Slowest Growth in India's Real Per Capita Income

(Updates 05Mar2023, 05Mar2023, 28Feb2023, 04Dec2022, Update 30Nov2022 with Q2 GDP data for FY 2022-23; and Update 16Sep2022 with Q1 GDP data for FY 2022-23 are available at the end of this article)

Governments are in the habit of making tall claims about economic progress and pull wool over citizens’ eyes. Day in and day out, we’re bombarded with useless data about the progress India has been making on all fronts–all part of a disinformation campaign. The governments will deflect our attention by not throwing light on what is needed for our progress, but they selectively highlight what they want the masses to know.

Ultimately, all actions taken and bets not taken are to reflect in per capita income of the population--but actually the "accomplishments" of the governments are not reflecting in personal incomes. One of the biggest failures of the PM Modi government in the past eight years is lack of job creation (others include, disastrous demonetisation or note ban of November 2016, sloppy rollout of goods and services tax or GST, draconian Corona Virus lockdowns and so on).

India's real per capita GDP* fell by 7.6 per cent in 2020-21 to Rs 100,032. Mind you, this includes the incomes of the Ambanis, Adanis, Tatas, Birlas and the like. If you exclude them, I'm sure ours has plunged by more than 25 per cent!

[* gross domestic product at constant (2011-12) prices adjusted for inflation]

During 2021-22, the real per capita income rose by 7.6 per cent to Rs 107,670. Interestingly, the per capita income during 2019-20 was Rs 108,247. So, in the past two years, the per capita income fell by 0.27 per cent which is unprecedented in India’s history.

Of course, Indian government has got a good excuse in the form of COVID-19 Pandemic to justify the fall in personal incomes. What is not highlighted is the fact that the fall in personal incomes is mainly self-inflicted, that is attributable to the draconian lockdowns imposed by the PM Modi government in March-June 2020.

Everyday, we’re told tax collections in India are at record highs. The gullible never understand why tax collections are high when their own personal incomes are down in the dumps. It’ll take some time for the masses to figure out tax collections are high due to the simple fact that tax rates are high; tax extortion is high; every payment and receipt are subject to tax deduction at source (TDS) and / or tax collected at source (TCS); and high indirect taxes have been hurting the vulnerable classes more.

India's per capita income is low and prospects for income mobility are dim. More students have been going abroad for studies as they are unable to find good opportunities at home. Most jobs are created in the information technology sector, especially for the educated people–which is also good indirectly for those in the lower strata of society.

(story continue below)

--------------

Related:

Why is India Falling Behind Bangladesh?

India 2nd quarter GDP FY 2021-22

--------------

The vulnerable classes are forced to depend on jobs created, not so well-paid, by the e-commerce and other digital sectors of the economy.

"The wealth of a nation must be measured by its per capita income. Only a commercial society, in which every individual acted in their own self-interest but was driven by competition, would improve everybody’s life for the better," thus said Scottish philosopher and economist Adam Smith more than 250 years back.

It's a big disappointment most of the young are unable to enjoy upward mobility in their careers. Rather, they are staring at the prospect of downward mobility.

The following tables highlight the GDP data of several years:

Table 1: India's Real per capita GDP Annualised Growth

Rate % under PM Modi government:

This is a fun diagram to 'extol' India's accomplishments >

e.g. i) annualised real per capita GDP growth rate for the past eight years (between 2013-14 and 2021-22) is 4.05%

ii) annualised real per capita GDP growth rate for the past five years (between 2013-14 and 2021-22) is 2.59%

iii) annualised real per capita GDP growth rate for the past two years (between 2019-20 and 2021-22) is negative 0.27

Table 2: India's per capita GDP -- at current prices and constant prices (base year 2011-12) >

Table 3: India's Real GDP Annualised Growth Rate % under PM Modi government:

This is a fun diagram to 'extol' India's accomplishments >

e.g. i) annualised real GDP growth rate for the past seven years (between 2014-15 and 2021-22) is 4.92%

ii) annualised real per capita GDP growth rate for the past four years (between 2017-18 and 2021-22) is 2.90%

iii) annualised real per capita GDP growth rate for the past two years (between 2019-20 and 2021-22) is just 0.75%

Table 4: India real GDP growth rate (yearly) at constant prices (base year 2011-12) >

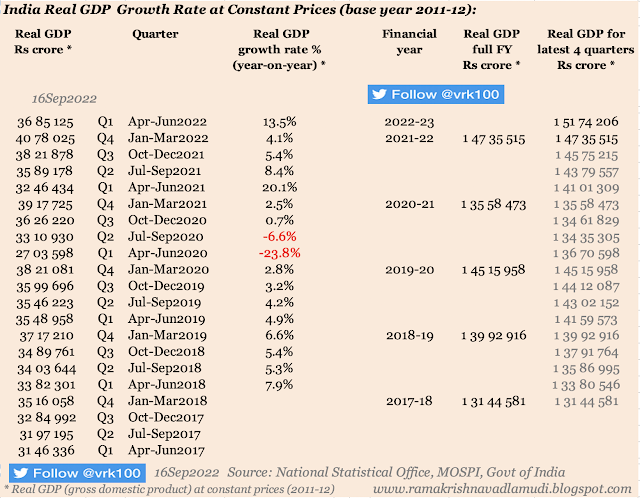

Table 5: India real GDP growth rate (quarterly) at constant prices (base year 2011-12) >

Table 6: India GDP growth rates (yearly) at current prices >

Table 7: India GDP growth rates (quarterly) at current prices >

-------------------

Read more:

Why is India Falling Behind Bangladesh?

How Rates and Ratios are Moving

Slowing Foreign Direct Investment to India

JP Morgan Guide to Markets

Rant on Tata Steel Ltd

A Quick Glance at UPL Limited

A Rundown on Prince Pipes & Fittings

Primer on Credit Rating Scales

When Will Foreign Investors Stop Selling Indian Stocks?

Do Paint Stocks and Crude Oil Tango?

Weblinks and Investing-------------------

Disclosure: I've vested interested in Indian stocks and other investments. It's safe to assume I've interest in the financial instruments / products discussed, if any.

Disclaimer: The analysis and opinion provided here are only for information purposes and should not be construed as investment advice. Investors should consult their own financial advisers before making any investments. The author is a CFA Charterholder with a vested interest in financial markets.

CFA Charter credentials - CFA Member Profile

CFA Badge

He blogs at:

https://ramakrishnavadlamudi.blogspot.com/

Twitter @vrk100

No comments:

Post a Comment