GE Shipping Company - Buyback Offer 2021

(This is for information purpose only. This should not be construed as a recommendation. Please consult your financial adviser before taking any plunge. Even though this blog was posted on 25Dec2021, I'll be updating this blog regularly with new information till the closure of this buyback offer, which may be some months away.)

The Great Eastern Shipping Company Limited (GE Shipping hereinafter) on 22Dec2021 announced, through a BSE stock exchange filing, that its board of directors would meet on 27Dec2021 to consider a proposal to buy back the company's equity shares. The following are the details / timeline of the buyback offer:

-------------------

Read more:

Kaveri Seed Company buyback offer

Saver's Curse: Low Savings Rates and Liquid Mutual Fund Returns

Indian Mutual Funds and The Art of Ripping Off Investors

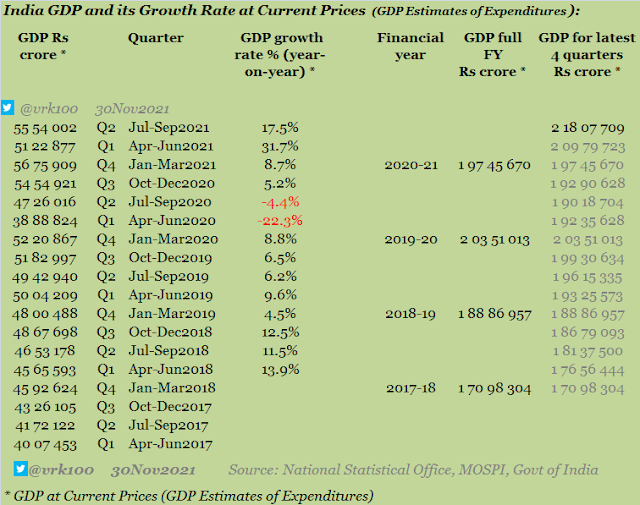

India Second Quarter GDP

Global bond yields and Interest rates

Do Paint Stocks and Crude Oil Tango?

BSE Broad and Sectoral Indices Returns

Real Estate Stocks and REITs

Weblinks and Investing

-------------------

1. A BSE filing dated 22Dec2021 announced that the Company's Board would meet on 27Dec2021 for a buyback proposal (the BSE announcement came after closure of market hours -- end-22Dec2021, when the company's market price was Rs 275.80 per share with a market cap of Rs 4,060 crore).

2. The next trading day, that is on 23Dec2021, the stock price reacted positively to the news item and rose by 6.70 per cent and closed for the day at Rs 294.35.

3. The company's stock price has remained subdued for a long time. Shipping stocks, in general, are highly volatile. Baltic Dry Index is one of the main factors that drive the fortunes of shipping firms. The fact that the index (BDI) fell by 60 per cent from 5,500 to 2,200 in the past three months (Oct2021 to Dec2021) is a testimony to this lack of market fancy for the GE Shipping stock.

4. GE Shipping has bought back its equity shares several times in the past decade, the latest being in 2019. Between June and November 2019, the company bought back 38,10,581 shares at an average price of Rs 261.60 per share, totaling nearly Rs 100 crore.

5. This 2019 buyback offer was through 'stock exchange' mechanism with a maximum buyback price of Rs 306 per share. As the buyback offer was through stock exchange mechanism, SEBI norms do not permit company's promoters to participate in the buyback offer. As a result, the GE Shipping promoters did not participate in the offer and their shareholding in the company rose from 29.66 per cent pre-buyback to 30.43 per cent post-buyback.

6. Apparently, the company's promoters want to use the current opportunity of low stock price to their advantage; and they are once again coming with a new buyback offer so that they can increase their shareholding further. Let us wait for the board meeting on 27Dec2021 and see the contours of the buyback offer.

7. Meanwhile, you can look at the fundamentals of the company here: Annual report 2020-21, conference call, investor presentation and AAA long-term rating for NCD.

8. The company's historical valuation measures can be gauged from here (source: Margin Value) >

(more details will be added as when more events are announced)

Update 27Dec2021

9. On 27Dec2021, the company announced (after market hours) the Board's decision (BSE filing dt 27Dec2021) to approve buyback of equity shares for a total amount of nearly Rs 225 crore with a maximum buyback price of Rs 333 per share.

The

total amount to be spent on buyback this time is 125 per cent more than the

size of previous buyback in 2019. The latest maximum buyback price is 8.82 per cent more than the previous buyback price.

The stock would react on 28Dec2021 to the buyback announcement. The stock price on 27Dec2021 closed at Rs 293.15, with a market cap of Rs 4,308 crore.

More details of the buyback are given, as per BSE filing dated 27Dec2021, in the Board's resolution of the buyback proposal.

10. The buyback route chosen by the Board is through the 'open market via the stock exchange' mechanism and the route is similar to the 2019 buyback offer. As such, the promoters are not allowed to participate in the buyback as per SEBI norms.

The promoters' non-participation in the buyback would result in the increase of their shareholding post-buyback. As on 24Dec2021, the promoters hold 4,29,36,248 shares amounting to 29.21 per cent of the equity share capital.

The Maximum Buyback Size of Rs 225 crore is 4.03 and 3.56 per cent of the aggregate of the fully paid up Equity Share capital and free reserves as per the audited balance sheet as on March 31, 2021 (on a standalone and consolidated basis respectively), which is within the statutory limits of 10 per cent of the total paid-up equity share capital and free reserves.

11. As the company will be buying back shares from the stock exchanges directly, investors need not do anything. It may be mentioned that in the case of 'tender offer' route, investors need to surrender their eligible number of shares to the company and simultaneously they will receive the amount of buyback.

