester Stallone, actor, director, scripwriter, producer and painter - Shot at Library of Congress, Washington, DC) - #Anecdote

Stallone's film "Rocky" (1976) was selected in 2006 by Library of Congress for preservation in the US National Film Registry

Stallone wrote script for Rocky (1976) movie in two days and a half

Stallone: "I don't own any rights in Rocky. There are some machinations. I'm an employee."

Stallone: "I was the eleventh choice for Rambo (in "First Blood" movie)"

Stallone: "I probably have more stunt injuries than anyone in the film industry."

Stallone (how he came with the idea of 2010-movie "Expendables"): "That's when I came up with the idea of Expendables--where you can't do it alone but I'll take it together. I'll take a group of actors that are not doing so well. And you put it all together. And I got the idea when I took my wife to a rock and roll revival. You have like 20 groups and each one worse than the next. But together it was an interesting ticket. Oh, look at this. I thought why don't I do the same or take all these guys who perhaps on their own are struggling and including myself. Put them together in that. I want to see how this turns out. This is kind of interesting."

21Oct2021 video - David Rubenstein talks to Kenneth Lauren Burns (or simply Ken Burns), documentary filmmaker – Ken does grant-funded, philanthropic projects – he does documentaries for PBS (Public Broadcasting Service) – most of his works chronicle American history and culture – his famous documentaries include “TheCivil War,” “Muhammad Ali,” “Baseball,” “The Brooklyn Bridge,” and “Jazz” –

Ken Burns: “ It took seven years for me to make ‘Muhammad Ali.’”

Ken Burns: “Muhammad Ali was very disciplined.”

Ken Burns: “When my mother died when I was 11, I saw my father crying for the first time and he cried at a movie. That’s when I decided I should be a movie maker.”

When asked why he did not go the route of becoming the next George Lucas or Steven Spielberg and make enormous amount of money, Ken Burns replied: “I don’t know. It wasn’t for me. I really liked the idea of public broadcasting PBS. It's public but it's also that is not system it's service. I like that idea. I also think PBS has one foot tentatively in the marketplace and the other proudly out of it. Lots of what's best about this country is not necessarily in the marketplace which is of course one of the best things in this country as well. And so it's not making the other wrong. It's just saying that if I'd gone to a premium channel or gone to a streaming service it might have been easier to get the money but then they would own it. I own my films. They would also not permit me ten and a half years to do the "Vietnam." They'd want it in a couple of years. And the kind of corners that would be cut in that process was nothing that I wanted to do.”

Ken Burns: "Our Civil War is not a civil war, it's a sectional war."

Ken Burns: "I think the divisions are huge and massive and threatening and have exposed the fragility of our institutions indeed our democracy and our future. But I also think deep down people if they're made aware of the fact that they share common everything I mean one of the fallacies of the Holocaust is just the myth of race. You know biologically it doesn't exist. You know we are all the same."

08Mar2018 video - David Rubenstein* talks to Marillyn A. Hewson, Chairman, President and CEO, Lockheed Martin Corporation - (shot at the The Economic Club of Washington, DC) - #Anecdote - F-22 to F-35 (what happened between 23 and 34?) - Hewson's mother to her when she was a child: "take USD 5 to a groecery store and bring back groceries worth USD 7" - unmanned helicopter - hypersonic aircraft - five defense companies in the US are Lockheed Martin, Boeing, General Dynamics, Raytheon and Northrop Grumman -

(* most of David Rubenstein's shows are presented by Bloomberg)

26Jul2022 NYT - New York Times - Recession: What Does it Mean? by Paul Krugman - Tweet dated 29Jul2022 -

"NBER or National Bureau of Economic Research of the US doesn't declare a recession in the US based solely on a single metric, like, two consecutive quarters of negative real GDP growth rate.

"To understand why, it helps to know a bit about the history of what is known as business cycle dating.

"A modern economy is a constantly changing thing, in which individual industries rise and fall all the time. (Remember video rental stores?) At some point in the 19th century, however, it became obvious that there were periods when almost all industries were declining at the same time — recessions — and other periods during which most industries were expanding.

"To understand these fluctuations, economists wanted to compare different recessions and search for common features.

