US Dollar Sales and Purchases by Reserve Bank of India

(Updated charts from Dec2024 onwards are available in India Forex Data Bank blog)

(note: Updates with latest information chart as of Mar2024, Jan2024, Sep2023, Jul2023, May2023, Jan2023, Sep2022, Aug2022 and May2022 are available at the end of this blog)

One of the major factors affecting US dollar - Indian rupee (USD-INR) exchange rate is the market intervention by India's central bank Reserve Bank of India in the foreign exchange (forex) market through sales and purchases of US dollar. The official RBI line is that it intervenes in forex market with a view to curtailing volatility in the exchange rate.

----------------------

Read more: Fed Tapering is Postponed

---------------------- RBI releases the monthly aggregate data of USD sales and purchases with a lag of two months. For example, the data for the month of July 2021 will be released in September 2021 as part of RBI's monthly bulletin.

As of today, the data till May 2021 are available. After selling US dollars to the tune of USD 6.92 billion in February and March this year, RBI again started buying USD in April and May this year. During May 2021, RBI net intervention in the forex market is to the tune of USD 5.84 billion.

The monthly data from January 2019 to May 2021 are given below (please click on the image for a better view):

References:

My tweet thread dated 17Jun2021

- - -

P.S.: After writing the blog, the following updates are added with new information / images:

Update 22May2024: , RBI net India Forex Reserves data from FY 2008-09 to FY 2023-24 including data of Fx reserves accretion / depletion, net sale / purchase of US dollars by RBI and USD INR exchange rate.

Update 22May2024: In

FY 2023-24, RBI net bought US dollars worth USD 41.3 billion, against net sales of USD 25.5 billion in FY 2022-23. After

selling dollars net for four months consecutively between Aug and

Nov2023, RBI was buying net dollars in the past four months consecutively.

Update 20Mar2024: In the first 10 months of

FY 2023-24, RBI net bought US dollars worth USD 19.5 billion. After selling dollars net for four months consecutively between Aug and Nov2023, RBI was buying net dollars in Dec2023 and Jan2024.

Update 16Nov2023: In the first half of

FY 2023-24, RBI net bought US dollars worth USD 17.687 billion. Interestingly,

for two consecutive months in Aug2023 and Sep2023, RBI was selling US

dollars -- obviously to stem the fall of rupee vs dollar.

Update 21Sep2023: In

FY 2022-23, RBI net sold US dollars worth

USD 25.52 billion to prop up a depreciating Indian rupee versus the US

dollar. However, from Apr to Jul2023, RBI net bought US dollars worth 23.05 billion.

Update 27Jul2023: In

FY 2022-23, RBI net sold US dollars worth

USD 25.52 billion to prop up a depreciating Indian rupee versus the US

dollar. However, in April and May, RBI net bought US dollars worth 15.08 billion.

Update 21Mar2023: In FY 2022-23 (10 months data till Jan2023), RBI net sold US dollars worth USD 26.52 billion to prop up a depreciating Indian rupee versus the US dollar.

Update 18Nov2022: In the past five months (Jun2022 to Sep2022), RBI sold dollars worth USD 37.38 billion, with a view to defending the depreciating Indian rupee versus the rising US dollar > mainly as a result of the rupee defense by RBI in the past one year or so, India's forex reserves are down by more than USD 100 billion to USD 544.72 billion as on 11Nov2022 >

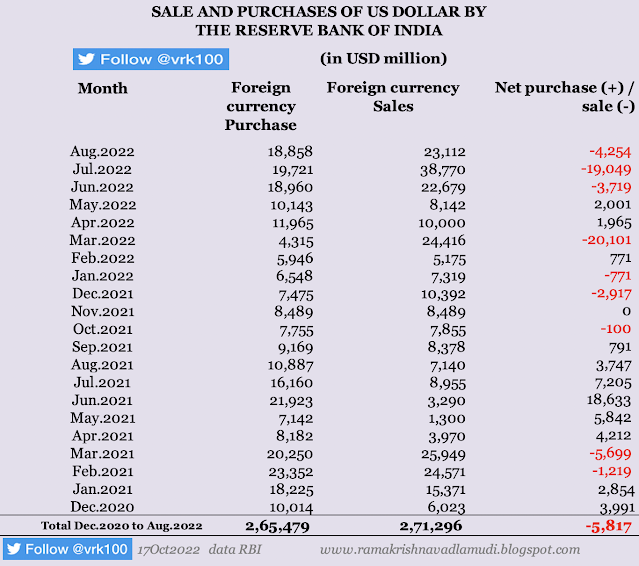

Update 17Oct2022: After one of the highest USD sales in a single month of USD 19 billion in Jul2022, the USD sales by RBI are dramatically down to USD 4.3 billon in Aug2022 >

Update 19Jul2022: After highest net sale of US dollars by RBI in a single month in Mar2022 in more than a decade, RBI bought USD to the tune of about USD 4 billion in April and May of 2022 >

Update 18May2022: Highest net sale of US dollars by RBI in a single month since Oct2008 (after Lehman Brothers collapse) -- in Mar2022, RBI net sold USD 20.1 billion versus net sales of USD 18.7 billion in Oct2008 -- of course, 2022 economy is bigger compared to 2008 economy -

Update 22Aug2021: During the month of June 2021, RBI's net purchases of US dollars are to the tune of USD 18.63 billion, this is the highest figure in the history of RBI. (Of course, Indian economy has grown hugely--to that extent the absolute numbers look higher and higher always).

Disclosure: I've vested interested

in Indian stocks and other investments. It's safe to assume I've interest in the financial products discussed, if

any.

Disclaimer: The analysis and

opinion provided here are only for information purposes and should not be construed

as investment advice. Investors should consult their own financial advisers

before making any investments. The author is a CFA Charterholder with a vested

interest in financial markets.

CFA Charter credentials - CFA Member Profile

CFA Badge

No comments:

Post a Comment