Update 28Dec2021

12. On 28Dec2021 the stock price reacted mildly to the buyback price of Rs 333 per share (announced on 27Dec2021) and closed the day at Rs 295.05 (market cap Rs 4,336 crore), up 0.65 per cent over previous day's closing price.

Update 29Dec2021

13. On 29Dec2021, the company made a public announcement via a BSE filing giving full details of the buyback offer:

The company says the buyback would start from 07Jan2022 till earlier of 06Jul2022 or the date when buyback size is fully used.

Since the maximum buyback size is less than 10 per cent of the total paid-up equity share capital and free reserves of the company, approval of the company's shareholders is not necessary. The details of paid-up equity and free reserves are as follows:

14. As per the company, the buyback aims to: increase the earnings per share (EPS), effectively use available cash, improve key return rations and enhance shareholder value.

The maximum buyback price (Rs 333 per share) represents:

a. Premiums of 11.30% and 11.83% over the volume weighted average market price of the Equity Shares on BSE and NSE, respectively, during one month preceding the date of intimation (December 22, 2021) to the Stock Exchanges of the Board Meeting to consider the proposal of the Buyback.

b. Premiums of 11.80% and 13.94% over the volume weighted average market price of the Equity Shares on BSE and NSE, respectively, during the two weeks preceding the date of intimation (December 22, 2021) to the Stock Exchanges of the Board Meeting to consider the proposal of the Buyback.

c. Premiums of 20.74% and 21.40% over the closing price of the Equity Shares on BSE and NSE, respectively, as on December 22, 2021, the date of intimation to the Stock Exchanges of the Board Meeting to consider the proposal of the Buyback.

Update 07Jan2022

15. On 07Dec2022, GE Shipping started the buyback programme. The details of buyback of shares can be accessed here and here.

Update 24Jan2022

17. Till 24Jan2022, GE Shipping bought back 466,494 shares at an average acquisition price of Rs 312.12, totalling Rs 14.56 crore. The maximum buyback size is Rs 225 crore.

Update 09Mar2022

18. Till 08Mar2022, GE Shipping bought back 41.39 lakh shares at an average acquisition price of Rs 315.97, totalling Rs 130.8 crore, which is 58 per cent of the maximum buyback size of Rs 225 crore.

Which means the company is yet to spend nearly Rs 90 crore of the balance amount. Interestingly, the market price of GE Shipping today surpassed Rs 333 (maximum buyback price) per share for the first time since the company announced the buyback proposal on 22Dec2021.

As the maximum buyback price is Rs 333, the company cannot further buy back the equity shares as long as the market price remains above Rs 333.

As per company's public announcement dated 29Dec2021, the company has the option to close the buyback issue provided that at least 50 per cent of the maximum buyback size (in the given case Rs 112.50 crore) is used for buying back the shares.

As stated above, the company has already used more than 50 per cent of the maximum buyback size. In view of this, the company may exercise the option to close the buyback before using 100 per cent of the maximum buyback size--if the share price does not fall below Rs 333 per share. Let us see how things pan out.

Table showing daily buyback details > (please click on the image for a better view)

Update 20Mar2022

19. As speculated here (update 09Mar2022), GE Shipping has not been able to buy back a single share since 09Mar2022 as the market price has stayed above Rs 333 (the maximum buyback price) since then. The current market price is Rs 345 (end-17Mar2022). Unless the price falls to or goes below Rs 333, the company cannot further buy back any shares.

Update 06May2022

20. Since 09Mar2022 till today (except for two trading days, on 23Mar22 and 24Mar22), the market price has been above maximum buyback price of Rs 333. As such, GE Shipping has not been able to buy back any shares for the past two months practically.

As on 06May2022, they could buy only 41,99,323 shares using Rs 132.79 crore at an average price of Rs 316.21. Buyback tax is nearly 23.30 per cent of buyback amount. Details of buyback (slide 15) as on 06May2022 >

Update 06Jul2022 - Closure of Buyback

21. In an exchange filing on 06Jul2022, GE Shipping Company announced the closure of the buyback. Between 25Mar2022 and 06Jul2022 (the last day of the buyback), the company could not buy a single share from the market as the market price had remained above Rs 333 per share, which was the maximum buyback price as per the buyback offer.

Since the start of the buyback on 07Jan2022, the company bought a total of 41,99,323 equity shares at an average price of Rs 316.21 per share using a total amount of Rs 133.23 crore. It may be recalled that the company had set aside Rs 225 crore for the buyback, but could only use 59.21 per cent of the maximum buyback size.

As stated above, the market price since 25Mar2022 had remained above the buyback price of Rs 333 per share and as such the company could not use the full amount earmarked for the buyback.

As the promoters did not participate in the buyback, the promoters stake in the company increased from 29.21 per cent (pre-buyback) to 30.07 per cent (post-buyback). The latest shareholding pattern is as follows >

- - -

NSE volumes for GE Shipping stock

BSE volumes for GE Shipping stock

Disclosure: I've vested interested in Indian stocks and other investments. It's safe to assume I've interest in the financial instruments / products discussed, if any.

Disclaimer: The analysis and opinion provided here are only for information purposes and should not be construed as investment advice. Investors should consult their own financial advisers before making any investments. The author is a CFA Charterholder with a vested interest in financial markets.

CFA Charter credentials - CFA Member Profile

CFA Badge

He blogs at:

https://ramakrishnavadlamudi.blogspot.com/

Twitter @vrk100