Rama Krishna Vadlamudi,

|

||

When the quick-tempered sage Durvasa

entered sage Kanva’s hermitage; Shankuntala, the beautiful young lady, is in

deep thoughts pining and day dreaming about her beloved husband, Dushyanta, the

king of Hastinapura. Slighted by her absent-mindedness, sage Durvasa curses

Shakuntala that her lover would forget her. At the end of this well-known

story, Abhijnanashakuntalam*, written

by renowned Sankrit poet Kalidasa, Durvasa’s curse is lifted as Dushyanta

recognizes and embraces his wife Shakuntala upon seeing the ring he gifted her.

At long last, Manmohan Singh seems

to have woken up from a self-imposed curse and has come back to the

centre-stage of governing the country once again by pushing through various

reforms amidst raucous opposition from other political parties. In his earlier

avatar as finance minister in the early 1990s, he loved economic reforms and

brought in path-breaking decisions which have now put India

But in his new avatar as India

Owing to his stony silence and

inability to communicate with common people, the general perception is that he

is at the helm only to serve the needs of the ruling Congress (I) party headed

by Sonia Gandhi and ultimately it is expected that he would pass on the baton

to Rahul Gandhi, son of Sonia and Rajiv (late) Gandhi. However, this is only in

the realm of speculation.

(*Abhijnanashakuntalam

is loosely translated as Recognition of Shakuntala)

Pushing

for Economic Reforms

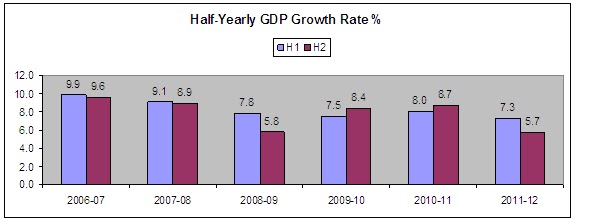

India was racing like a gazelle

posting record economic growth rates of 8 to 9 per cent between 2003-04 and

2007-08, but the gazelle was caught by a large Indian python of indecision,

misallocation of natural resources, dithering and prevarication – constricting

India’s economic growth rate, which has fallen to as low as 5.3 to 5.5 per cent

in the recent two quarters.

After a gap of almost two years, the

self-imposed curse is lifted for the good of the country. And Manmohan Singh’s

government has now recognized the importance of providing good governance to

Indians. In the last few days, his government has taken a number of measures

aimed at boosting India

On Thursday, the 13th of

September 2012, diesel price was increased by Rs 5 per liter (including taxes)

aimed at slashing the fiscal deficit and reducing the burden on public sector

oil marketing/upstream oil companies.

The next day the government has

decided to allow foreign direct investment (FDI) in multi-brand retail and

civil aviation sector and enhanced the ceiling for foreign investment in

broadcasting sector (see details below).

The Manmohan Singh government received

scathing criticism for almost two years for lack of economic reforms. Now, his

government seems to be serious in reversing the perception. The PM himself

described the latest decisions as:

“The Cabinet has taken many decisions today

to bolster economic growth and make

|

A gist of

cabinet’s decisions on 14 September 2012:

1. FDI In Multi-Brand Retail:

ü Foreign Direct Investment of up to

51 per cent is now allowed in multi-brand retail (This decision was kept in abeyance since November 2011 in the face of

opposition from various quarters)

ü State Governments can allow

setting up these retail outlets subject to state laws

ü Such retail outlets can be set up

only in cities with population of more than 10 lakh as per 2011 Census

ü At least 50 per cent of the total FDI

brought in must be spent in ‘backend infrastructure’ – within three years of

the induction of FDI

2. FDI in Civil Aviation sector:

ü

Foreign airlines

(existing policy allows only foreign investors other than airlines to invest in

aviation sector) are now allowed to make FDI of up to 49 per cent in schedule

and non-schedule airlines

ü

For example, British

Airways can now invest in Kingfisher Airlines or Spicejet Airlines (not that the

foreign airlines would find it attractive to invest in debt-ridden and loss-making

Indian companies in the aviation sector)

ü

The 49 per cent limit would

subsume FDI and FII investment

ü

Substantial ownership and

effective control shall rest with Indian nationals

ü

The total FDI inflows into the air transport sector,

during January, 2000 – April, 2012, were USD 434.75 million – which is just

0.25 percent of the total FDI inflows

3. FDI in Power Trading Exchanges

ü

Foreign investment is now permitted

up to 49 per cent (26% FDI & 23% FII limit)