"Since 1978 the NBER has had a standing group of experts called the Business Cycle Dating Committee, which decides — with a lag — when a recession began and ended based on multiple criteria, including employment, industrial production and so on. And the U.S. government accepts those rulings. So the official definition of a recession is that it is a period that the committee has declared a recession; it’s an expert judgment call, not a formula.

"The NBER doesn’t make recession calls in real time. For example, while the Great Recession is now considered to have begun in December 2007, the dating committee didn’t make that call until December 2008. Also, other nations don’t have any equivalent of the N.B.E.R. So there has always been an incentive to look for simple formulas, not dependent on judgment, that can quickly determine a recession."

"So it would be foolish to declare that we’re in a recession even if Thursday’s number is negative and the first-quarter number isn’t revised upward."

Nov2011 Ted Talks - video - Shlomo Benartzi - Saving for tomorrow, tomorrow - behavioural finance - loss aversion - instant gratification - retirement saving - #Anecdote -

image > video 9' to 11' > "No, no, no, this is a real study and it's got a lot to do with behavioral economics. One group of monkeys gets an apple, they're pretty happy. The other group gets two apples, one is taken away. They still have an apple left. They're really mad. Why have you taken our apple? This is the notion of loss aversion. We hate losing stuff, even if it doesn't mean a lot of risk."

26Jul2022 TED Talks - video - David Wengrow - A new understanding of human reality and roots of inequality - agriculture - civilisation > #Anecdote > video 12' to 14' >

"Actually, the city where Hernan Cortéz found his military allies, the ones who enabled his successful assault on the Aztec capital of Tenochtitlán, was exactly one such city without rulers: an indigenous republic by the name of Tlaxcala, governed by an urban parliament, which had some pretty interesting initiation rituals for would-be politicians. They'd be periodically whipped and subject to public abuse by their constituents to sort of break down their egos and remind them who's really in charge. It's a little bit different from what we expect of our politicians today."

21Jul2022 TE - The European Central Bank (ECB) raised interest rates by 50 basis points in the euro area (eurozone) for the first time in 11 years; the main refinancing rate is now 0.5 percent (earlier 0 percent) - image >

19Jul2022 CCIL India - USD - INR exchange rate - Indian rupee touched an all-time-low of Rs 80.05 today versus US dollar >

19Jul2022 City Guide - Washington Post - Local guide for Bombay or Mumbai - Chor Bazaar, Bandra West, Cafe Madras, Colaba, Persian Darbar, 145 Bandra, Kamala Nehru Park, Royal Opera House, etc.

19Jul2022 Treasury Department, USA - Treasury International Capital (TIC) data for May2022 PDF - Portfolio Holdings of US and Foreign Securities >

China's holding of US Treasuries (as part of Bank of China's forex reserves) are below USD 1 trillion for the first time in 12 years. China now, as of May2022, holds USD 981 billion of US debt. Japan is the biggest holder of US Treasuries at USD 1.21 trillion.

Major holders that have reduced their US debt holdings in the past one year are: Japan, China, Brazil, Taiwan, India, Saudi Arabia, South Korea, etc.

Major holders that have increased thier US sovereign debt in the past one year are: the UK, Switzerland, Luxembourg, Belgium, France, Canada, Germany, Australia, etc.

14Jul2022 > Blog 14Aug2021: As described in the blog, India has suffered three bouts of high inflation in the past three decades:

1) 1990 to 1999: This high inflation period was a result of: oil price (imported) inflation from 1991 Gulf War; Balance of Payments (BoP) crisis of 1991; 1991 devaluation of rupee; and others

2) 2008 to 2015: The high inflation was from a combination of factors: 2008 Global Finance Crisis (GFC) after Lehman Brothers' Collapse; monsoon failure; high increase in minimum support prices (MSPs), higher global commodity prices; high government borrowing; reckless government dole-outs; growth slowdown; 2013 Fed Taper Tantrum leading to exchange rate crisis for Indian rupee; and others

14Jul2022: How many times in the past the monetary tightening by the US Federal Reserve led to recession in the US?

Since 1954, there are ten instances when the Fed tightening led to a recession in the US--but every instance of Fed tightening need not result in a recession.

