Foreigners' Shrinking Pie in Indian Equities

(A New blog on this topic is posted on 10Jul2022)

(Updates 03Aug2022, 01Jul2022, 01Jun2022 and 02May2022 with new information are available at the end of this blog post)

During the financial year 2021-22, foreign investors withdrew Rs 140,000 crore (nearly USD 20 billion) worth of Indian stocks from Indian market. There was a time foreign portfolio investors (FPIs) used to hold almost one-fourth share in Indian stocks.

Over the past four to five years, as domestic investors have taken higher interest in Indian equities, the share of FPIs has fallen to 17.8 per cent now, as at the end of March 2022. The share is calculated as a percentage of market capitalisation of all BSE listed firms. (BSE Limited is one of two leading stock exchanges in India).

The movement of FPI equity assets over the past five years is delineated in Table 1 below.

Table 1: FPIs' waning interest in Indian stocks >

(please click on the image for a better view)

Even during the current month, they sold off stocks worth Rs 19,000 crore. As recounted in an earlier blog, they may have found other markets more attractive; or the withdrawal could be due to the US Federal Reserve, America's central bank, raising interest rate; or simply it could be a case of profit-booking during times of uncertainty and volatility.

As stated in Table 2 below, the value of equity assets under the custody (AUC) of foreign investors is Rs 46.91 lakh crore or USD 619 billion, end-31Mar2022, as per data from NSDL or National Securities Depository Limited. The total AUC including equity and debt is Rs 50.97 lakh crore or USD 673 billion.

Even though the value of equities held by FPIs has grown by 15.5 per cent (in rupee terms) during FY 2021-22, their share declined to 17.8 per cent versus 19.9 per cent last year--a fall of two percentage points.

Table 2: Monthly data of FPI flows >

Table 3: Monthly data of FPI flows >

Table 4: Quarterly data of FPI flows >

So far, domestic investors including retail and institutions (like, mutual funds and insurance companies) have acted as a counter-balance to foreign selling. It's not clear how long the resilience of domestic investors will hold the Indian equity market.

- - -

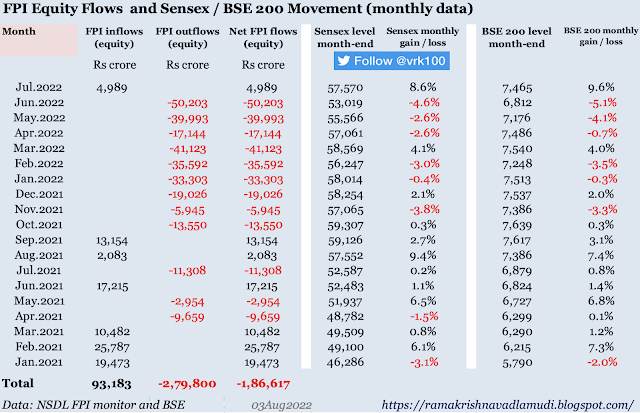

P.S.: Update 03Aug2022 >

FPI monthly data > After continuously selling Indian stocks for three quarters (net sales of Rs 256,000 crore) between Oct2021 and Jun2022, FPIs turned positive in Jul2022 with net purchases of Rs 5,000 crore >

P.S.: Update 01Jul2022 >

Table 1: FPI monthly data >

FPIs have been relentlessly selling Indian stocks for the nine consecutive month in May 2022 > monthly data since Jan2021 >

Table 2: FPI quarterly data > Data from Jan2019 to Jun2022 >

FPI outflows (equity) in the past three quarters (Oct2021-Jun2022) is Rs 256,000 crore, which is almost equal to >

FPI inflows (equity) of Rs 253,000 crore in the previous five quarters (Jul2020 to Sep2021) >

P.S.: Update 01Jun2022 >

FPIs have been selling Indian stocks for the eighth consecutive month in May 2022 >

P.S.: Update 02May2022 >

FPIs have been selling Indian stocks for the seventh consecutive month in April 2022 >

References:

Disclosure: I've vested interested

in Indian stocks and other investments. It's safe to assume I've interest in the financial instruments / products discussed, if

any.

Disclaimer: The analysis and

opinion provided here are only for information purposes and should not be construed

as investment advice. Investors should consult their own financial advisers

before making any investments. The author is a CFA Charterholder with a vested

interest in financial markets.

CFA Charter credentials - CFA Member Profile

CFA Badge

He blogs at:

https://ramakrishnavadlamudi.blogspot.com/

https://www.scribd.com/vrk100

Twitter @vrk100

No comments:

Post a Comment