India Up the Ladder in MSCI EM Index

(Updates 06Apr2024, 10Mar2024, 06Feb2024, 09Jan2024, 12Dec2023, 12Oct2023, 07Sep2023, 06Aug2023, 31Jul2023, 19Jul2023, 10Jun2023, 05May2023, 06Apr2023, 07Mar2023 and 04Feb2023 are available at the end of the article)

India's ranking in the MSCI Emerging Markets Index has climbed to second place recently as its stock market remained resilient amid the turbulent times for the rest of the global stocks.

As mentioned in my previous blog, the MSCI EM Index captures large- and mid-cap stocks representing 24 emerging market (EMs) countries, with 1,377 constituents. The index covers nearly 85 percent of the free float-adjusted market capitalization in each country.

The countries representing the index, as on 31Dec2022, are: Brazil, Chile, China, Colombia, Czech Republic, Egypt, Greece, Hungary, India, Indonesia, Korea, Kuwait, Malaysia, Mexico, Peru, the Philippines, Poland, Qatar, Saudi Arabia, South Africa, Taiwan, Thailand, Turkey and United Arab Emirates.

India actually surged to second place, replacing Taiwan, in the index in September 2022. The MSCI EM Index was launched on January 01, 2001. The index is expressed in US dollar terms.

Comparison over the past three years

I've compared the important metrics of the index over the past three years. I've also included the data as on 31Mar2020, when the global markets were afflicted by the COVID-19 outbreak.

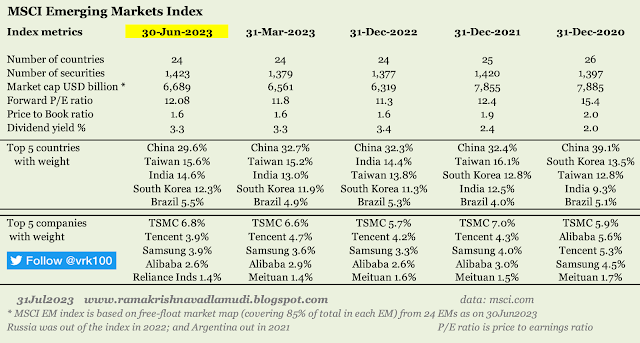

Table >

As shown in above table, India's ranking in the index rose from fourth place with 12.5 percent weight in Dec2021 to second place with 14.4 percent weight at the end of December 2022.

In 2022, Taiwan lost its weight in the index from 16.1 percent (Dec2021) to 13.8 percent (Dec2022), South Korea's weight fell from 12.8 percent to 11.3 percent -- but Brazil managed to increase its share from 4.0 percent to 5.3 percent. China managed to hold its weight during 2022.

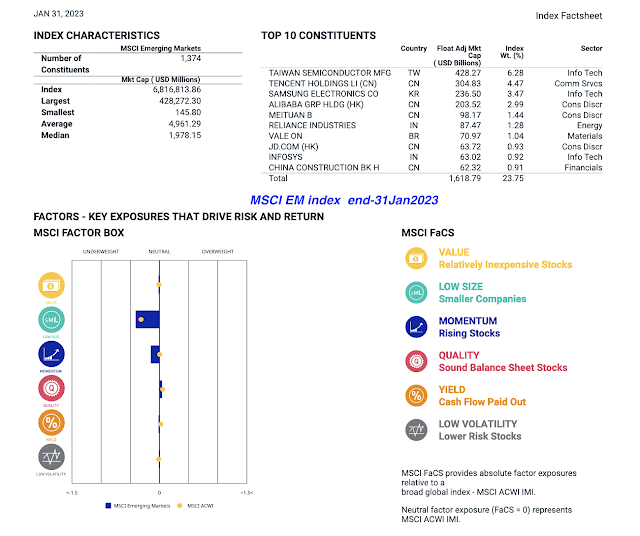

As on 31Dec2022, there are two Indian companies in top 10 of the index, namely, Reliance Industries (6th place) and Infosys (8th place). As of 31Oct2022, there were four companies in top 10 -- namely, Reliance Inds, Infosys, ICICI Bank and HDFC Ltd. I'm sure once the amalgamation of HDFC Ltd with HDFC Bank is completed, HDFC Bank will find a place in the top 10 of the MSCI EM Index.