ü As per extant policy, FDI of up to

100 per cent in the power sector (except atomic energy) is already permitted

ü As per extant policy, foreign

investment of up to 49 per cent (26% FDI limit and 23% FII limit) is already

permitted in stock exchanges and depositories

4. Review of FDI policy in Broadcasting

sector:

ü Foreign investment limit is now raised

from the current 49 per cent to 74 per cent for companies operating in direct

to home (DTH), teleports and cable networks

ü Foreign investment of up to 74 per

cent is now permitted in Mobile TV

5. Disinvestment of 9 to 12 per

cent is permitted in four public sector companies, namely, Hindustan Copper,

MMTC Ltd, Oil India, and National Aluminium Company.

Support

for Reforms

As described by the prime minister,

these decisions are to be welcomed by all people, no doubt. For example, the

diesel subsidy burden is taking a heavy toll on companies, like, BPCL, HPCL,

IOC, ONGC, GAIL and Oil India

The people need to ask who is

providing for these subsidies and from whose pockets the subsidies are

recovered. The truth is that the government is giving from one hand and taking

away the benefit from another hand and the net result is zero benefit to common

people. We need to understand this basic reality.

To

know more about the oil subsidy burden, just click:

|

The Case

for FDI in multi-brand retail sector

As per the latest FDI policy, respective

state governments are vested with powers to give licenses to companies that

want to bring in FDI in multi-brand retail outlets. The central government’s

decision to allow FDI is enabling provision for state governments to act. If a

specific state government is not comfortable with central government’s FDI policy,

the state government is free to not allow such outlets.

But one important point to note here

is that in the last decade, most of the state governments have been competing

with one another to attract capital investments to their own states by

providing a number of incentives. Gujarat, Maharashtra ,

Karnataka and Tamil Nadu state governments are in the forefront to entice large

companies of late. So, competition may force majority of states to allow FDI in

multi-brand retail outlets.

As part of the new policy, a lot of

investments will be made in the back-end infrastructure, which includes, investment in processing, manufacturing, distribution, design

improvement, quality control, packaging, transport, logistics, storage,

ware-house, agriculture market produce infrastructure; excluding investments on front-end units.

Without any doubt, the new FDI

policy on multi-brand retail outlets will be beneficial to farmers as well as

consumers.

Is there

any flipside to FDI in retail?

Yes, there will be some negatives.

We need to prepare ourselves for some small sacrifices for the sake of greater

good. India

When computerization was introduced

in the banking sector, there was a huge opposition to it. Computerization has

not resulted in job losses. The sons of trade union leaders who stridently

opposed bank computerization have now been working in large multi-national IT

companies! The trade union leaders just bluffed the nation at that time.

What are

the political ramifications?

The ruling Congress (I) party seems

to have taken a calculated risk – they may have consulted some of their allies

before pushing for economic reforms. Or, the ruling party may be thinking

enough is enough. Mamata Banerji, chief minister of West Bengal, expects some

economic revival package for West Bengal and

so is Uttar Pradesh state government led by Samajwadi Party. May be, the

central government will appease the allies through certain measures. It is

hoped the present UPA government will last its full term till 2014. But watch

out!

Conclusion

Real foreign investment, however,

will take some more time to come. It may take as long as six quarters to two

years for actual setting up of multi-brand retail outlets in India

Diesel price increase of Rs 5 per

liter is only symbolic as it would not bring down the fiscal deficit

considerably. However, it needs to be grudgingly accepted that some times

symbolism or tokenism helps to some extent.

At long last, the central government

seems to have woken up from the deep slumber by pushing for economic reforms.

The government’s policies for allowing FDI in multi-brand retail and civil

aviation sectors and raising diesel prices are to be welcomed wholeheartedly.

Some of these are enabling provisions for attracting foreign investment to

Indian shores. These measures will definitely enhance India

- - -

Notes: FDI

– Foreign Direct Investment; FII – Foreign Institutional Investors

and RBI – Reserve Bank of India Delhi

Disclaimer: This should not be

construed as a recommendation by the author. The author has a vested interest

in the stock market going up. The views of the author are personal and he

changes his views on the market and economy very quickly depending on various

factors. Readers or investors must consult their certified financial advisors

before taking any decision on their investments.