Short Opinion on HDFC Bank

(This

is for information purposes only. This should not be construed as a

recommendation or investment advice even though the author is a CFA Charterholder. Please consult your financial

adviser before taking any investment decision. Safe to assume the author has a vested

interest in stocks / investments discussed if any.)

(please look for updates dated 10Aug2023, 18Jul2023, 14Jul2023 and 12Jul2023 at the end of the blog)

In May2022, I opined I was not in favour of buying stocks of HDFC Ltd and HDFC Bank based on certain assumptions.

Since then, their stock prices have risen by more than 30 percent, slightly underperforming Nifty Bank, but outperforming Nifty 50 index. In the same period, the stocks of IndusInd Bank and Axis Bank have done way better.

As bank credit growth picked up in latter half of 2022, banks did well in second half of 2022 -- resulting in banking sector outperforming other sectors during the period (the bank credit growth in this period was beyond my May2022 expectations).

Year to date though, Nifty Bank's performance is feeble.

One bank that is underperforming in the past one year is Kotak Mahindra Bank.

Now to the present: The merger of HDFC Ltd and HDFC Bank is complicated and the record date for the merger on the stock exchanges is 13Jul2023. As per the amalgamation scheme, shareholders of HDFC Ltd, as on the record date, will receive 42 shares each of face value of Re 1 each of HDFC Bank for 25 shares each of face value of Rs 2 each held in HDFC Ltd.

Since then, their stock prices have risen by more than 30 percent, slightly underperforming Nifty Bank, but outperforming Nifty 50 index. In the same period, the stocks of IndusInd Bank and Axis Bank have done way better.

As bank credit growth picked up in latter half of 2022, banks did well in second half of 2022 -- resulting in banking sector outperforming other sectors during the period (the bank credit growth in this period was beyond my May2022 expectations).

Year to date though, Nifty Bank's performance is feeble.

One bank that is underperforming in the past one year is Kotak Mahindra Bank.

Now to the present: The merger of HDFC Ltd and HDFC Bank is complicated and the record date for the merger on the stock exchanges is 13Jul2023. As per the amalgamation scheme, shareholders of HDFC Ltd, as on the record date, will receive 42 shares each of face value of Re 1 each of HDFC Bank for 25 shares each of face value of Rs 2 each held in HDFC Ltd.

With all the regulatory approvals received, the hangover was lifted on both the stocks in the past three to four months. It may sound repetitive, but I'd like to say all the positives on HDFC Bank are fully priced in.

The merger of HDFC Ltd with HDFC Bank became effective 01Jul2023. After the merger, companies like, HDFC Securities Ltd, HDB Financial Services Ltd,

HDFC Asset Management Company Ltd, HDFC ERGO General Insurance Company Ltd,

HDFC Capital Advisors Ltd and HDFC Life Insurance Company Ltd have become subsidiaries of HDFC Bank.

HDFC Bank is now a conglomerate holding several businesses, like, general insurance, life insurance, brokerage, asset management company (AMC) and others. Holding companies usually quote at a discount of 40 to 60 percent to the value of their underlying businesses. Markets will somehow factor in the holding company discount for HDFC Bank in future.

Maybe, it would be better, in future, if we compare HDFC Bank with the likes of Bajaj Finserv Ltd.

Liabilities franchise

One of the strongest points of HDFC Bank is its liabilities franchise. The bank's focus on liabilities accretion (through branch expansion, customer additions and relationship building with existing customer) gets reflected in superior cost of deposits, higher share of low-cost deposits (like, savings and current account) and net interest margin (NIM).

Back in Mar2023, Silicon Valley Bank (SVB) of the US collapsed due, among other things, to high concentration of uninsured deposits among venture capital firms. The inability of SVB to manage its liabilities franchise cost the bank dearly.

Not many investors realise this -- an effective liabilities franchise is one of the main pillars of a bank. HDFC Bank is strong in this area.

Compared to other private banks, HDFC Bank's profitability ratios are superior. Its net interest margin (NIM) and return on equity (RoE) are good. Institutional investors have no choice except hugging index stocks, like, HDFC Bank -- for them, what matters is relative performance; not absolute performance.

Individual investors have no such compulsions of hugging index stocks. They've more flexibility in terms of choosing stocks. If at all you've to buy HDFC Bank, you're better off waiting for at least two years and see how the integration of HDFC Ltd with HDFC Bank would pan out and how the market responds to the integration.

Bank credit growth may slow down in the next few quarters, which could be negative for banking sector. I'm not in favour of banking stocks in general and HDFC bank in particular. I don't expect this elephant to dance in future. I don't hold any banking stocks in my stock portfolio.