India's outperformance in 2022 attracted the attention of global investors, though portfolio flows from foreign portfolio investors (FPIs) are not that great in the past six months. In fact, FPIs have been selling Indian stocks in the past 10 days -- though it could be surmised that they are rebalancing their portfolios away from India toward China in the short term.

What is remarkable is India's weight in the MSCI EM Index rose spectacularly from 9.3 percent in Dec2020 to 14.4 percent in Dec2022 while that of first-ranked China fell from 39.1 percent to 32.3 percent in the same period. China in 2021 cracked down on big Chinese technology companies, leading to heavy losses in market cap for Chinese bellwether companies, like, Alibaba, Tencent and JD.com.

MSCI (Morgan Stanley Capital International) removed Argentina from its EM index in 2021 and Russia in 2022. As such, the index now has 24 countries.

Between Dec2020 and Dec2022, the free-float market cap of the index fell by almost 20 percent to USD 6,320 billion. You can find the valuation ratios of the index in the above table.

What of the future?

Will India's outperformance continue in 2023? My guesstimate is that in the next two quarters, global investors may rebalance their portfolios away from India to China, as they may find Chinese stocks more attractive due to heavy losses in China stocks since the 2021 Chinese Tech crackdown.

Moreover, China has reopened its economy after shunning its zero-COVID policy in recent weeks, though these are still early days to get a full picture from an opaque country, like, China.

Overall, Indian stock market is well placed to do well in the next two to three years because of favourable demographics in India, shift in global supply chains partly to India, some revival in capex (capital expenditure) cycle, strong balance sheets of India Inc and resurgence in bank credit -- though political developments, problems in fiscal and current account deficits, longer than expected monetary policy tightening by the US Federal Reserve and fears of global recession may dampen Indian stock markets in the next two quarters.

Index Raw data as on 31Dec2022 >

- - -

P.S.: After writing the blog, the following updates are added with new information / images:

Update 06Apr2024 : As of 31Mar2024, the MSCI EM index details >

India's share has been growing steadily in the MSCI EM index, while that of China has been falling. But Taiwan is closing the gap with India, and is threatening to reach 2nd place in the index replacing India.

Taiwan's increasing share in the index is driven mainly by TSMC, the semiconductor giant -- whose share has increased to 8.33 percent from 6.74 percent a quarter ago.

Update 10Mar2024 : As of 29Feb2024, the MSCI EM index details >

India's weight decreased slightly to 17.6% while that of China rose slightly to 25.8%.

Update 06Feb2024 : As of 31Jan2024, the MSCI EM index details >

India's weight further increased to 18% while that of China declined to 24.9%. The number of Indian stocks in top 10 of the index dropped to three, with HDFC Bank going out. HDFC Bank suffered a heavy drubbing at the hustings in Jan2024.

Update 09Jan2024 : As of 31Dec2023, the MSCI EM index details are >

India continues to be at second place in the index with a weight of 16.73%; while China's weight continues to decreased at 26.53%. Now, there are four Indian companies in the top 10 of MSCI EM index.

HDFC Bank entered the top 10 of the index in the month of December 2023.

It's worth recalling China's weight used to be above 40% in Mar2020. But in less than four years, its share in the index slid to 26.5 percent; while India's weight more than doubled to 16.7 percent in the same period.

Update 12Dec2023 : As of 30Nov2023,the MSCI EM index details are >

India ceded its second place to Taiwan during Nov2023. Meanwhile, China's share in MSIC EM index continues to fall.

Update 12Oct2023 : As of 30Sep2023,the MSCI EM index details are >

India regained its second place in the index with a weight of 15.73%; while China's weight decreased for the first time in several years to below 30%. Now, there are only three Indian companies in the top 10 of MSCI EM index.

