Global Market Data: 2012 to 2022

I present here global market data pertaining to stocks, bonds, commodities and currencies. The data points are yearly changes from 2012 to 2022, indicating how the values have moved over the years.

This is just raw data. You can draw your insights from the data.

Table: (please click on the image to view better) >

The stock market data presented in the table are price returns (not including dividends) and they are in local currency terms > For example, Sensex returns are price returns (not including dividends) shown in local currency (Indian rupee) terms >

You can find out how the assets classes and currencies have moved over the years. The table reveals the cyclical nature of the returns in global financial markets.

For example, have a look at the Bitcoin's returns in US dollars -- it provided spectacular returns till 2017, but it lost almost three-fourths of its value in 2018. It bounced back strongly between 2019 and 2021, only to lose 65 percent of its value in 2022.

In contrast, gold and silver proved to be pathetic, for seven continuous years, between 2012 and 2018. But they generated decent returns in 2019 and 2020 -- only to fail once again in 2021. In the light of the rout in global stock markets in 2022, gold and silver proved to be resilient in US dollar terms.

The individual levels of the year-wise data points, from 2011 to 2022, can be accessed here and here.

- - -

P.S. dated 17Jan2023: I added the following after publishing the above blog on 16Jan2023:

Ask Questions

In markets, we need to question everything -- I mean everything. For example, it is often said that if the US dollar is strong (reflected in strong returns for the US dollar index or DXY), commodities -- like, crude oil and gold -- tend to give negative returns and vice versa.

Does the data indicate so? Ask the question yourself and find out the answer from the data -- and the answer may surprise you. The data for 11 years are available in the above table. If you're not satisfied with 11 years of data, look for data for longer periods, say, 20 or 40 years, and discern your own patterns.

Another platitude we hear often in global markets is a strong US dollar (or 'dollar wrecking ball') is bad for currencies and stocks of emerging markets. You can look at the data for DXY, USD-INR (Indian rupee versus US dollar) and USD-RMB (Chinese renminbi versus USD) and find out the answer for yourself.

For example, a strong dollar (DXY is up 8.2 percent) in 2022 proved to be negative for Indian rupee and Chinese yuan with INR and RMB losing to USD. But the data points for 2021, 2020, 2014 and 2013 give a different picture.

One more banality we often encounter in the media is a falling currency leads to fall in stock prices. Look at the data for FTSE 100 and USD-GBP in 2022. The British pound lost 10 percent of its exchange value versus the US dollar, but what about the returns of FTSE 100? The data for other calendar years too reveal conflicting signals.

It is often said wisdom lies in asking the right questions, though you may not find the right answers.

P.S. dated 19Jan2023: I added the following table / image containing compounded annualised growth rates (CAGR %) of the metrics of global markets >

The table 2 reveals CAGR returns for 3-year, 5-year, 7-year and 10-year as at the end of 31Dec2022 >

You can also compare the CAGR returns with yearly returns presented in table 1 above >

For example, Bitcoin had generated spectacular returns between 2019 and 2021, but its 5-year CAGR return is only 3.1 percent -- because it has two years of drastic falls in 2018 and 2022 >

That's why it's often said we are better off with assets or currencies that are less volatile and which experience smaller drawdowns as compared to more volatile asset classes >

One year of large fall will wipe out four to five years of spectacular returns -- this has happened often in the past with extremely smart investors and it's going to happen in future also >

- - -

-------------------

Read more:

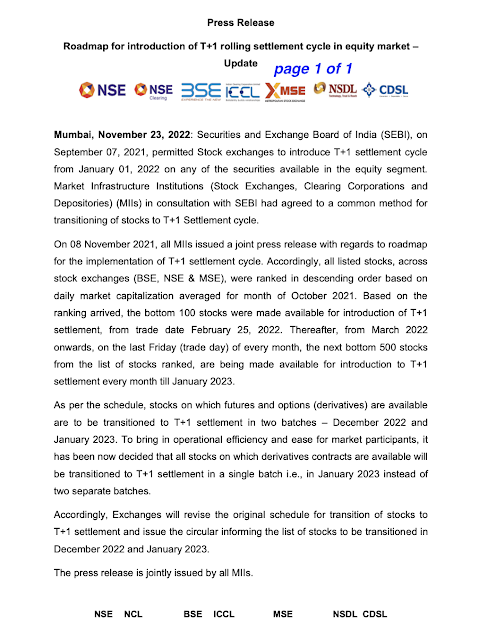

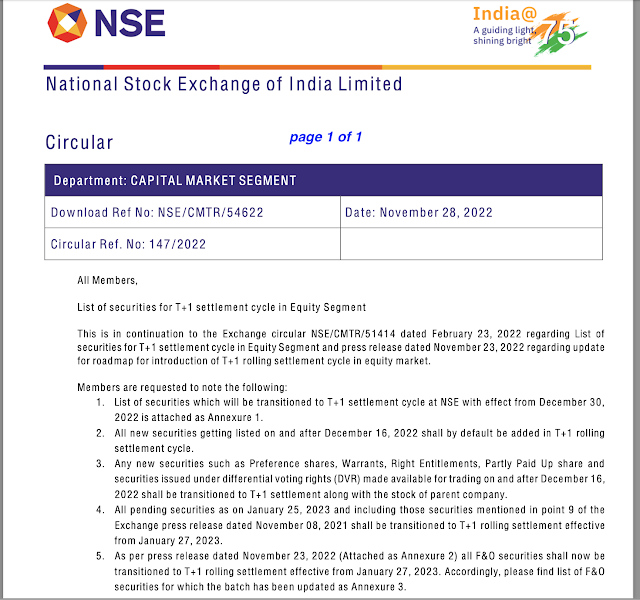

Indian Stock Market Moves Fully to T+1 Settlement

NSE Indices Comparison 31Dec2022

BSE 500 vs S&P 500 Indices Compare 31Dec2022

Nifty 50 Index Yearly Movement 31Dec2022

India Up the Ladder in MSCI EM Index

New Rules on Ex-date and Record date

Mutual Fund Asset Class Returns 31Dec2022

BSE Broad and Sector Indices Market Cap 31Dec2022

Global Market data 31Dec2022

BSE Broad and Sector Indices Returns 30Dec2022

Crisil Report - Big Shift in Financialisation

Global bond yields, negative real interest rates and soft landing

Indian Energy Exchange Buyback Offer 2022

Indians' Love For Cash Continues Unabated

Weblinks and Investing-------------------

Disclosure: I've vested interested

in Indian stocks and other investments. It's safe to assume I've interest in the financial instruments / products discussed, if

any.

Disclaimer: The analysis and

opinion provided here are only for information purposes and should not be construed

as investment advice. Investors should consult their own financial advisers

before making any investments. The author is a CFA Charterholder with a vested

interest in financial markets.

CFA Charter credentials - CFA Member Profile

CFA Badge

He blogs at:

https://ramakrishnavadlamudi.blogspot.com/

https://www.scribd.com/vrk100

Twitter @vrk100