It is yet to be seen whether the current bout of Fed monetary tightening (in the form of forward guidance, Federal Funds rate hikes and quantitative tightening or QT--QT is withdrawal of liquidity or reduction of Fed balance sheet) since September 2021 will lead to a hard landing (global recession) or soft landing (a blend of lower levesl of GDP growth and modest inflation).

10Aug2022 New York Fed > Global Supply Chain Pressure Index (GSCPI) > the index integrates transportation cost data and manufacturing indicators to provide a gauge of global supply chain conditions. -- As per this index, global supply chain pressures declined in July 2022 (index estimate at 1.84) --

14Jul2022 Chicago Fed > National Financial Conditions Index or NFCI >

The Chicago Fed’s National Financial Conditions Index provides a comprehensive weekly update on U.S. financial conditions based on 105 measures of financial activity.

The index accounts for conditions in money markets, debt and equity markets, and the traditional and “shadow” banking systems, using weekly, monthly, and quarterly data.

Some well-known and key measures are:

3-5 year AAA CMBS OAS spread

ABS / 5-year Treasury yield spread

2-year interest rate swap / treasury yield spread

CBOE market volatility index VIX

3-month Eurodollar spread

commercial paper outstanding

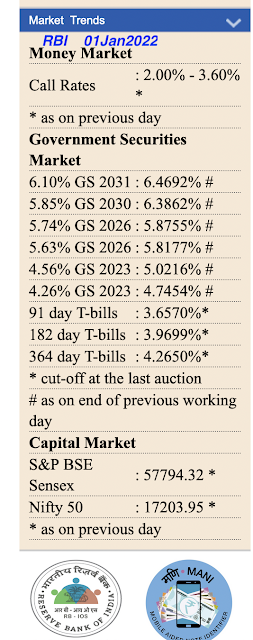

RBI Speech 24Jun2022 > "The overnight weighted average call money rate is the operating target of monetary policy of Reserve Bank of India."

Flexible Inflation Targeting (FIT): RBI accountability > monetary policy credibility >

"The RBI Act mandates that in the case of the inflation target not being met for three consecutive quarters, the RBI shall set out in a report to the Central Government:

(a) the reasons for failure to achieve the inflation target;

(b) remedial actions proposed to be taken; and

(c) an estimate of the time-period within which the inflation target shall be achieved pursuant to timely implementation of proposed remedial actions.

What constitutes failure has been notified by the Central Government in the Official Gazette of India as (a) average inflation being more than the upper tolerance level of the inflation target for any three consecutive quarters; or (b) average inflation being less than the lower tolerance level of the inflation target for any three consecutive quarters."

Tweets on Flexible Inflation Targeting (FIT) > FIT was formally adopted in June 2016 > Monetary policy framework of MPF > inflatin target > CPI inflation > Urjit Patel panel >

15Feb2021 The Algebra of Wealth - video - Prof Scott Galloway - wealth creation >

Algebra of wealth = Focus + [stoicism x time x diversification]

the circumstances of your birth, unfortunately, make a lot of difference -- received free education, grew up in age of internet, etc.

don't conflate luck with talent

Focus on what you're great at

focus on something you can do better

focus on something people will pay for

focus on positioning yourself for success--getting certified, getting to a city where you can meet and play against the best in your league; focus on industries / companies that are poised for growth

focus on investing in the right relationships--business and personal

stocism -- stoics are clear about what is in their control and what is not in their control

living below your means is in your control; your spending habits are a big factor in wealth creation

stoics have good temperance and discipline--control your temptations for consumption of goods / services

upgrading your lifestyle (lifestyle creep) is not sustainable

in the long term, time is your friend and in the short term, it's your enemy

don't squander your time

don't be generous with your time

in investing, diversification is your kevlar

get rich slowly

08Sep2022 CCI antitrust order on JSW Paints vs Asian Paints -

27Jun2022 Asian Paints - Investor Presentation - new products and services - business update - decorative business - Beautiful Homes - wood solutions - safe painting service - Sabysachi design - home decor business -

'share of surface' to 'share of space'

- Beautiful Homes Stores - furnitue -rugs - wall paper - designer lighting - wardrobes - vanities - designer tiles - kitchen ware - Sleek - Ess Ess - doors and windows - White Teack - Weatherseal - Bathsense Canvas range - sanitaryware - faucets - fittings - tiles -

26Jun2022 Guardian - Concerns that India is ‘back door’ into Europe for Russian oil - crude oil - Russia - Ukraine - shipping - "going dark" - ship-to-ship oil cargo transfers mid-sea -

"Industry sources said tracking shipments of Russian oil to Europe via India is proving very difficult. “You’ll find that several shipments of crude will arrive at a port from different countries and be blended together. Tracking a hydrocarbon is basically impossible.”

