|

|

|

|

|

Rama Krishna Vadlamudi,

|

||

First

Quarter GDP

The

first quarter for India

As

can be seen from the following graph, the growth rate in the first quarter of

current year has fallen to 5.5 per cent from a high of 9.2 per cent in the

fourth quarter of 2010-11, showing a rapid deceleration in the GDP growth rate.

Note: GDP at factor cost at constant prices (2004-05). Data from CSO.

Investment

Activity Hits Rock Bottom

The

most worrying factor is the lack of any meaningful growth in investment

activity in the country. Due to a virtual halt in government clearances for new

projects, lack of environmental approvals, bottlenecks in coal supply linkages

and other policy inactions, new projects are not coming up at the desired level

in the economy. This is shown in the gross fixed capital formation (GFCF),

which is a measure of total investments made in the economy. It is measured by

the total value of all fixed assets acquired less disposals, plus certain

additions.

At constant (2004-2005) prices,

the GFCF is estimated at Rs 4,49,701 crore in the first quarter of 2012-13 as

against Rs 4,46,754 crore in the first quarter of 2011-12, showing a dismal

growth of less than one per cent. This dismal situation is corroborated by

other indicators, like, IIP.

In terms of GDP at market

prices, the rates of GFCF at current and constant (2004-2005) prices during Q1

of 2012-13 are estimated at 29.9 per cent and 32.8 per cent, respectively, as

against the corresponding rates of 31.2 per cent and 33.9 per cent,

respectively in Q1 of 2011-12.

What of the

Future?

The

future for new investment activity is dicey. The Government of India seems to

be in no mood to revive the slowing economy despite hopes of some policy

initiatives from the government. India

Various

estimates put out by different agencies put India

Ø

Reserve Bank of India

Ø

Crisil Ltd,

Moody’s & CLSA 5.5%

Ø

Citigroup 5.4%

The

reasons attributed by the private agencies for their pessimism are:

Ø

Government’s

lack of control on fiscal deficit and growing public debt

Ø

Sticky inflation

which remains at elevated levels of 7 per cent or more

Ø

Policy inaction

from the Government on various reforms or measures

Ø

The continued dissonance

between India

Ø

The debt problems

in eurozone and the US

My Take on

the GDP Estimate

A

wise man has once said that the best estimate for the next value is the same as

the current value. The latest quarter growth rate is 5.5 per cent and so the

best estimate for the next quarter could be 5.5 per cent, which gives an

average of 5.5 per cent for the first half-year 2012-13 of 5.5 per cent.

What

about the next half-year? Let us see some past data as given below:

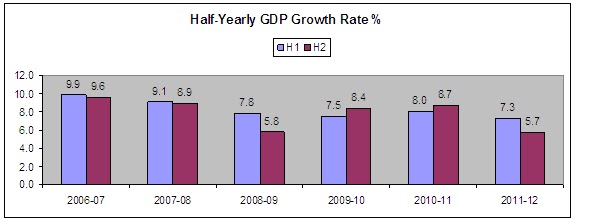

Note: GDP at constant prices (1999-2000) for years from 2006-07 to

2008-09 and at constant

prices (2004-05) for years from

2009-10 to 2011-12. Data source: CSO.

The

above graph shows in the last two years, only two years (2009-10 and 2010-11)

have seen GDP growth rates higher in second half-year than that of first half. So

my presumption is that second half growth could be much lesser than that of

first half, though absolute GDP in second half is higher than that of first

half.

Even

if we assume that the Government takes some policy initiatives to revive the

economy, it will take another three to four quarters to reflect in the GDP

figures. Considering the fact that the economy recorded a growth of 5.7 per

cent in the second half of 2011-12, my guesstimate is that the economy may not

be able to do any better in the second half of 2012-13.

Overall,

it is safe to predict that India

The

2012-13 GDP estimate of 5.5 per cent is the ‘New Normal’ for India

My

assumptions in arriving at the above GDP estimate are:

1). The Government will continue with its ‘dithering’

over policy reforms despite all talks to the contrary as it is bogged down in

corruption scandals

2). India

3). The fiscal room available to revive the economy is

limited at this point of time as the fiscal deficit is going to be very high in

future

4). The Government will be unable to reduce its subsidy

burden from fuel (diesel and LPG especially), food and fertilizers

5). Any downgrade of country rating by Standard &

Poor’s will further weaken the sentiment about India

6). No doubt this is a crude attempt at estimating the

GDP figures

- - -

|

|

|

Sorry friends, if I

sound very gloomy about the economy,

|

|

but this is the

reality and let us face it squarely!

|

|

|

CSO –

Central Statistics Office of the Government of India

IIP – Index

of Industrial Production

Graphs:

Author

Data source: CSO

Disclaimer: This should not be construed as a

recommendation by the author. The author has a vested interest in the general

stock market going up. The views of the author are personal and he changes his

views on the market and economy very quickly depending on various factors.

Readers or investors must consult their certified financial advisors before taking

any decision on their investments and the investment should be in line with

their risk profile & risk appetite and their general market perception.

You can access my articles

on financial markets at:

No comments:

Post a Comment