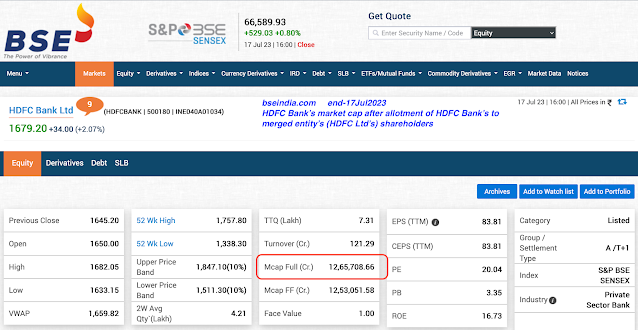

You can check the valuation matrix of HDFC Limited and HDFC Bank in the following three images >

Individual investors have no such compulsions of hugging index stocks. They've more flexibility in terms of choosing stocks. If at all you've to buy HDFC Bank, you're better off waiting for at least two years and see how the integration of HDFC Ltd with HDFC Bank would pan out and how the market responds to the integration.

Bank credit growth may slow down in the next few quarters, which could be negative for banking sector. I'm not in favour of banking stocks in general and HDFC bank in particular. I don't expect this elephant to dance in future. I don't hold any banking stocks in my stock portfolio.

You can check the valuation matrix of HDFC Limited and HDFC Bank in the following three images >

- - -

P.S. 10Aug2023 HDFC Ltd was merged with HDFC Bank Ltd in Jul2023 (record date 13Jul2023). HDFC Bank Ltd and HDFC Ltd had a combined weight of 15 percent in Nifty 50 index as on 30Jun2023 (before the merger). After the merger (as on 31Jul2023), HDFC Bank Ltd has a weight of 14.10 percent. As on 31Jul2023, HDFC Bank Ltd has a weight of 15.6 percent in BSE Sensex (combined weight was 17.15 percent as on 30Jun2023).

As per NSE India, HDFC Bank's market cap is Rs 12,36,700 crore with a price of Rs 1,638 as at close of 10Aug2023.

Valuation ratios of HDFC Bank Ltd as on 10Aug2023 (screenshot below) >

P.S. 18Jul2023

Screenshots >

P.S. 14Jul2023

As on 30Jun2023, HDFC Bank and HDFC Ltd had a combined weight of 14.94% and 17.15% in Nifty 50 and Sensex indices respectively (screenshots enclosed).

P.S. 12Jul2023

Though the official merger / amalgamation of HDFC Limited into HDFC Bank Limited was effective 01Jul2023, the record date on stock exchanges for the merger was 13Jul2023. So, the last trading day for HDFC Ltd stock on stock exchanges is 12Jul2023.

HDFC Ltd stock on 12Jul2023 ended on BSE Ltd with a price of Rs 2,729.95 per share, with a market cap of Rs 505,430 crore. And HDFC Bank Ltd stock on 12Jul2023 ended on BSE with a price of Rs 1,633 a piece, with a market cap of Rs 913,141 crore.

Screenshots of HDFC Ltd and HDFC Bank Ltd stocks on Screener.in and bseindia.com as at close of 12Jul2023 are as follows >

----------------

References:

HDFC Ltd to merge into HDFC Bank effective 01Jul2023

Read more:

Listed Companies with no History of Bonus Share Issue

JP Morgan Guide to Markets Apr2023

Nexus Select Trust (Retail REIT) and Office REITs

Listed Companies with Zero Promoter Holding Mar2023

Buyback Offers and Weblinks

Negative Cash Conversion Cycle and Negative Working Capital

Aspects of Shadow Banking System

Understanding Floating Rate Savings Bonds 2020 (Taxable)

Ipca Labs to Acquire Unichem Labs

Wipro Ltd Buyback Offer 2023

Short Notes on Bandhan Bank

JP Morgan Guide to Markets Mar2023

The Scourge of Negative Real Interest Rates Continues

BSE 500 vs S&P 500 Indices Compare 31Mar2023

Nifty 50 Index Quarterly Movement 31Mar2023

Negative Impact of Debt Mutual Fund Tax Changes

Why Do Indian Equity Mutual Funds Always Disappoint Investors?

Weblinks and Investing-------------------

Disclosure: I've vested interested in Indian stocks and other investments. It's safe to assume I've interest in the financial instruments / products discussed, if any.

Disclaimer: The analysis and opinion provided here are only for information purposes and should not be construed as investment advice. Investors should consult their own financial advisers before making any investments. The author is a CFA Charterholder with a vested interest in financial markets.

CFA Charter credentials - CFA Member Profile

CFA Badge

He blogs at:

https://ramakrishnavadlamudi.blogspot.com/

Twitter @vrk100