There are several tactics shippers are using to hide the origin of Russian oil, sources said. Financially, paying in Chinese currency – rather than the industry standard dollar – is an option. Yuan-rouble trading volumes have surged 1,067% since February’s invasion of Ukraine. Transfers of oil cargoes from ship-to-ship have also spiked, suggesting oil is being switched from Russian flagged-vessels to other ships. Increasing numbers of vessels have been “going dark” by switching off their automative identification systems as thousands of gallons of the black stuff are transferred on the waves.

A third, more niche option to hide Russian transactions is to cut out using a currency and trade oil directly for other products, such as gold, food or weapons. Iran has previously taken payment from trading partners in gold rather than dollars.

“If a country or oil operator wants to hide the source of crude or oil products, it can very easily do so,” said Ajay Parmar, an oil market analyst at ICIS." - image >

05Mar2022 Tweet - Top Ramen's lost brother found in Coimbatore! - #Advertising - #Imitation -noodles -

09Mar2022 Tweet - Frederik Gieschen - Neckar Value - What makes a great investor? Longevity. "The best returns that you could earn for the longest period of time, which usually aren’t the highest returns that are out there" "If Buffett had retired at age 60, no one would’ve ever heard of him."

09Mar2022 Tweet - Simon Kuestenmacher - hacking - cyber security - "Time it takes a hacker to brute force your passwords in 2022" -

18Mar2022 Tweet - Shashi Tharoor's tweet on Happy Holi - "What They Need" and "What We Need" -

17Apr2015 Video - Sufi Soul - William Dalrymple's documentary for Channel 4 on the Mystic Music of Islam -

William Dalrymple: "Sufism has two registers: high philosophy & folk mysticism. At the latter level it takes on local colouring- influenced by Coptic folk cults in Egypt & by a variety of Hindu ascetic & mystical practices across S Asia. I've written about this in 'From the Holy Mountain & Nine Lives.'"

Oct2021 demilked - 30 Times Architects Impressed Everyone Around The World (New Pics) - #Architecture - 30 famous buildings and structures around the globe -

20Mar2022 Rabih Alameddine - Entrance Gate Of The St. Petersburg Mosque, Russia. Designed By Architect Nikolai Vasilyev - #Architecture - (there are more images in the Tweet thread) -

27May2022 CNBC - UK slaps one-off tax on oil and gas giants to ease the pain of soaring household energy bills - - "temporary energy profits levy" - windfall tax - inflation - energy crisis -

26May2022 India INX Global Access - India INX is started by BSE Limited - how to access global stock markets -

26May2022 UTIITSL - UTI Infrastructure Technology And Services Limited (Govt of India company) for providing PAN services - new PAN card, change in PAN card, etc.

Another firm that offers PAN services is Protean e-Gov Technologies Ltd (formerly NSDL e-Governance)

02May2022 Tweet - Srinivas Kodali: "Cameras won't solve crime, Flyovers won't solve traffic, electric vehicles (EVs) won't stop climate change. The faster people understand this the better society will be."

20Apr2022 Tweet - 50 Timeless Naval Ravikant quotes visualised - visual experiments - images more powerful than words -

20May2022 CNBC TV18 - according to media reports, German retailer Metro AG is scouting for a partner to sell its stake in its Indian subsidiary Metro Cash & Carry India - Foreign companies exiting India?

