What are Asset Classes?

|

The broad asset classes are equities or shares, bonds or fixed income, cash & cash equivalents, real estate and alternative investments.

Cash equivalents are investments in liquid instruments, for example, US Treasury bills. Alternative investments can be further classified as commodities (like gold, silver, crude oil, copper, coffee, and soyabean), currencies, private equity and hedge funds’ derivative strategies.

Shares and bonds can be subdivided into assets in emerging markets, developed markets or frontier markets. In fact, one can subdivide these broad asset classes into several kinds of narrow asset classes – for example, large cap stocks, mid cap stocks, growth or value stocks, non-US bonds or treasury-inflation protection securities (TIPS).

What are the Features of Asset Classes?

|

Different asset classes have different features. Investment in real estate is highly illiquid in general; whereas investment in large-cap equity shares is highly liquid – in the sense that investments can be converted into cash easily and immediately.

This table gives a broad overview of liquidity, risk and return parameters of some asset classes:

Asset Class

|

Liquidity

|

Short-term return

|

Long-term return

|

Short-term risk

|

Long-term risk

| |

Large cap equity shares

|

High

|

Uncertain

|

High

|

High

|

Low to Moderate

| |

Mid cap equity shares

|

Moderate

|

Uncertain

|

High

|

Very High

|

Moderate to High

| |

Real estate

|

Low

|

Uncertain

|

Moderate to High

|

Low to Moderate

|

Moderate to High

| |

Commodities

|

High

|

Uncertain

|

Moderate to High

|

Moderate to High

|

Low to Moderate

| |

Govt. Bonds (long term)

|

Low to Moderate

|

Low

|

Moderate

|

Low

|

Low to Moderate

| |

Govt. Bonds (short term)

|

High

|

Low to Moderate

|

Low to Moderate

|

Low

|

Low

| |

Cash

|

Very High

|

Low

|

Low

|

Low

|

Low

|

Note: The above table is only for illustrative purposes

1. Short-term returns on equities, real estate and commodities are uncertain – but the chances of getting attractive and superior returns from them in the long-term is high

2. From a risk point of view, the risk of losing one’s money in the short-term is higher in case of equities and commodities

3. Cash entails low risk and return, but offers higher liquidity

4. Government bonds bear no default risk, but have interest rate risk – the latter risk is higher for long-term bonds

5. As we have experienced in the past few years, even government/sovereign bonds may suffer huge risk – for example, as in Greece , Spain , and Portugal

- - -

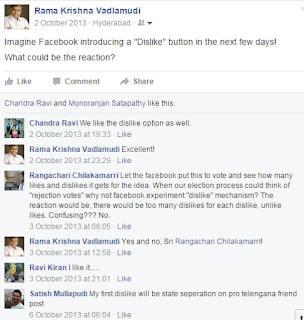

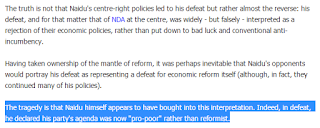

The following images (from old files) are included here after 06Oct2020 for reference purpose >

These images are sourced from various web sources >

These

images are just for information purposes only, this is not investment

advice. Readers should consult their own advisers for advice before

making any investment decisions.

Disclaimer:

The author is an investment analyst, equity investor and freelance writer. This

write-up is for information purposes only and should not be taken as investment

advice. Investors are advised to consult their financial advisor before taking

any investment decisions. He blogs at:

Connect

with him on twitter @vrk100

No comments:

Post a Comment