How To Calculate US Real GDP Growth Rate?

(Updates dated 31Jan2023, 28Oct2022 and 29Jul2022 are available at the end of the article with latest US real GDP data)

On 30Jul2020, media headlines screamed, "US second quarter GDP plunges by 32.9 per cent!" A fall of 32.9 per cent is big; this big drop has to be seen in the context of rapid spread of COVID-19 Pandemic during Apr-Jun2020 quarter.

What is the meaning of this 32.9 per cent decline? Before we delve into this, let us see how GDP growth rates are calculated in India.

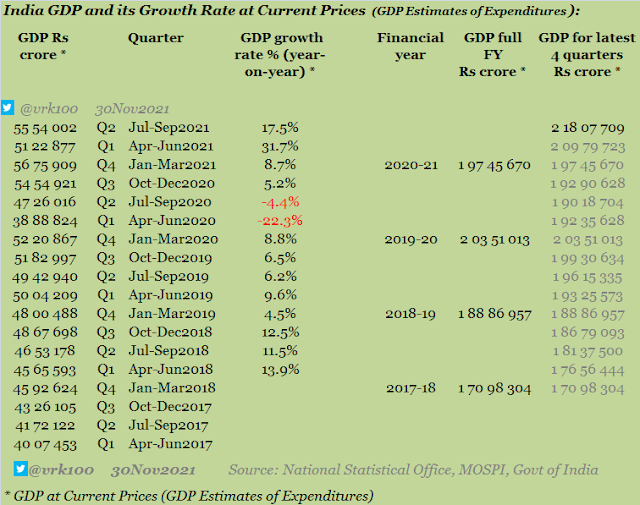

India GDP Growth Rate Calculation

India gross domestic product (GDP) growth rates are calculated in a simple way. They are stated as year-on-year growth rates, using the growth of a particular quarter GDP in a financial year over the same quarter GDP in previous financial year.

For example, India's third quarter real GDP (Oct-Dec2021) of financial year 2021-22 is Rs 38.22 lakh crore; and its third quarter real GDP (Oct-Dec2020) in FY 2020-21 is Rs 36.26 lakh crore.

The calculation:

(38.22 - 36.26) ÷ 36.26 = 0.054 or 5.4 per cent.

This is reported as: India's third quarter GDP growth rate year-on-year is 5.4 per cent.

US GDP Growth Rate Calculation

In the US, quarterly GDP growth rates are calculated differently. Sequential quarterly growth rates are annualised and the annualised numbers are reported.

In fact, many data points in the US are reported as annual rates. This tradition goes back to several years.

Let us calculate the rate using the 32.9 per cent drop in growth rate in the second quarter of 2020 cited above.

The first quarter (Jan-Mar2020) US GDP was USD 19,010.8 billion and the second quarter (Apr-Jun2020) was USD 17,205.8 billion (these number were slightly revised later).

The calculation:

The sequential growth rate is minus 9.495 per cent.

(17205.8 - 19010.8) ÷ 19010.8 = - 0.09495 or minus 9.495 per cent.

This negative sequential growth rate is then annualised as follows:

[1 + (- 0.09495)]^4 - 1 = [0.90505]^4 - 1 = 0.67096 - 1 = - 0.32904 or negative 32.9 per cent.

Note: ^4 is to the power of four

This is reported as: Real gross domestic product (GDP) in the US decreased at an annual rate of 32.9 percent in the second quarter of 2020.

Let us give another example using positive growth rate:

The third quarter (Jul-Sep2021) real US GDP was USD 19,478.89 billion and the fourth quarter (Oct-Dec2021) print was USD 19,806.29 billion.

The calculation:

The sequential growth rate is positive 1.681 per cent.

(19806.29 - 19478.89) ÷ 19478.89 = 0.01681 or 1.681 per cent.

This sequential growth rate is then annualised as follows:

[1 + (0.01681)]^4 - 1 = [1.01681]^4 - 1 = 1.06895 - 1 = 0.06895 or 6.9 per cent.

This is reported as: Real gross domestic product (GDP) in the US increased at an annual rate of 6.9 percent in the fourth quarter of 2021.

You can calculate the above numbers using MS Excel tool also. The above manual computation looks like 'meaningless' when you've enormous computational power in your hands these days.

But in order to understand the mechanics behind the reported numbers, you sometimes need to do / learn things the old way.

If you compare India's quarterly GDP growth rate with the US quarterly GDP growth rate, you would get a wrong picture due to differences in calculation of the growth numbers.

As such, before comparing the growth rates of two countries, say, India and the US, it would be of great help to know how these growth numbers are calculated and reported.

Table showing simple year-or-year quarterly growth rates and annualised growth rates for the US since 2018 till now >

- - -

P.S.: The following data are included after the above article was published on 02May2022:

Update 31Jan2023

US GDP data for 4th quarter of 2022 > In Oct-Dec2022 quarter, the US real GDP increased at an annual rate of 2.9 percent, versus 3.2 percent in Jul-Sep2022 quarter.

The US real GDP increased 2.1 percent in 2022 (from the 2021 annual level to the 2022 annual level), compared with an increase of 5.9 percent in 2021.

Update 28Oct2022

US GDP data for third quarter

of 2022 > After suffering two negative quarters of growth consecutively, the real GDP growth expanded by 2.6 percent (annualised rate) in Jul-Oct2022 quarter >

Update 29Jul2022

US GDP data for second quarter of 2022 >The US real GDP growth rates are negative for two consequent quarters of 2022, with the real GDP contracting by 1.6 percent and 0.9 percent in first and second quarters respectively >

Note: The US GDP numbers are released by Bureau of Economic Analysis. BEA and the Fred data reports the numbers as 'seasonally adjusted annual rates.'

References:

Why does BEA publish estimates at annual rates?

Apr-Jun2020 US GDP full release by BEA

Fred data - US real GDP quarterly in US dollars

Fred data - US real GDP growth rate yearly

-------------------

Read more:

Foreigners Shrinking Pie In Indian Stocks

A Quick Glance at UPL Limited

A Rundown on Prince Pipes & Fittings

Primer on Credit Rating Scales

Speed Read on FDC Buyback Offer 2022

BSE Broad and Sector Indices Returns

BSE Broad and Sector Indices Market Cap

When Will Foreign Investors Stop Selling Indian Stocks?

Rise of Retail Investors and Demat a/cs in India

Do Paint Stocks and Crude Oil Tango?

Weblinks and Investing-------------------

Disclosure: I've vested interested in Indian stocks and other investments. It's safe to assume I've interest in the financial instruments / products discussed, if any.

Disclaimer: The analysis and opinion provided here are only for information purposes and should not be construed as investment advice. Investors should consult their own financial advisers before making any investments. The author is a CFA Charterholder with a vested interest in financial markets.

CFA Charter credentials - CFA Member Profile

CFA Badge

He blogs at:

https://ramakrishnavadlamudi.blogspot.com/

Twitter @vrk100