Why do foreign companies sell out their India operations so frequently? Recently, Holcim of Netherlands has decided to sell their AmbujaCements and ACC Ltd to Adani Group; other foreign firms that quit India in recent years are: Ford Motor Co, General Motors (left after 21 years), Harley Davidson, Honda Cars, MAN Trucks, Cairn Energy, Hutchison Telecom, Lafarge, Carrefour, Daichi Sankyo, Citibank, Barclays, Royal Bank of Scotland, Nokia, United Motors, Cleveland Motorcycles, Ssangyong Motor Company, etc.

some possible reasons:

-- they are unable to understand Indian consumer mind

-- inability to understand price-sensitive Indian consumers

-- they find better opportunities elesewhere

-- lack of income mobility for Indians (low per capital income)

-- unable to sell and make profits

-- unbale to compete with local firms and gain market share

-- Foriegn owners unable to provide right management (agency conflict or principal-agent problem)

-- failure to catch new trends in the market

-- some industry people feel that governments favour local companies (they cite how Govt of India and Indian regulators favoured Reliance Industries when it rolled out telecom operations in India in 2016; how Adani Group was favoured when comes to takeover of ports and airports; and how government banks seem to favour Ambani Group and Adani Group when it comes to loan sanctions) - aka crony capitalism -

-- restructuring by foreign companies or sale or amalgamation of entire foreign group

-- Indian tax policies more adverse to foreign companies in India

-- capricious policy changes by governments (central and states)

-- onerous safety and emission norms (related to automobile firms)

-- Indian economic growth rates have faltered in the past five years (2017 - 2022)

-- draconian shutdown of India during the Pandemic (March to June 2022) had impacted several businesses in India adversely

- foreigners are unable to navigate Indian bureaucracy

-- maybe, cost of doing business is high in India

16Feb2023 Crisil MF Ranking - Crisil Mutual Fund Ranking as on Dec2022 PDF - Mutual fund categories >Equity, hybrid and debt mutual funds > Index funds and ETFs are clubbed together >

17Dec2022 Crisil MF Ranking - Crisil Mutual Fund Ranking as on Sep2022 PDF - Mutual fund categories >Equity, hybrid and debt mutual funds > Index funds and ETFs are clubbed together >

22Aug2022 Crisil MF Ranking - Crisil Mutual Fund Ranking as on June 2022 PDF - Mutual fund categories >Equity, hybrid and debt mutual funds > Index funds and ETFs are clubbed together >

26May2022 CRISIL PDF - CRISIL Limited's Mutual Fund Rankings in India as on 31Mar2022 - Mutual fund categories >Equity, hybrid and debt mutual funds > Index funds and ETFs are clubbed together >

21May2022 XE - USD - RUB exchange rate - US dollar to Russian rouble (ruble) - one-year USD - RUB chart recovery of RUB since 10Mar2022 when it touched 10-year low (low for rouble) of 135.80 and rouble surged to 62 by 21May2022 - 10-year chart is also added here -

19May2022 CNBC - A 1955 Mercedes just nabbed $143 million at auction, making it the most expensive car ever sold

Stock market excesses we witnessed in 2021 are nothing compared to the auction market >

14Dec2022 WPI Inflation - India wholesale price index (in the West, WPI is known as producer price index or PPI) - India WPI inflation fell to 5.85% in Nov2022 -

20May2022 WPI Inflation - India wholesale price index (in the West, WPI is known as producer price index or PPI) -

"The annual wholesale price inflation rate in India rose to 15.08 percent in April 2022 from 14.55 percent month earlier and above market forecasts of 14.48 percent. This was the highest reading since December 1998, amid a broad-based price increase due to disruption in global supply chains caused by Russia-Ukraine conflict"

23Jul2022 BSE - merger / amalgamation of Mindtree into L&T Infotech - valuation - share exchange ratio - DCF - market multiples - NAV - valuation based on IVS 104 - Tweet dated 23Jul2022 -

15Jul2022 ET - Higher LTCG Tax for Those Betting on Mergers - (this article has implications for those holding Mindtree Ltd shares that were bought before 01Feb2018 -- Mindtree is slated to merge with L&T Infotech Ltd in 2022/2023 subject to regulatory approvals)

Economic Times article dated 09Oct2018 - By Pavan Burugula

Investors of at least two dozen companies, including Capital First,

Ultra Tech Cement, Bharat Financial, will have to shell out higher

capital gains tax. This is because the ‘grandfathering’ benefit for

taxes on longterm capital gains — reintroduced in this year’s Union

Budget — doesn’t cover mergers and demergers. Grandfathering refers to

exemptions on the gains made prior to enactment of a new law from the

ambit of the new law.