HDFC Bank was out of the top 10 after its parent, HDFC Ltd, was merged with HDFC Bank.

Update 07Sep2023 : As of 31Aug2023,the MSCI EM index details are >

Update 06Aug2023 : As of 31Jul2023,the MSCI EM index details are >

Update 31Jul2023 : In the month of Jun2023, India's Reliance Industries dethroned China's Meituan as having the fifth largest weight in MSCI EM Index.

Since the outbreak of COVID-19 Pandemic, China's weight in MSCI EM index has drastically fallen by more 10 percentage points from 41 percent to a little less than 30 percent. India and Taiwan have gained the most from China's fall.

Comparison of EM index for the past three years is provided here >

Update 19Jul2023 : As of 30Jun2023, MSCI EM index continues to underperform both MSCI ACWI and MSCI World indices on a 1-year, 3-year, 5-year and 10-year basis. Four Indian firms are in top 10 of the index, namely, Reliance Inds, HDFC Ltd, ICICI Bank and Infosys as on 30Jun2023.

Update 10Jun2023 : India is at 3rd place in MSCI EM Index as on 31May2023. Infosys rejoined the top 10 firms; Reliance Inds, ICICI Bank, HDFC Ltd and Infosys are now in the Top 10 of the MSCI EM Index as on 31May2023.

Update 05May2023 : India is at 3rd place in MSCI EM Index as on 30Apr2023. Infosys is out of the top 10 firms and ICICI Bank is now in top 10 of the index.

Update 06Apr2023 : India continues to remain at 3rd place in MSCI EM Index. The three Indian firms, namely, Reliance Inds, Infosys and HDFC Ltd continue to remain in the top ten of the index.

Comparison of EM index for the past three years is provided here >

Screenshots of MSCI EM index as at end-31Mar2023 >

Update 07Mar2023 : India continues to remain at the third place (with 13.2% weight) in MSCI EM Index. Now, there are three Indian firms, namely, Reliance Inds, Infosys and HDFC Ltd, in the top ten of the index.

Update 04Feb2023 : Even as politicians and financial market participants have been cheering the country as "It's India's Decade," our place in the MSCI EM index slipped to third position in Jan2023 from second position at the end of 2022. Taiwan is now in second position with 14.4% (previous month 13.8%) and India's weight is at 13.0% (previous month 14.4%).

India climbed to second position in the index for the first time in Sep2022, but could retain the position only for four months till Dec2022.

At number one, China's weighting rose to 33.5% (previous month 32.3%, which is almost lowest for China in several years). This seems to be a reverse case of "China's pain is India's gain."

References:

Weblink for old data on MSCI EM Index (with several screenshots)

Tweet 31Jan2021 for 31Dec2020 data

Tweet 20Apr2020 for 31Mar2020 data

-------------------

Read more:

New Rules on Ex-date and Record date

Mutual Fund Asset Class Returns 31Dec2022

BSE Broad and Sector Indices Market Cap 31Dec2022

Global Market data 31Dec2022

BSE Broad and Sector Indices Returns 30Dec2022

Crisil Report - Big Shift in Financialisation

Global bond yields, negative real interest rates and soft landing

Indian Energy Exchange Buyback Offer 2022

Larsen & Toubro Infotech & Mindtree Merger Effective 14Nov2022

Indian Energy Exchange Limited - Brief Analysis

JP Morgan Guide to the Markets

Infosys Limited Buyback Offer 2022

Indians' Love For Cash Continues Unabated

-------------------

Disclosure: I've vested interested in Indian stocks and other investments. It's safe to assume I've interest in the financial instruments / products discussed, if any.

Disclaimer: The analysis and opinion provided here are only for information purposes and should not be construed as investment advice. Investors should consult their own financial advisers before making any investments. The author is a CFA Charterholder with a vested interest in financial markets.

CFA Charter credentials - CFA Member Profile

CFA Badge

He blogs at:

https://ramakrishnavadlamudi.blogspot.com/

Twitter @vrk100

No comments:

Post a Comment